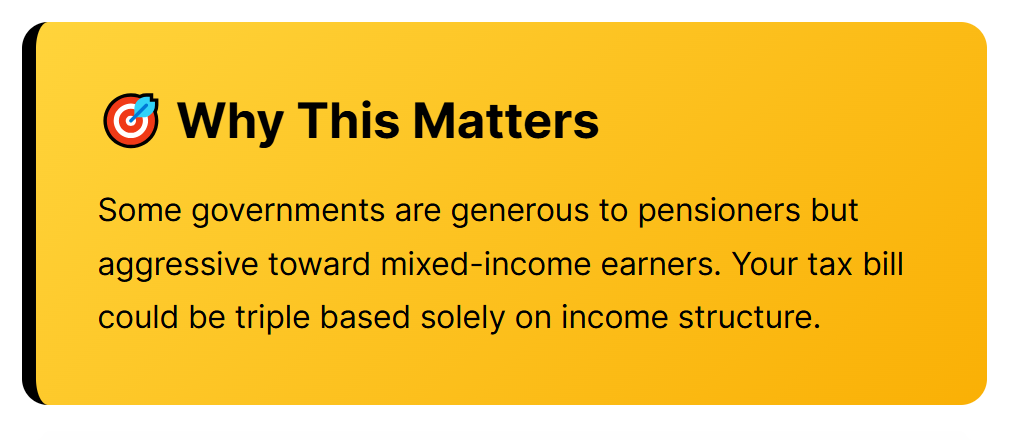

Becoming a resident of South America can cost you 35% of your income starting on day one. Expats often budget for rent and groceries, while overlooking the “silent killer”: income tax in South America.

- In five of these countries, you trigger a worldwide tax trap that can cost more than your rent.

- In others, the tax rate on foreign income drops to 0%.

That difference can mean tens of thousands of dollars every year.

I’ve lived in South America for 26 years and today I’m breaking down what really hurts expat wallets.

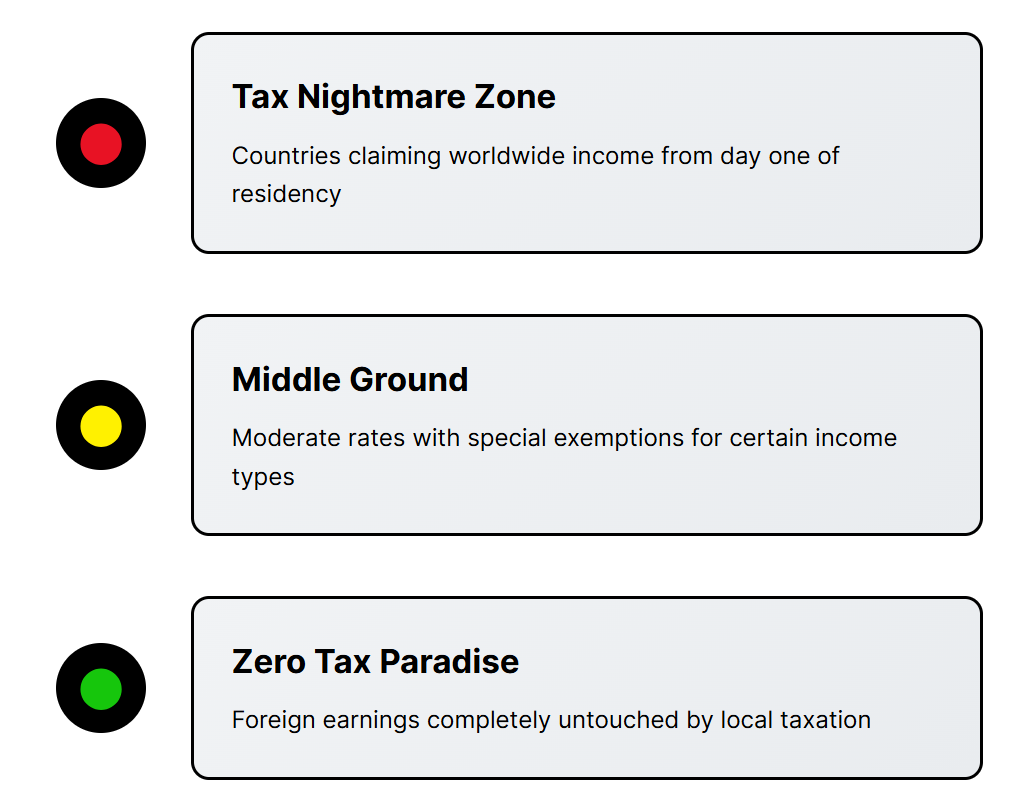

We are ranking 10 countries from “tax nightmare” to “zero tax expat dream,” covering tax traps, wealth taxes, and legal costs most people never hear about.

