You’ve probably heard that Uruguay is often called the Switzerland of South America.

- Stable.

- Calm.

- Comfortable.

But there are some obstacles that can mave a move to Uruguay, in 2026, a quiet trap for expats like you.

If you are over 50 years old, with a good income, and looking to buy back your freedom, listen closely: the issues there is completely different from the rest of the continent.

And those issues don’t just hurt your budget; they hurt your freedom.

I lived 26 years in South America and watched expats arrive with dreams of “peace and stability,” only to find themselves losing money and locked into a system they don’t understand.

The good news? These 5 problems are entirely avoidable if you know exactly what they are.

## Weather That Taxes Your Comfort

Unlike Colombia or Ecuador, Uruguay does not have big problems with a lack of safety. But it also does not have the weather perks of the eternal spring you can find in Medellin or Cuenca.

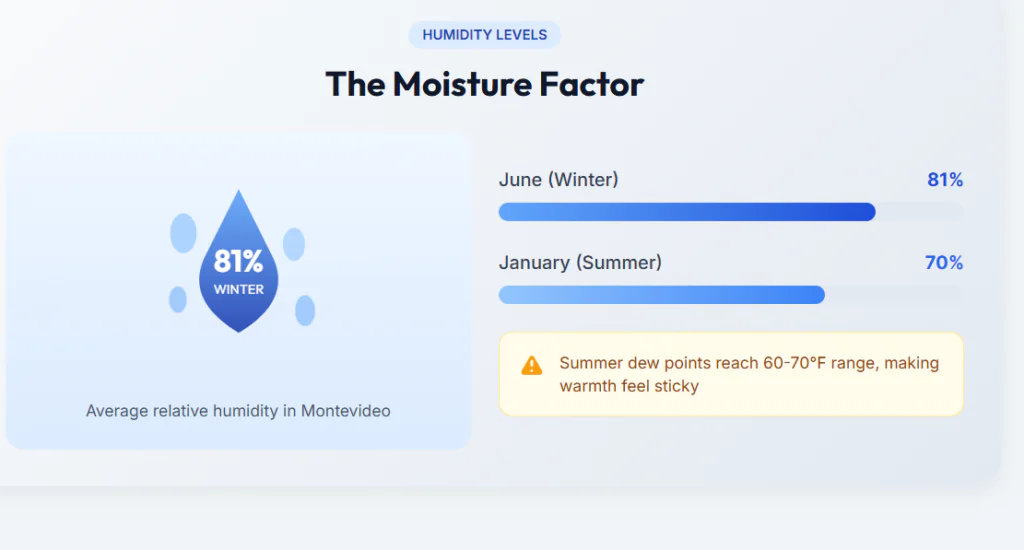

Somehow, some people believe Uruguay has a Mediterranean flair with mild seasons and coastal life where you walk outside most days and it just works. But Uruguay runs on humidity and wind, with average relative humidity in Montevideo running about 81% in June and 70% in January.

That turns “warm” into sticky and “cool” into that wet-cold discomfort where the air feels heavier. Bedsheets don’t feel crisp, towels take longer to dry, and you will wipe condensation while still smelling moisture.

Once warm, humid indoor air hits cold, uninsulated walls, you create perfect conditions for mold, including species like Stachybotrys chartarum. This becomes a significant issue when you’re older or deal with allergies, forcing you to manage the climate like a part-time job.

You run dehumidifiers, wash more laundry, and replace small items you didn’t plan to buy. Even your furniture and building materials take a hit from constant hygrothermal stress, which means more maintenance over time.

During winter, gray days show up, the wind cuts through, and the wet cold gets into your joints. A 10°C day can feel much colder when wind chill and humidity team up to bite through your layers.

And then there’s the Sudestada, which are southeasterly winds that can push up to 45 knots (50 miles per hour) and last for days. In the extreme case, water surges up to four meters, bringing salt spray, corrosion on cars, and flood risk in some parts.

