What matters more to you: paying less, or living without the quilombo of constant surprises?

Argentina in 2026 looks more stable than during the hyperinflation era, but it is also undeniably more expensive.

Some problems got smaller, while others moved to very different places, and many expats arrive in Buenos Aires using a 2023 playbook that will absolutely fail them today.

If you are over 45 and earn in dollars, euros, or pounds, Argentina offers something more valuable than a low price tag.

It is not what most YouTubers tell you—after all, most of them have never even set foot here. I had, and by the end of this guide, we will answer the most important question: Is moving to Argentina in 2026 still worth it?

The Negative Side of the 180-Degree Turn

1. The Shock of Dollar Inflation

If you move to Argentina in 2026 expecting 2023 prices, you will feel like you got scammed. But you didn’t; the country simply repriced.

This phenomenon is called “dollar inflation.” It happens when the currency regime stabilizes, old distortions fade, and local prices rise in straight USD terms.

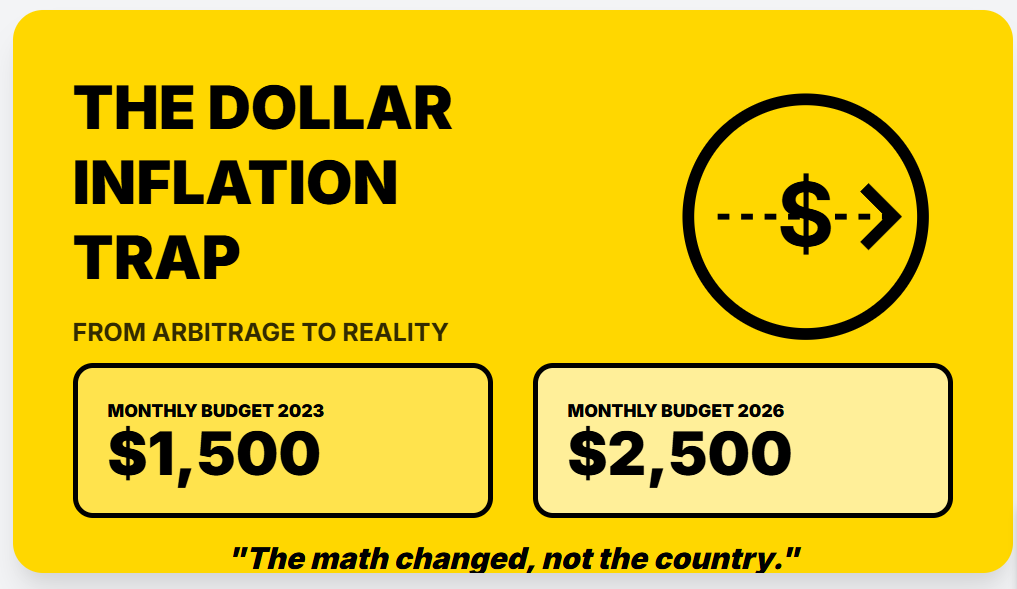

The same expat who previously lived well for $1,500 a month now calculates a budget of $2,500 and claims Argentina is “over.” It is not over, but the math changed.

That $1 coffee you saw on TikTok in 2023 is $3 now. An Argentinian who also lived in Germany told us that Buenos Aires is a bit cheaper than Berlin in terms of everyday expenses, though not by much.

Transportation and rent are way cheaper in Buenos Aires. The rest of Argentina is cheaper than Buenos Aires, except for the tourist areas in the south.

2. The End of Low Utility Prices

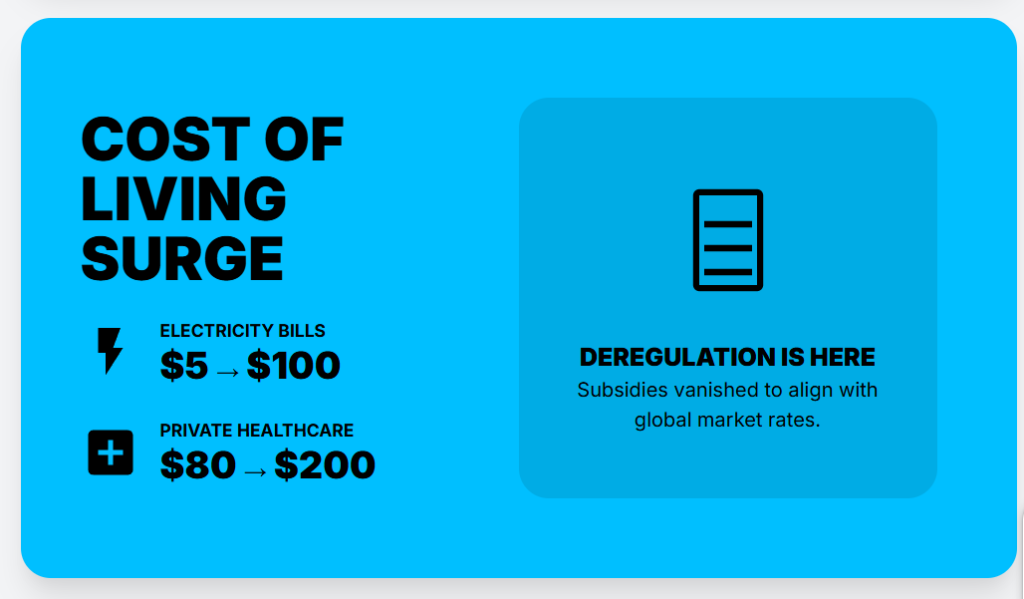

This price increase hits hardest in the categories you cannot avoid. To cut expenses, the new government removed subsidies on energy and other utilities, and companies now charge market rates.

That household electricity bill that was a negligible $5 back in 2023 now ranges from $50 to $100 during peak summer months. Private health insurance, or “prepagas,” followed that same trajectory.

After the recent changes, plans that used to cost $80 surged to upwards of $150 to $200. While that cost remains lower than in the US, the rate of increase significantly outpaced inflation in developed nations.