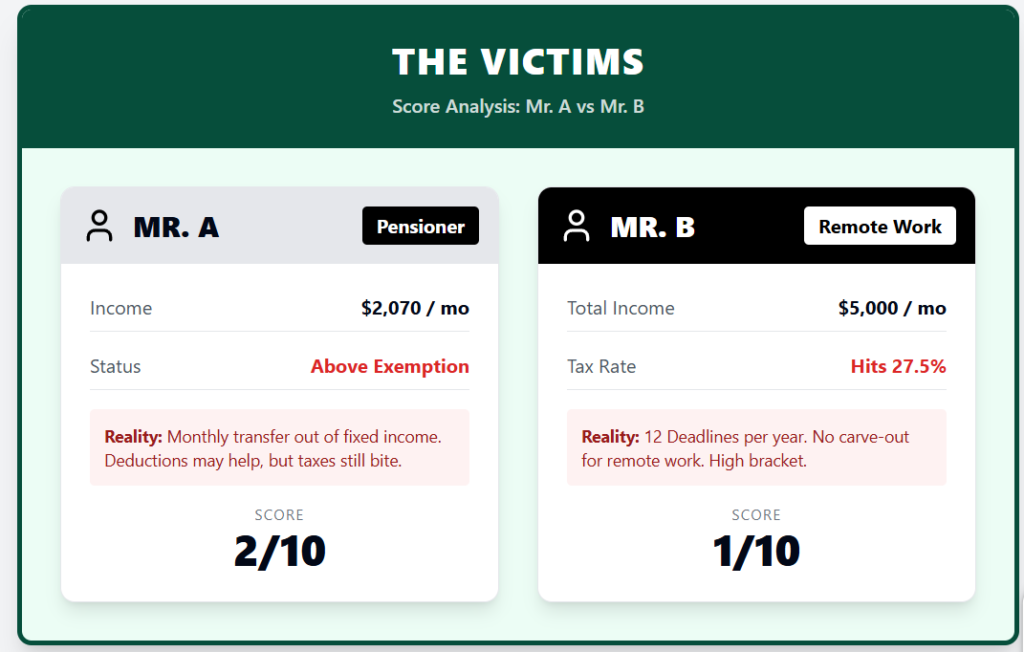

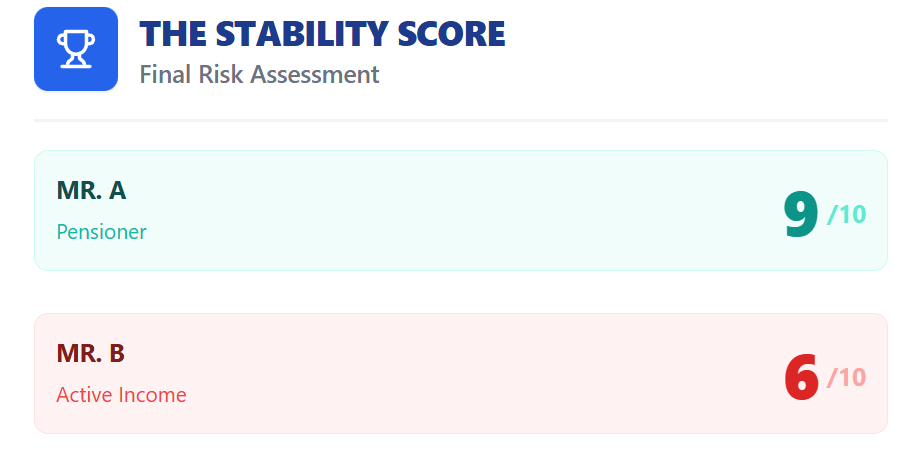

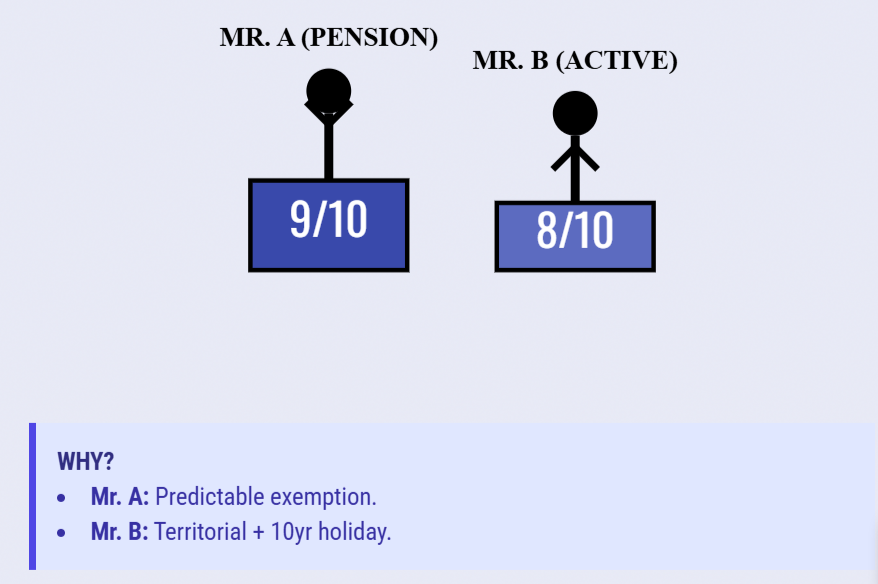

To get a real answer, we analyze two specific types of people: Mr. A and Mr. B.

Mr. A is a Social Security-only pensioner earning $2,070 a month who wants a quiet life.

Mr. B earns $5,000 a month, mixing that same pension with $2,930 from remote work or investments.

The difference between these two is massive because some countries have huge differences in taxation depending on how much you earn.

Mr. B often faces tax-hungry governments that Mr. A never sees.

The Rankings: From Tax Nightmare to Expat Dream

## 10. Venezuela: The Failed State Trap

We start at the bottom with the one place where the right move is not to “avoid it,” but to flee from it. Compliance itself can create physical risk in a country where low enforcement does not mean low tax.

Trying to be tax compliant here is like trying to obey traffic laws during a demolition derby. You can try to follow the rules, but you are mostly just painting a target on your back.

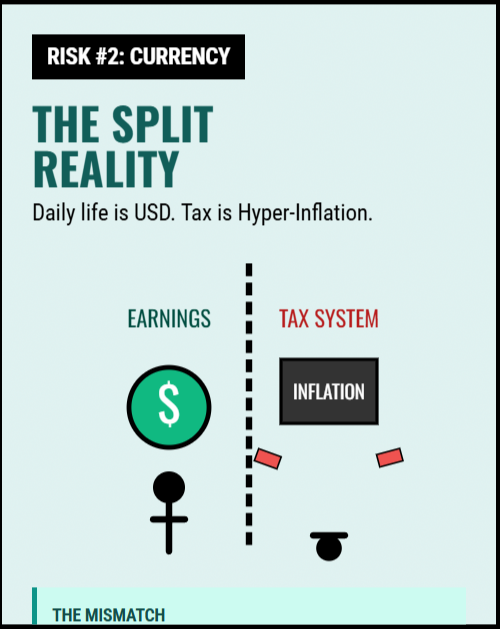

Venezuela runs tax collection through SENIAT. It operates in a confusing way since everyone uses two different currencies to deal with hyperinflation.

That mismatch is where the trouble starts. Even a small income in US dollars becomes a huge income when converted to their extremely devalued currency.

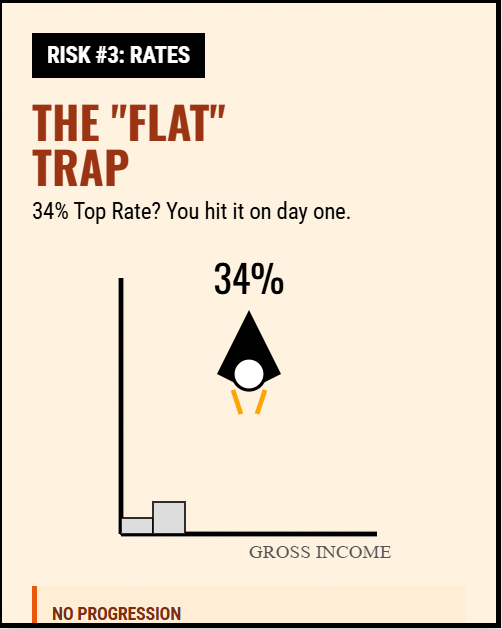

On paper, the income tax has progressive rates that go to a maximum of 34%. In practice, for a dollar earner, there is no real progressive climb.

You convert hard-currency income and you hit the top bracket fast. The system behaves like a flat, high-rate tax on gross income for anyone paid in USD.

Declaring foreign income can signal that you have outside assets. The risk shifts from “how much tax will I owe” to “what happens after I disclose the numbers.”

For Mr. A, even a $2,070 monthly pension creates exposure. Even he can be considered “wealthy” in Venezuela.

For Mr. B, it is even worse. You cannot model that risk. A zero percent tax rate is worthless if you cannot walk down the street.