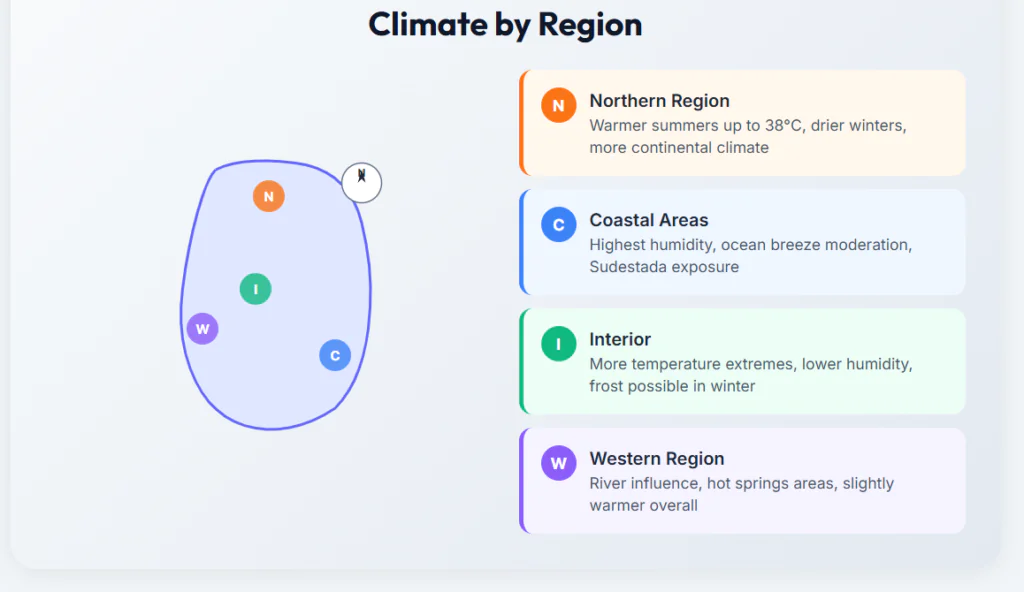

Said all that, remember that “Cold” for us South Americans might not be the same as “Cold” for Canadians or Northern Europeans. For me, 8 degrees Celsius is cold, but for my Polish wife, it is just Spring.

It is also important to remember that Uruguay is bigger than the state of Florida or the country of Greece, so there is a lot of climate diversity, too.

An Uruguayan summarized it best for us:

“Temperatures in winter rarely go under 0 Celsius, and in the summer it usually stays below 32-33 Celsius.”

## When Tranquilo Turns Into an Inefficiency

“Tranquilo” sounds like freedom until you need something done on a deadline. A lot of people come to Uruguay because they want a calmer baseline, less drama, and more stability.

One Uruguayan made a good comparison on the laidback culture of his country:

“Uruguay is very laidback—even for Latin American standards—and it is just like the Shire: very green, with slow-paced people.”

