Imagine you and a friend buy identical two-bedroom apartments in two different European capitals.

Five years later, one of you feels like the taxes were a one-time sting.

The other is stuck with endless annual bills.

That massive financial gap comes down to one thing: is the country ‘entry-tax heavy’ or ‘holding-tax heavy’?

Because here, property taxes can completely ruin your financial plans.

During these 9 years living in Europe, I’ve seen too many people budget for the mortgage, utilities, maybe healthcare … and then get surprised by recurring taxes over the roof that you already paid for!

You will discover that some places punish you upfront, but after that, you pay nearly nothing. Others feel “cheap” to buy, then keep billing you like your house is a subscription service.

And there are three exceptional countries where you pay close to ZERO.

So, we start with the exact criteria we are using to judge these countries.

The Criteria

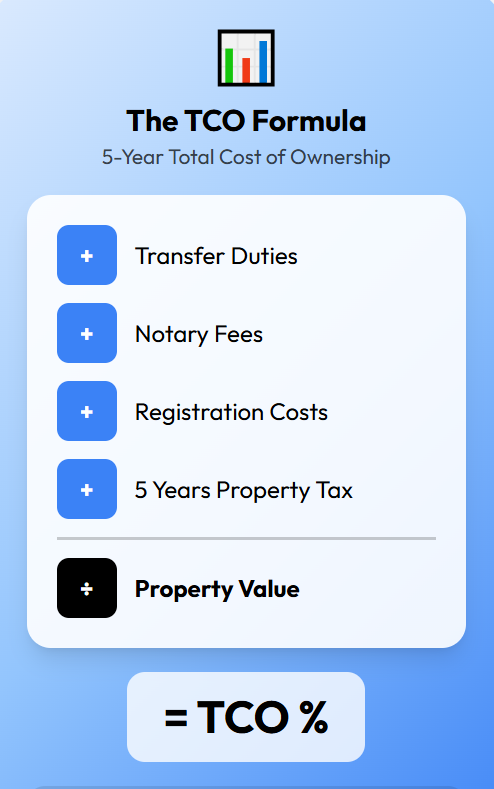

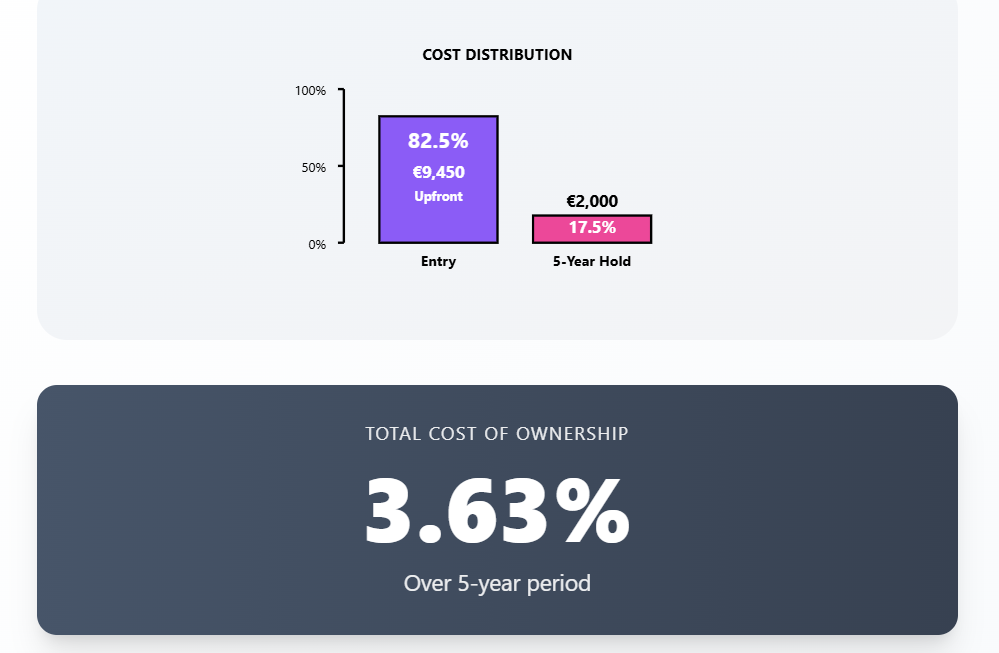

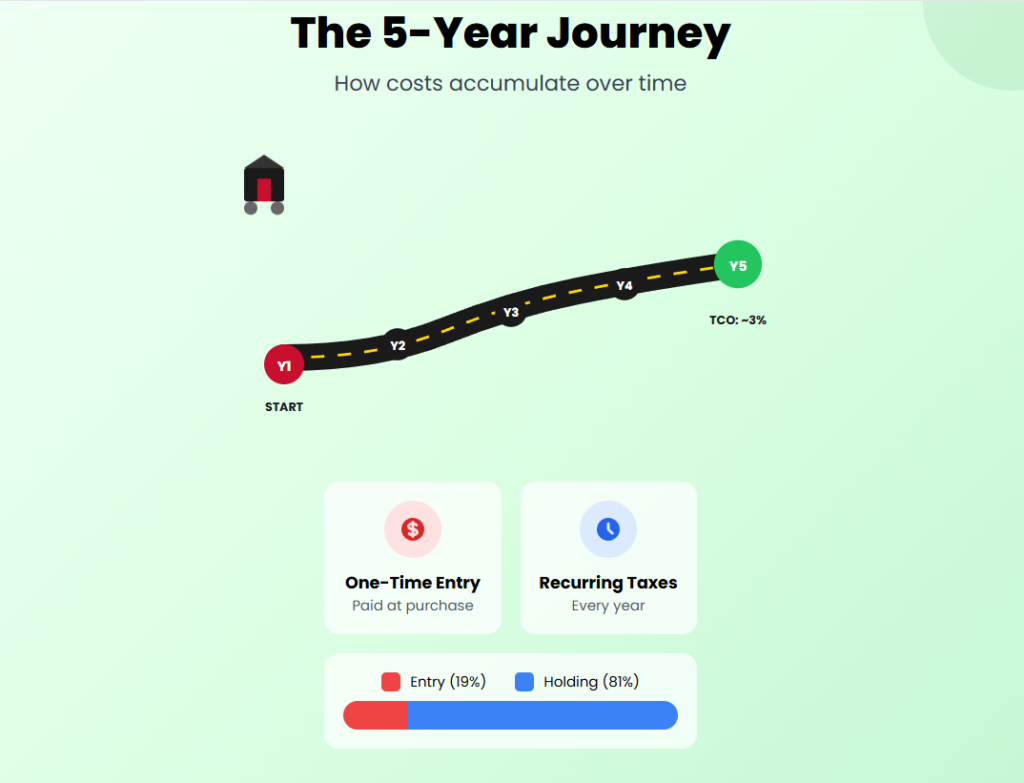

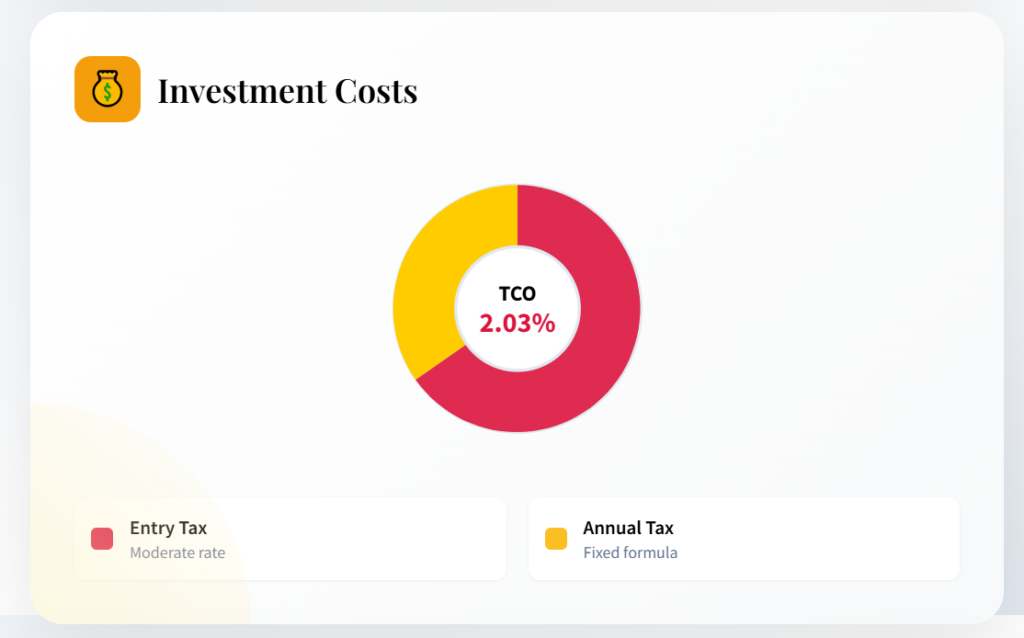

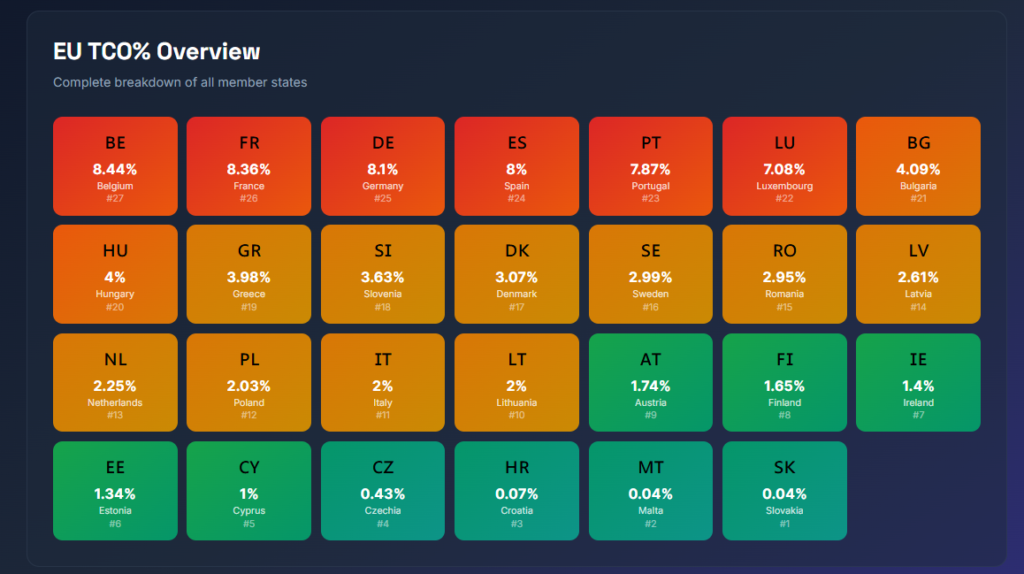

To make it completely fair, we use a single indicator: the five-year Total Cost of Ownership (TCO) percentage for a 70-square-meter, two-bedroom apartment in each capital.

The mathematical formula is simple.

- We take all purchase fees—transfer duties, notary costs, and registration costs—and add five years of annual property taxes.

- Then, we divide that total by the market price of the property.

- This percentage reveals your total tax burden relative to the property’s overall value.

A TCO of 5% means you pay 5% of the home’s price in taxes over five years – but do not view this as 1% per year, because in many markets, you pay almost everything upfront.

The worst countries in this list are expensive tax traps, while the top reveals outliers where owners pay nearly zero property taxes. Countries vary significantly in their economic climates, as in our income tax rankings in places like South America.

Let’s start with the absolute worst of all.

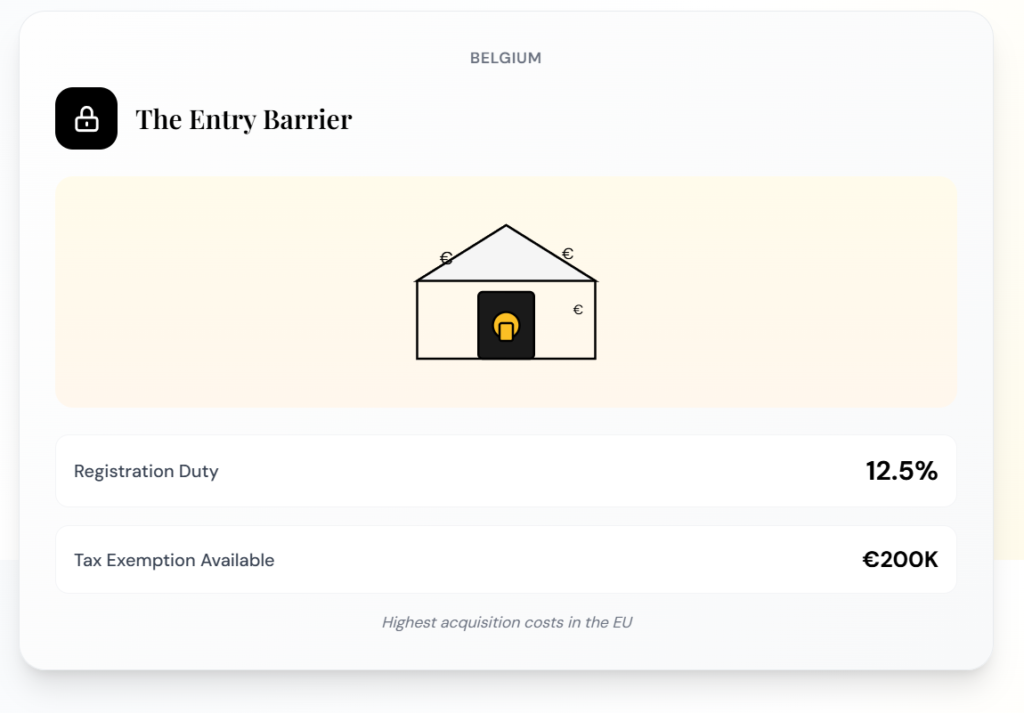

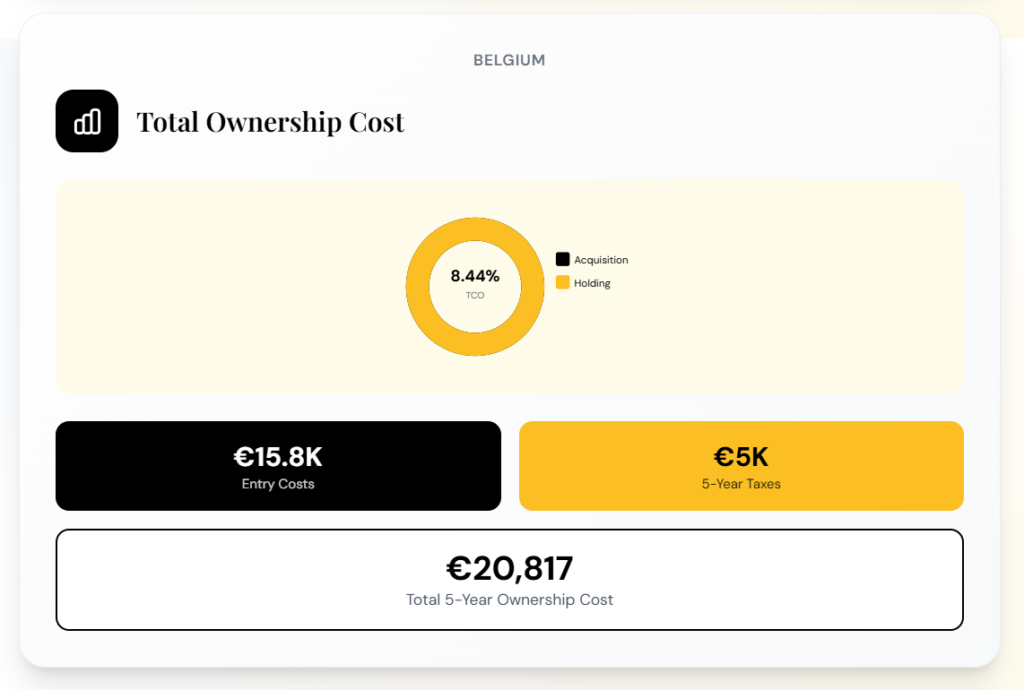

27: Belgium

Belgium has a terrifying amount of property taxes. For our calculations, we use a 70-square-meter, two-bedroom apartment as an example, which is the same standard we will use for all countries in this ranking.