## 9. Brazil: The Monthly Filing Burden

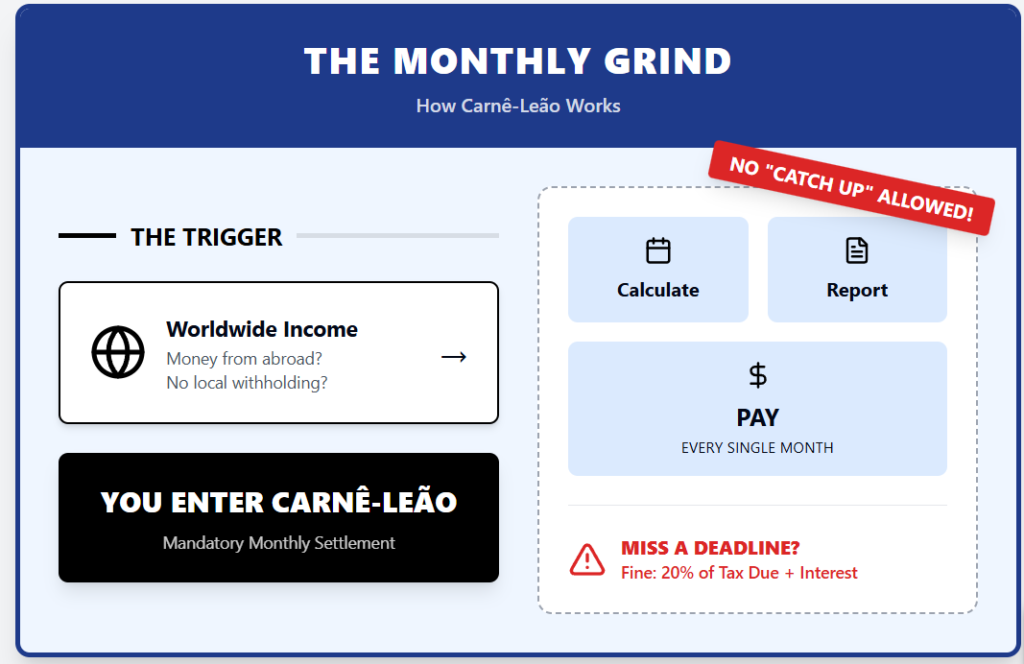

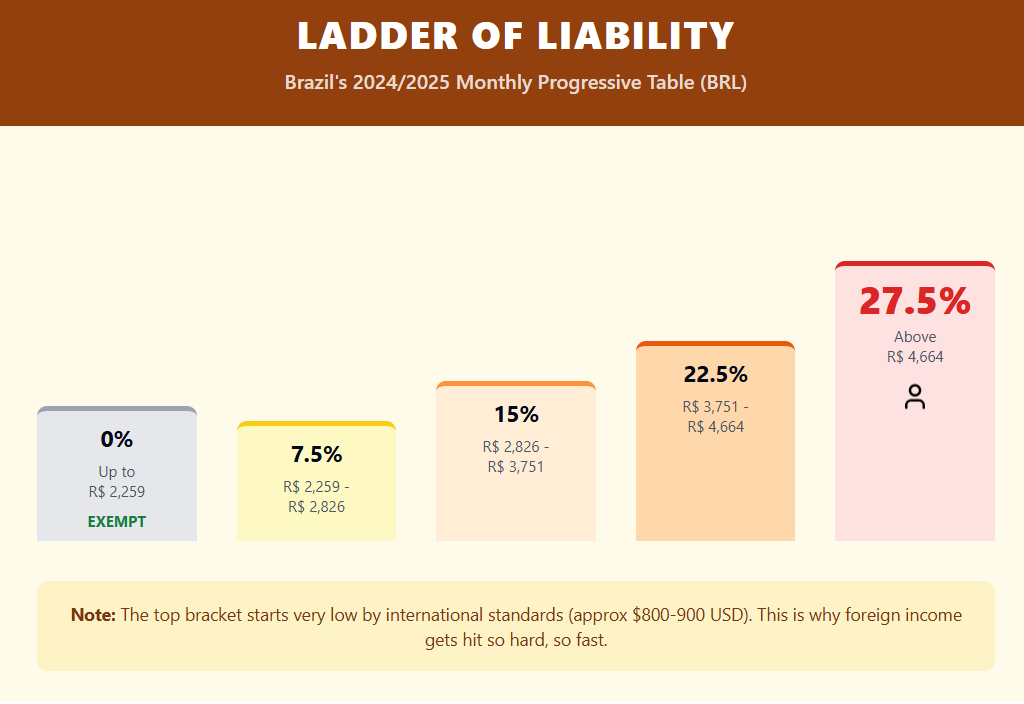

Brazil becomes expensive the moment you become a tax resident because it taxes you on worldwide income. If your money comes from outside Brazil, there are big chances you enter the Carne Leão system.

This means you must calculate, report, and pay income tax every month. Miss it, and the fine can reach 20% of the tax due, plus interest.

Now put Mr. B into that system. He earns $5,000 per month, with $2,930 coming from investments and remote work.

Brazil taxes that foreign income, and for this profile, it can hit the top marginal rate of 27.5%. Instead of one annual decision, you manage twelve deadlines and twelve payments.

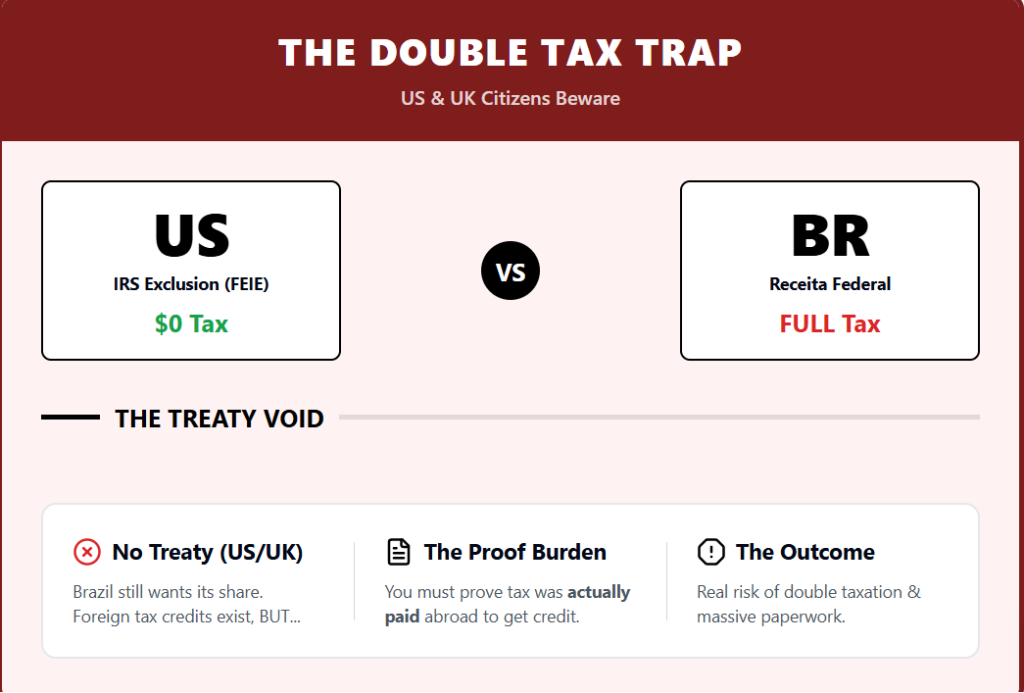

If you are a US citizen using the Foreign Earned Income Exclusion and paying $0$ to the IRS, Brazil still wants its share. Brazil allows tax credits only if you can prove the tax was actually paid abroad.

With no tax treaty with the US or the UK, that burden is on you, and the double-tax risk is high. Mr. A does not escape either.

His $2,070 monthly pension converts into a figure that sits far above Brazil’s monthly exemption range. A large part of his income becomes taxable in Brazil.

If you hold foreign assets above $1 million, Brazil adds the CBE declaration to the Central Bank as another bureaucratic obstacle. Brazil is predictable on its tax hunger, bureaucracy, and absurd amount of paperwork.

The tax code is so complicated that the only people who understand it are either politicians or in jail. In some cases, it is both.

Tax Friendliness Score:

- Mr. A: 2/10

- Mr. B: 1/10

## 8. Argentina: The Volatility Gamble

Argentina can look better one week and get harder the next. While the current government pushes a fast fiscal reset, you still deal with the old structure underneath it.

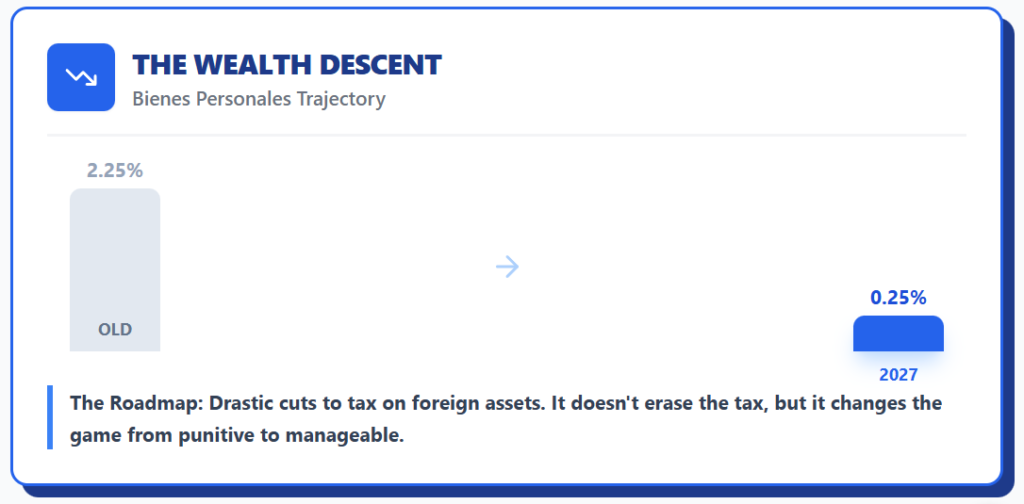

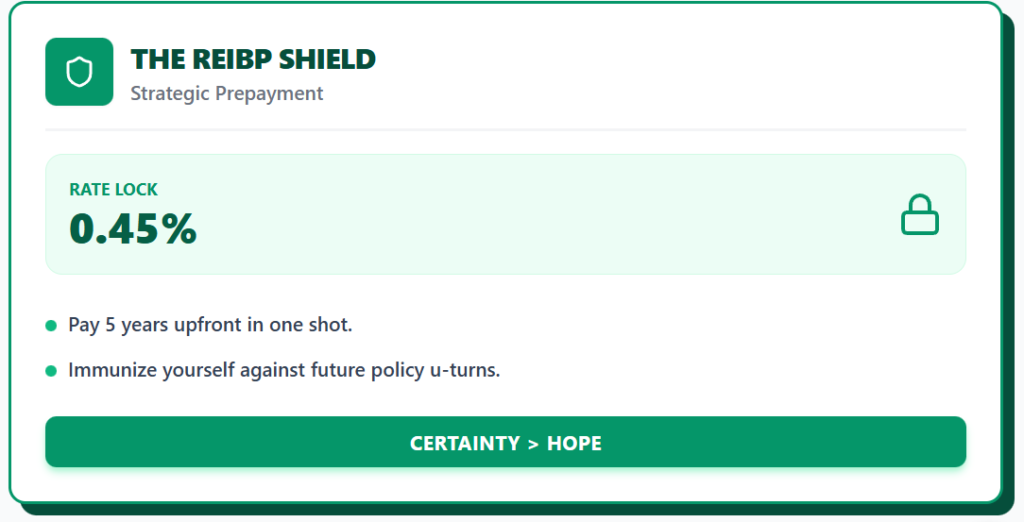

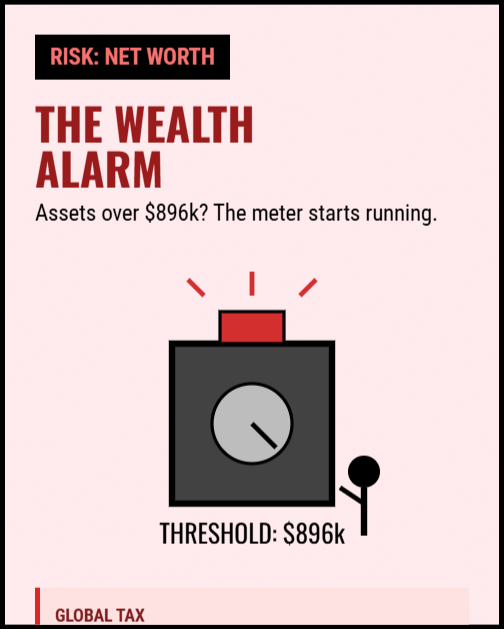

Start with the Argentinian wealth tax, or Impuesto sobre Bienes Personales. Before the reforms, assets held abroad could face rates up to 2.25%.

