One European country drains your pension so fast that living on $2,007 means serious debt.

Yet, just a short flight away, you can enjoy life and still save 51% of your pension!

The reason?

The cost of living swings wildly in Europe.

A beer might cost $2 in one city and $9 in another.

Now, imagine that gap applied to rent, groceries, and every monthly bill – that’s how the same $2,000 can buy you freedom or financial stress.

After eight years living in Europe and helping expats like you, I realized one of their biggest surprises is the extreme differences in living costs between European countries-and today I will reveal how much you can save in each of the 27 EU countries, ranking them from worst to best. For those considering relocation, it’s essential to know the best countries in europe for expats, as this can significantly impact your overall experience.

Keep watching, because the final ranking may flip every assumption you’ve had about the best countries to retire in Europe.

And wait until you see where Italy and Portugal rank on this list—you might be shocked.

The Criteria To Define The Cheapest Countries to Live in Europe

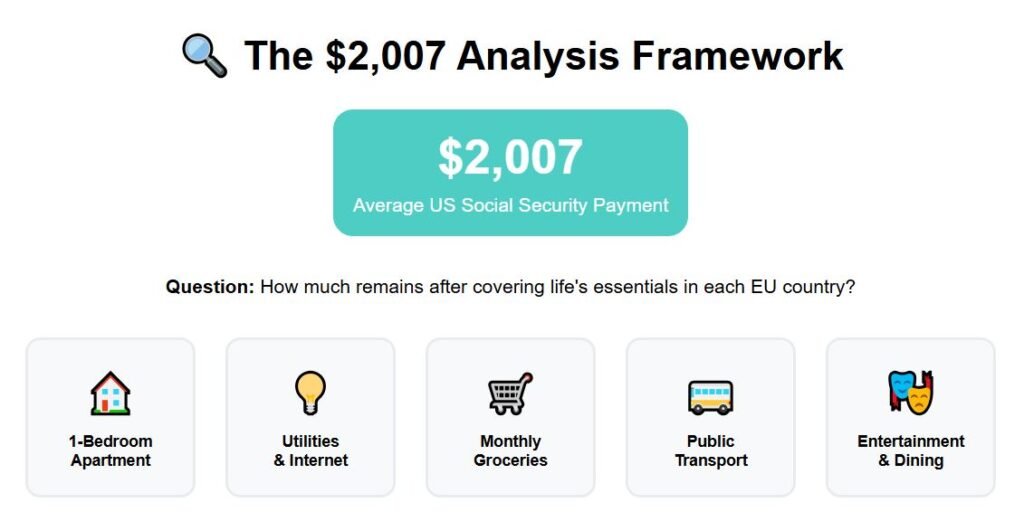

Our budget of $2,007 was not chosen at random; it is the current average monthly Social Security pension paid to retirees in the United States—a practical reference point.

The question we will answer is: if you moved to an EU country with that income, how much would remain after the basics?