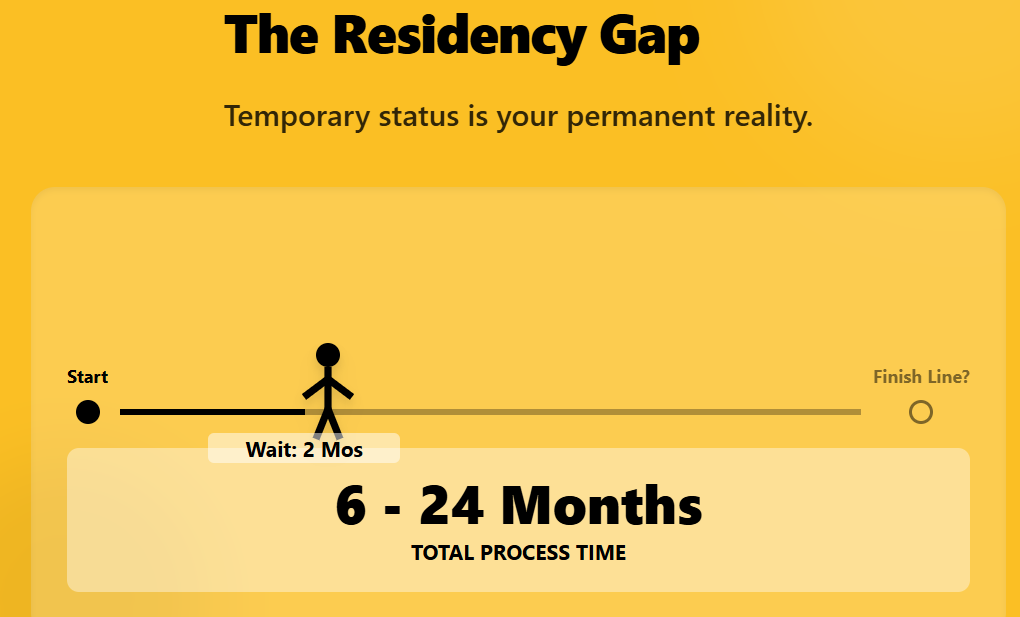

Residency is the first place you feel it, as in 2025 and 2026, you can wait about two months just to get the initial appointment. Then the full process can take six months to two years, which is a wide window for something that controls your ability to settle.

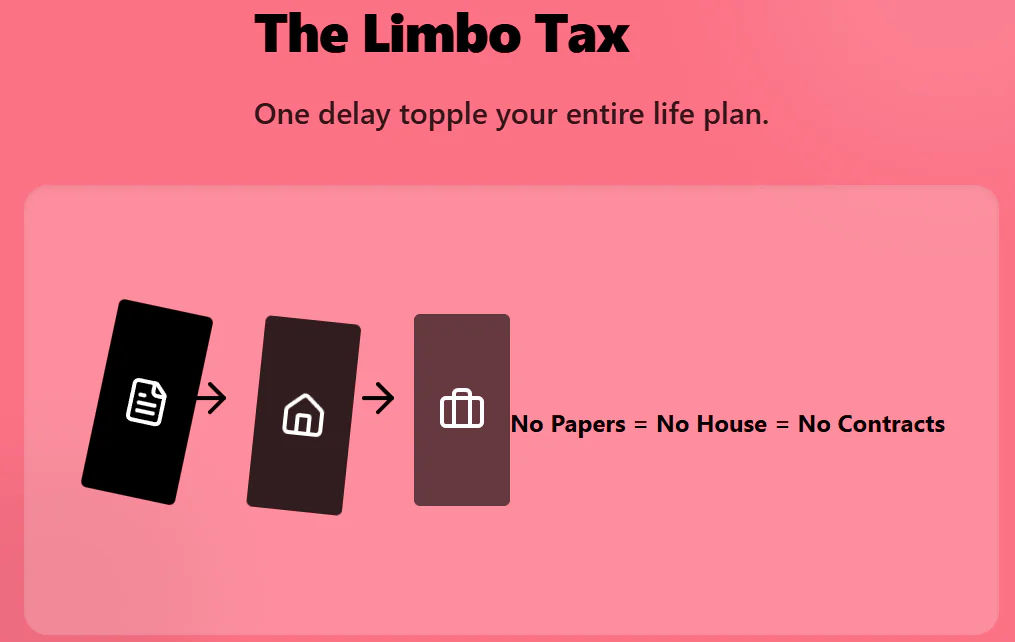

During that entire stretch, you live in temporary status, which means more paperwork and more visits. You often think you’re done, only to find out you’re not, creating a chain reaction that delays buying a home or opening an investment account.

None of these delays feel dramatic on their own, but together, they eat months of your life. Here’s where the “gestor economy” shows up, where people hire a fixer or specialized lawyer to shepherd paperwork through the system.

Uruguay has the lowest corruption index in South America, so these fixers aren’t for bribes. They are necessary because the system moves faster with a local who knows which office handles what and how to avoid dead ends.