The roadmap cuts that down step by step, aiming for 0.25% by 2027. This is a real drop, but it does not erase the tax or the filing requirement.

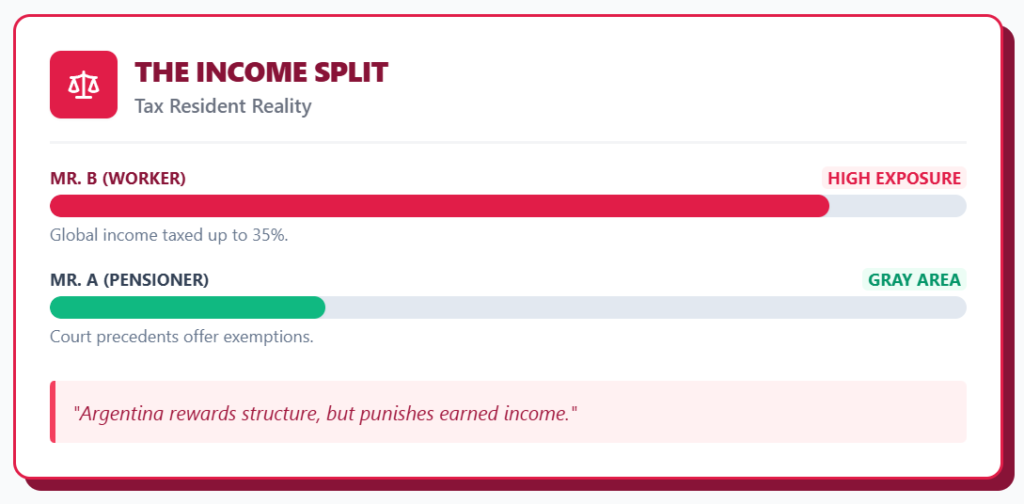

The biggest risk is that the opposition has made it a priority to raise this tax again if they return to power. Once you qualify as a resident, Argentina taxes global income at progressive rates up to 35%.

This hits Mr. B the hardest. Due to his higher income, he climbs into the highest income tax brackets in Argentina.

Then there is bracket creep. Tax brackets and minimums adjust using inflation data, but the updates can lag behind real price jumps.

If your income stays the same in dollars, it can look higher in pesos after a devaluation. This pushes you into higher brackets without any real gain in purchasing power.

The gap between the official rate and the “Blue Dollar” changes what your income looks like in pesos and what things cost day to day. For Mr. A, pensions often land in a gray area.

The pension enters the taxable base, but court precedents and deductions can exempt a large part when it is the only income. Add the IVA of 21% and you will pay more for products like electronics and cars.

Argentina rewards timing and structure but punishes anyone who needs the rules to stay stable. If you want the exact contacts I use to navigate this, I share them on my Patreon.

## 7. Peru: The Domicile Loophole

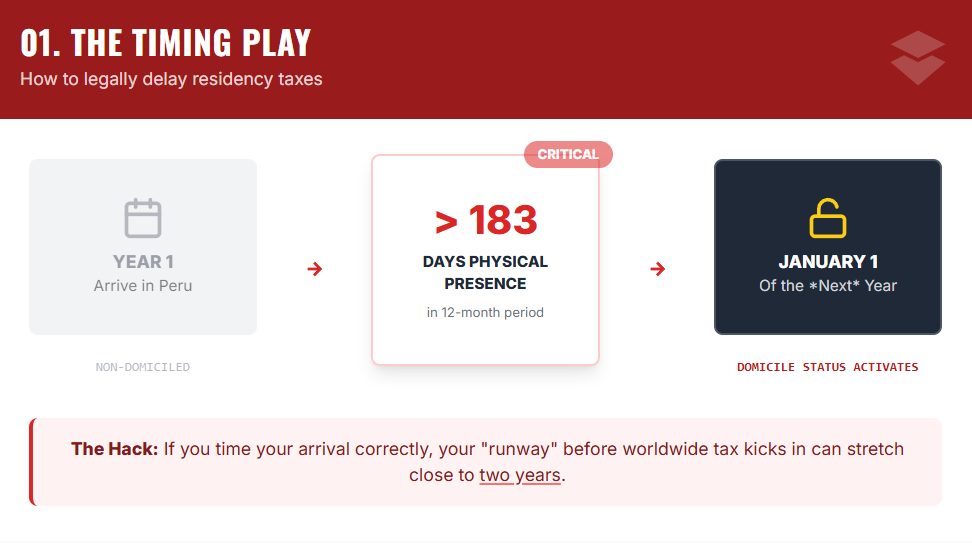

Peru gives you a timing play that most expats miss. The system splits people into “non-domiciled” and “domiciled,” and that label controls if foreign income is taxed.

You become domiciled only after you spend more than 183 days in Peru within a 12-month period. Then the switch starts only on January 1 of the next calendar year.

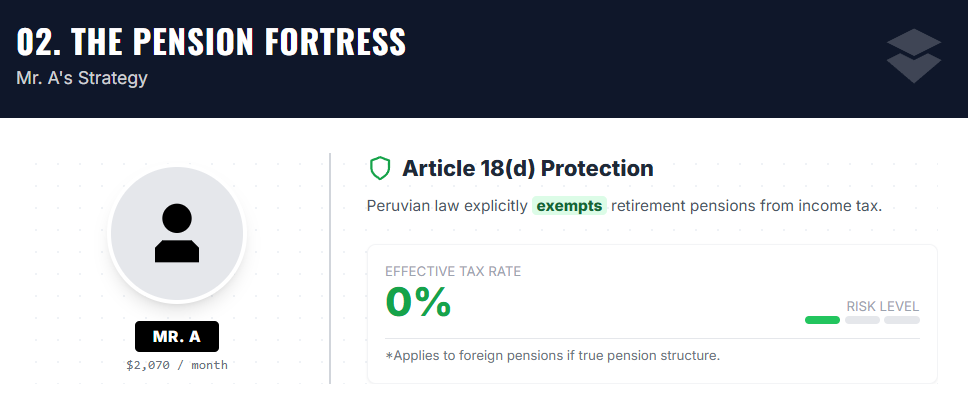

This creates a long runway where you can live in Peru with your foreign income free of taxes. For Mr. A, Peru gets simple fast.

Article 18(d) of the Peruvian Income Tax Law exempts retirement pensions from income tax. SUNAT tends to apply that exemption to foreign retirement pensions as long as the payment is a real pension.

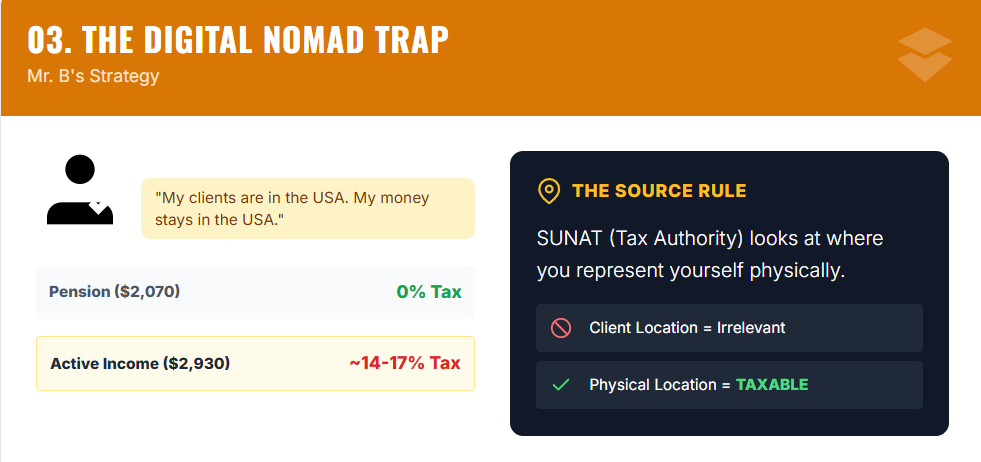

If your only income is a $2,070 monthly pension, this structure points to a 0% income tax outcome. Mr. B has a split result.

