What if your money suddenly became twice as powerful overnight? What if the place you chose to live suddenly became one of the cheapest countries for retirees?

When a country’s currency CRASHES overnight, your dollars or euros suddenly gain MASSIVE purchasing power.

Apartments, food, services – all at fire sale prices.

In the last 12 months, 8 countries have seen their currencies collapse against the dollar and euro.

But there’s a catch most people miss: sometimes currency crashes usually signal DEEPER problems. Hyperinflation, political chaos, safety concerns.

Out of these 8 countries, only TWO are places I’d recommend for expats.

- Places where a $1100 apartment now rents for $530.

- Places where you can enjoy a millionaire’s quality of life for a fraction of the price.

- But all that is possible in just 2 of these 8 countries.

What about the 6 others?

Well, let’s say the currency collapse is just the tip of their iceberg of problems.

I have personally visited these eight countries, and in the next few paragraphs, I’ll show you exactly which ones offer real opportunity right now.

Number 8 – Turkey

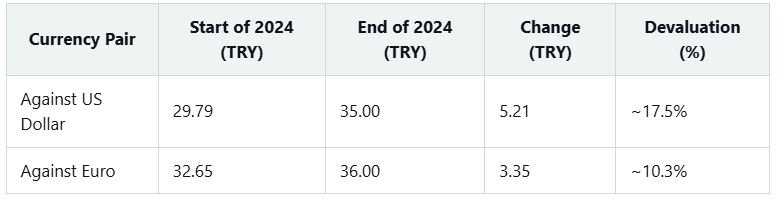

Imagine waking up tomorrow to discover that everything in your bank account has lost 17.5% of its value.

This isn’t a hypothetical scenario – it’s exactly what happened in Turkey over the past year.

The numbers tell a devastating story. The Turkish lira’s value plummeted from about 29.8 lira per dollar to 35 – a staggering 17.5% decline. While this creates the sensation of bargain prices for tourists, the reality for locals and potential expats is quite different.

What’s particularly concerning is that experts believe the lira is being artificially maintained at these levels.

Yes, in fact, it should have devaluated much, much more.

According to economic analysts, the realistic value should be closer to 70 lira to the euro, creating an imminent risk of massive devaluation that could wipe out savings overnight.

But why hasn’t it dropped further? That’s where the manipulation comes in.

The Turkish government, through its central bank and state-owned institutions, has been burning through billions in foreign currency reserves to prop up the lira. They’re selling dollars and euros on the open market to artificially boost demand for their own currency. This keeps the exchange rate from spiraling – at least temporarily.

At the same time, they’ve tightened capital controls. It’s harder for Turkish citizens and businesses to buy foreign currency, and international investors face restrictions on how quickly they can move money out. These tactics slow down the outflow of capital and mask the true market value of the lira.

They’ve also leaned on state banks to offer favorable loan terms and to sell foreign currency at fixed rates. It’s a short-term sugar rush. But underneath, inflation continues to roar – officially above 60%, though many believe the real figure is higher.

The result? An illusion of stability.

The digital landscape adds another layer of complexity for expats. Turkey has implemented sweeping restrictions on internet platforms and introduced new taxes on digital income, severely limiting remote work opportunities.

Perhaps most alarming is the combination of economic instability with practical challenges, making financial planning nearly impossible.

Meanwhile, major cities like Istanbul remain surprisingly expensive despite the currency’s fall, with inflated rents and exorbitant taxes on vehicles and fuel.

Would it be a country that I recommend?

Well, Turkey has a beautiful coast and a pleasant climate

However, the political and economic instability, plus the excessive controls over how you can change your money or what you can say on the internet, make me NOT recommend Turkey.

If you think I am wrong and Turkey deserves a recommendation, tell me in the comment section – I am curious and open to hearing different opinions.

Number 7 – Lebanon

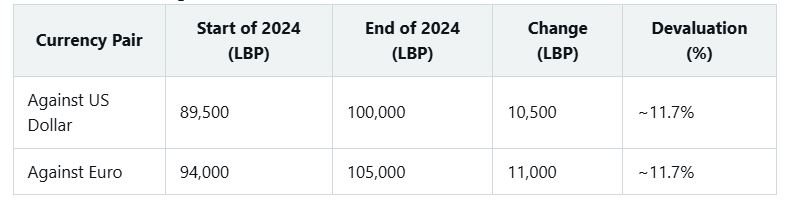

As bad as 70% inflation sounds, Lebanon’s economic disaster makes Turkey look like a minor hiccup.