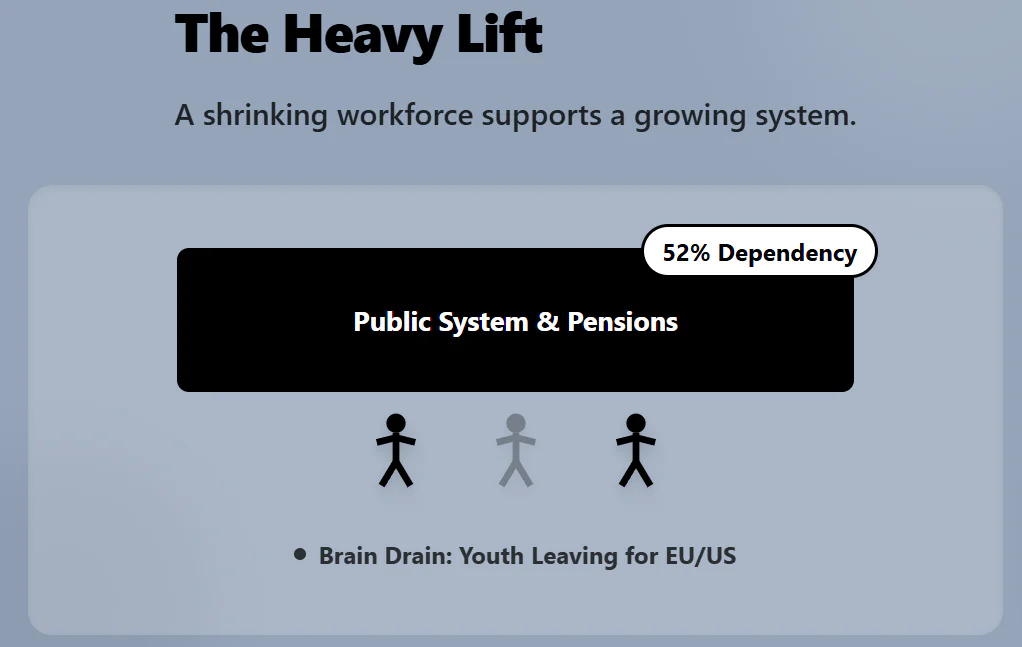

Uruguay is going through demographic changes similar to Italy or Spain, with an elderly dependency ratio around 24.7% and a total dependency ratio near 52%. When that load rises, public services don’t get faster; you feel it in limited office hours and long lines.

The labor market feels the same pressure as many younger Uruguayans leave for Europe or the US. This narrows the pool of trades and support services, so if you need a healthcare aide, the wait and quality swings can surprise you.

To navigate this system without losing your mind, learning Spanish is non-negotiable. It’s a very straightforward language to pick up, and my secret weapon for this is LingQ, which turns learning into a fun, immersive experience.

## Import Taxes Make Things Expensive

In Uruguay, your biggest surprise can be simple stuff: a car, a phone, a laptop, or a replacement part. You think you’re stepping into a calmer life, then you find the price tags for many goods look like those in Silicon Valley.