The $2,070 pension can stay under the same exemption. The issue is the extra $2,930 per month from investments and remote work.

After the annual tax-free allowance of about 7 UIT (~36,000 soles), the effective rate often lands in the 14% to 17% range. If you perform work while physically in Peru, SUNAT treats that as Peruvian-source income.

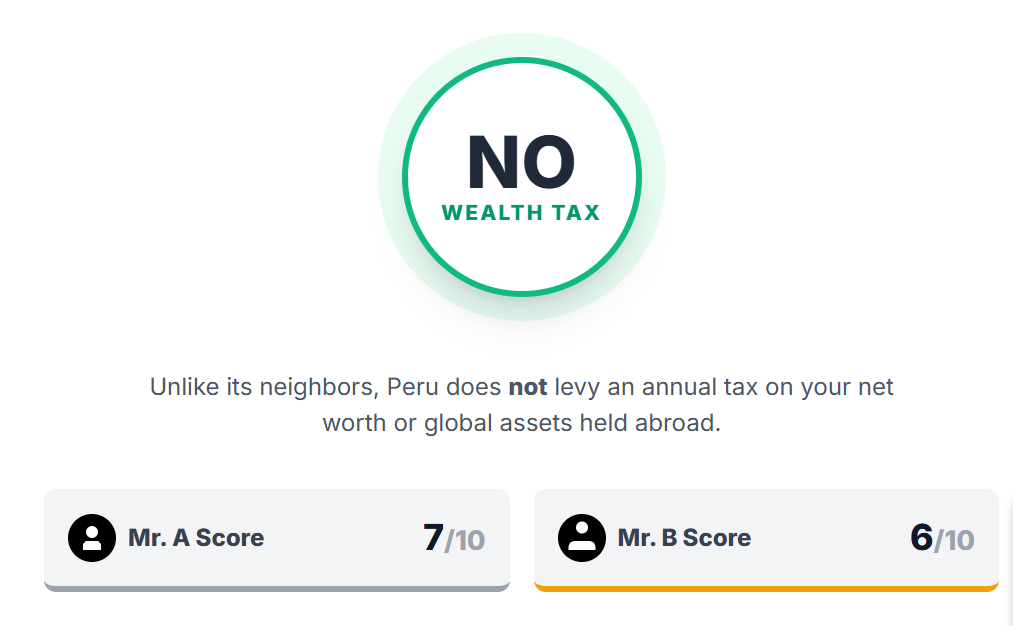

One advantage stays constant for both profiles: Peru has no wealth tax. If you hold investments abroad, Peru does not add an annual net worth bill on top.

Tax Friendliness Score:

- Mr. A: 7/10

- Mr. B: 6/10

## 6. Colombia: The Pensioner’s Paradox

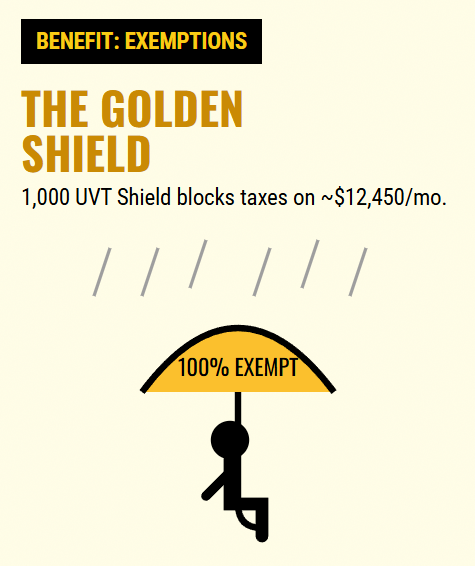

Colombia has the widest gap between Mr. A and Mr. B, and it comes down to the 1,000 UVT monthly limit for pension income. Colombia acts like a tax haven for pensions but a high-tax country for active income.

Their tax-free ceiling for pensions is so high that most foreign retirees never reach the taxable zone. For Mr. A, his $2,070 pension falls under the 1,000 UVT exemption, making his income tax bill 0%.

The main possible cost is not income tax, but health contributions through EPS. These can run from 4% to 12% of income.

Now flip to Mr. B. The $2,070 pension stays exempt, but the extra $2,930 per month is treated as taxable income.

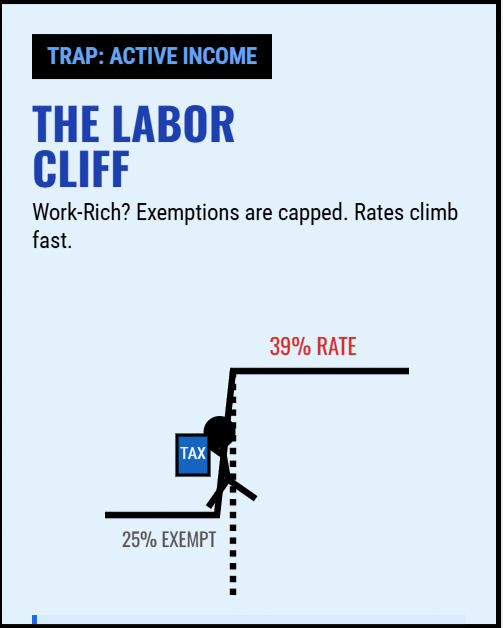

Colombia allows a 25% exemption on taxable income, but it has an annual cap. After the cap, the taxable part grows and the progressive rate schedule can climb fast.

Then comes the wealth tax, Impuesto al Patrimonio. Rates run from 0.5% to 1.5%. In addition to the wealth tax, many countries implement varying property tax structures that can significantly impact overall taxation levels. For example, a comprehensive european property tax rates comparison reveals that in the Old Continent some nations impose higher rates on residential properties, while others may offer incentives for investment properties.

If you hold $1.5 million in worldwide assets, a 1% rate will cost you $15,000. Under 2022 to 2025 reforms, dividend tax rates can now go up to 39%.

Tax Friendliness Score:

- Mr. A: 9/10

- Mr. B: 4/10

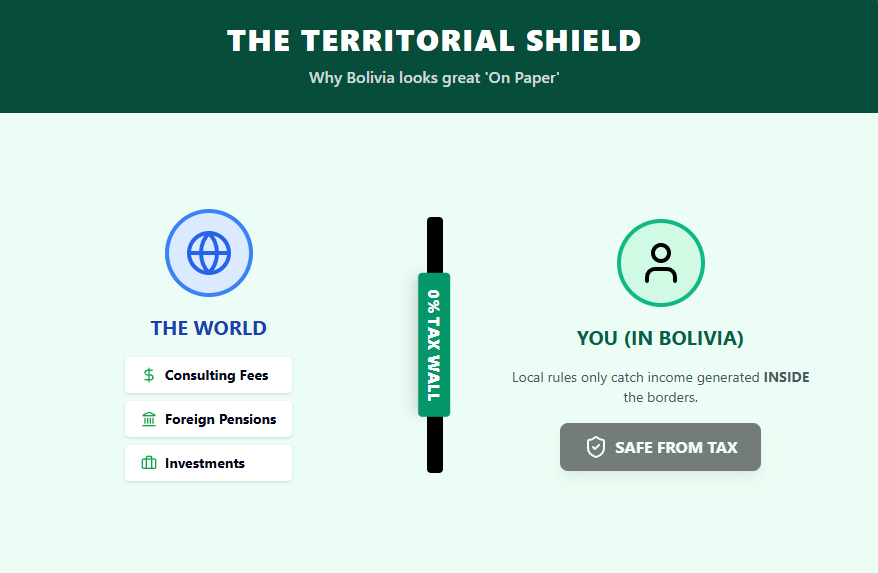

## 5. Bolivia: The Paper Haven

Bolivia is where the rules give you what you want, but the infrastructure makes you work for it. On paper, Bolivia runs a territorial system.

It taxes income generated inside Bolivia and leaves foreign-source income outside the net. A foreign pension or money paid by an overseas client usually does not become taxable just because you live there.

For Mr. B, this is the attraction. If his higher income comes from remote consulting for foreign clients, the territorial rule turns it into tax-free income.

The same applies to foreign capital gains. You earn abroad and live locally without triggering a worldwide tax calculation.