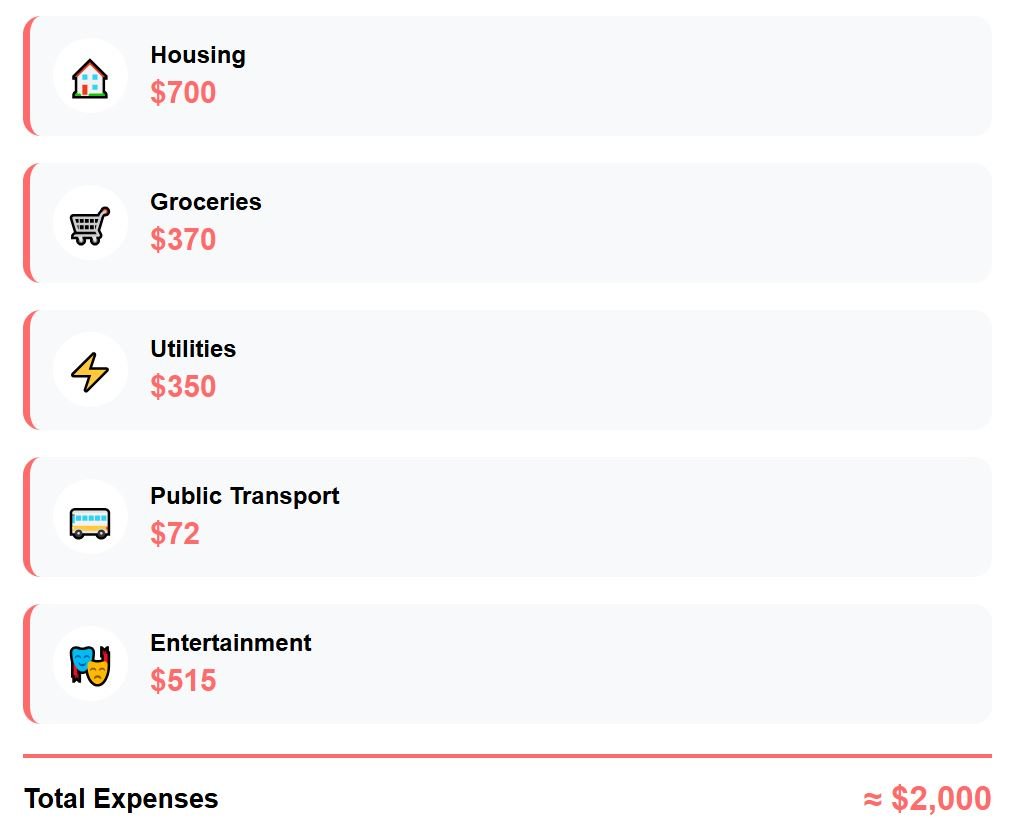

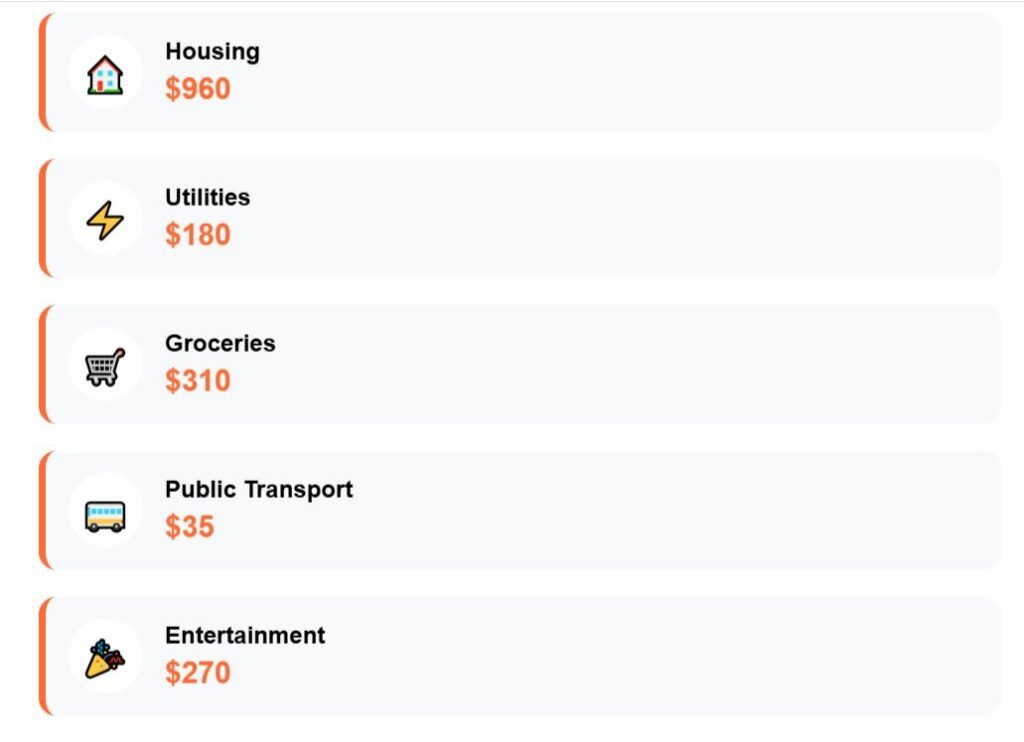

To answer this, I analyzed five key spending categories: rent for a one-bedroom apartment, utilities, groceries, public transport monthly passes, and entertainment.