The headline registration duty in Brussels is 12.5%, and that number scares people for a good reason. If you buy as a resident natural person and it is your primary residence, Brussels applies an abattement (a partial tax exemption) of €200,000 on the taxable base. On a €247,000 property, the duty only applies to the remaining €47,000.

Even if you qualify for the exemption, the registration duty alone will cost you more than €5,800. After that, there are still notary and mandatory administrative costs estimated at €10,000. You start off already losing almost €16,000.

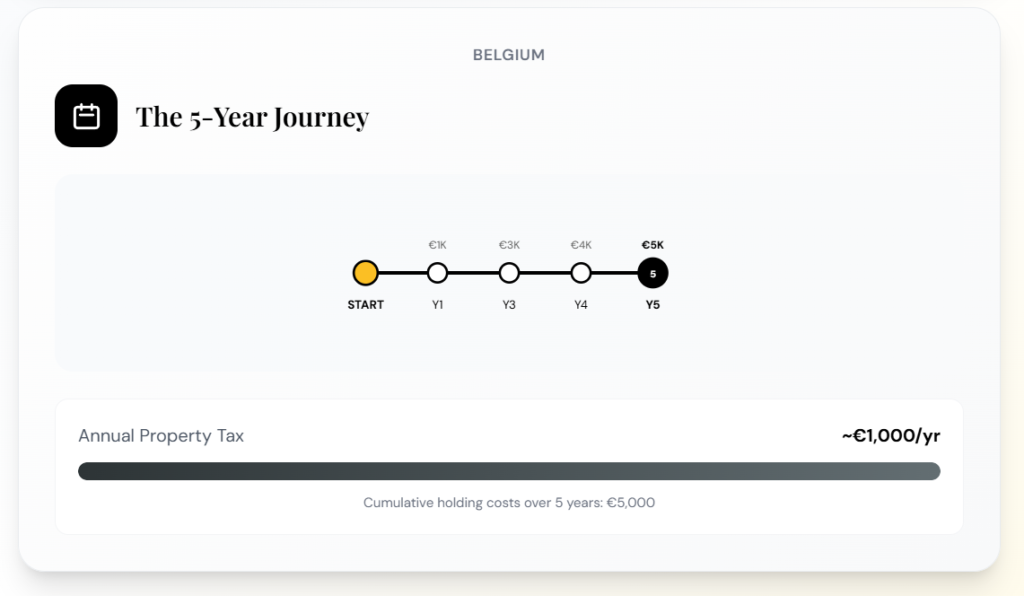

The main annual tax in Belgium is the Précompte Immobilier, which is based on indexed cadastral income. For this unit, we estimate €1,000 per year, totaling €5,000 over five years.

The five-year total is almost €21,000, meaning a Total Cost of Ownership of almost 8.5%.

Belgium ranks poorly because the financial pain hits early and hard.

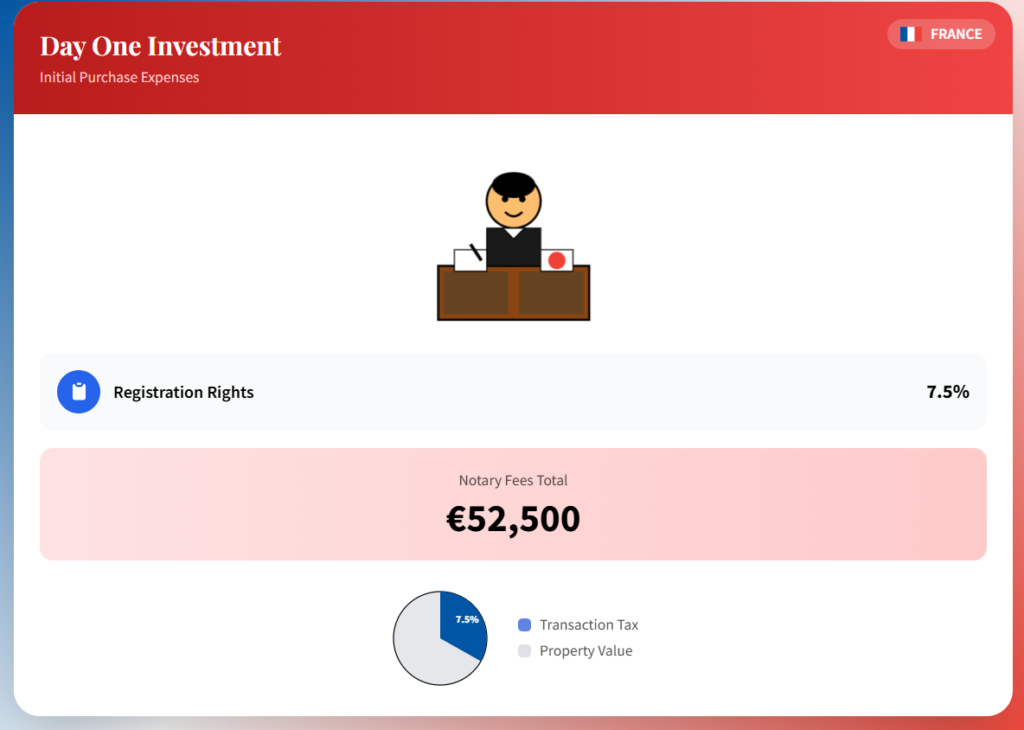

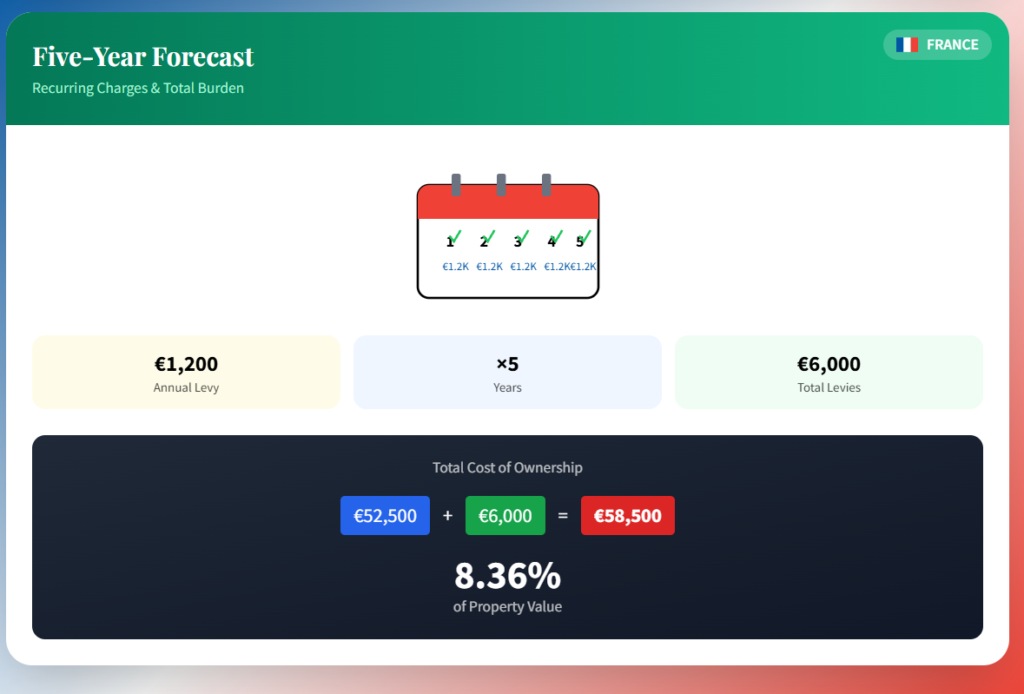

26: France

France is the country that can raise your tax bill just for upgrading your bathroom. That is not a joke, because in 2026, “Operation Transparency” expands the Taxe Foncière taxable base by adding “comfort elements” that were not recorded before. Modern plumbing and air conditioning now count against you.

For affected households, the average increase is €63 per dwelling, even if nothing changes outside your building. Now look at Paris, where the price for our 70-square-meter unit is an eye-watering €700,000. The entry hit comes first.

On a resale purchase, notary fees plus Droits d’Enregistrement total about 7.5% of the price. Just on that single transaction, you have lost €52,500.

Then comes the annual taxes. In Paris in 2026, the effective annual Taxe Foncière for our two-bedroom apartment is around €1,200 per year, which becomes €6,000 after five years. It can get even worse because the government can impose base recalibrations, and municipalities can index rates on top of the base updates.

France ends at a total tax cost during five years of 8.36%—the second worst in the entire European Union.

Remember, what we are covering today is just the briefing and the starting point. If you want the actual strategy to save money in Europe, our Patreon subscribers get privileged access to detailed reports and direct contacts to experts who can answer your questions. Do not risk doing this alone when you can have a dedicated team on your side for just the price of a coffee.

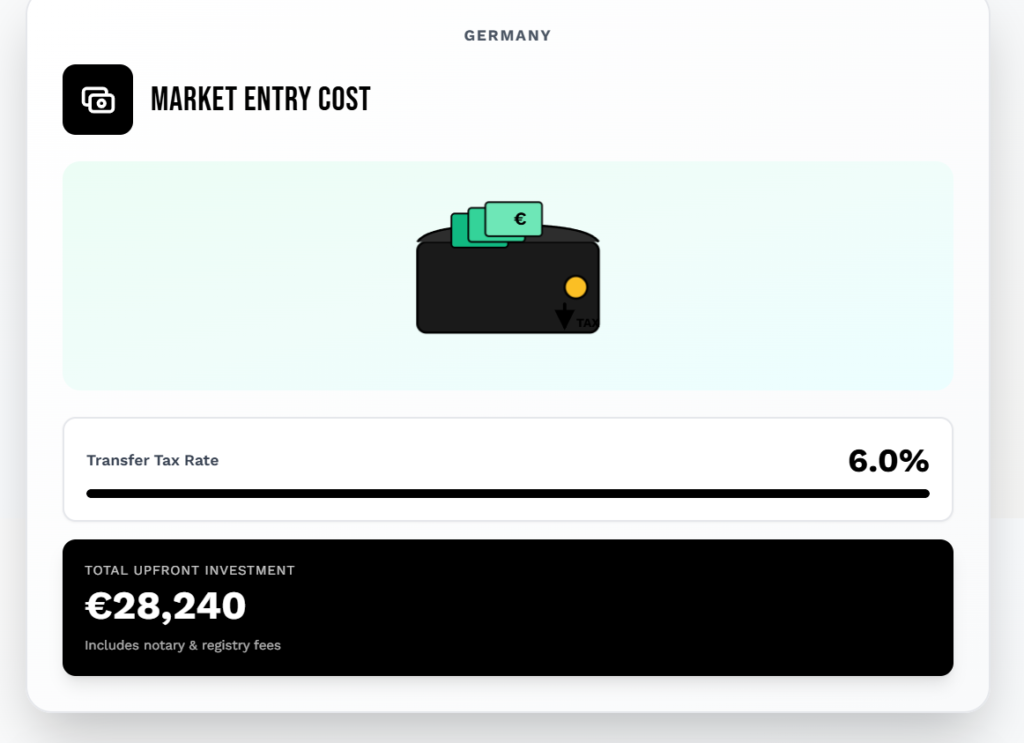

25: Germany

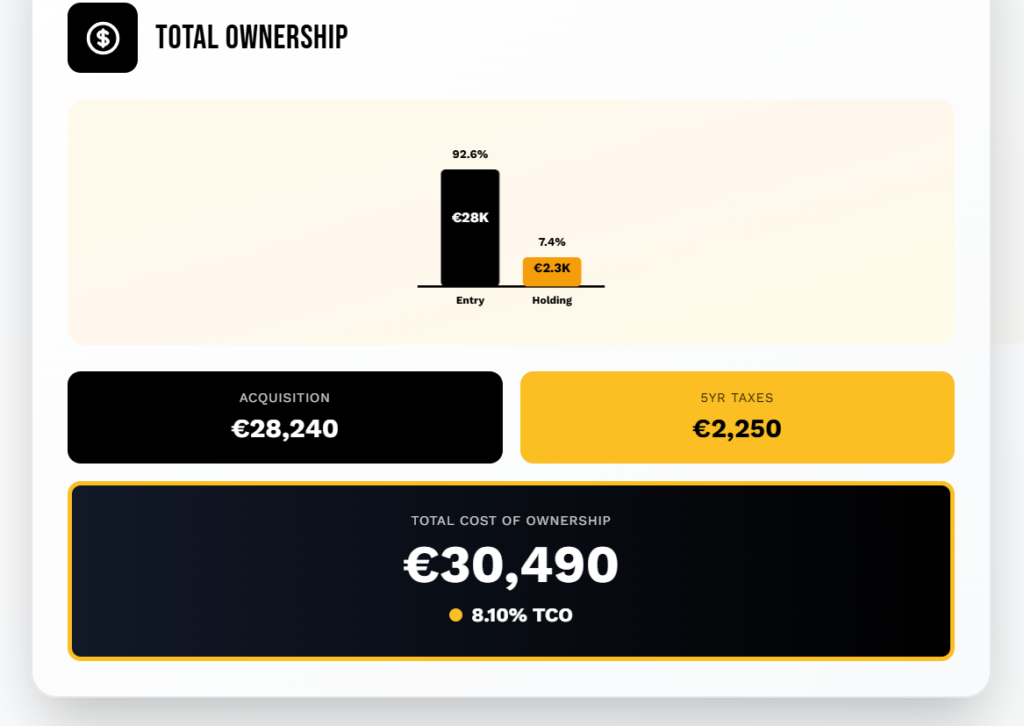

Germany looks simple until you actually add up all the taxes you must pay. Let’s consider a 70-square-meter apartment with a price of €377,000. You pay Grunderwerbsteuer—the transfer tax rate—at 6.0%.

Then, notary and land registry fees add around 1.5%. Together, they hit about 7.5% of the total price. For our apartment, that upfront bill is a staggering €28,240.