3. The Normalized Housing Market

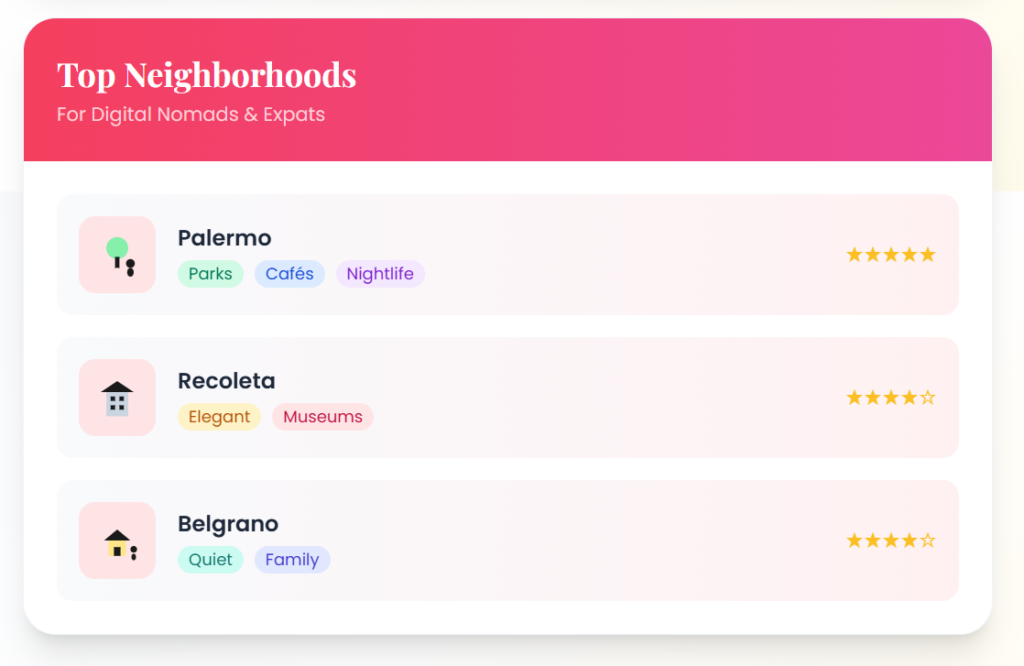

A high-end, furnished one-bedroom apartment in prime neighborhoods like Palermo or Recoleta now costs more than $1,000 per month. This represents a considerable difference from the lows of $400 seen in 2020.

The market tightened, but it also normalized. With the repeal of the Rental Law, which prohibited landlords from offering rental contracts in US Dollars, supply increased.

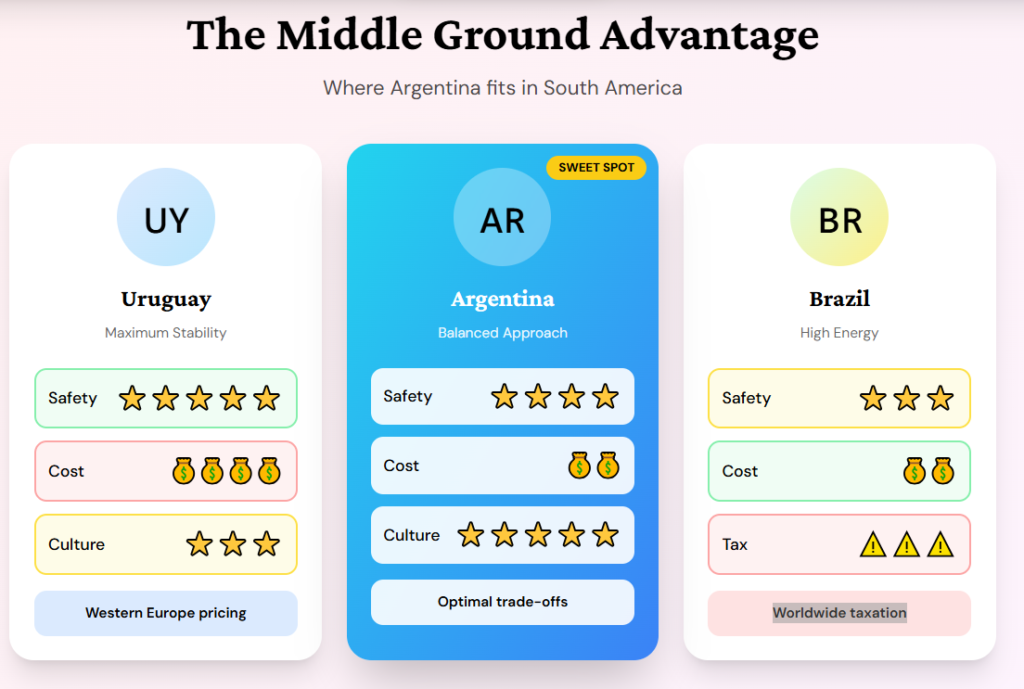

While rents increased, they remain on levels comparable to Santiago, Chile, and well below the prices of Montevideo in Uruguay. This new environment rewards expats who budget like adults, not tourists trying to win at arbitrage.

The Argentinian market no longer has the crazy bargains, but it gained predictability and a housing market you can actually plan around. You are paying more, but you are buying fewer surprises.

4. Fragile Infrastructure and Power

Argentina can feel modern until the lights go out. Then you learn what “fragile” means.

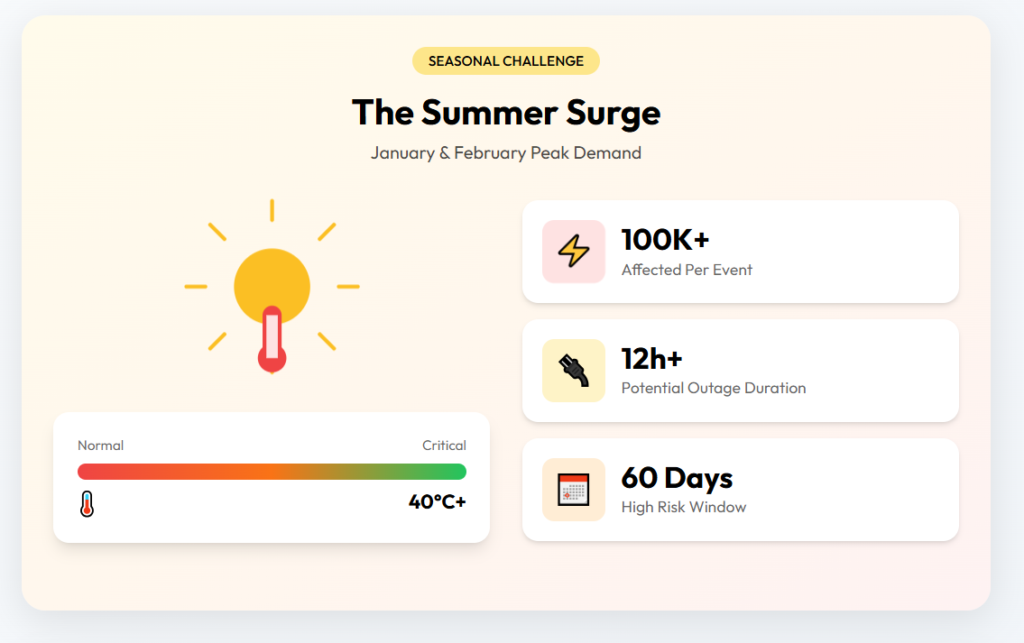

The problems cluster around the summer months. When heatwaves hit in January and February, demand spikes and the infrastructure sometimes fails.