Once proudly known as the “Switzerland of the Middle East,” Lebanon now experiences one of history’s most catastrophic financial collapses, with the World Bank ranking it among the worst economic crises globally since the 1850s.

And this thing about the Switzerland of the Middle East makes some sense for me – I lived for 3 years in Qatar, and there I met plenty of Lebanese people. They were some of the most sophisticated and educated people I met.

Most of them went to Qatar because of the economic downfall of Lebanon – which continued last year. The Lebanese pound has plummeted from 89,500 to 100,000 against the US dollar in just one year—an 11.7% freefall that continues unabated.

But this isn’t merely about currency devaluation…

It’s about the complete disintegration of a functioning economy.

Daily life in Lebanon has become an exhausting struggle – electricity operates for just a few hours daily, with residents held hostage by private generator cartels charging exorbitant fees.

The banking system has essentially collapsed, making basic financial transactions nearly impossible for locals and foreigners alike. Hyperinflation has sent prices skyrocketing by over 50% annually.

Even expatriates earning in dollars or euros report dramatic decreases in their standard of living despite the currency advantage they theoretically hold.

What good is a favorable exchange rate when basic services like garbage collection often fail to work properly? The country’s infrastructure is crumbling—roads are dangerous, public transportation is unreliable, and 62% of the workforce operates in an unregulated, informal economy.

Not a country I would recommend for relocation.

Number 6 – South Africa

I had a good time in South Africa, and I don’t think twice to say that it is one of the most beautiful places I’ve ever seen in my life – from Durban to Cape Town, it is a spectacular coastline.

However, South Africa also reveals a deceptive opportunity.

Since 2022, the South African Rand has lost 12.2% of its value against the US dollar. This might make those stunning landscapes and world-class vineyards seem like good deals, but there’s a rugged reality waiting for anyone tempted by these favorable exchange rates.

What currency calculations won’t show you is that South Africa suffers from a phenomenon locals call “load-shedding” – scheduled power outages that plunge entire regions into darkness for 8+ hours daily.

These aren’t occasional disruptions; they’re a chronic condition that has become normalized. Imagine running a business, keeping food refrigerated, or simply feeling secure in your home when electricity disappears for most of your day.

The energy crisis is just the beginning.