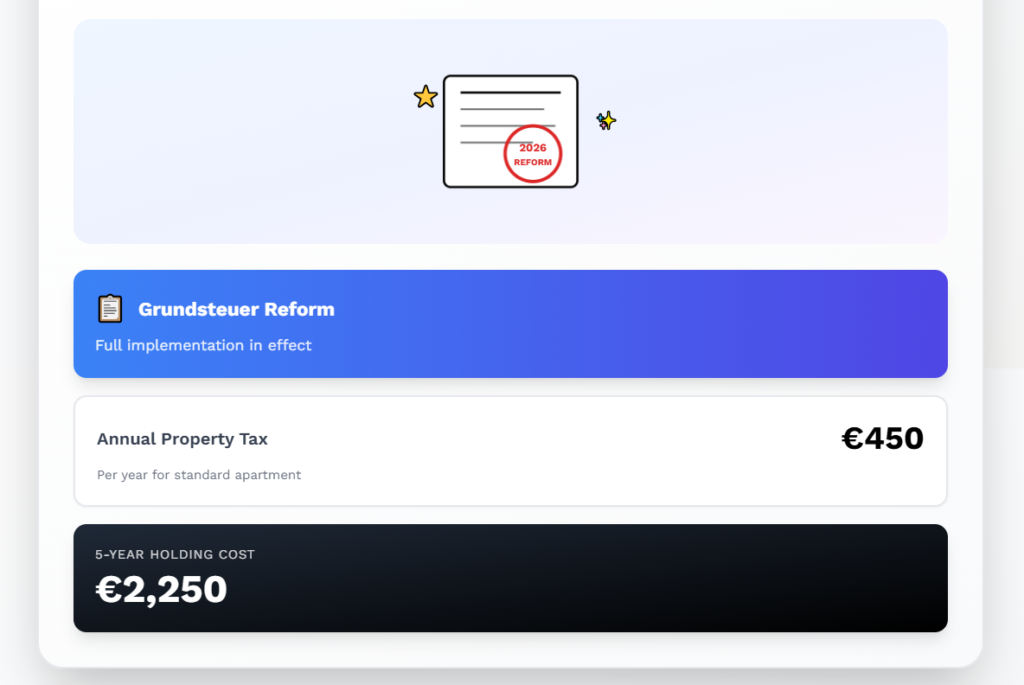

Germany’s Grundsteuer (annual tax) reform is fully in place for 2026, and the annual bill depends on new valuations and municipal multipliers. In Berlin, the estimated annual tax for this unit is €450 per year, or €2,250 over five years.

“Green” retrofit incentives can cut your net upgrade cost, but only if the timing and eligibility perfectly match your specific case. Germany’s total tax cost during five years is 8.10%.

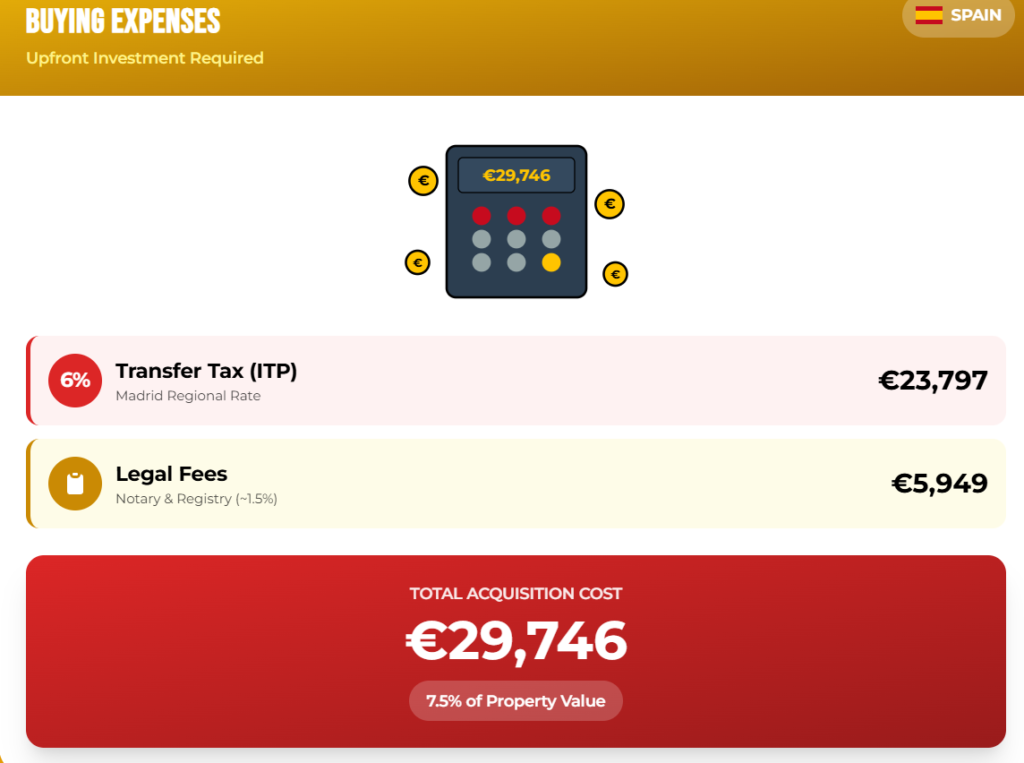

24: Spain

Spain is where expats fixate on the purchase tax and miss the recurring layer that follows you every single year. In Madrid, our two-bedroom apartment costs €397,000. On a resale, the ITP in Madrid is 6%, so you pay €24,000 right away.

Then, notary and land registry add 1.5%, which is almost another €6,000. Your entry bill is almost €30,000 before you have enjoyed a single year of ownership.

The main annual tax is called IBI, which is set by the municipality and based on the cadastral value. In Madrid, the IBI on this unit is around €400 per year. Spain also uses the Valor de Referencia (reference value for the real estate) as a strict tax floor.

Even if you buy your home below the official reference value, your transfer tax can still be calculated based on the higher number. This basically means the tax is not based on the real value you paid, but on an indicator created by the government. Over five years, that annual tax totals €2,000.

Add that to the entry costs, and you reach €32,000 in five-year taxes and required fees. Spain’s total tax cost during five years is exactly 8.00%.

An important thing about Spain is that the tax code changes between Autonomous Communities. In our example, we use Madrid, but in other parts of the country, the rates are completely different.

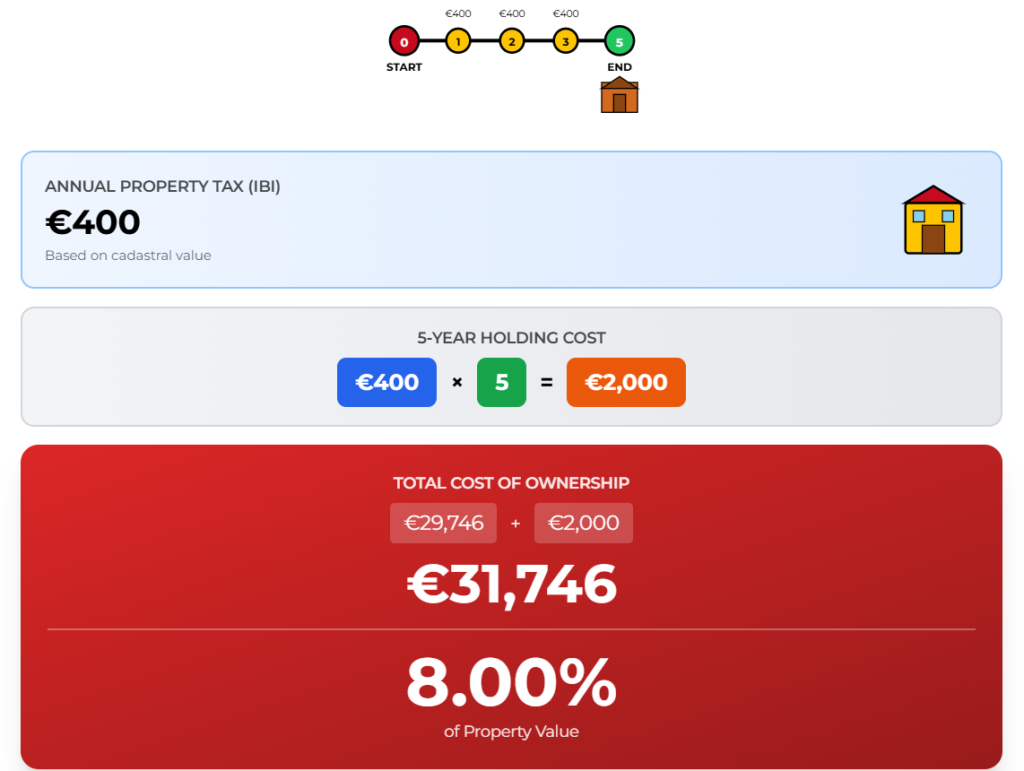

23: Portugal

The 23rd spot goes to Portugal, where “just a little upgrade” can drastically change your entry bill. Lisbon is the baseline, and a two-bedroom apartment costs about €460,000. The main upfront tax is IMT, and it is progressive, meaning the tax grows faster as the price climbs.

Add Stamp Duty, and the combined load is near 6.8% of the purchase price, or about €31,500. Then, notary and legal fees add close to 1%, which is around €4,500. You can lose nearly €36,000 before you even move in.

The main annual tax in Portugal is the IMI, which is heavily based on the property value. In higher-demand Lisbon areas, the annual bill is around €800. Over five years, that is about €4,000.

Remember that most of those taxes are municipal, so other Portuguese cities might be much cheaper. However, in Lisbon, the TCO during five years is one of the worst in Europe at 7.8%.

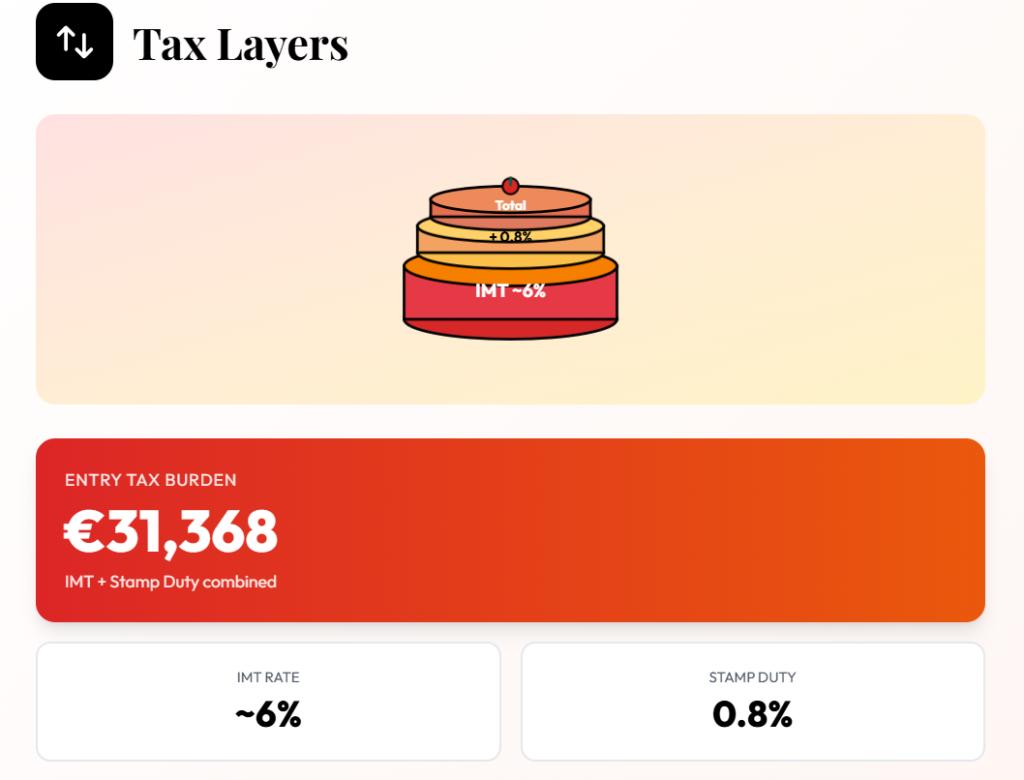

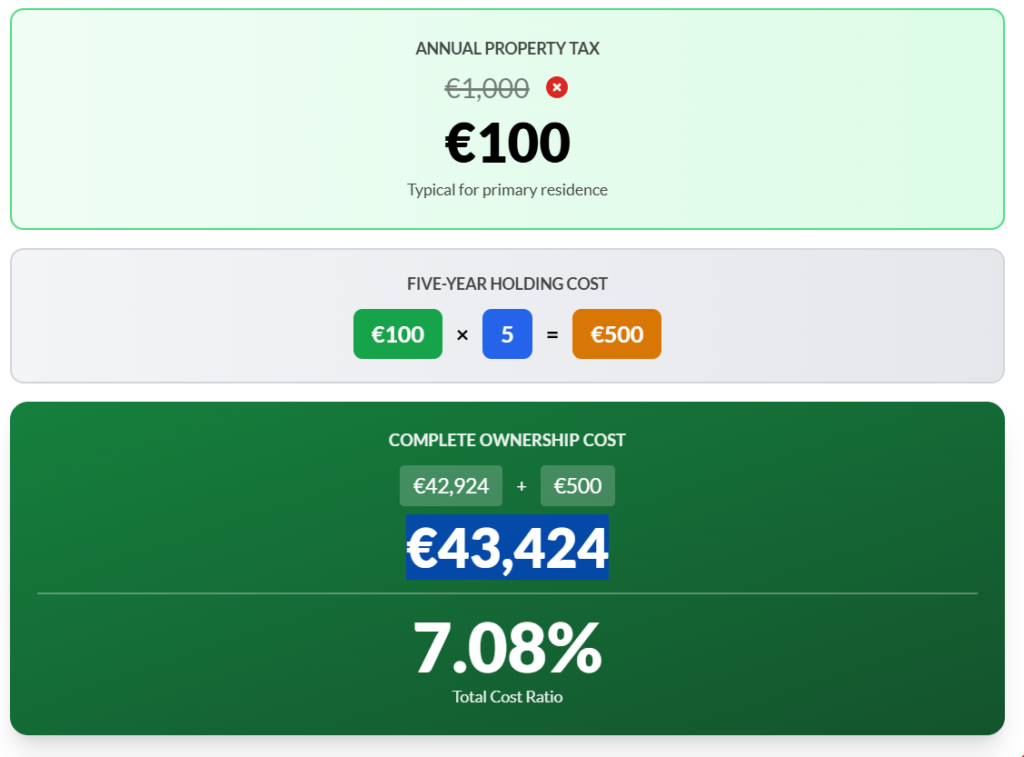

22: Luxembourg

For 22nd place, we have the curious case of Luxembourg. Our two-bedroom unit in Luxembourg City costs about €613,000, with prices hovering near €9,000 per square meter.

The transfer tax rate is 7% in total, split into a 6% registration duty and a 1% transcription duty. Annual municipal property taxes for a primary residence are relatively low, and in this specific case, would be near €100 per year.

Since almost all your expenses are on the purchase and the annual tax is small, it is only worth considering Luxembourg if you plan to stay for a very long time. The five-year TCO sits at 7.08%. Luxembourg is the last country on this list where the total cost of ownership for five years is above 5%.

From now on, things get MUCH better!