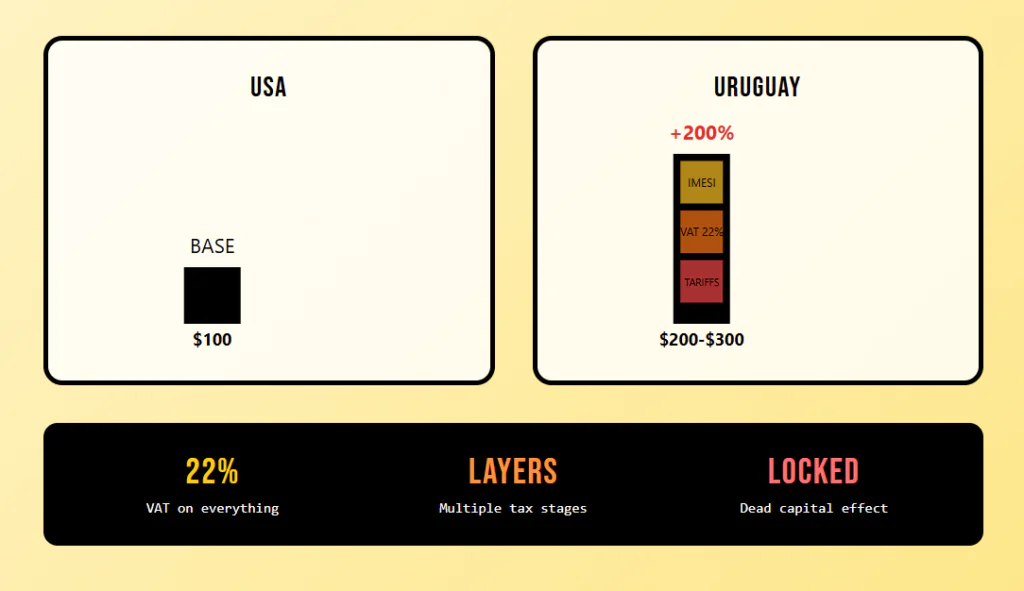

You pay much more for imported goods and deal with a smaller market with fewer models to choose from. Uruguay runs inside Mercosur rules, so external tariffs hit imports before domestic taxes like IMESI and a 22% VAT stack on top.

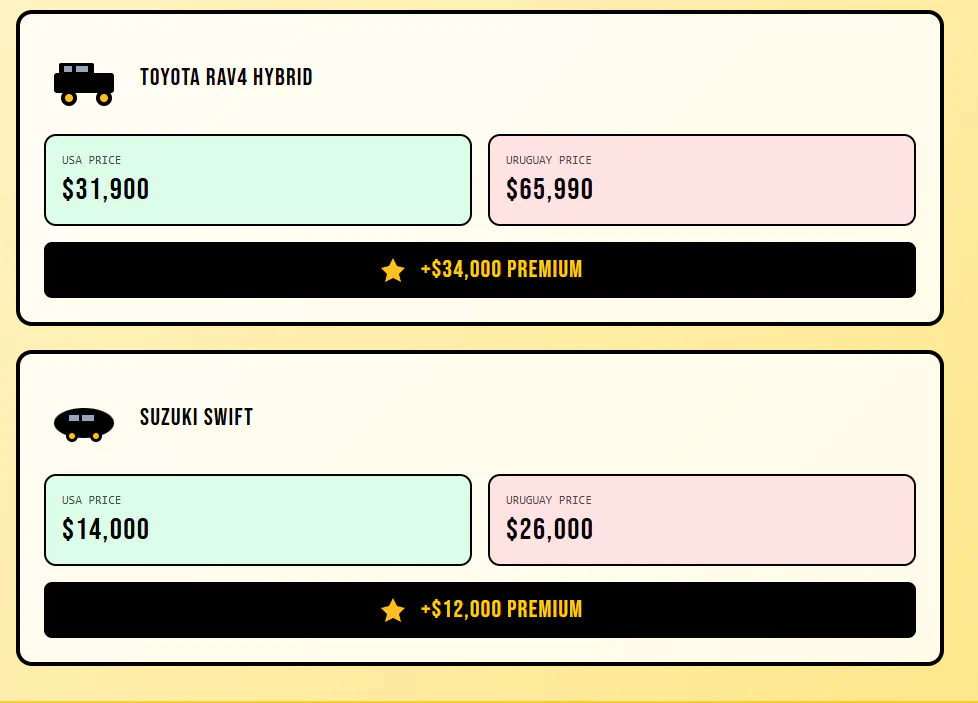

Cars show the problem in the cleanest way, as common models can land at 200% to 300% of US or European pricing. One example: a Toyota RAV4 Hybrid that sells for about $31,900 in the US can cost up to $66,000 in Uruguay.