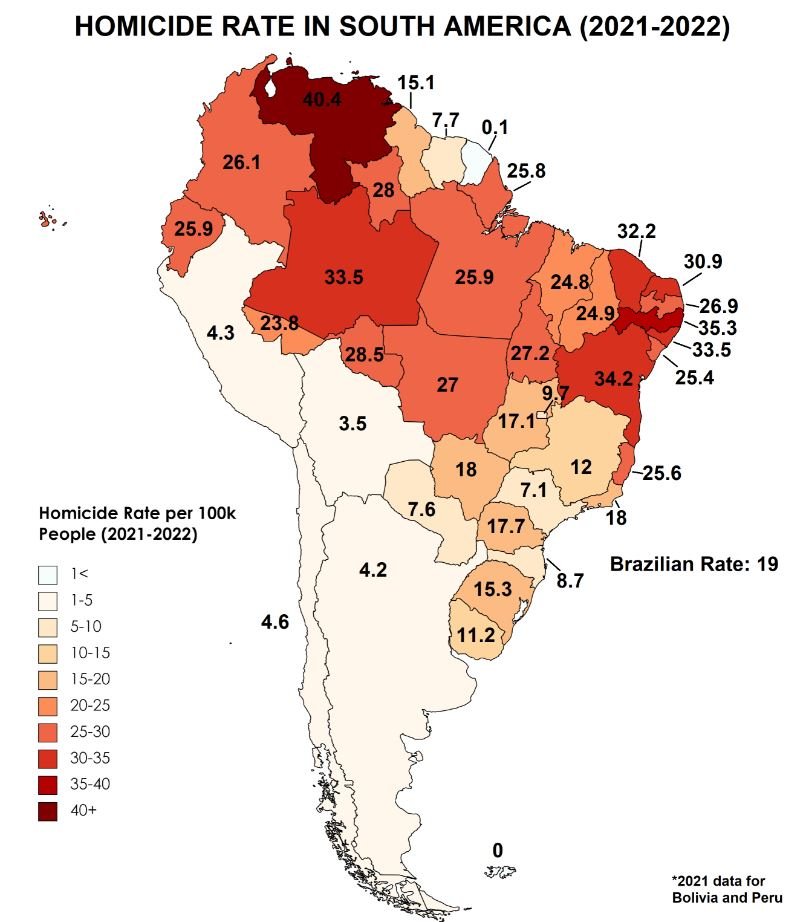

South Africa is one of the most dangerous countries in the world, with 2 cities among the 25 most violent on the planet – all the other 23 are in the American continent.

Crime rates in major cities like Johannesburg and Cape Town are among the world’s highest. Armed robberies, carjackings, and home invasions aren’t rare occurrences – they’re statistical probabilities that reshape how you’ll live your daily life.

For those still considering the move, prepare for bureaucratic battles. Visa processing notoriously drags on for up to six months.

The labor market has strict regulations, and since South Africa enacted the Broad-Based Black Economic Empowerment, it is much more difficult for non-black people, especially foreigners, to find a qualified job.

The painful truth is that South Africa represents a country where infrastructure failures directly impact the quality of life in ways that no currency discount can compensate for.

When your physical safety becomes your primary daily concern rather than enjoying that beautiful vineyard, you’ve made a poor relocation decision.

So no, despite all the beauty and good memories, I cannot recommend South Africa.

The next country is a bit colder than South Africa, but before I talk about, I have some good news.

FREE FOR A LIMITED TIME: Grab your Expat Wealth & Lifestyle Compass ($108 value) today! Includes our 74-page guide of Affordable European Cities, our Zero-Tax countries report, and our expat checklist. https://bit.ly/ExpatWealthLifestyleCompass Join us here before this offer ends

Number 5 – Russia

Russia offers an unexpected economic paradox that might catch unsuspecting bargain hunters off guard.

The Russian ruble’s 31% drop against the dollar since 2022 has transformed Moscow from one of the world’s most expensive capitals into what appears to be a remarkable deal on paper.

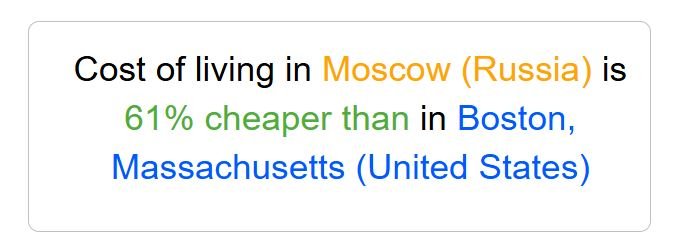

The Russian capital, nowadays, is 61% cheaper than Boston, for example.

Things like the rent of a high-rise apartment, skiing in Krasnaya Polyana, or fine dining in a Sochi resort, seem like a steal.

Behind these apparent bargains lies a harsh reality created by international isolation. Western sanctions have essentially severed Russia from the global banking system, creating a financial prison for anyone who relocates there.

You might have plenty of rubles in your local account, but…

Good luck accessing your home country funds or using your credit cards.

The banking restrictions make everyday financial transactions that expatriates take for granted virtually impossible. This isolation extends beyond just money matters.

Job opportunities for foreigners have sharply declined with the departure of international companies, further complicating potential relocation plans.

Despite the central bank’s interventions, inflation remains stubbornly high as export earnings from oil and gas declined.

Add to this mix the restricted freedom of speech, terrorist incidents, and various security concerns that have prompted travel advisories against all travel to Russia.

I had a good time in Sochi, but I would not recommend relocating there.

Number 4 – Brazil

Shifting from Russia’s isolation to Brazil’s beaches and healthy commercial relations with the rest of the world might seem like trading problems for paradise.

Things might look even better when you consider that their currency dropped almost 40% in a single year.

You heard it right: in ONE year, not two or three – the Brazilian real lost almost 40% of its purchasing power.

Things got really cheap there, to the point that I received numerous comments from people asking me to make an article about retirement in Rio de Janeiro. I did it, even though it was not what most people expected, and in that article, I wrote that relocating to Brazil, in most cases, is not really worth it.

It is painful for me to say that since part of my family lives there.