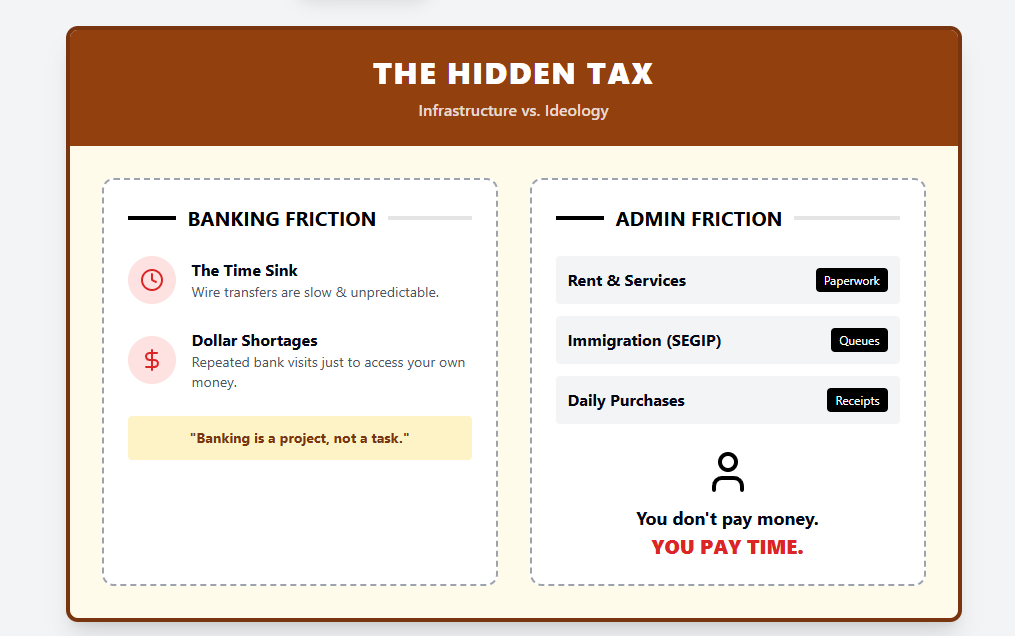

However, Bolivia has an IVA with a 13% withholding system tied to local transactions. This makes normal spending more paperwork-heavy.

The bigger problem is banking friction. The financial system runs into recurring US dollar shortages, turning basic tasks into projects.

Receiving international wire transfers can be slow, expensive, and unpredictable. If your money arrives from abroad, you can deal with delayed transfers.

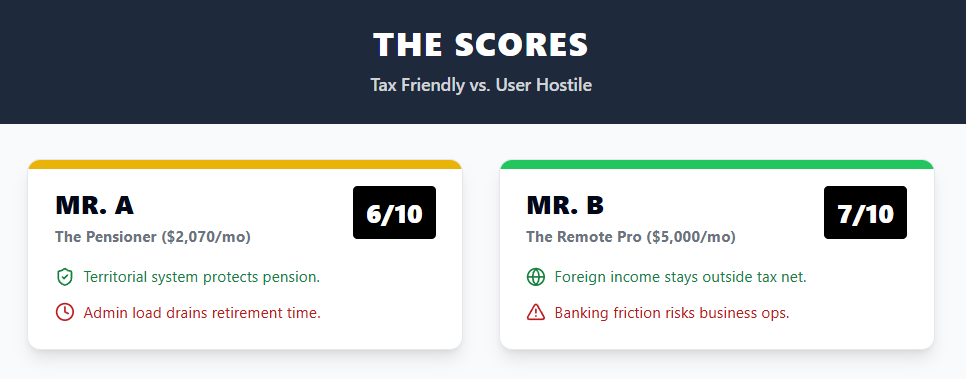

Tax Friendliness Score:

- Mr. A: 6/10

- Mr. B: 7/10

## 4. Chile: The Three-Year Holiday

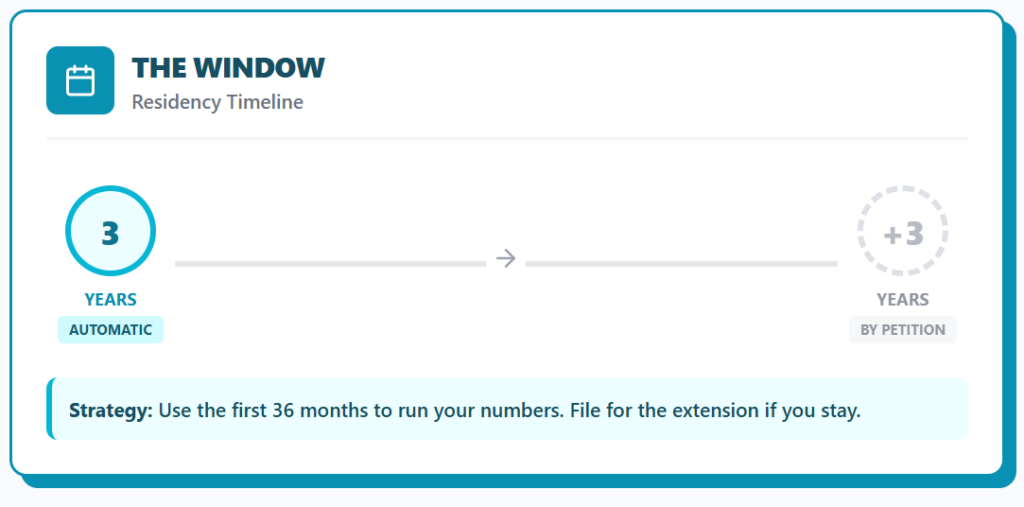

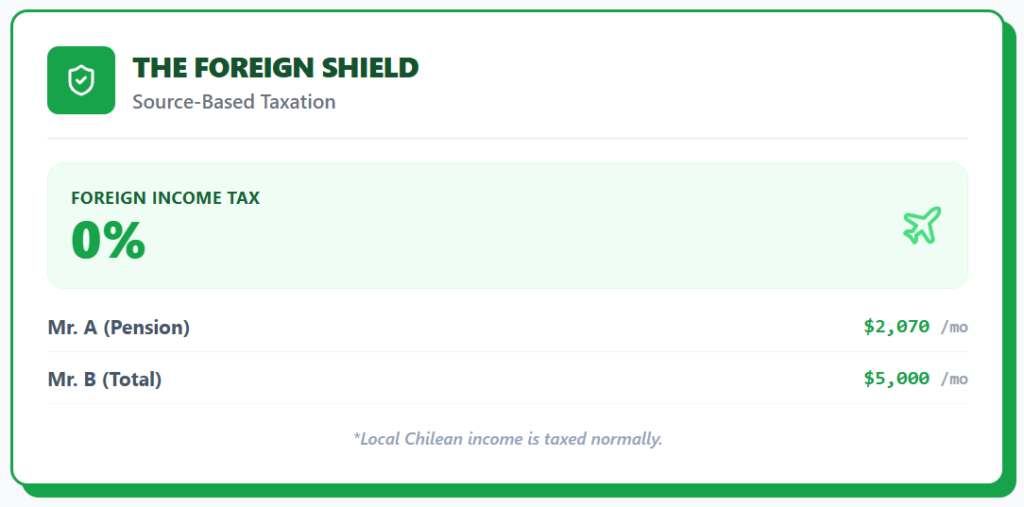

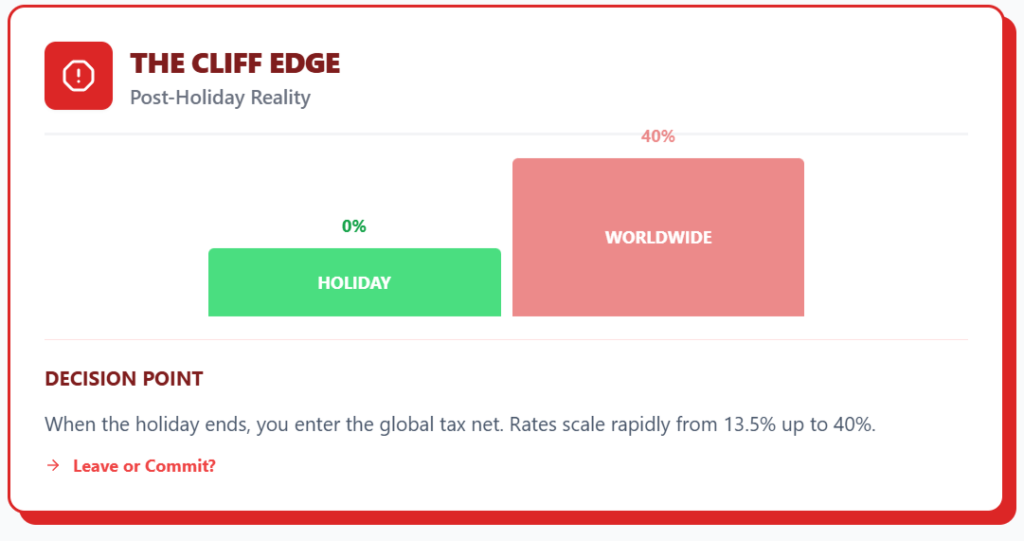

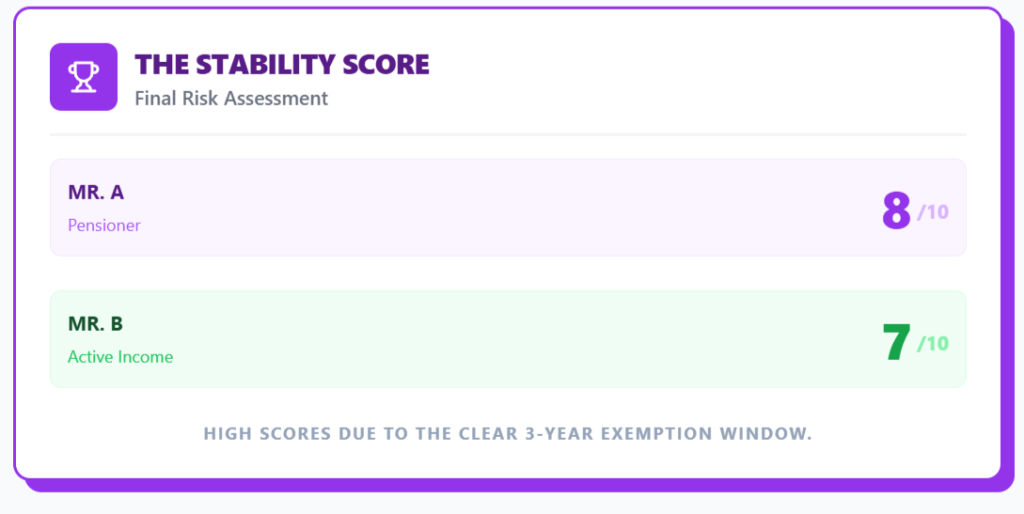

Chile gives new residents a foreign-income exemption for 3 years. During that window, Chile taxes local-source income but leaves foreign-source income alone.

For an expat, this turns Chile into a controlled “test drive.” You can live there and run your numbers before deciding to commit long-term.

During this period, both Mr. A and Mr. B pay zero income taxes. Chile allows an extension to reach a full 6 years, but it is not automatic.

You must file a petition with the Servicio de Impuestos Internos (SII). You must support the request by showing continued strong ties abroad or other justifications.

Chile also offers a social security exemption. If you can prove you keep coverage in your home system, you can be exempt from paying into Chile’s system.

There is also no net wealth tax. This matters if you hold assets outside Chile and want to avoid an annual net worth bill.

When the 3-year or 6-year holiday ends, Chile moves you into worldwide taxation with progressive rates up to 40%. At that point, you either leave or accept high-tax status.

Mr. B’s $60,000 annual income often lands in the 13.5% to 23% range after the holiday. This marks the transition into the high-tax resident status.

## 3. Ecuador: The Senior’s Sanctuary

Ecuador earns its spot because it treats retirees like a target group inside the tax code. The core rules come from the Ley de Régimen Tributario Interno, representing direct cash savings.

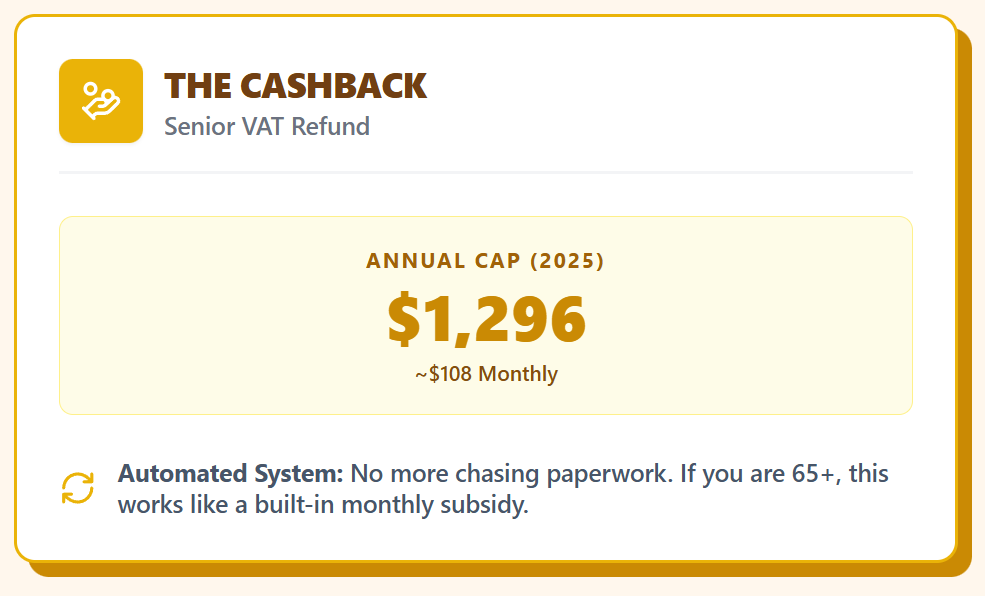

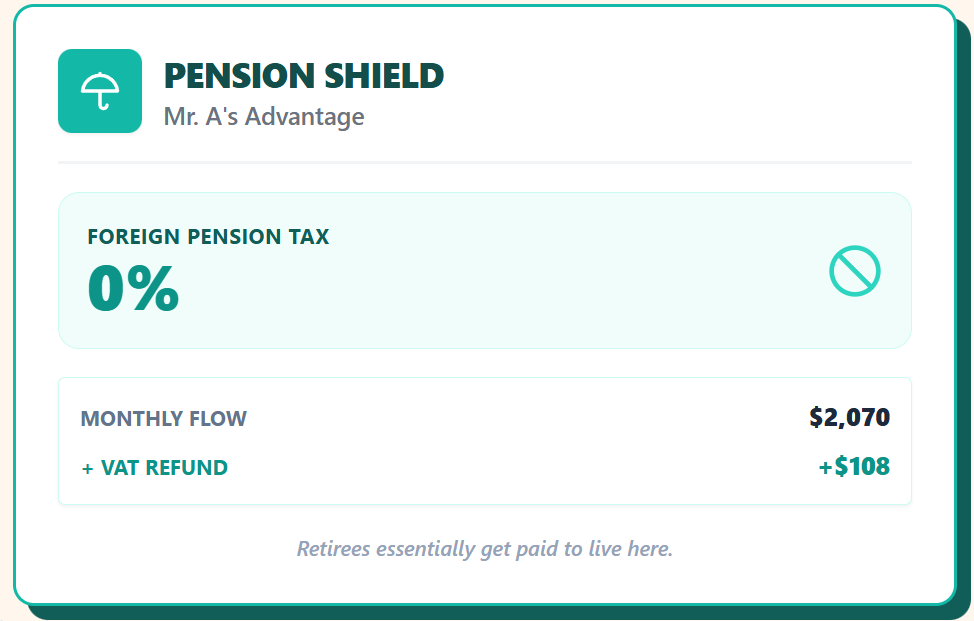

If you are 65 or older, the biggest perk is the VAT refund on personal goods and services. The monthly cap is about $108, or $1,296 per year back to you.

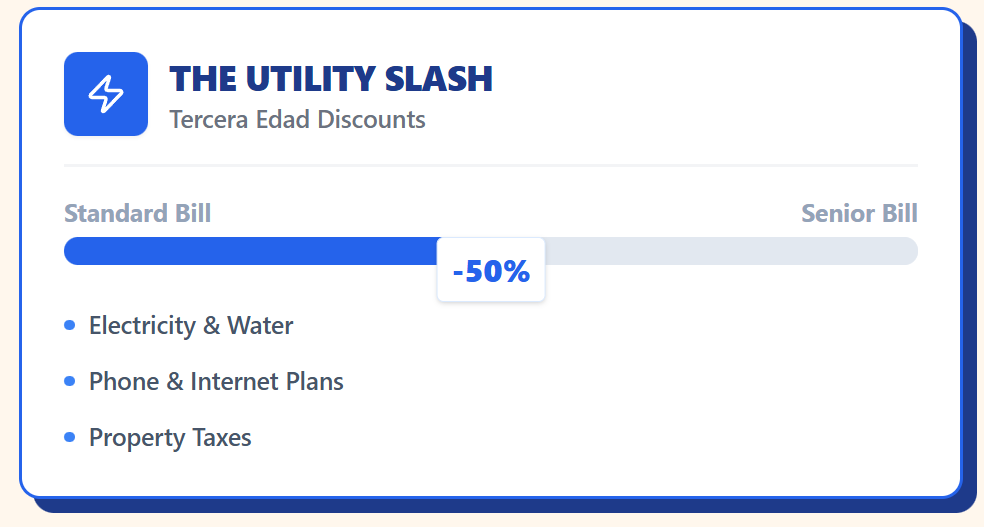

Utilities like electricity, water, and phone bills often get a 50% reduction for “Tercera Edad.” Property taxes also drop for seniors.