Economists say this is because of decades of frozen energy tariffs, which discouraged energy companies from investing in updates to handle higher demand. Sometimes, the older grids cannot handle the load, and there are localized blackouts that impact hundreds of thousands of residents at once.

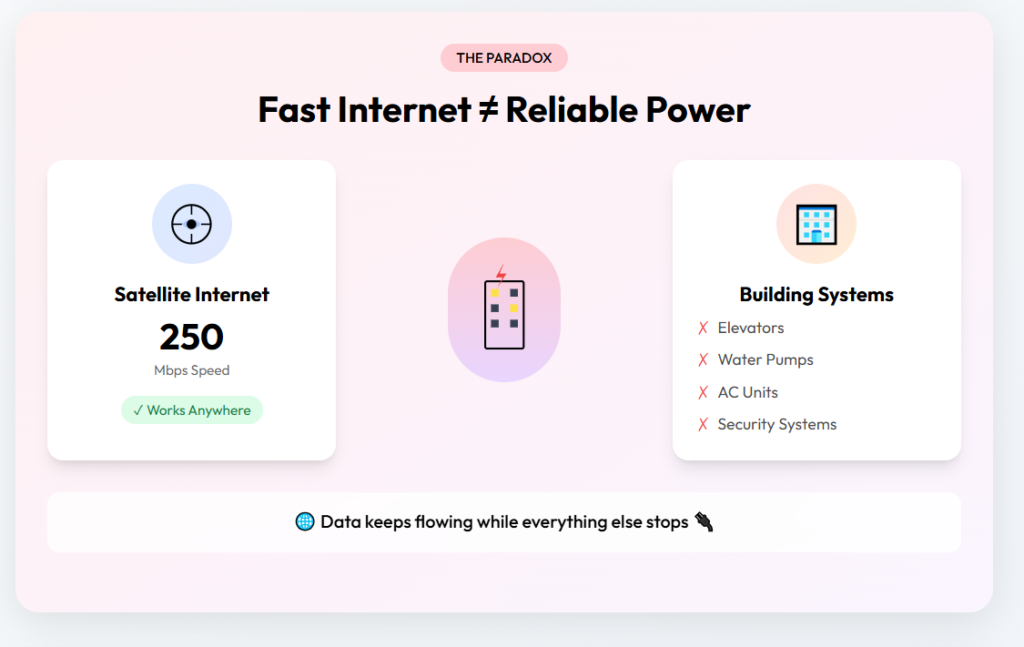

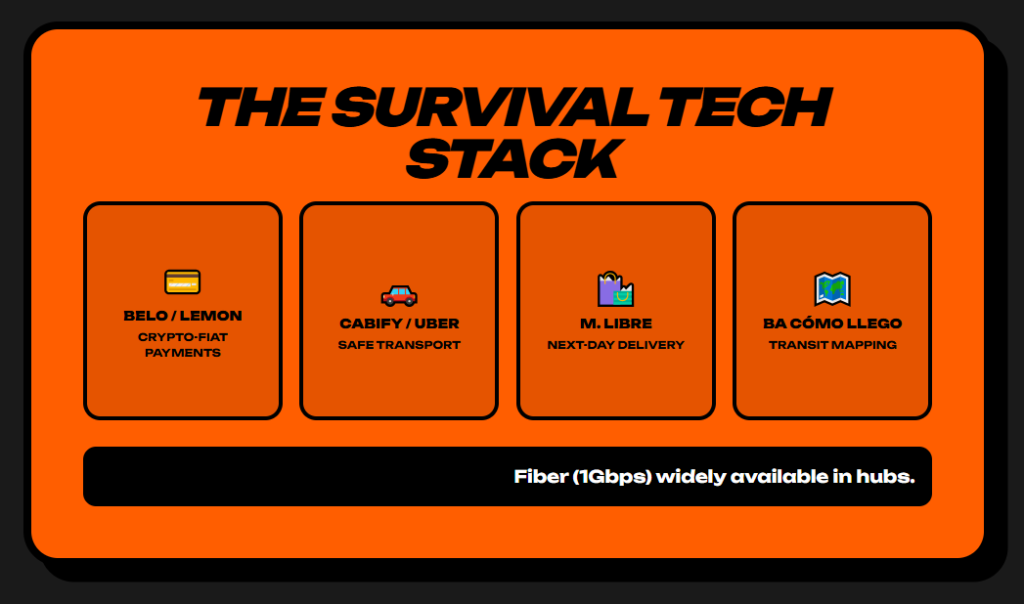

These power cuts often trigger a domino effect, disabling traffic lights, halting subway lines, and even cutting off water supply to buildings that rely on electric pumps. In terms of internet, things are better; modern providers and Starlink offer robust connectivity with speeds of 150-250 Mbps, even in rural areas.

High-speed internet does not help if your apartment lacks electricity. If you have a flight to catch, pray there isn’t a strike, because in Argentina, unions are never playing around.

Last December 2025, these actions caused flight cancellations and paralyzed the city center. You survive this by changing your decision framework: have a generator if you live in a house and check the news for strikes.

5. Social Unrest and Piquetes

Stability in the spreadsheet does not guarantee calm in the streets. You can secure a stable rental contract and legal residency, but you cannot dictate the social climate outside your door.