But beneath the surface of these tempting currency discounts lies a complex reality where your safety, not just your savings, hangs in the balance.

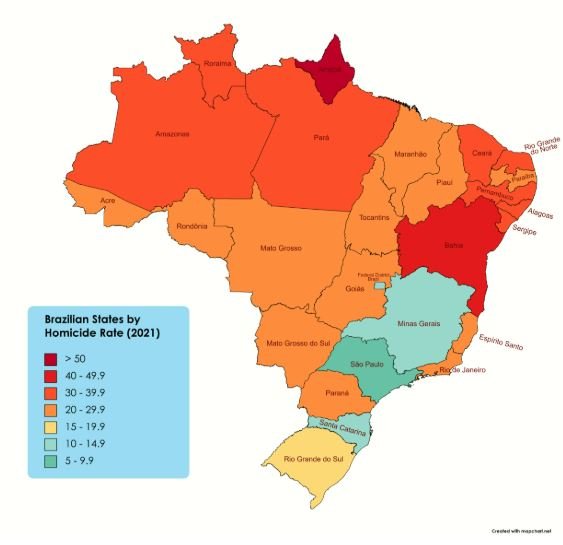

Brazil has one of the highest murder rates globally – of the 30 most violent cities in the world, 6 are there.

Those picturesque gated communities you see in travel photos? They’re not just a luxury—they’re a necessity that creates the impression that it is not the criminals, but you are the one living in a jail.

Of course, not every place in Brazil is that violent – in fact some parts, like Florianópolis, are actually quite ok, and attract a lot of foreigners.

But violence is not the only issue….

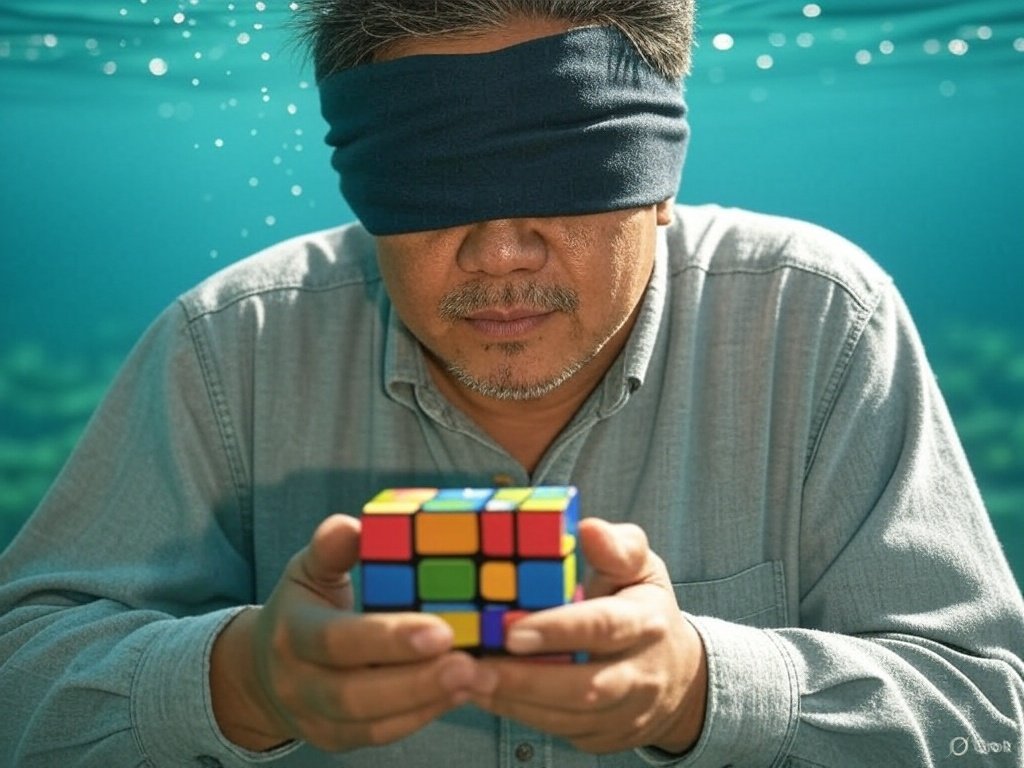

Even if you’re willing to navigate the safety concerns, prepare for a bureaucratic odyssey harder than solving a Rubik’s cube while blindfolded and underwater.