Mr. A lives on $2,070 per month from a foreign state pension. Ecuador does not tax foreign pensions, and he can still collect the VAT refund.

On top of paying ZERO taxes, he might “earn” up to $108 per month back! Mr. B brings in $5,000 per month, with $2,930 coming from other sources.

Ecuador can exempt foreign-source income if you prove you paid income tax in the source country. However, Ecuador draws a hard line on source rules.

If the remote work is treated as Ecuadorian-source because you are physically in Ecuador, the income tax rates can go up to 37%. While enforcement can feel light, the statutory exposure is significant.

Tax Friendliness Score:

- Mr. A: 9/10

- Mr. B: 6/10

## 2. Uruguay: The Predictable Outlier

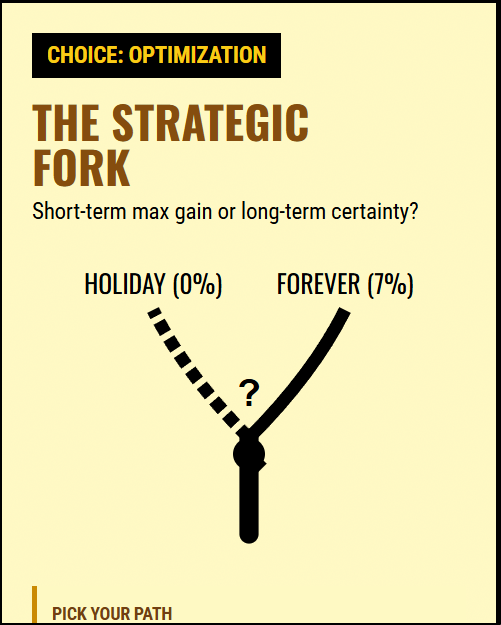

Uruguay trades “creative loopholes” for predictability. The main benefit is the “10+1” tax holiday for new tax residents.

You get the tax year of arrival plus the next 10 years where Uruguay exempts foreign passive income. This specifically covers dividends and interest.

Alternatively, you can skip the holiday and lock in a permanent 7% flat tax on foreign passive income. This path matters if you want a long-term number you can plan around.

For retirees, foreign pensions are exempt because Uruguay does not classify them as capital yields. For higher earners like Mr. B, the territorial principle is the deciding factor.

If you perform services for clients abroad and the income counts as foreign-source, Uruguay does not tax it. The tradeoff is the high cost of living.

Uruguay charges a premium, and the cost of living there is the highest in South America by far. You save on taxes but feel pressure in the budget.

Uruguayan processes are more modern compared to most of the region. Bureaucracy is manageable, and the system is stable.

Tax Friendliness Score:

- Mr. A: 9/10

- Mr. B: 8/10

## 1. Paraguay: The Best-Guay

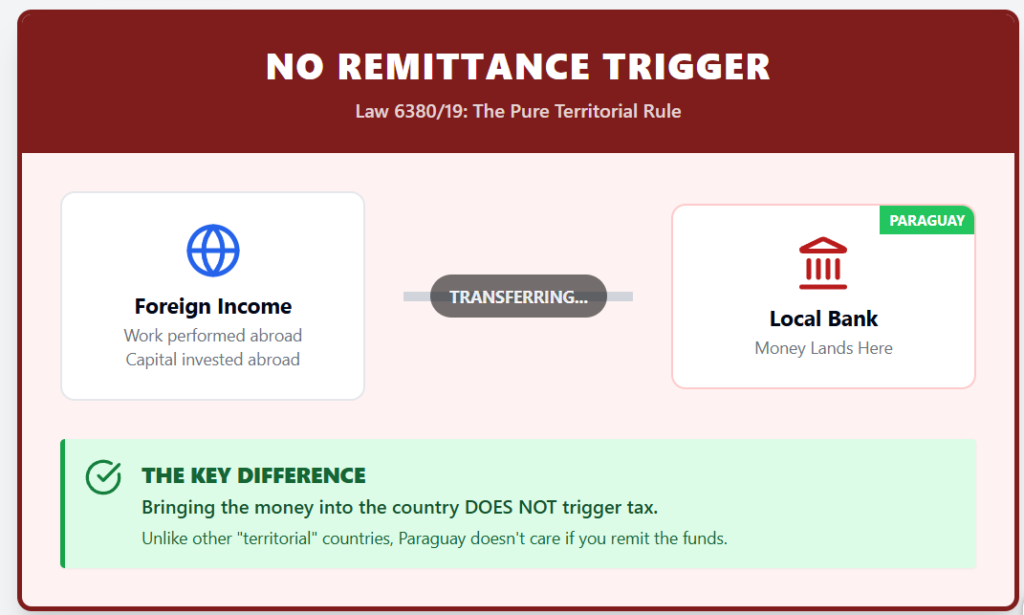

Paraguay runs a pure territorial system to define if someone pays income tax. Income from work performed abroad, capital invested abroad, or rights used abroad is exempt.

It does not matter if the money lands in a Paraguayan bank account. Paraguay has no “remittance” trigger that turns foreign income into local taxable income after you transfer it.

In Paraguay, you can spend your foreign pension, dividends, or remote income locally without turning it into local taxable income. For Mr. A, that means ZERO income tax permanently.

There is no phase-out after three or ten years. For Mr. B, the same territorial rule covers his $5,000 income, which is also tax-free if earned outside Paraguay.

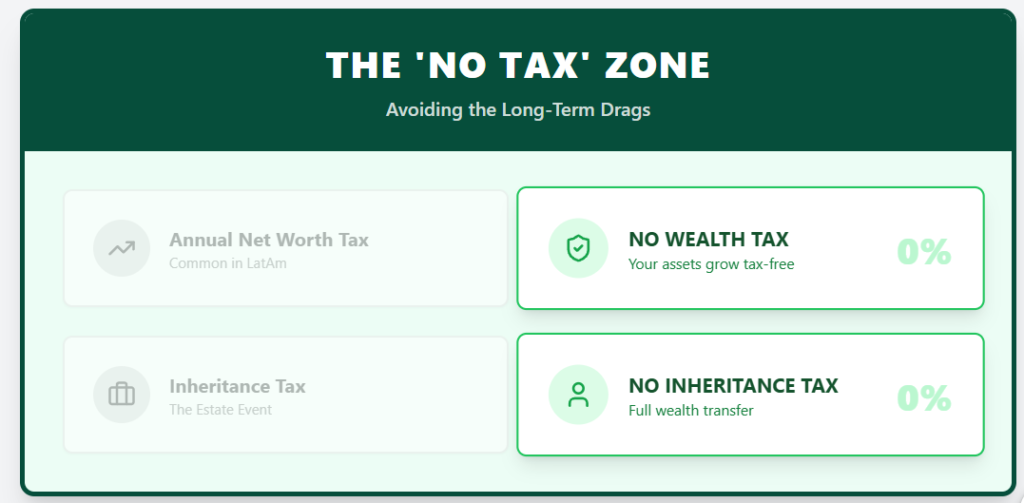

Paraguay also removes two taxes that create long-term drag elsewhere. It has no wealth tax and no inheritance tax.

If you do business locally, Paraguay applies a modest flat 10% rate for income tax. It also charges a 10% VAT and an 8% withholding tax on dividends from local profits.

Residency stays simple. The standard pathway uses a solvency deposit of about $5,000 in a local bank, which is low compared to other programs.

Tax Friendliness Score:

- Mr. A: 10/10

- Mr. B: 10/10

If you want to know how these countries rank in other factors like safety and quality of life, check this ranking of the best countries to live in South America, considering factors like cost of living, healthcare, and more.

And join my Patreon for all the sources and charts from our articles, plus a chat, so I can answer your questions. Tier 2 includes all my eBooks on living and retiring abroad-scan the QR code today!

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.