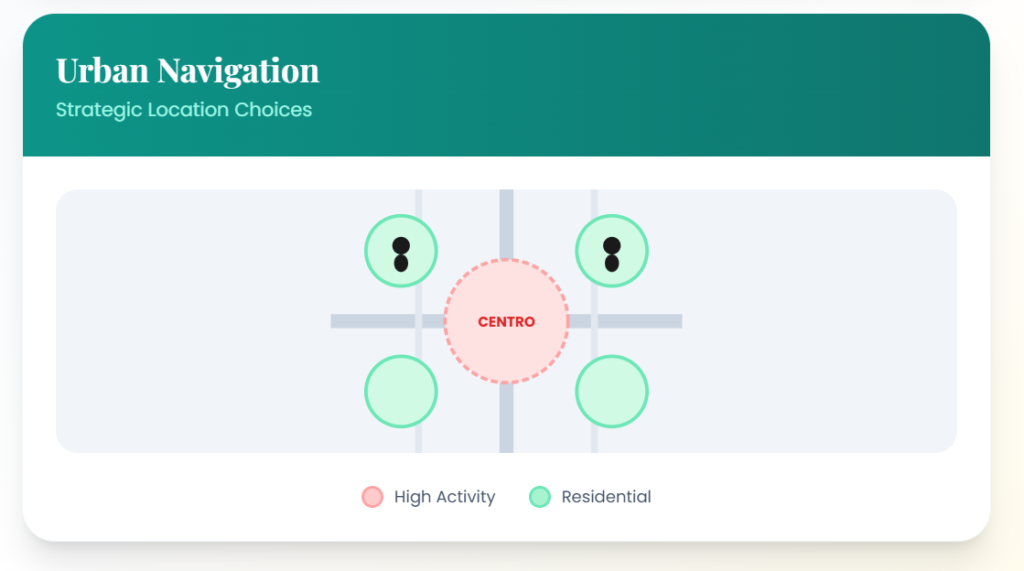

In downtown Buenos Aires, particularly the Microcentro area, there might be “piquetes,” where groups block arteries like Avenue 9 de Julio. This creates massive traffic jams where you can get trapped in the wrong place at the wrong time.

If you ignore the alerts, you lose hours of your day stuck in a gridlock that no taxi driver can solve. The austerity measures implemented by the new government led to a confrontational stance with powerful labor unions.

You control this risk through location and information. To live in the microcentro is not a good idea if you seek calm, so choose neighborhoods removed from the main demonstration corridors.

Unrest becomes manageable when you treat it like weather since it often has predictable zones and times. If you stay aware of the protest patterns and avoid focal points, your daily life continues without interruption.

FREE FOR A LIMITED TIME: Grab your Expat Wealth & Lifestyle Compass ($108 value) today! Includes our 74-page guide of Affordable European Cities, our Zero-Tax countries report, and our expat checklist. Join us here before this offer ends.

The Positive Side of the 180-Degree Turn

1. Cost of Living Arbitrage

There is something many people get wrong. Yes, Argentina got more expensive, but it did not become expensive.

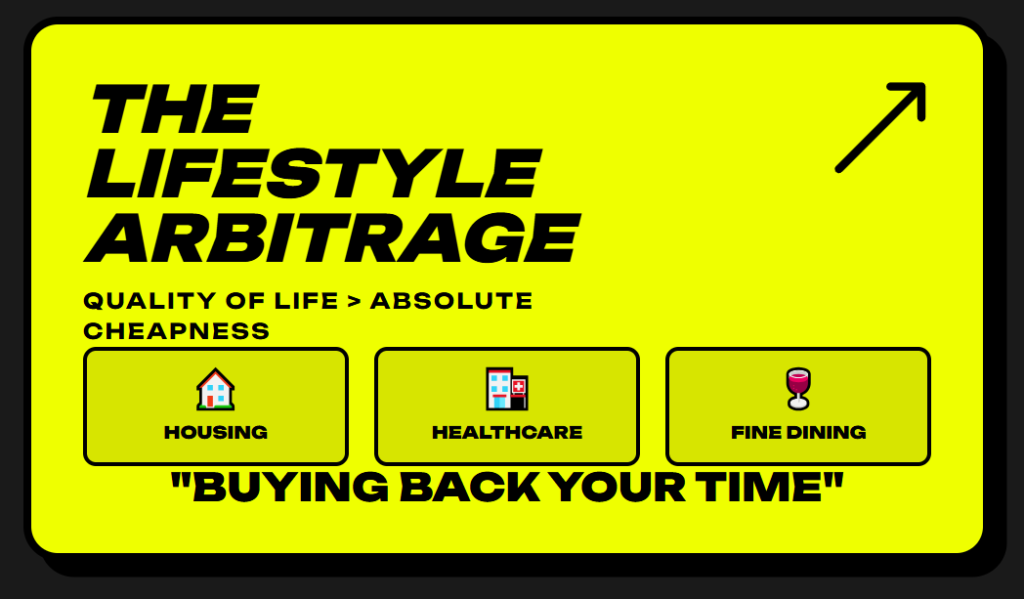

The era of the “free lunch” driven by a collapsing currency is over. But the new arbitrage works differently; it is about specific lifestyle categories staying underpriced compared to the US and Western Europe.

The real savings show up in services that create quality of life. We are talking about domestic help, personal care, fine dining, and private healthcare—things out of reach in the US if you live on social security.

A decent apartment in a good area in Santiago might cost you more than US$2,000. In São Paulo, a 2-bedroom apartment in a zone that is NOT close to the infamous “Cracolândia” will cost you around US$1,400.

In Buenos Aires, it is a similar price. But if you go outside Buenos Aires to Mendoza or Córdoba, rents drop by 40 to 60 percent. In Godoy Cruz, close to Mendoza, you can live in a massive house for US$1,200. These cheaper costs also allow you to “buy time.”

Domestic help typically costs between $4 and $6 per hour. You can hire a full-time cleaner for $600 a month. You outsource the friction of daily life for a price that is impossible to match in North America.

You also have to understand the “two budgets” concept. There is a tourist budget and a long-term resident budget. Tourists pay high short-term rates, while residents access local discounts and better leases.

You see this value in dining as well. A three-course dinner with wine at a good Argentinian steakhouse outside Buenos Aires costs around $40 to $50 per person.

That is 25 percent of the cost of a comparable meal in New York City. Even healthcare remains a massive bargain compared to US premiums.

The low cost of living in Argentina is about accessing quality you could not in the US or England. You optimize for lifestyle efficiency by moving to wine country for a Napa Valley lifestyle at 1/4 the price.