The tax system is intentionally complex, especially for foreigners unfamiliar with local regulations. Lines in the local “bureaucracy party hall” called “repartição pública” are slow and often you will wait the entire day for nothing.

And this creates an economic inefficiency that, honestly, makes me wonder why Brazil is in the BRICS. Look at the economic growth of China or China – and meanwhile, Brazil grows slower than some European nations.

This slow economic growth comes together with persistent inflation that steadily erodes purchasing power.

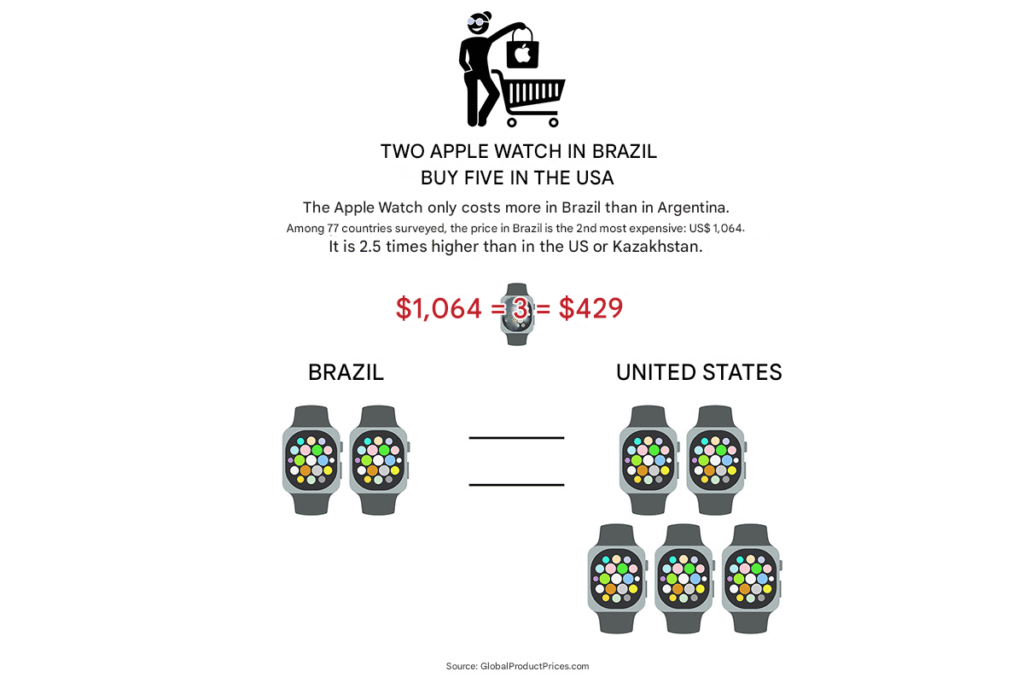

And the cherry on the cake, which is the most impressive part of all: the super high import taxes that make Brazil have some unbelievably high prices for things like electronics, clothes, and many other industrialized items.

Sorry Brazil, I cannot recommend you.

Number 3: South Korea

On the other side of the world lies another country experiencing dramatic currency shifts—but with a completely different economic profile.

With a drop of 14.2% in the last year alone, South Korea’s won has quietly been sliding to 16-year lows against the dollar, transforming the math for anyone earning in Western currencies.

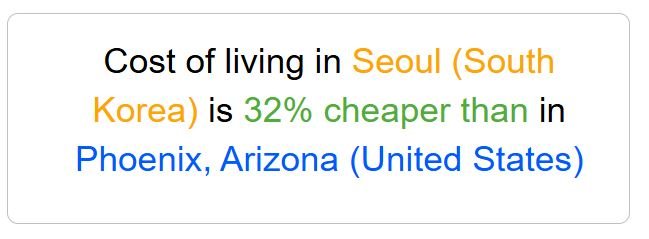

Seoul, the capital, which is also considered “very expensive” by locals, is 32% cheaper than Phoenix, Arizona.

This high-tech powerhouse suddenly costs 15% less for dollar-holders.

The currency’s tumble isn’t just a matter of global market whims; recent political turmoil, including the jailing of prominent politicians, has shaken confidence and sent the won reeling further.

While this creates buying power for foreigners, South Korea presents unique hurdles.

Unlike other countries on our list, the challenge isn’t crime or failing infrastructure—it’s integration.