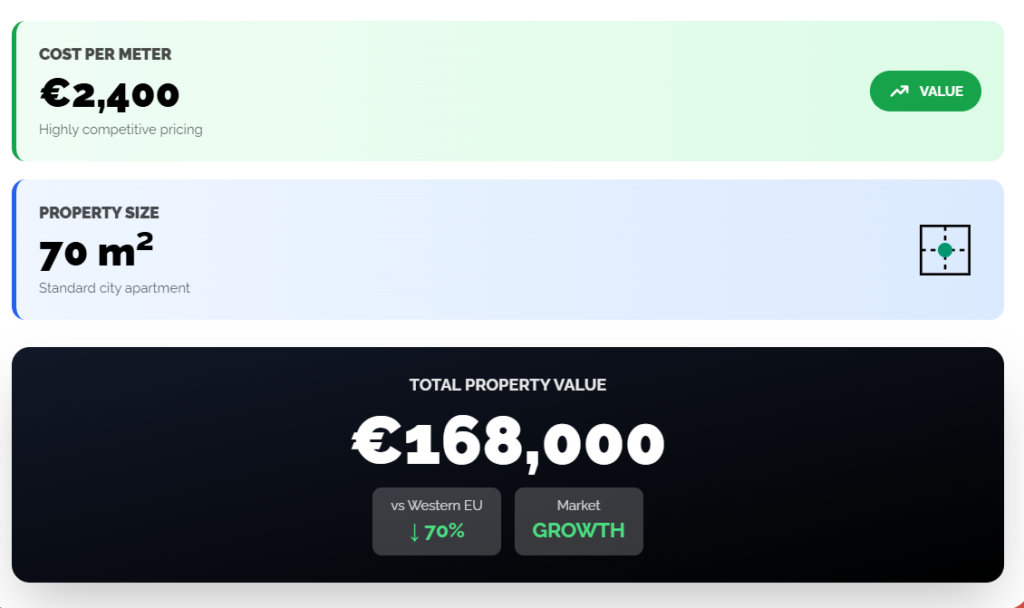

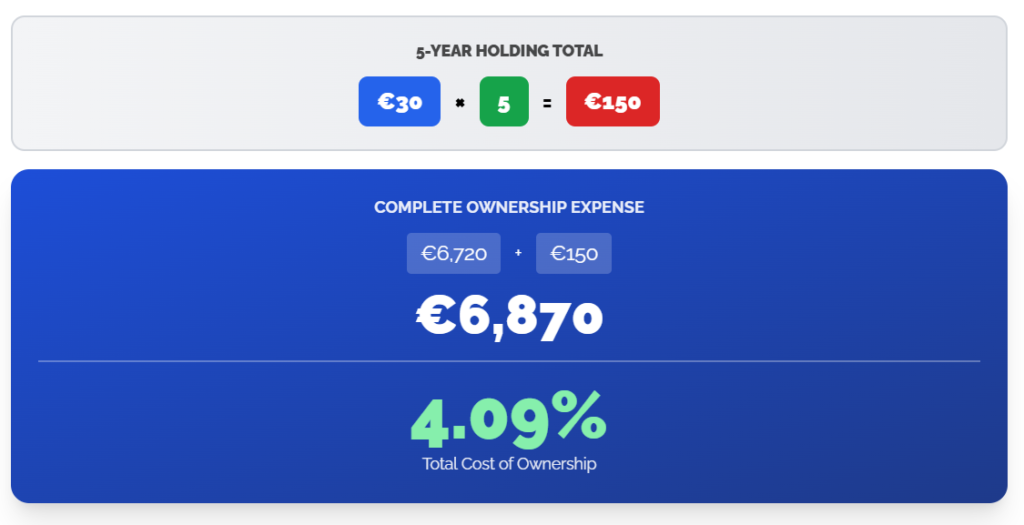

21: Bulgaria

Position 21 goes to Bulgaria. We use a two-bedroom apartment in Sofia that costs €168,000 as an example. At purchase, the local transfer tax is 3%.

Add notary and registration fees of near 1%. That puts your overall acquisition costs around €6,700.

The annual property tax is remarkably low. On a typical unit, it is close to €30 per year, so five years costs around €150.

While the acquisition costs in Bulgaria are on the higher side, the country has annual taxes well below the average. The total tax cost during five years is exactly 4.00%.

Just do not confuse a low tax rate with low risk. In Bulgaria, it is extremely important to confirm renovation permits and look carefully at the overall building quality.

20: Hungary

In 20th place is Hungary, where you will take a hard hit at purchase, but then have a wonderful surprise later. At signing, the transfer duty is based on the full market value, and the legal and registration costs add directly to the price. In Budapest, our example apartment costs €191,000.

All the purchase fees and taxes together are 4% of the total value, which equates to €7,700. That 4% hits you immediately in your first year.

However, the recurring annual property tax is €0, so your five-year “ownership tax” line does not keep adding new bills! Over five years, the total in this model stays at exactly €7,700. The total tax cost during five years is 4.00%.

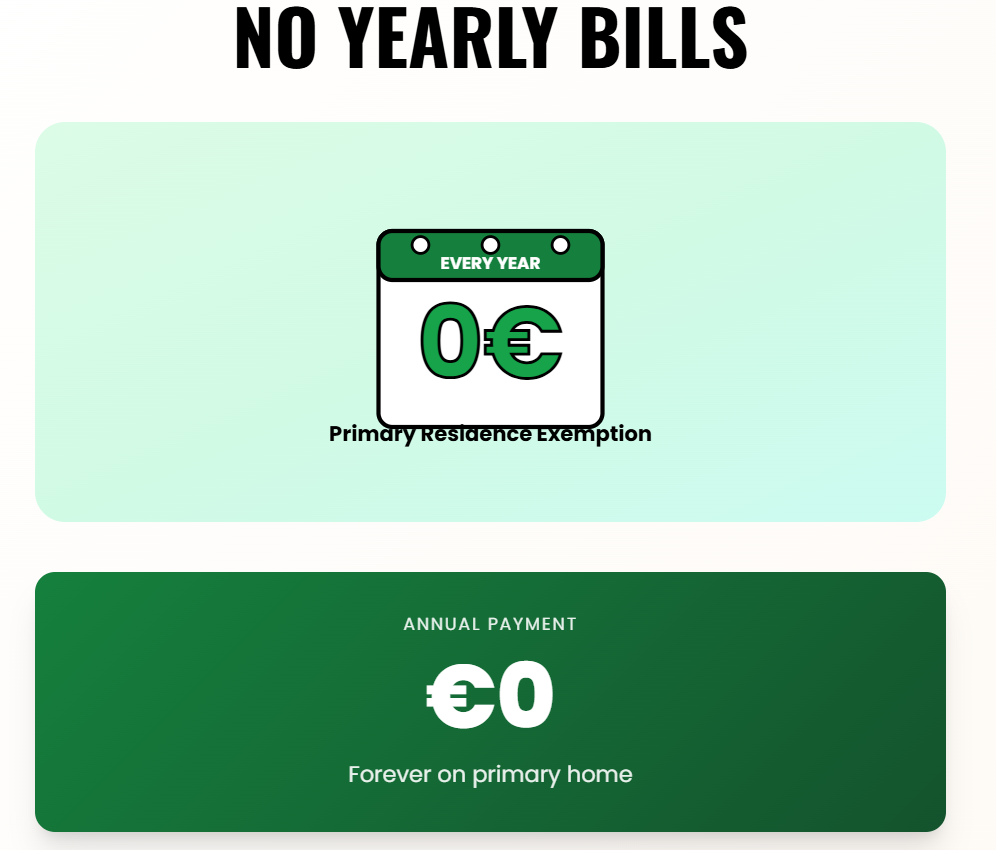

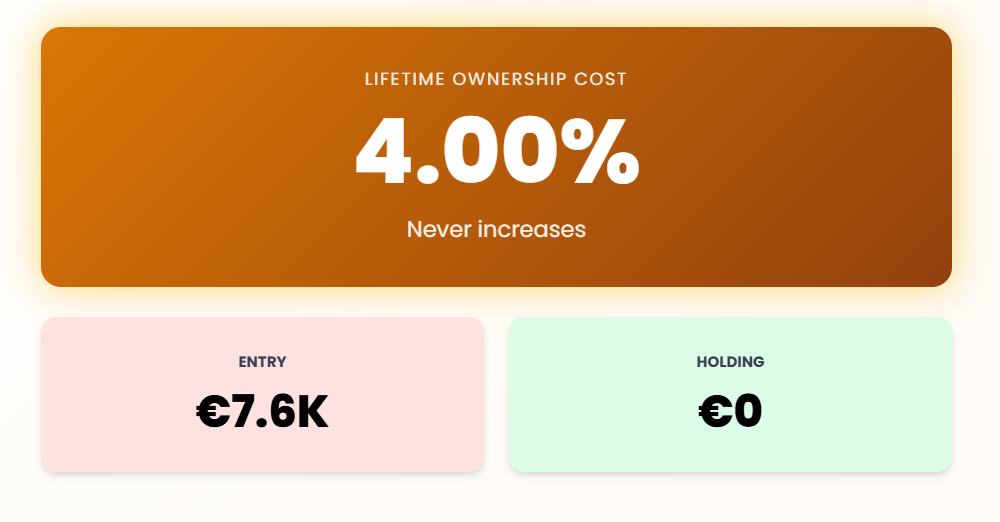

19: Greece

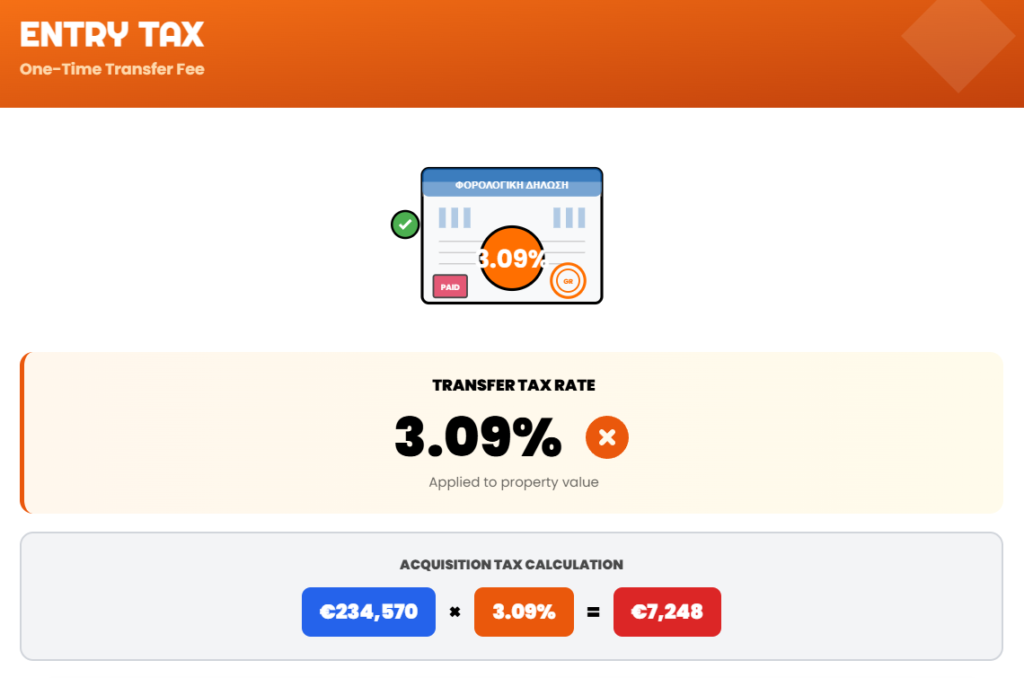

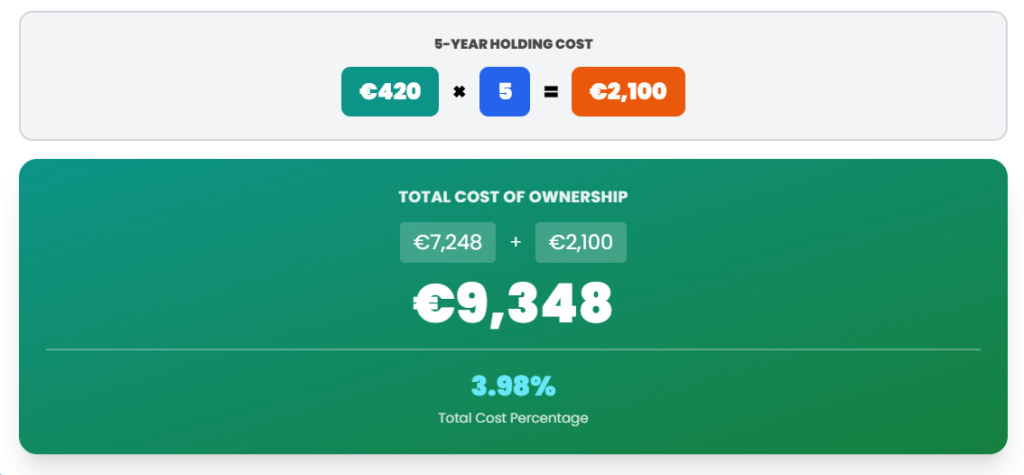

In 19th place is Greece, which is the exact opposite of Hungary in many aspects. In Athens, we consider a two-bedroom apartment that costs €235,000, and you pay the transfer tax up front at 3%. That entry tax alone is around €7,250.

Now comes the bad part: you need to pay the annual tax, called ENFIA, every single year. For this apartment, the annual bill averages close to €420. Over five years, that amounts to about €2,100.

In Greece, while your initial cost is lower than in Hungary, the annual costs are much heavier. In the end, both Greece and Hungary have a very similar TCO.

While Greece might not have the lowest property taxes, they do have a very good incentive for expats: a notably low income tax on foreign income.

18: Slovenia

The 18th place goes to Slovenia. There, we use an apartment in Ljubljana that costs €315,000 for our calculations. On purchase, all the costs like the Immovable Property Transfer Tax and registry are close to 3%.

The annual tax adds €400 per year, which is a heavy fee that offsets the smaller purchase costs. The total tax cost during the five years sits at 3.60%.

17: Denmark

In the 17th position, we have a Scandinavian country that keeps purchase taxes remarkably low but has some massive annual taxes. In Copenhagen, Denmark, we consider a two-bedroom apartment with a price of €575,000. The transfer fee is just 0.6%, so the entry costs are very small compared to many EU capitals.

It is the annual tax that really brings the overall costs up. The property value tax uses a 0.51% rate after a 20% deduction, which lands near €2,350 per year at this price point. Add a land tax near €500 per year, and you are close to €2,850 each year, or about €14,250 across five years.

The total tax cost during five years is 3.07%, and most of it comes from the annual taxes rather than the purchase fee. Green upgrades can cut energy bills, but if the improvements push the assessed value up, the annual tax base can unfortunately rise too.

16: Sweden

The 16th place goes to Sweden, which is a place with huge annual taxes. For an apartment in Stockholm, the annual municipal property fee is tightly capped. In our model, that cap lands near €800 per year, so five years of annual taxes come to about €4,000.

There are also the purchase costs to consider. Sweden applies a 1.5% stamp duty in this scenario, which is close to €4,000. Add that to the annual taxes, and you get a total near €8,000 over five years.