2. Openness to Expats and Residency

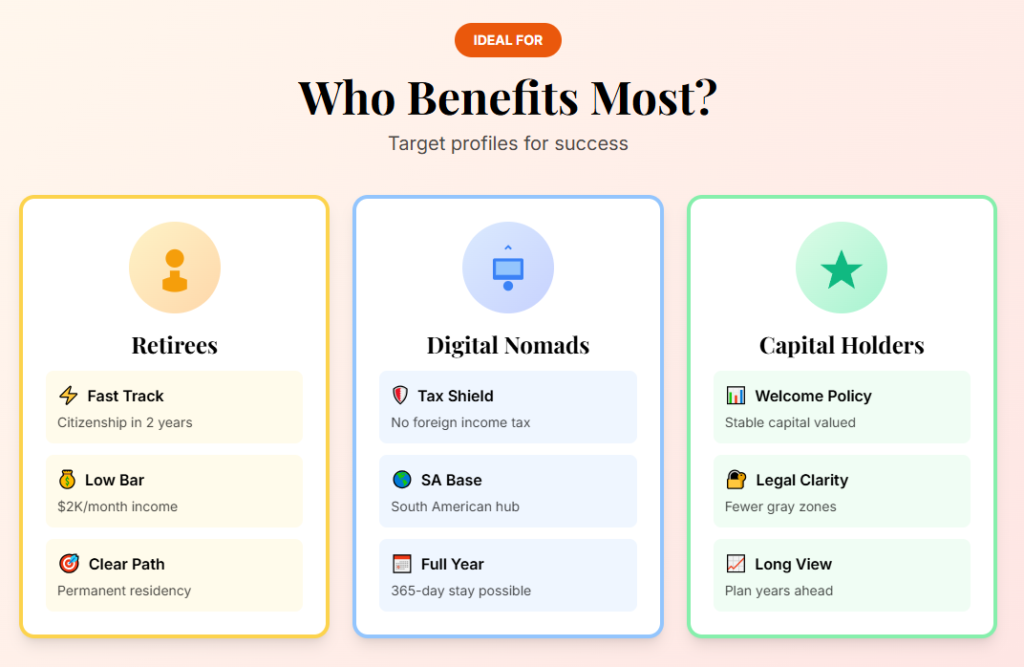

Argentina actually hands you a pathway you can execute. Many countries claim they want foreigners, but the new policies here make it easier.

An Australian expat married to an Argentinian told us that people in the countryside are incredibly kind despite looking at their red hair strangely. Mastering the language, especially Argentinian Spanish, helps immensely.

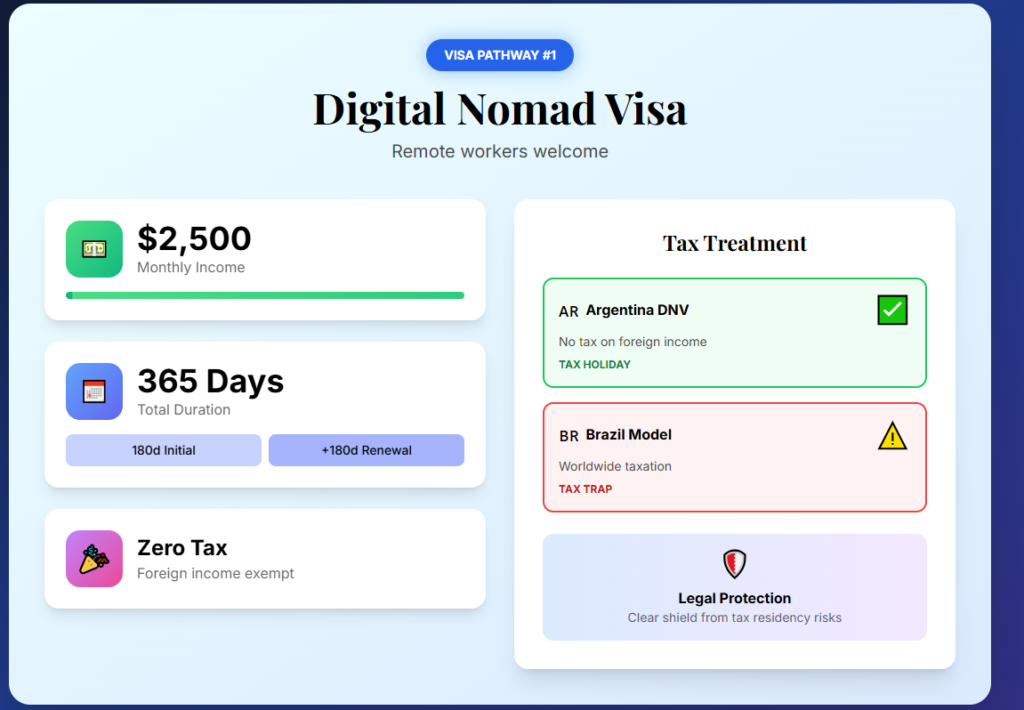

The Digital Nomad Visa (DNV) targets remote earners who can prove a monthly income of around $2,500 USD. It gives you a 180-day stay that you can renew for 180 days more, totaling one full year.

DNV holders receive an exemption from Argentine income tax on foreign income. This acts as a tax holiday and provides a huge contrast to neighbors like Brazil.

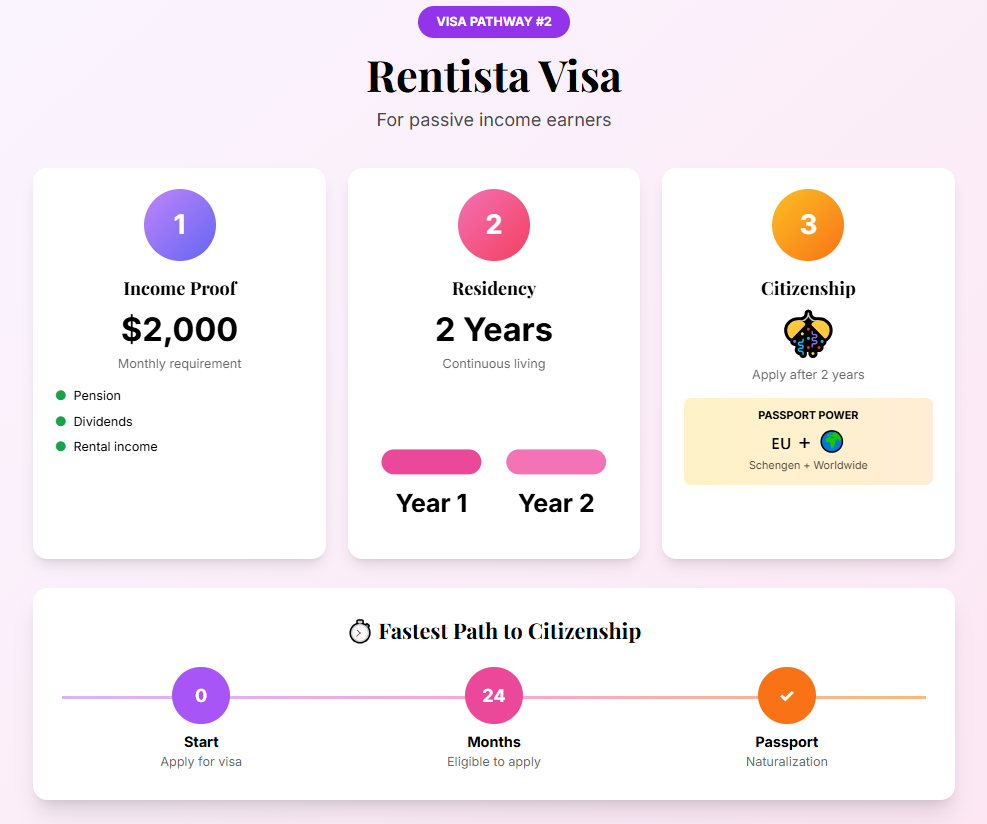

The Rentista visa targets retirees or anyone living on dividends, pensions, or rental income. The financial requirement involves proof of about $2,000 USD per month and offers a clear route to permanent residency.