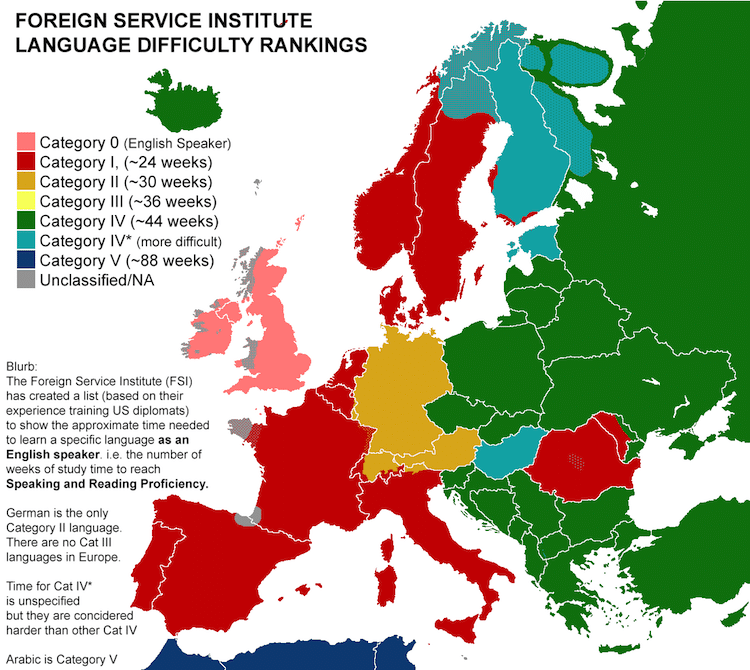

The Korean language ranks among the hardest for English speakers to master, with its unique alphabet and complex honorific system.

Even with excellent healthcare and transportation, foreigners often struggle with the intense work culture and social expectations. Many expats find themselves in an “English bubble,” never truly connecting with local life despite years in the country.

Beyond these immediate barriers, South Korea faces a deeper, looming crisis.

The country is aging at breakneck speed, presenting one of the most dramatic scenarios of demographic collapse in the modern world. With one of the lowest birth rates globally and a rapidly shrinking working-age population, the nation’s economic dynamism could falter under the weight of an elderly majority. This ticking time bomb adds another layer of complexity for anyone eyeing the country as a long-term bet.

So I would not put it on my list of recommendations.

Number 2: México

Mexico’s story isn’t about an entire country—it’s about finding pockets of tranquility within a sea of uncertainty.

The Mexican peso has lost more than 22% of its value against the dollar during the last year, with exchange rates jumping from 17 to almost 21 pesos per dollar. This dramatic shift stems from election anxieties, energy policy debates, and concerns about changing trade relationships with the US.

Here’s where Mexico differs from our previous examples: the country isn’t uniformly problematic. While national headlines focus on cartel violence and a homicide rate of 24.9 per 100,000 residents, the experience varies dramatically depending on where you are.

This contrast is visible when we compare México with Brazil, for example.

They are very similar countries in terms of violence.

But the most violent states of Mexico are way more violent than the most violent states of Brazil, and the safest parts of Mexico are way safer than the safest parts of Brazil.

Colima or Baja California in Mexico both have homicide rates above 70, while the most violent states in Brazil are around 50. On the other hand, the safest state in México, Yucatán, is far safer than the safest state in Brazil.

And that is crucial to understand why, differently from all other countries until here, I would recommend México for relocation – as long as you choose correctly.

Mérida in the Yucatán region offers something remarkable

It is a harbor with significantly lower crime rates than the national average – in fact, Mérida has safety numbers comparable to Zurich in Switzerland!

This colonial city also has reliable electricity and water services, unlike many Mexican regions plagued by frequent outages. For expats, this combination of basic stability and peso devaluation creates a genuine financial advantage.

The city’s appeal extends beyond safety. The cost of living ranks notably lower than comparable US locations – Mérida is 51% cheaper than Orlando, Flórida. This creates a rare situation where currency weakness actually translates to enhanced quality of life for dollar-earners, rather than just theoretical savings on paper.

Mexico also offers accessible visa options for both retirees and remote workers, removing the bureaucratic barriers that complicate expat life elsewhere. While specific programs vary, the pathways to legal residency remain straightforward.