Even budget models show the same pattern, with a Suzuki Swift that costs around $14,000 in the US selling for $23,000 to $26,000 in Uruguay. This is where “dead capital” becomes your real issue, as you spend money on an asset but the taxes don’t bring extra value.

The tax premium evaporates on resale because the buyer does not pay you back for what you paid in duties. Electronics follow the same logic, with the iPhone 16 Pro Max 256GB ranging from $1,709 to $1,913 compared to the $1,199 US price.

This pricing creates the “mule economy” where people time purchases with trips abroad to save money. This is fine until your work laptop fails on a Tuesday and you need a replacement that the local guarantee might not cover.

You don’t just pay extra for one-time purchases, but also for recurring needs like gasoline. Gasoline hovers around $2.00 per liter in January 2026, which is about $7.57 per US gallon.

Before the next point, I have some really good news. FREE FOR A LIMITED TIME: Grab your Expat Wealth & Lifestyle Compass ($108 value) today! Includes our 74-page guide of Affordable European Cities, our Zero-Tax countries report, and our expat checklist. Join us here before this offer ends.

## Real Estate: Safe on Paper, Illiquid in Practice

A lot of expats treat Uruguay property as a stability play, and while the stability part is true, the liquidity part is the trap. You assume you can exit later without drama, but in Uruguay, that clean exit is not guaranteed.

The market moves slowly because many deals run cash-only, and mortgage lending for foreign buyers is almost non-existent. Your buyer pool shrinks to people with a lot of liquid cash, and demand leans heavily on Argentina and Brazil cycles.

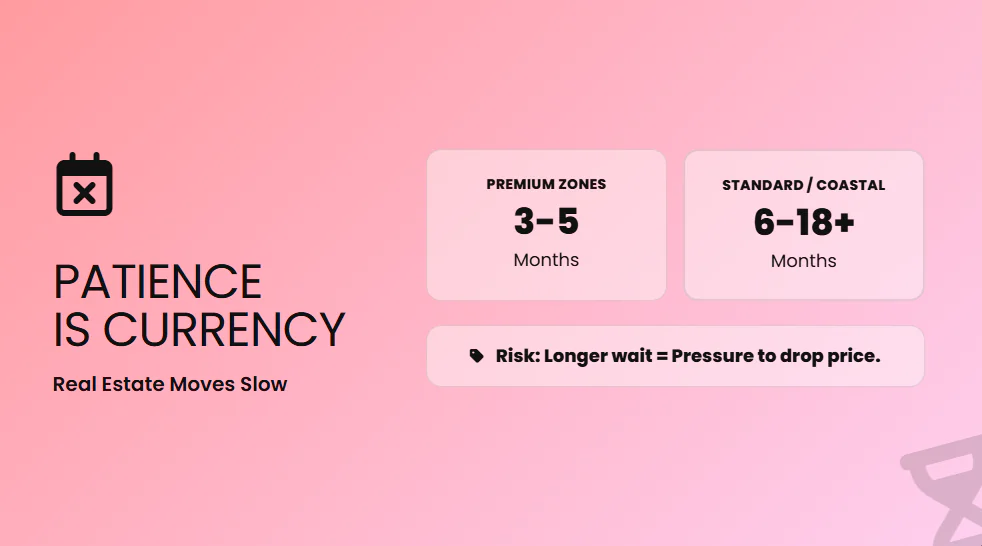

Premium apartments in top Montevideo neighborhoods can move in a few months, but outside those areas, listings can linger for six to eighteen months. The longer a property stays for sale, the more you feel pressured to cut prices or accept odd payment structures.