The total tax cost of ownership is 2.99%.

Now, I need to make a quick disclaimer: expats often blame “taxes,” but a big part of the costs of having a home comes from association fees, which are not included in our calculations. The money you pay for that grumpy building administrator to keep the elevators running is completely left out of this ranking.

15: Romania

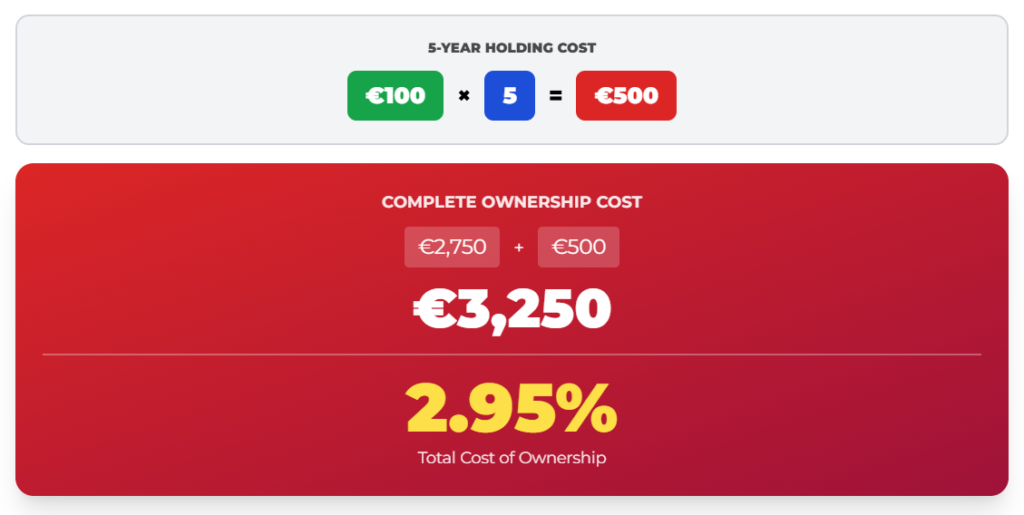

Romania is one of the clearest cases where low property taxes are real, provided you buy the right apartment in the right area. For our calculations, we use Bucharest. On the entry side, buyers pay combined notary and land registry charges of about 2.5% of the property value.

For the standard unit in our dataset, that comes to close to €2,750 at purchase. The annual property tax comes in at about 0.1% of the cadastral value.

Romania has a final TCO of 2.95%, with most of it paid during the purchase since the annual taxes are incredibly small.

14: Latvia

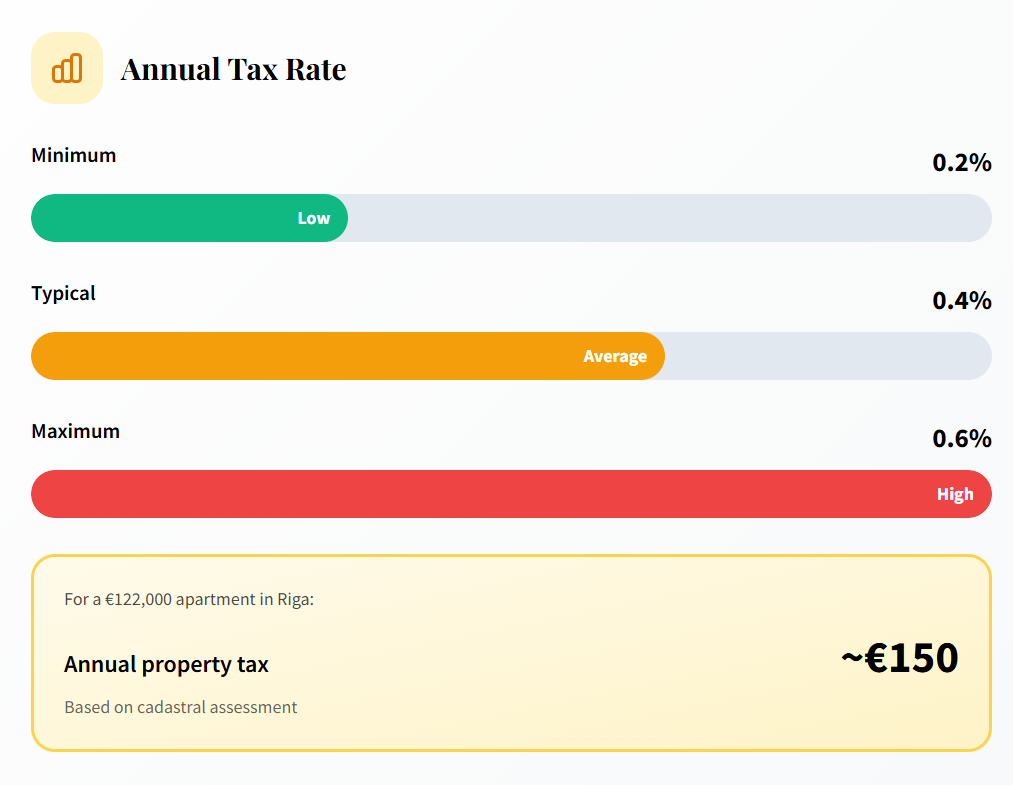

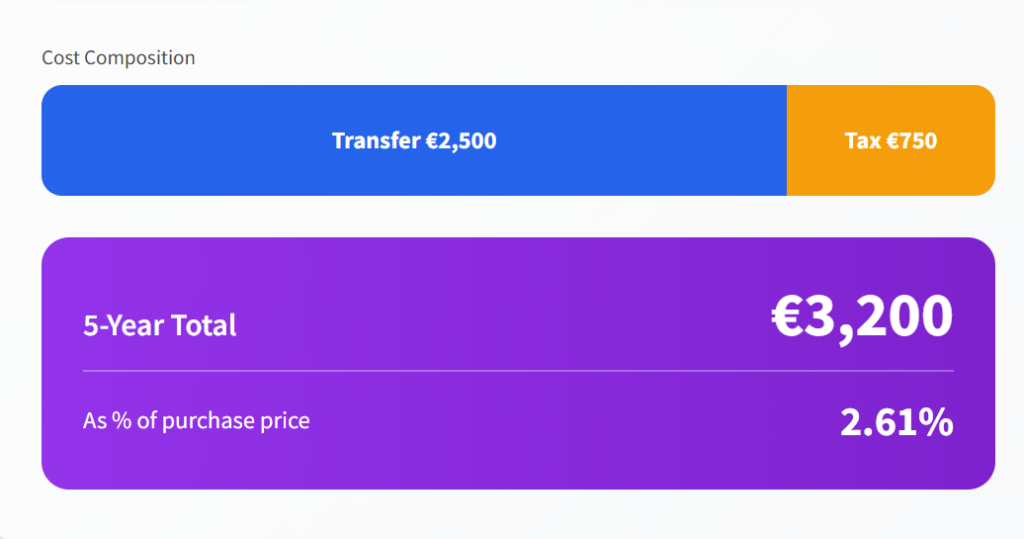

For the 14th place, we fly all the way to the Baltics to Latvia. This is a country that looks low-cost at first glance, until you track how government valuation drives the yearly bill. In Riga, our two-bedroom apartment costs about €122,000.

Entry costs are not high, but not low either, as Latvia charges a 2% transfer tax. Then, the annual property tax ranges from 0.2% to 0.6% of the cadastral value. The huge risk here is that the government frequently updates the assessed values.

Your annual bill can move significantly even when you change absolutely nothing about the apartment. For this specific apartment, the annual tax is close to €150 a year.

The total tax cost during five years in Riga, Latvia is 2.61%, making it a middle result that stays manageable, but not “cheap.” Cold-climate buildings also face energy-upgrade pressure, and owners can feel it through both upgrade obligations and valuation changes.

13: Netherlands

Position 13 goes to a very expensive place. In the Netherlands, we considered a two-bedroom apartment priced at €593,600 in Amsterdam. As a primary residence, the transfer tax is 2%, meaning €11,900, which is not that high considering the steep value of the property.

Then the annual bill shows up. The OZB rate in Amsterdam is 0.0577%, charged on the officially assessed value, not your personal budget. For our example, the annual OZB is close to €300.

The biggest danger is the official market valuation used for these taxes. If the valuation rises with the market, the tax rises right alongside it. If the government decides that your apartment increased 10% in value, the annual OZB instantly jumps to €380.

The total cost of ownership during five years is 2.25%, which is tied to the constant risk of the government revaluating your property and increasing your taxes.

12: Poland

Poland gets the 12th position because it is incredibly predictable, as things in Poland usually are. In Warsaw, a two-bedroom apartment costs about €271,500. At purchase, the standard Property Transfer Tax, known as PCC, is 2%.

That puts the main entry tax near €5,500. The annual property tax is capped at 1.25 PLN per square meter. On a typical apartment, that equates to about €20 per year.

The peculiar thing about this system is that a luxurious apartment with a marble floor pays the exact same tax as an old, crumbling apartment of the exact same size. That is because the tax is calculated strictly by size, not by value! The TCO for Poland is 2.03%, and fast price growth does not force your annual tax bill higher by default.

11: Italy

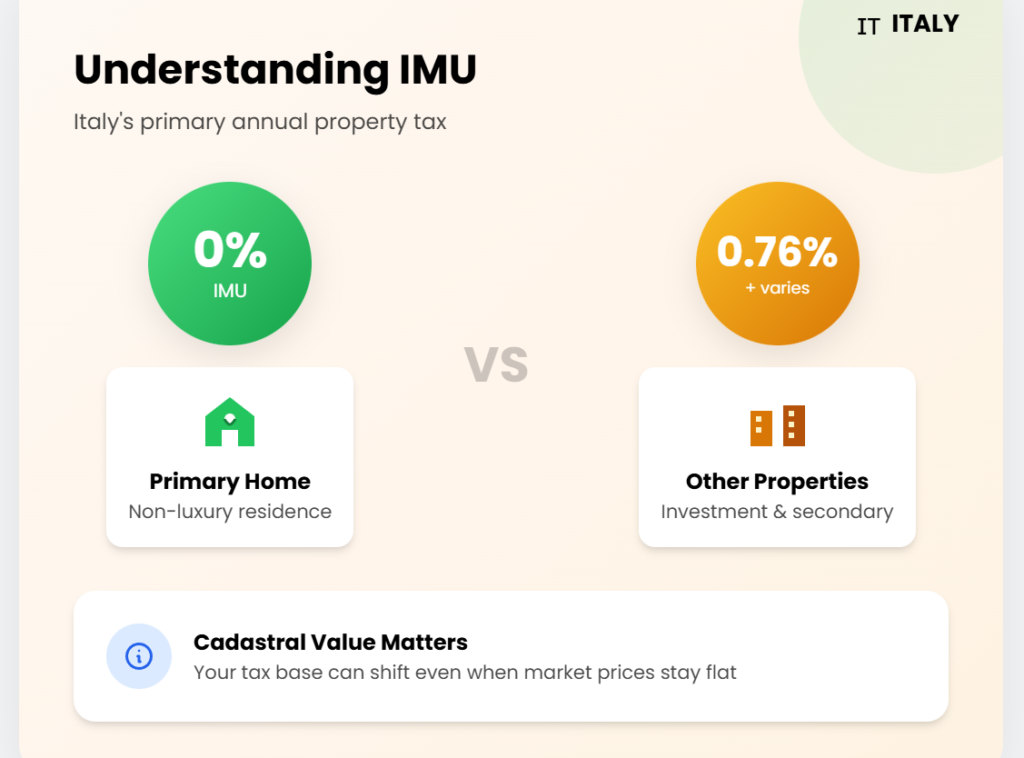

Italy is the country where a tax credit can matter as much as a tax rate because the rules split homes into two tracks: “brown” inefficient units and “green” retrofitted ones. Programs like the Ecobonus can cut your effective ownership costs if you qualify, but you must perfectly match the timing and paperwork. The main annual tax is the IMU.

For a non-luxury primary residence, you pay zero IMU each year. That is a massive deal if you want stable cash outflows. Expats still get confused because Italy bases many fees on the Rendita Catastale, and that cadastral base can be revaluated and changed by the government.

Your tax profile can shift even when the market price looks completely flat. Let’s consider a 70-square-meter apartment in Rome with a price of €240,000. The primary-residence registration tax is 2%, so you pay €4,800 at purchase.

Italy has no annual taxes for primary residences, helping it land mid-range in our ranking with a highly respectable TCO of 2.00%.

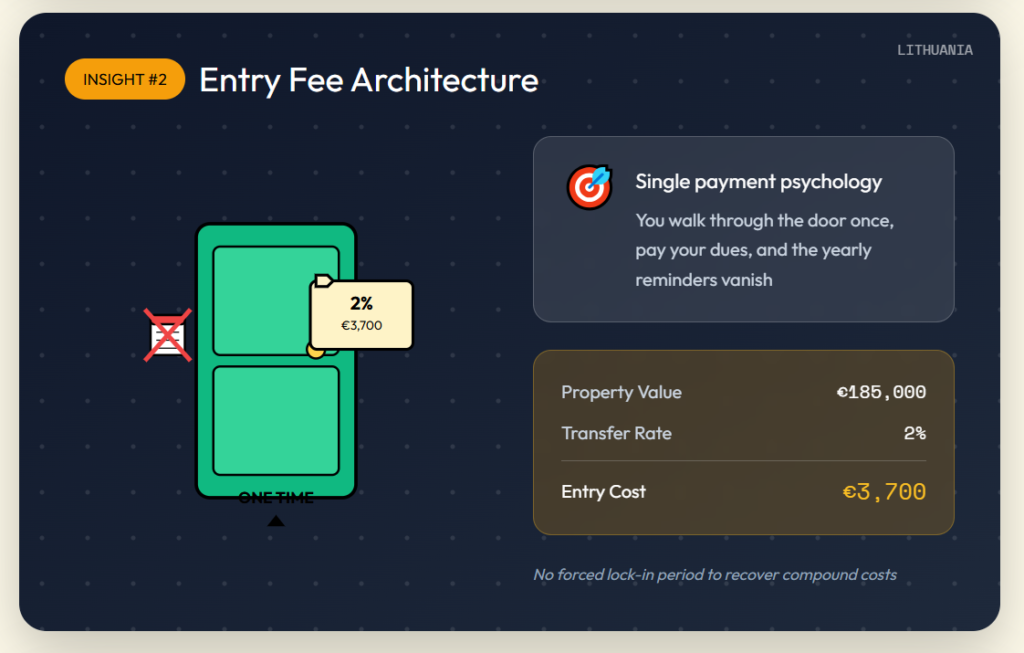

10: Lithuania

Lithuania gets a top 10 spot because the ongoing tax line stays close to invisible, which is better than any “tax-friendly” slogan. In Vilnius, our two-bedroom apartment costs about €185,000. The transfer fee is 2%, equating to close to €3,700, paid once at the purchase.

The blind spot for many is annual charges, but Lithuania completely avoids that problem for many primary homes. Under 2026 rules, if your primary residence is worth less than €450,000, the annual property tax is strictly exempt. For this case, the five-year annual-tax line stays firmly at €0.