So it is a YES for México – or at least to this city of México called Mérida, which I covered in a previous article about the safest big cities in Latin America.

Now, our last country stands out as perhaps the most fascinating on our list.

By the way, if you’re reading this article, you’re probably planning to travel abroad for a longer time, and you want to save money and pay fewer taxes. I’ve written three top-rated Amazon books on living abroad, based on my experiences and insights from hundreds who’ve done the same – You can purchase them through this link.

Number 1: Argentina

Argentina’s peso has experienced a truly dramatic fall – the most significant of any nation or currency I’ve covered in this article. In the last year alone, the Argentine Peso devalued by 32.4% against the US dollar and 25.8% against the Euro.

Things get even more – or should I say MUCH more impressive when instead of considering just last year, we consider the last 2 years.

In January 2023, 1 US dollar bought 177 Argentine pesos. By December 2024, 1 US dollar could buy 1074 pesos. 6 times more.

What’s particularly notable is how this happened: in December 2023, the government implemented emergency measures that devalued the currency by over 50% overnight.

This wasn’t just a gradual decline – it was a deliberate shock therapy approach to address the country’s triple-digit inflation and fiscal deficits.

The Argentine economic struggle is nothing new. For years people who earn their income in hard currency (meaning Dollars, Swiss Francs, Euros, British Pounds, etc) know that Argentina is a very inexpensive place.

This is one of the reasons I chose to go there as a destination for my honeymoon.

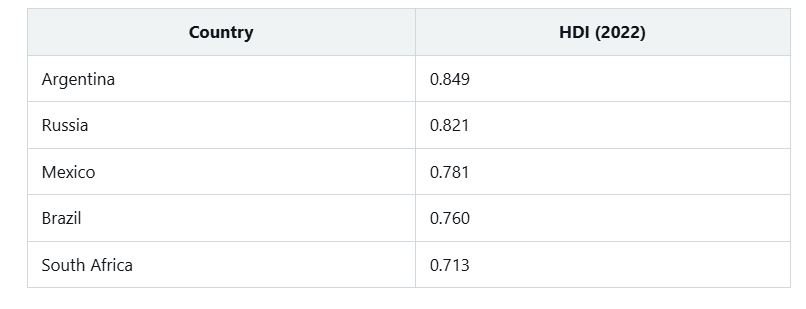

What makes Argentina unique among the countries with severe currency problems I listed today is that it is way more developed than Brazil, South Africa, Russia, or Mexico.

And it has a culture easier to adapt to, and a language much easier to learn than in South Korea or Turkey.

It is also a remarkably safe country when compared to other Latin American nations. And, most of all, it is VERY affordable.

The Argentinian homicide rate is very low, 4.2 per 100,000 people, which a bit over half of the US, for example.

Which cities? Well, let’s take the example of Mendoza.

It is a city that is located in what we can call the “Napa Valley” of Argentina. A winery region famous for its Malbec, pleasant weather, safety indicators, mountains, and ski resorts.

And despite all that, it is still 61% cheaper than San Diego in California!

That is what a local told us about Mendoza:

“It’s not heaven, of course, it has some favelas, but it is so safe that I’m sure I can be walking around midnight looking at my phone and nothing’s gonna happen.”

But I am not here to talk about violence, but about how currency devaluation made life cheap there.

So, what does this impressive currency devaluation mean for you?

The numbers tell an extraordinary story.

In Mendoza, for 900 dollars or less, you can find really good homes.

In the greater Mendoza, I found a 150-square-meter apartment in an A-class building for $900 that looked more like an expensive hotel than an ordinary apartment building.

But the value extends far beyond housing.

While the economy struggles, you’ll still find decent roads, reliable utilities, and exceptional internet connectivity in major cities.

There are also multiple signs that the Argentinian economy is improving. For foreigners with external income sources – especially remote workers, digital nomads, and expat retirees – Argentina currently presents a rare opportunity where extreme affordability meets genuine quality of life, so yes, I do recommend you consider it if you plan to retire abroad.

Just to the side of Argentina, there is a tiny country that, while not as affordable as Argentina, offers one of the most spectacular tax incentives in the world – Uruguay.

And in this article here at your left, I compared the low-cost advantages of Argentina versus the tax incentives of Uruguay, to arrive at a conclusion of which one is the best destination for you in South America.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purcha