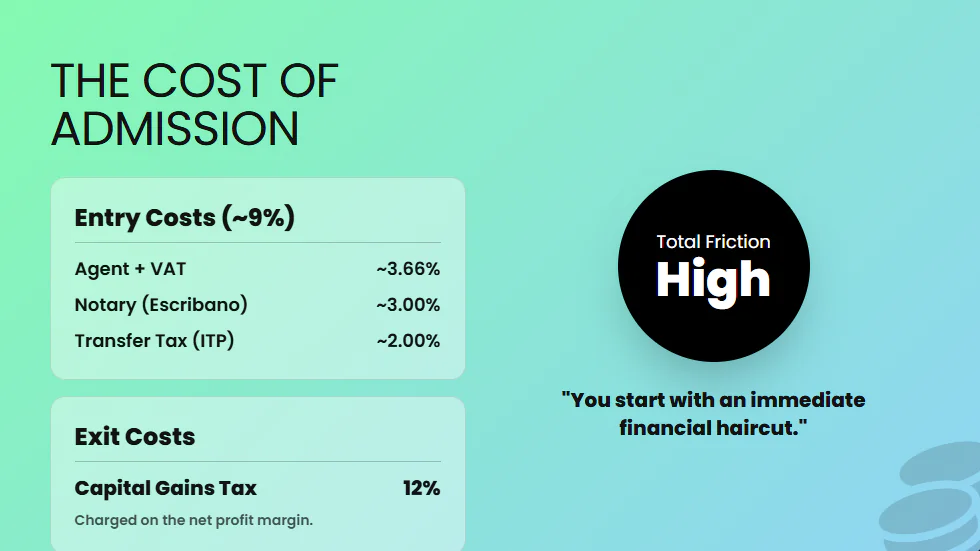

Transaction costs are also high, as you must add agent commissions around 3% plus VAT and escribano fees of 3% plus VAT. With transfer taxes like ITP at 2%, buying and selling in Uruguay becomes very expensive.

If you do sell for a profit, Uruguay adds a capital gains tax of 12% on net profit. If you plan to rent the property for half the year to make extra cash, remember that rental income is also heavily taxed.

This means your net yield will be considerably lower than you likely projected in your initial budget. If you need to relocate on short notice, property can turn from a “home base” into an “anchor” that ties up your freedom.

On our Patreon, we give you special reports every month so you are ahead of these market changes. For the cost of one coffee, you have all that plus direct access to our team for your questions.