The total cost of ownership for Lithuania is just 2.00%, and it stays low specifically because there is no annual tax.

And allow me a personal digression: when we need to pay an annual tax for the government for a home that we already paid for… is the home really ours? Because for me, it looks like an annual tax means you are paying rent for the government. Tell me what do you think in the comment section. Sorry for the interruption; today is Saturday, and I tend to be a bit reflective on weekends.

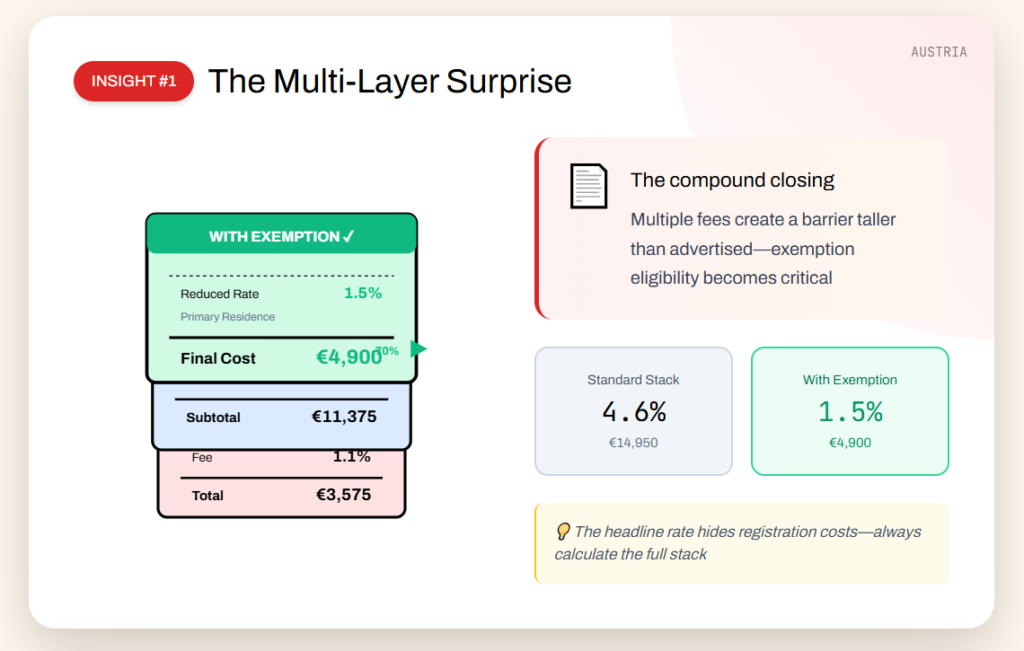

9: Austria

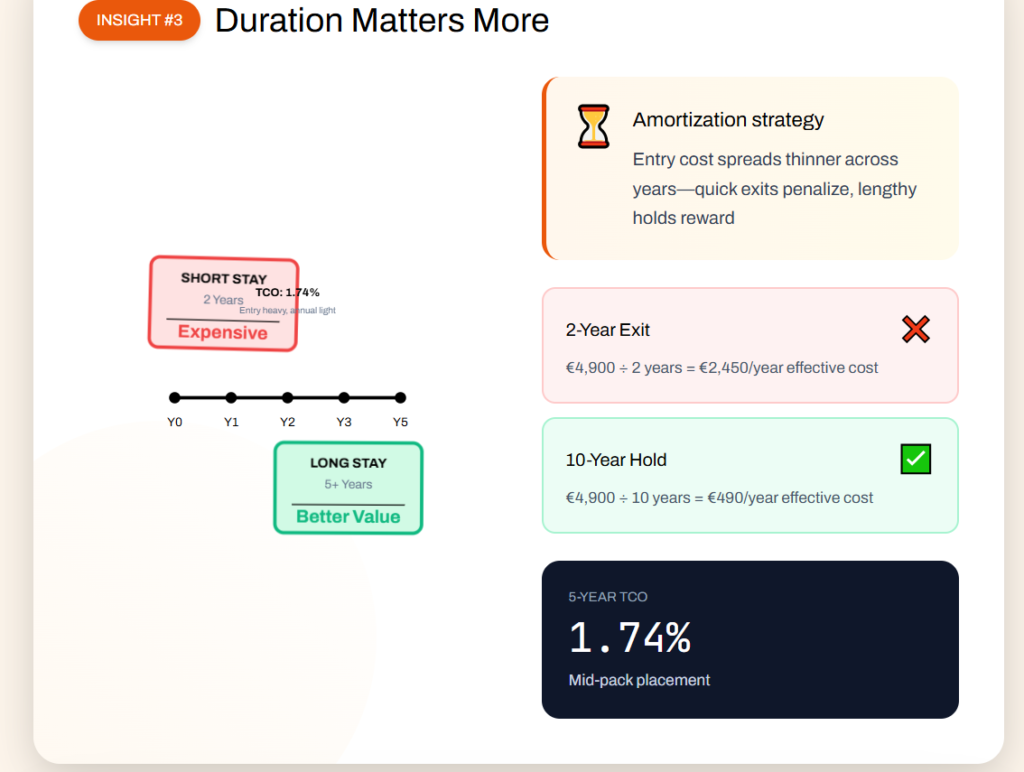

For a two-bedroom apartment in Vienna that costs about €325,000, the standard acquisition costs are a 3.5% real estate transfer tax plus 1.1% registration, totaling a combined 4.6%.

If you qualify for a primary residence exemption, that effective acquisition cost can drop to 1.5%, which is around €4,900.

An annual tax called the Grundsteuer exists, but it stays remarkably small for many apartment owners. For this unit, it costs less than €160 per year, remaining under €800 over five years.

Austria lands mid-pack because entry costs weigh heavily on the first five years. The TCO is 1.70%, which is much better for long stays than a quick two-year test.

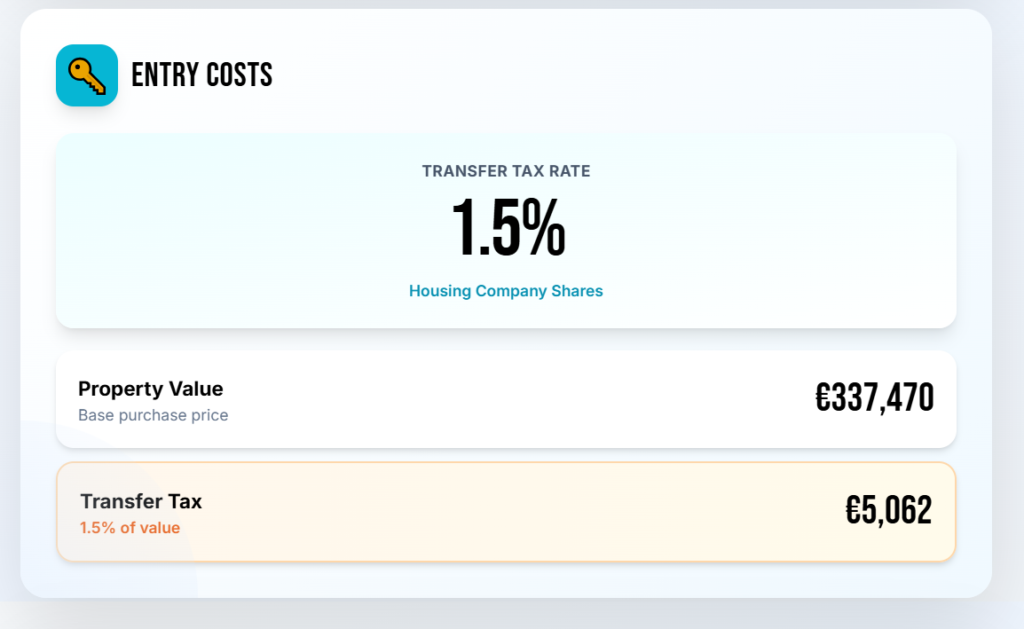

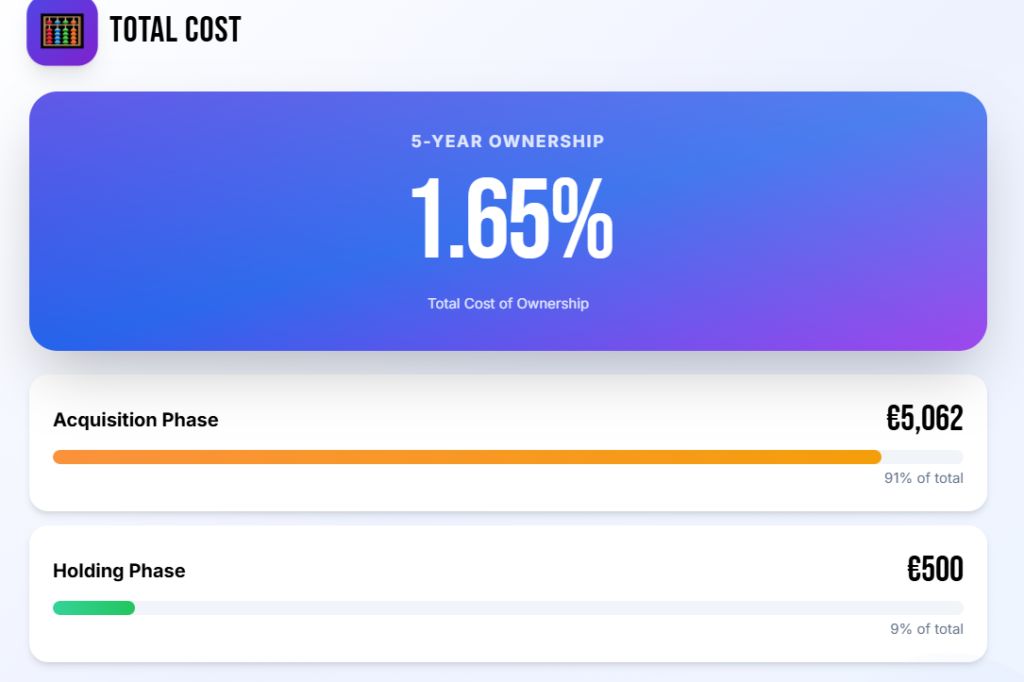

8: Finland

Finland lands high on the “predictable” side, but it still charges you every year because municipalities want that recurring revenue. In Helsinki, our two-bedroom apartment costs €337,500. At purchase, you pay a 1.5% transfer tax, which is about €5,000.

Annual taxes are low on paper, sitting near €100 per year for this specific unit. Cold weather adds another filter to this equation. If the building has weak energy performance, policy pressure and upgrade expectations can raise your ownership costs over time, even when the property tax bill stays perfectly stable.

When you evaluate Finland, check the municipality’s specific tax policy history, not just the national rules. The TCO is an impressive 1.65%.

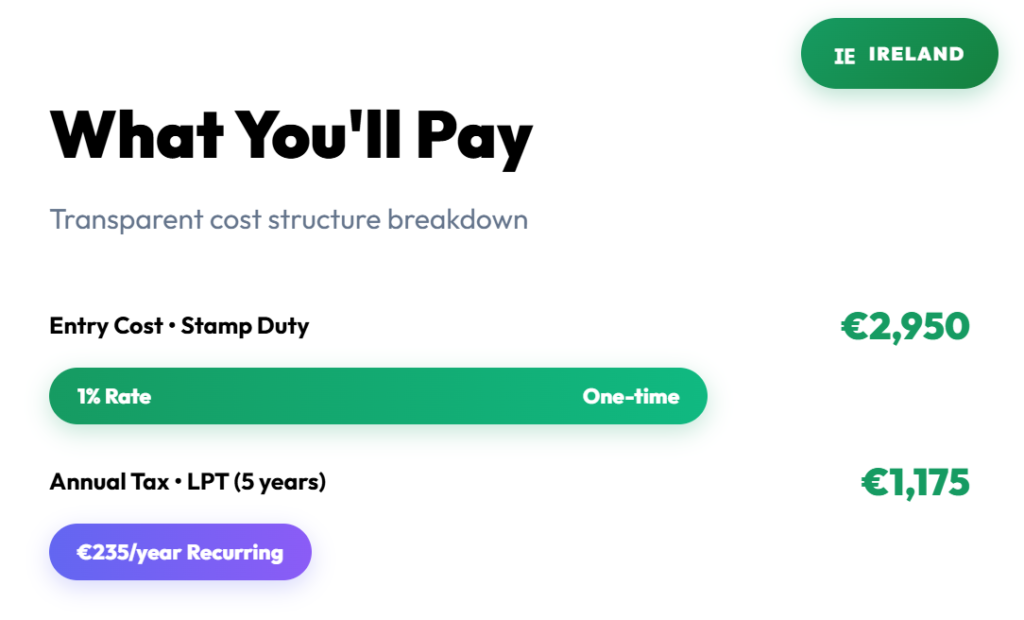

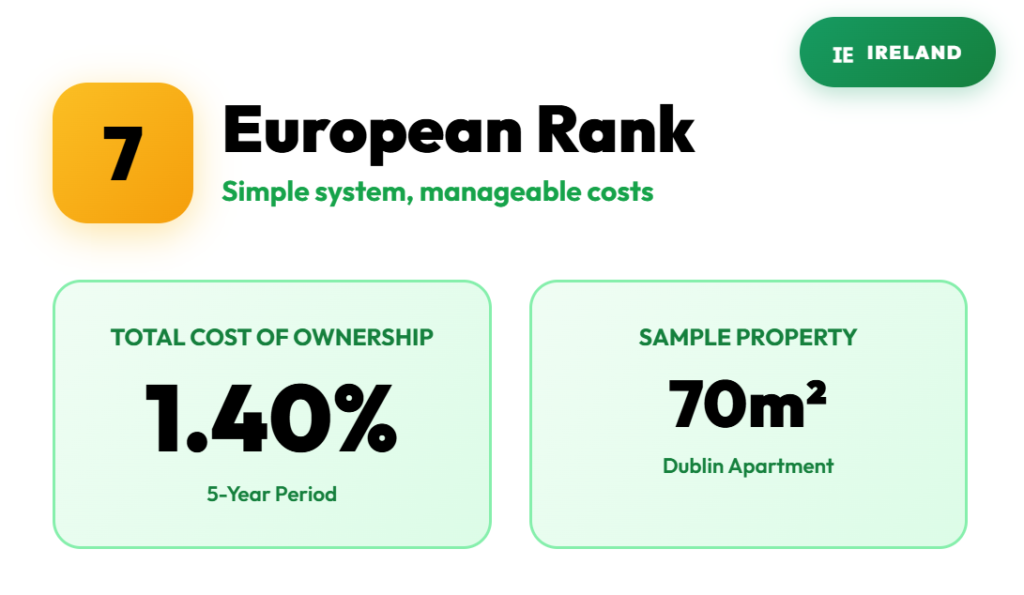

7: Ireland

Ireland lands in 7th place because the system stays refreshingly simple and straightforward. Let’s consider a 70-square-meter apartment in Dublin that costs about €290,000. Stamp duty is just 1%, so your entry tax is a low €2,950.

Annual costs come through the LPT (Local Property Tax). For 2026, a home valued in the €240,001 to €315,000 band pays €235 per year. Add the acquisition cost and five years of LPT, and you pay €4,125.