Once established, you can apply for naturalization after just two years of continuous residency. That Argentine passport carries significant weight, granting visa-free access to the Schengen Area and the Mercosur bloc.

The government designed these policies to attract individuals with consistent foreign income streams. They do not want people looking for loopholes, so you must handle the compliance and bureaucracy side correctly.

You need clean income documentation and must use legitimate financial transfer methods rather than informal cash swaps. You also need to secure private health insurance and register your address officially.

This setup benefits expat retirees, for whom the residency process is relatively fast. The biggest win is the possibility to plan years ahead with fewer legal gray zones.

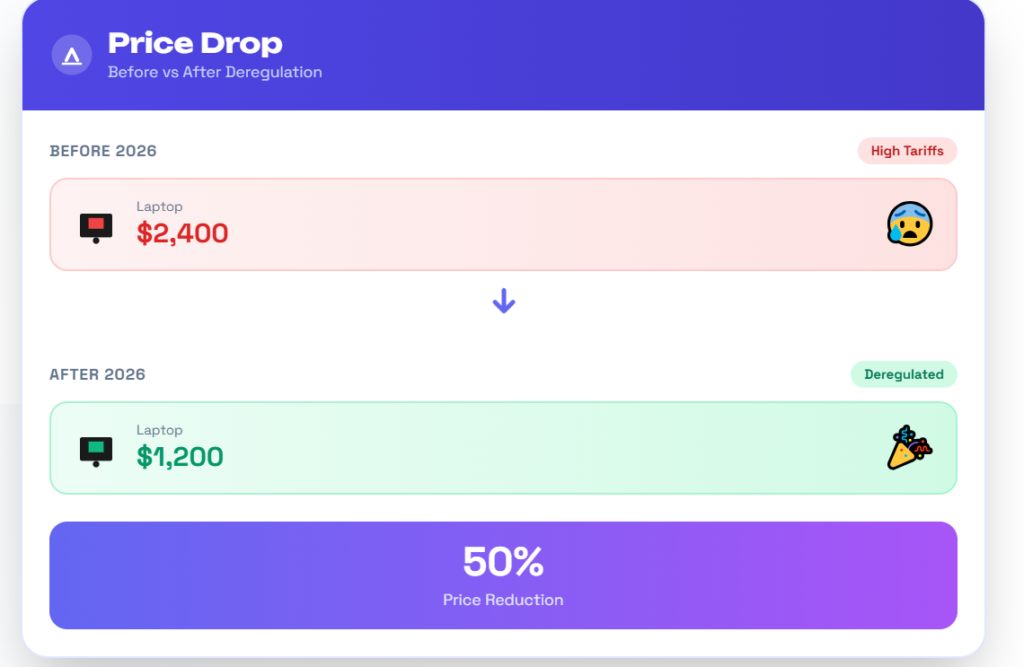

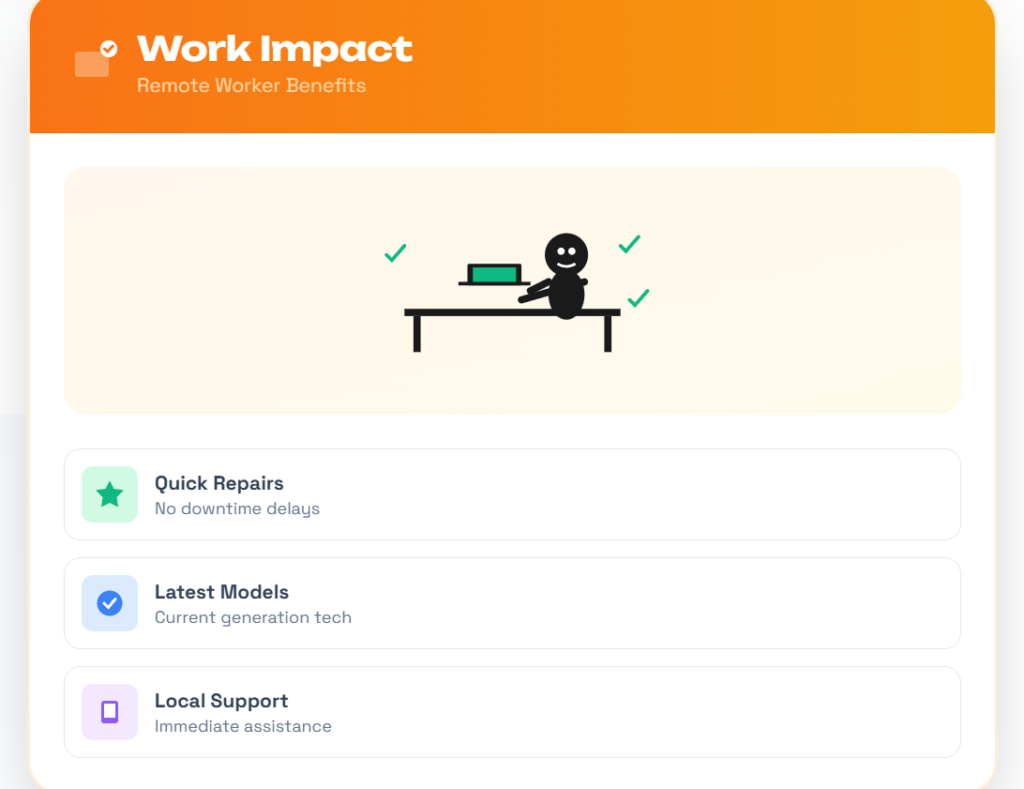

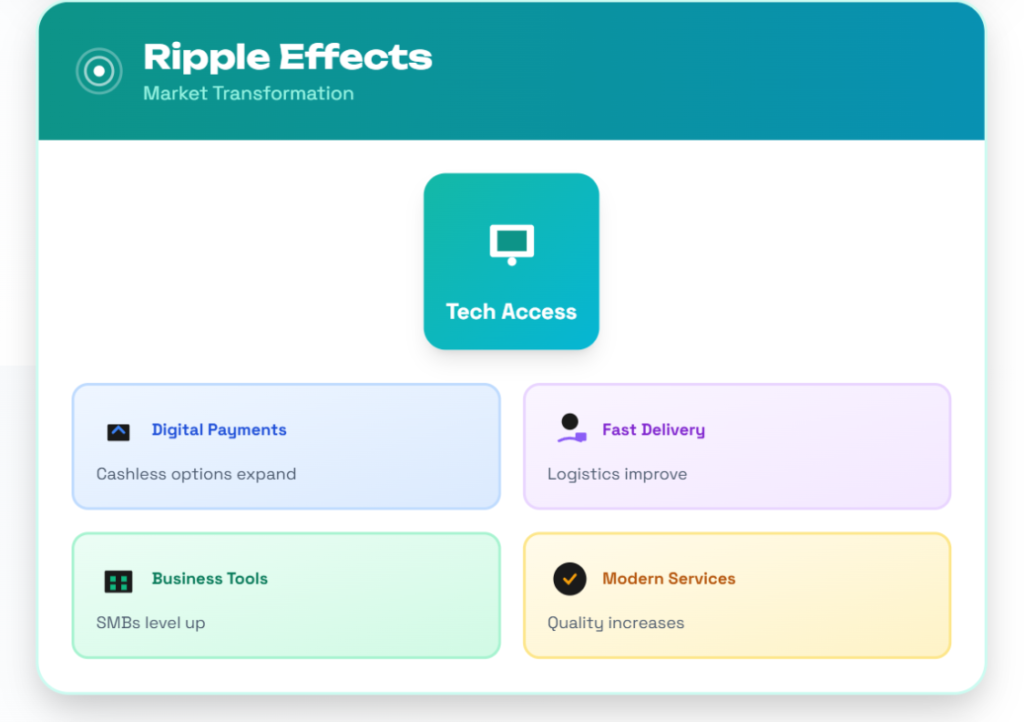

3. The End of the “Tech Gap”

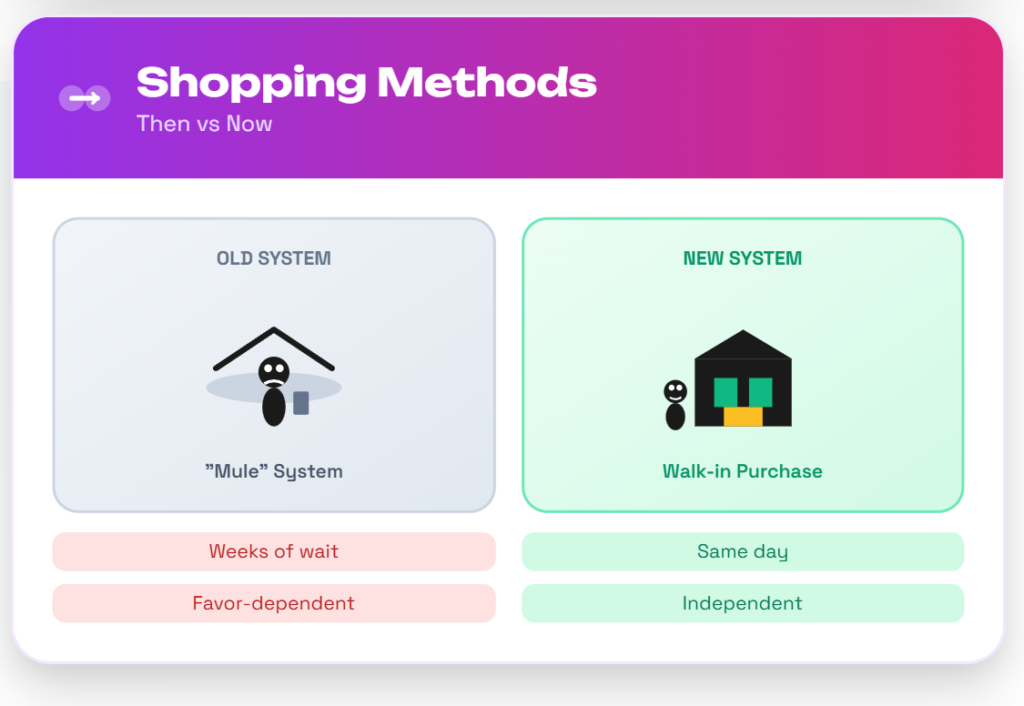

A country can be cheap and still cost you money if replacing a laptop becomes a nightmare. For years, this was the hidden tax of living in Argentina.

Strict import restrictions and punishing tariffs made phones and computers overpriced and hard to find. You would often pay nearly double the US price for a model that was already two years old.

That dynamic finally shifted in January 2026. The government pushed import deregulation and rolled back tariffs to reduce tech prices to international levels.

You no longer need to rely on the “mule” system where friends bring phones from Miami or Madrid. Now you can walk into a local retailer and buy what you need that afternoon.

More affordable technological products push more modern services. You see more digital payment options and faster delivery logistics because small businesses can afford better tools.

Check the local Argentine price for a standard iPhone model online right now. Compare that to your home country price and you will see the difference is now negligible.

With that, Argentina is closer to being a normal, functional, and even developed country. There is still a long way to go to be called fully developed, but the gap is closing.