## The Cost of Living Trap

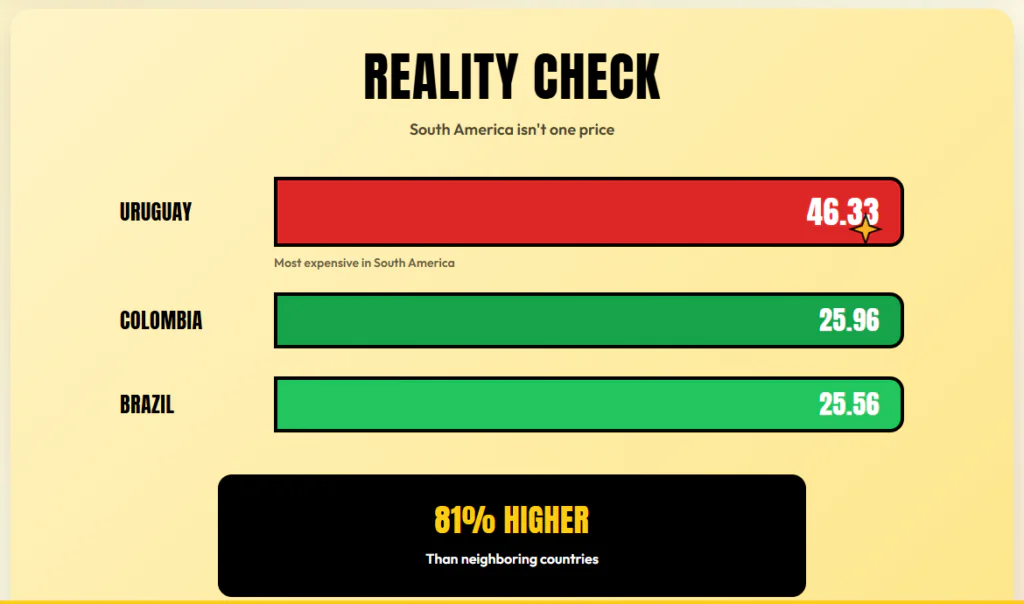

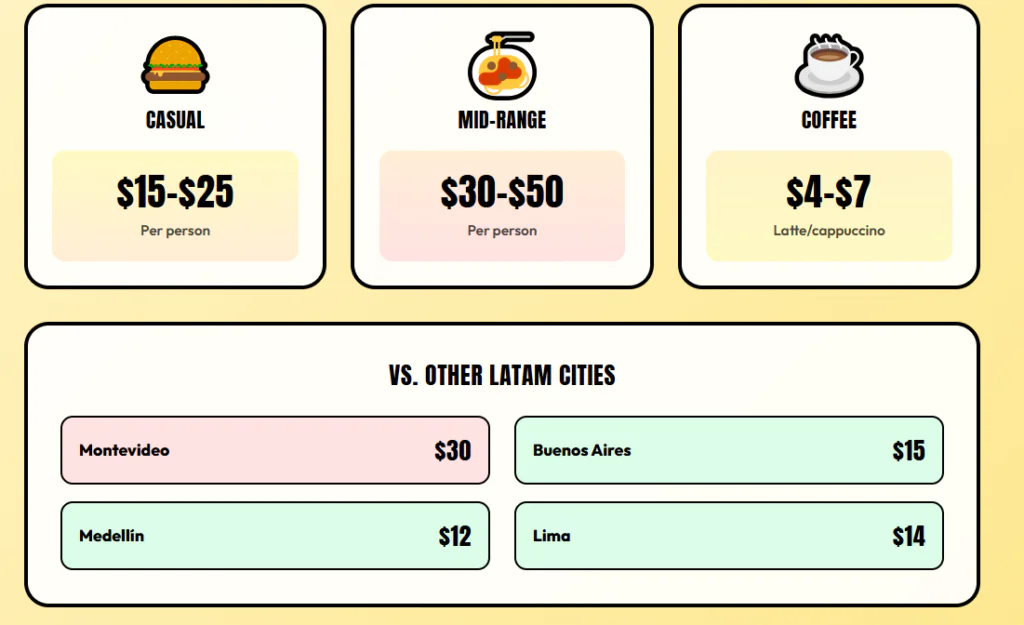

If you move to Uruguay for affordability, you can end up paying premium prices for a mid-range lifestyle. The cost of living index of Uruguay is 46.33, which is by far the highest in all of South America.

For comparison, Uruguay is 78% more expensive than Colombia, which has an index of only 26. This gap shows Uruguay behaves less like a budget option and more like a high-cost market.

Import dependence, limited domestic competition, and taxes keep everyday household items expensive. Utilities hit even harder, with residential electricity running around $0.266 per kWh.

To keep an indoor environment comfortable, many households spend $150 to $300 per month on electricity. That is normal living when you need heating, cooling, and dehumidifying to keep the air and surfaces under control.

In terms of Healthcare, Uruguay is cheaper than the US, but it is not a bargain compared to other expat hubs. Private premiums for a 60-plus male can run $140 to $230 per month, plus co-pays for tests and medications.

Then we get to the 2025–2026 tax shift where the 2025 Budget Bill expands IRPF to reach capital gains from foreign assets. This weakens the old appeal of a tax-free “South American Switzerland” that many expats counted on.

Once taxes, utilities, and healthcare inflate at the same time, Uruguay stops being geo-arbitrage. It simply becomes a case of “paying more to feel normal.”

Uruguay stays stable and delivers one of the best quality-of-life packages in South America. But stability is not the same as value, and there are countries that deliver better value-for-money. That is why I ranked all 10 countries in South America from the worst to the best – the first place is not what you think.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.