The TCO is 1.40%, which is a fantastic result for a high-price capital like Dublin.

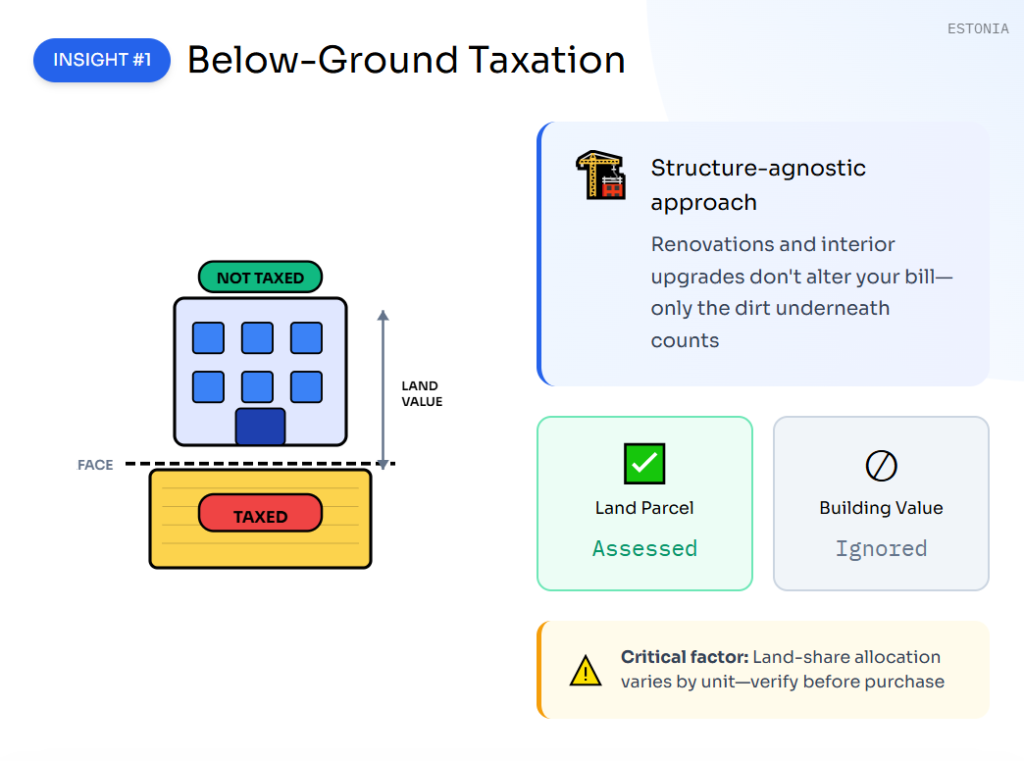

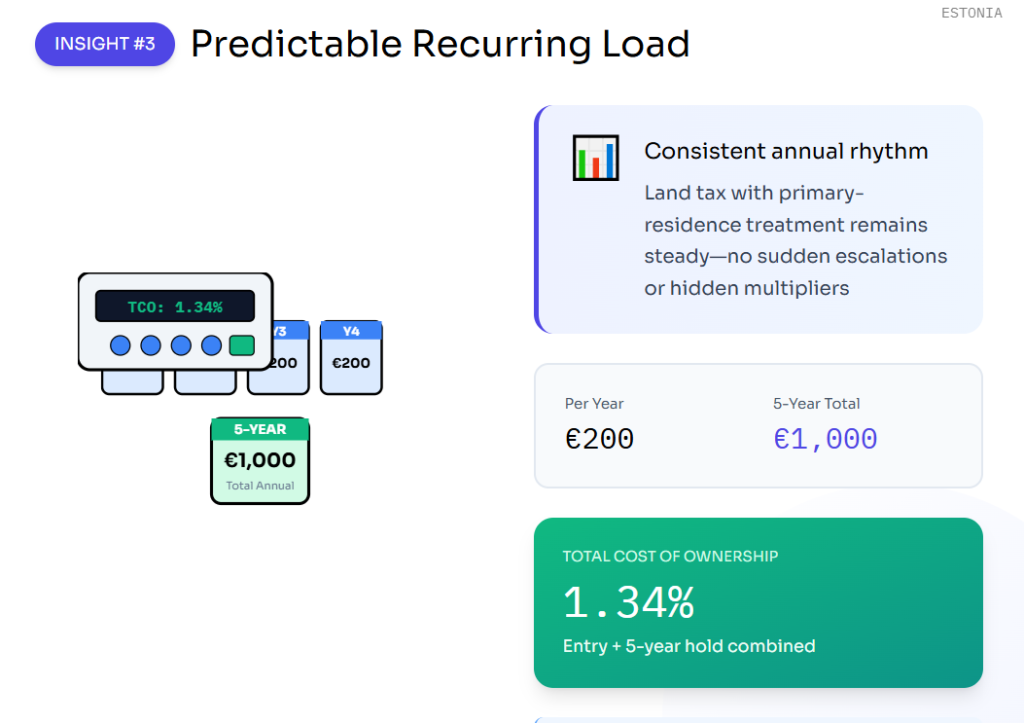

6: Estonia

Estonia is close to what many expats want: low purchase taxes, clear rules, and small bills while you hold the property. In Tallinn, our two-bedroom apartment costs €215,500. Transfer fees and notary charges average about 0.9% of the price, which is one of the absolute lowest percentages so far.

The peculiar thing with Estonia is the tax base, as the country leans on a land-only model. Your annual taxes are based on the land value under the building, not on the apartment’s actual value. This strongly favors vertical structures, where a home is built on narrow terrain and goes taller instead of going wider.

The annual cost—specifically the land tax—is close to €200 per year in our example. The TCO for Estonia is 1.34%, and it does not depend on how fancy your apartment is, but strictly on how expensive the ground underneath it is.

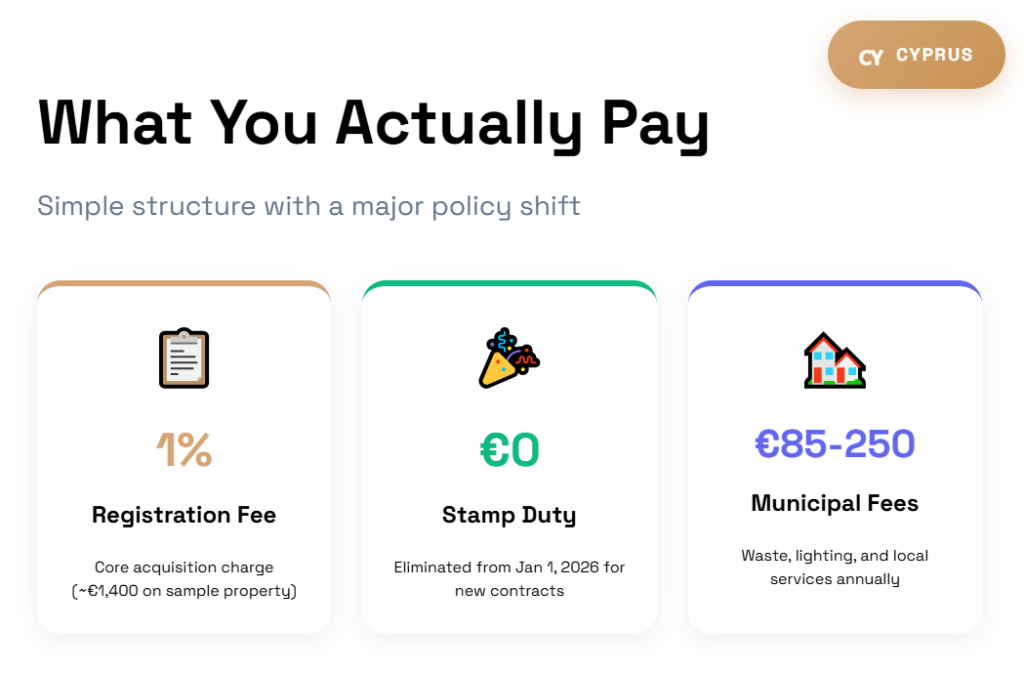

5: Cyprus

Cyprus is the kind of country that we always expect to be in the top five of any “low tax ranking” in Europe, but you must still take care. To make our calculations, we use a two-bedroom apartment in Nicosia that costs €136,000. The core acquisition cost is a 1% registration fee near €1,400, plus some small administrative costs.

From January 1, 2026, stamp duty officially drops to €0 for new contracts, so one common line item disappears entirely. There are some specific rules between new builds versus resales and how VAT applies that might confuse some people.

For a primary residence up to 130 square meters, new builds can qualify for a reduced VAT rate of 5%, while other cases face the full 19%.

This is a huge difference that must be evaluated case by case.

Now for some really good news: there is absolutely no annual property tax!

The Total Cost of Ownership during five years in Cyprus is just 1.00%. Cyprus not only has very low property taxes, but they also have many other tax incentives that make this island a really attractive place to settle.

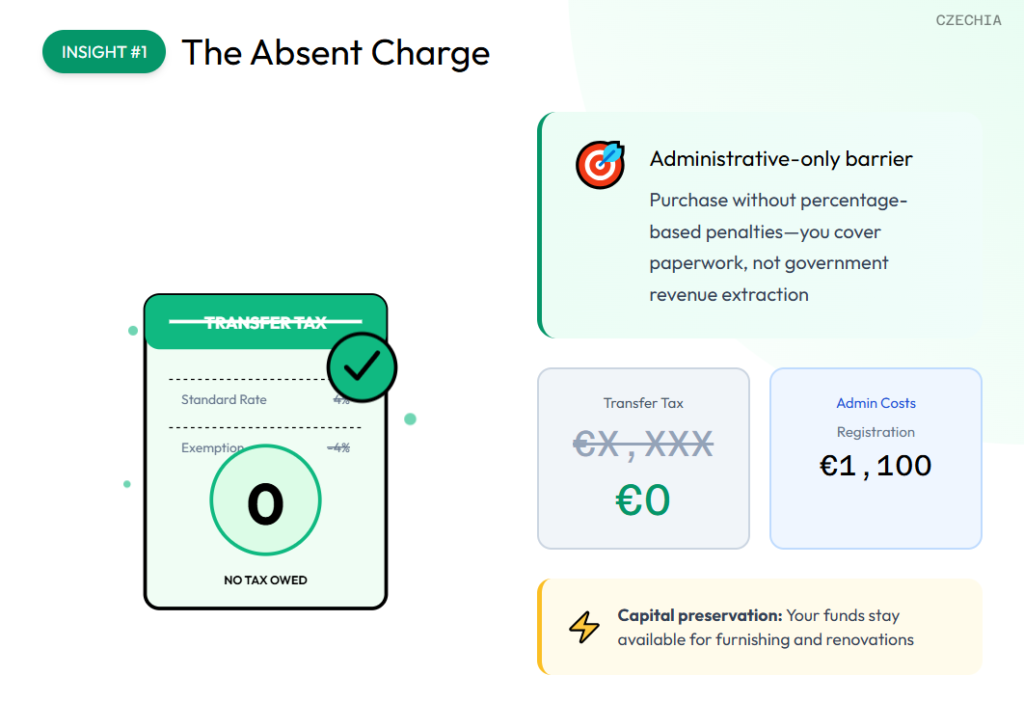

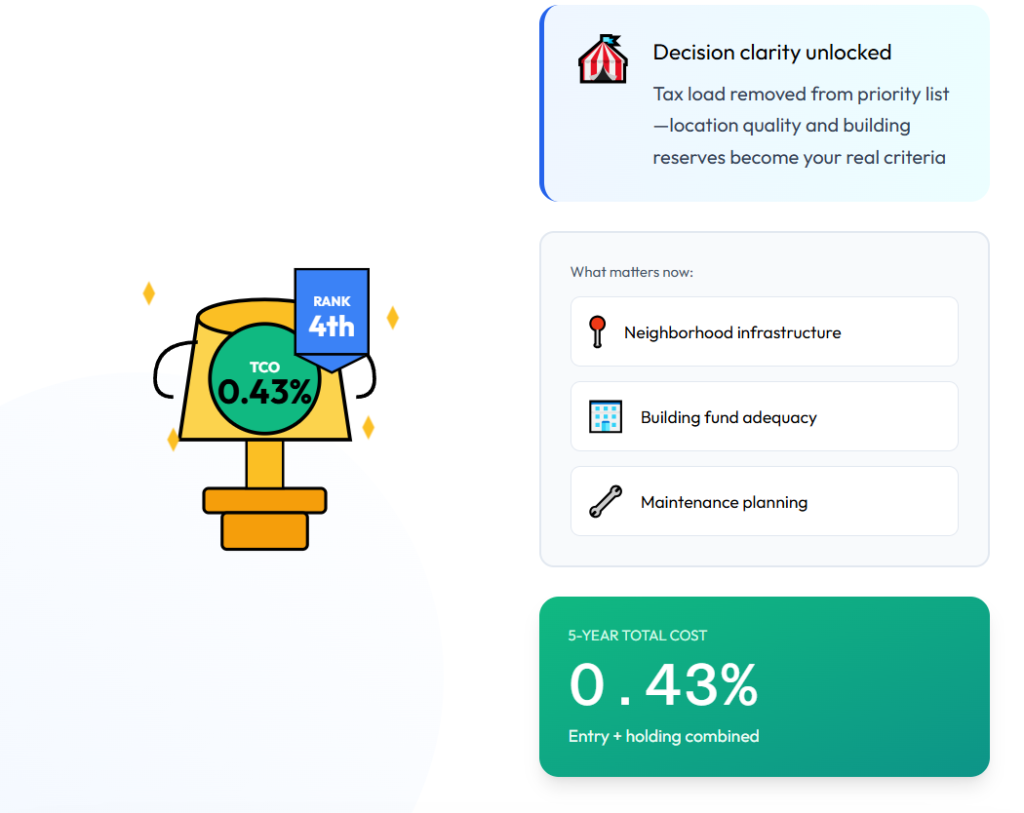

4: Czechia

Czechia gets to 4th place because there are absolutely no acquisition taxes! Yes, you heard that correctly. In Prague, you can buy a two-bedroom apartment and not get hit with a transfer tax at all.

On acquisition, the tax is a beautiful zero. You still pay for paperwork, but it is just a minor administrative fee. Prague’s annual property tax is based strictly on square meters, not the market price.

For the apartment we are using as an example, the bill is close to €150 per year. The Total Cost of Ownership in Prague during five years is less than 0.50% of the value of the property!

But the big surprise is that there are three other countries with an even lower TCO.