4. Quality of Life and Relative Safety

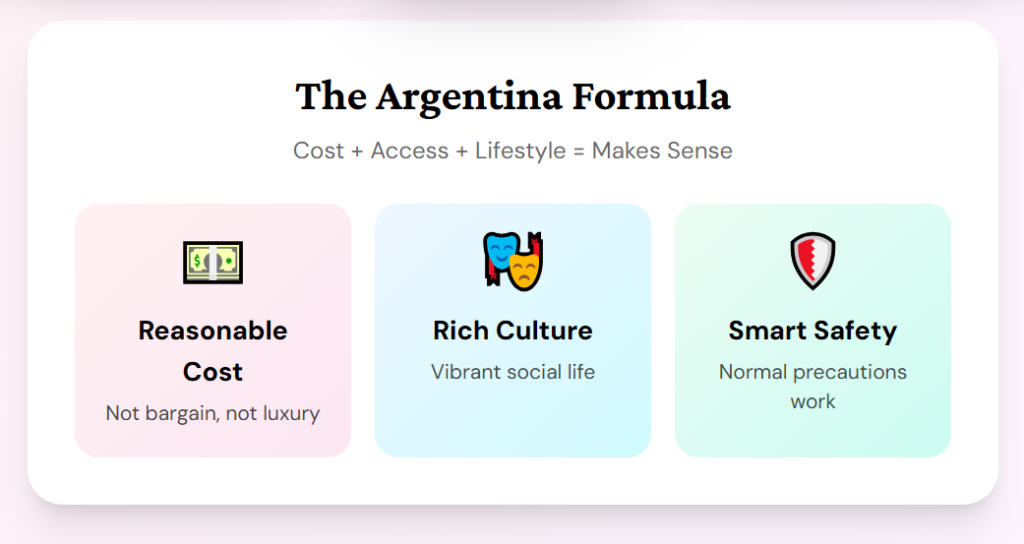

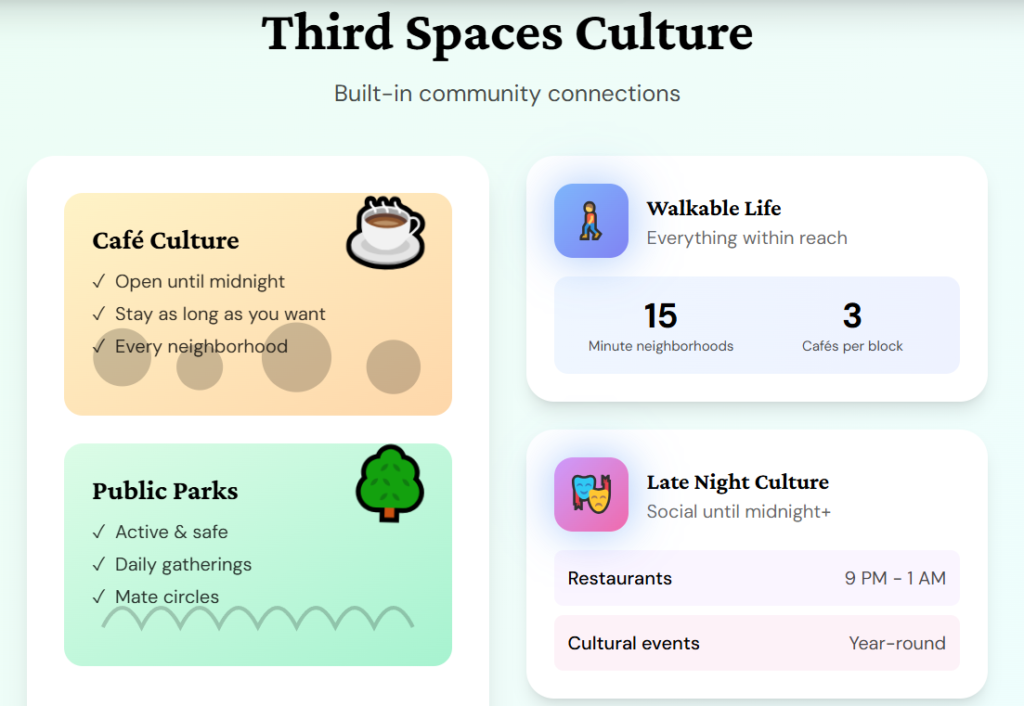

The real reason Argentina works is not the exchange rate. It is the walkability, food culture, and reliable access to third places.

The internet frames Argentina as either a danger zone or a bargain theme park. It is not that cheap, but it is also not that violent either.

Just a few years ago, Argentina ranked as the second safest country in Latin America, tied with Chile. Buenos Aires offers widespread neighborhoods where normal precautions allow for a completely normal life.

Other cities also have remarkably good safety records, with a few violent exceptions like Rosario. Multiple provinces have crime indicators comparable to European countries and far below the US.

Uruguay has great stability but a cost of living that rivals Western Europe. Brazil introduces enormous tax complexity and a fair dose of insecurity.

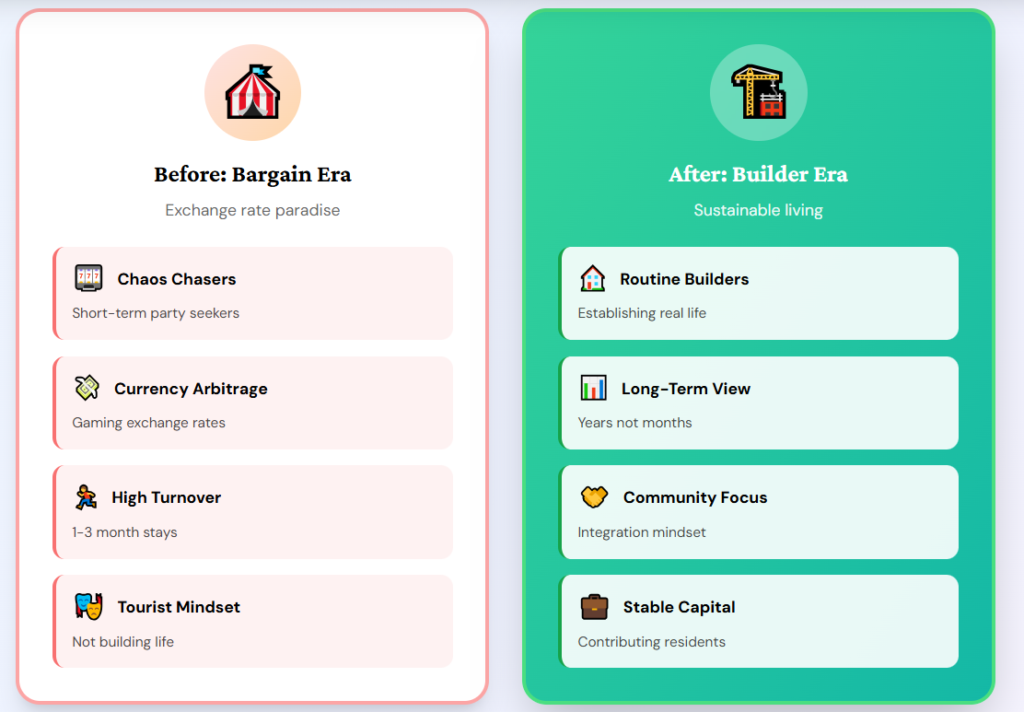

Argentina lands in the middle with a good trade-off between cost, safety, and lifestyle. This price surge acts as a filter that pushes out the chaos-chasers.

This brings a “calmer” type of expat who enjoys the culture rather than just wanting to save some bucks. You have a social structure that operates until late in the night.

Plenty of “third spaces” like cafés, events, and active public parks prevent the isolation that often hits retirees. Affordable private healthcare plans grant you specialist access without the long wait times typical in the UK or Canada.

You can see a dermatologist or a cardiologist in days, not months. In 2026, Argentina feels less like a financial hack and more like a place you can actually commit to.

If your goal is a stable life, not a temporary bargain, Argentina becomes more attractive as it gets more normal.

Conclusion: Is moving to Argentina in 2026 still worth it?

If you value quality of life and predictability over the lowest possible price, the answer is yes. However, there are a lot of changes you must be aware of – some of the clarified in the previous paragraphs.

But to where? Discover the answer in our article about the best cities to move to in Argentina.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.