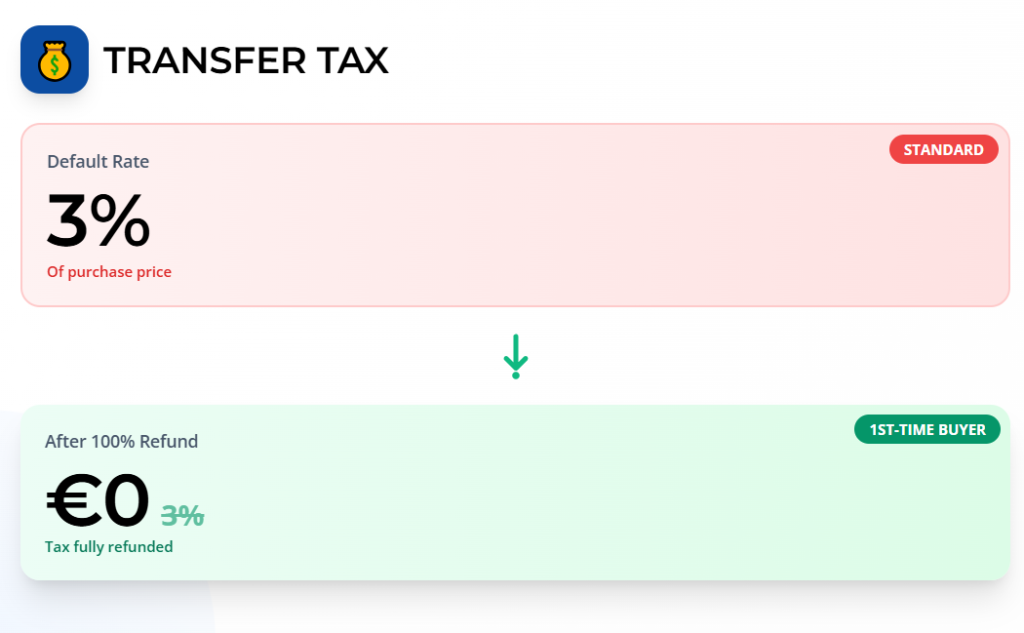

3: Croatia

The standard Property Transfer Tax in Croatia is 3%, which is quite high, so maybe you think I made a mistake by ranking Croatia in 3rd place, right? But this 3% does not apply to first-time buyers purchasing primary residences! They can get a 100% refund of that transfer tax.

After that refund, the remaining entry costs in Zagreb are near €200 in fixed administrative and notary fees. Croatia makes the “low property tax” promise incredibly real for primary homes, and it gets even better. Croatia introduced an annual property tax in 2025 with rates from €0.60 to €8.00 per square meter, but primary residences get a full waiver.

So there is also no annual tax, which is a rare and highly desired combination in the EU. You basically just pay the standard administrative costs. The TCO is 0.07%, remaining near zero even over five years.

But there are two other EU countries that have even lower property fees.

Do not worry about taking notes on all these percentages, because we have compiled all this data into our Smart PDFs. These include all the research behind this ranking and other rankings we regularly publish, and you can download them on our Patreon. If you join during the next 14 days counting from today, even on the free tier, you unlock over $108 in exclusive reports instantly for free!

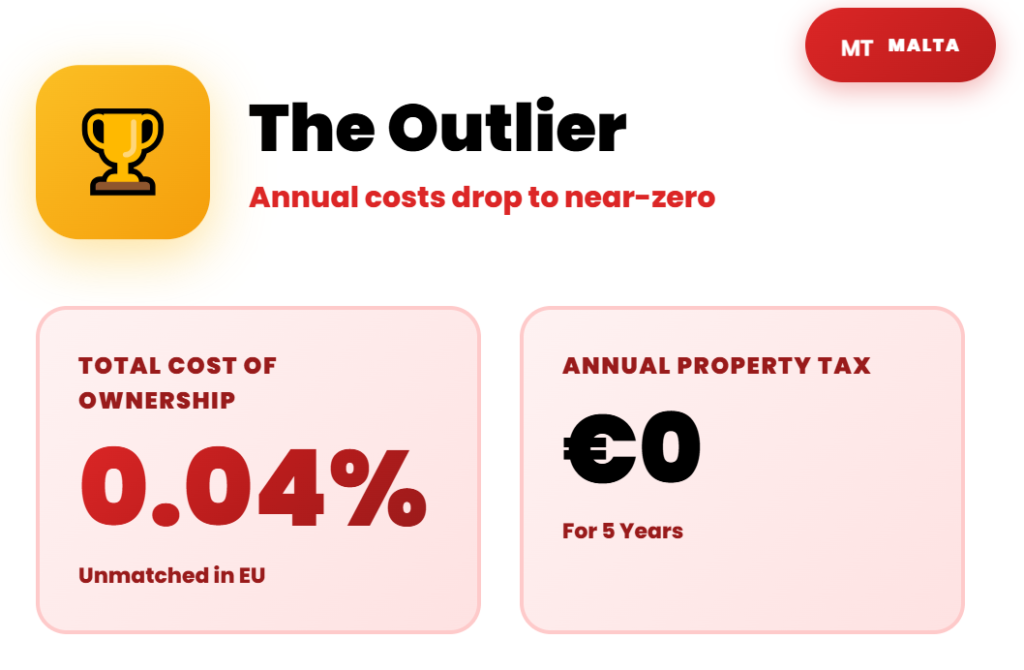

2: Malta

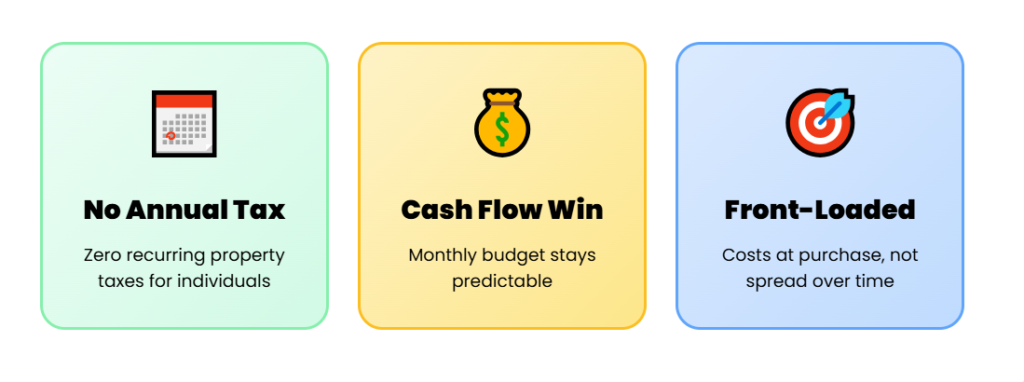

Malta shows up in the top two for one clear reason: your annual-cost line can drop close to zero if you qualify. That sounds impossible because most EU systems collect something every year, either a municipal property tax or a national annual charge. However, Malta shifts the burden to the transaction stage and then uses targeted exemptions that can wipe out recurring taxes for individuals.

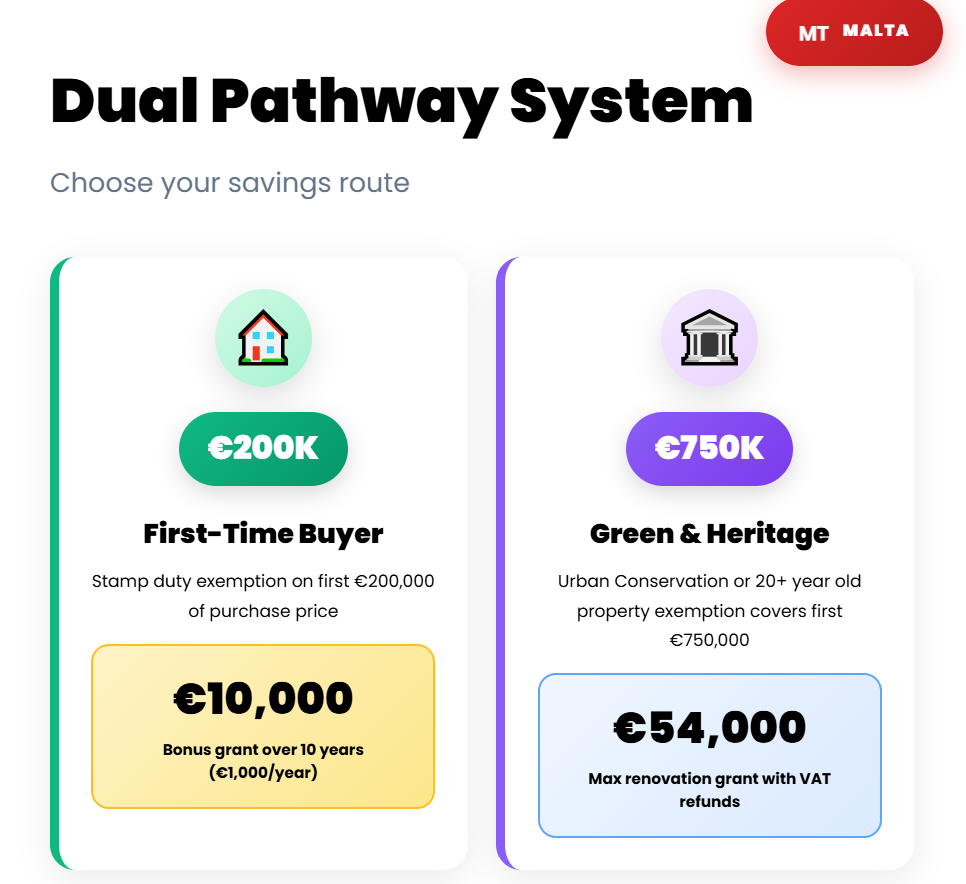

Let’s calculate the costs for a two-bedroom apartment in the Maltese capital, Valletta, at a price of €375,000. Stamp duty applies at purchase, but first-time buyers get an exemption on the first €200,000 of the price. Malta also offers a €1,000 annual grant for ten years specifically for first-time buyers.

There is a second path known as “Green & Heritage.” If the property is in a Conservation Area or over 20 years old, the stamp duty exemption can cover up to €750,000.

On top of that, renovation support can include VAT refunds, with grants up to €54,000, depending strictly on the project.

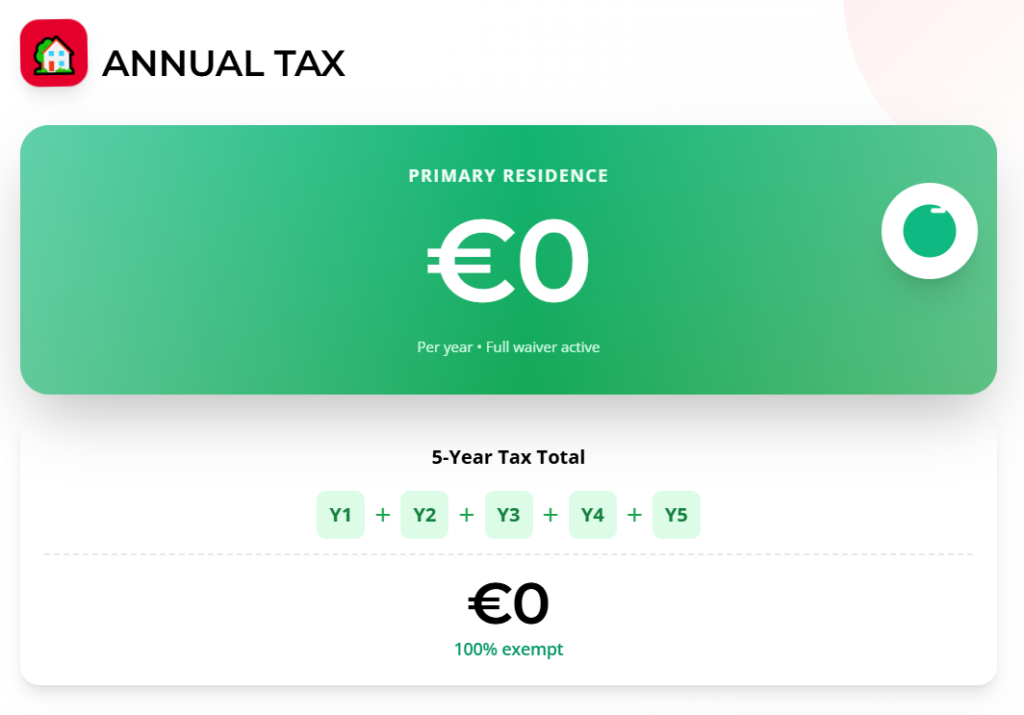

Malta charges no recurring annual property taxes or council taxes for individuals in this model, so your five-year annual tax total stays at €0.

The total cost of ownership for five years in Malta is just 0.04%—the second lowest in the entire European Union.

1: The Country with the Lowest Property Taxes in Europe – Slovakia

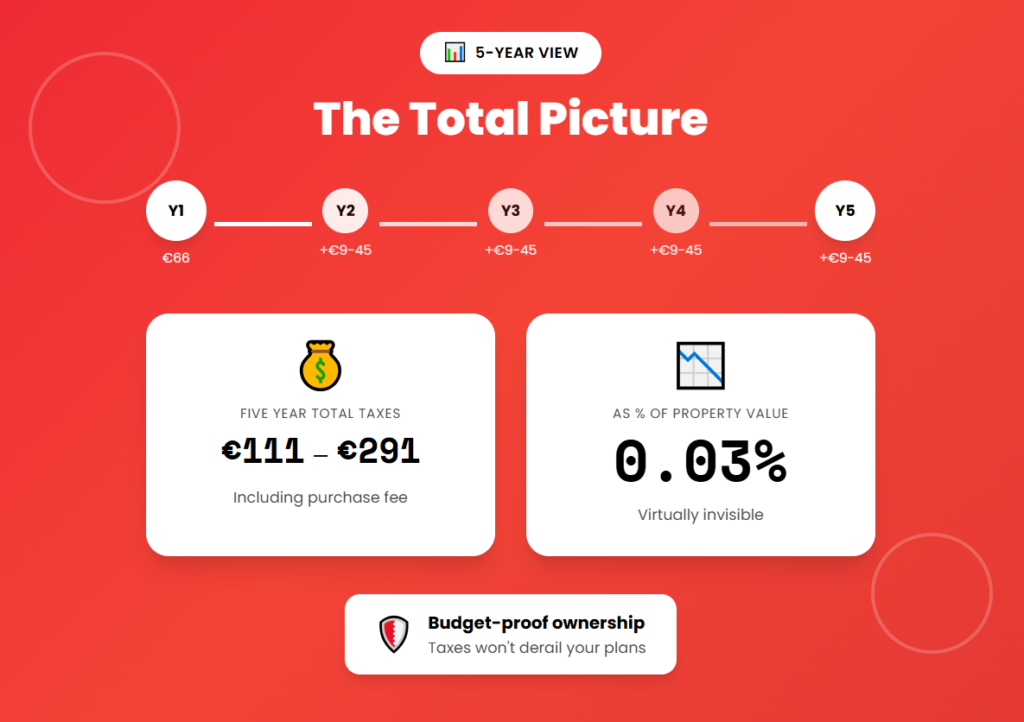

Slovakia takes first place, and the key shock is how extraordinarily little the state takes from you when you buy a property. You pay absolutely zero transfer tax. The only mandatory acquisition charge in our model is a flat cadastre fee of €66.

That is less than the price of a nice dinner for two! Annual property tax is set per square meter, completely ignoring the market value. For a 70-square-meter apartment, the yearly bill ranges from €9 to €45, depending on the exact district.

The total tax cost during five years is an unbeatable 0.03%, meaning your property taxes are not a threat to your budget there.

Now you know much more about European property taxes. But what about the overall cost of living? Do you know that in Europe, there are places where you can live like a rich person on a $2,500 income?

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.