Entertainment in this case means a gym membership, four restaurant meals, a couple of cinema visits, and twenty beers out at a pub—per month, not per night.

Cities were carefully chosen, too.

Instead of focusing on capitals, the analysis looked at mid-sized cities.

Capitals like Prague or Warsaw are often much pricier than their countries, while medium cities are attractive to expats due to strong infrastructure, healthcare, and amenities—without the inflated bills.

But if you would like me to make an article ranking European capitals, let me know in the comment section—enough comments and I will do a ranking of the capitals too.

So, back to our ranking: we start with the worst cases.

27 – Luxembourg

Luxembourg City is located in the heart of Western Europe, bordered by France, Belgium, and Germany. The city has around 130,000 residents in a nation of just over 650,000.

It consistently ranks among the richest places in Europe, with average income exceeding $120,000, nearly three times higher than the EU norm. That economic strength comes with a cost of living that is almost unmatched.

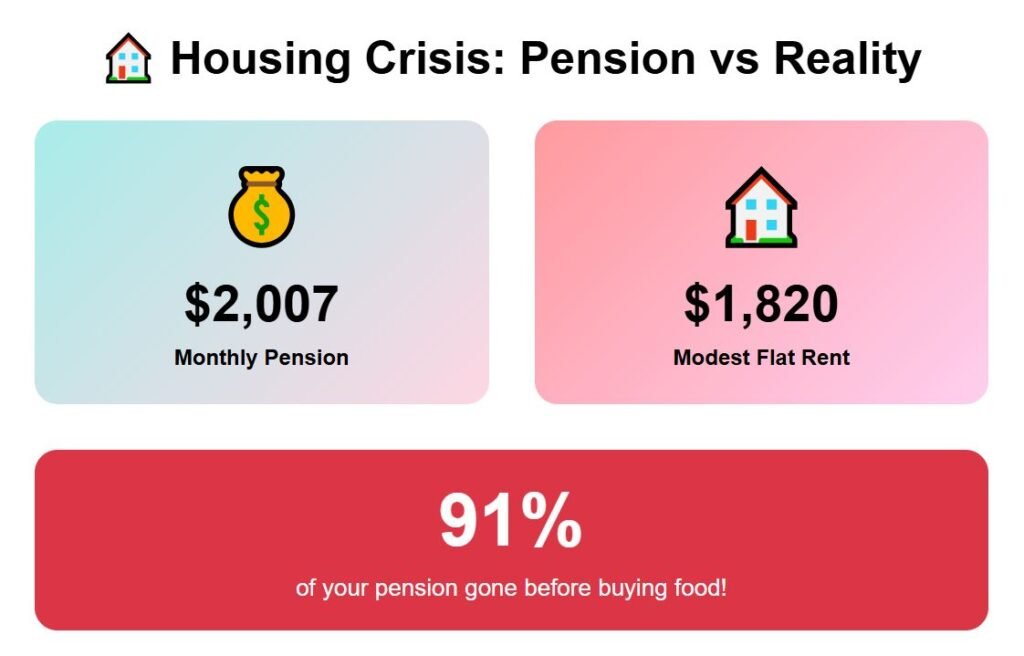

Luxembourg City is best known as a hub for banking and EU institutions, and like most financial hubs, housing costs are sky high. Rent averages $1,820 for a modest flat, which already consumes 91% of a $2,007 pension.

A local told us something interesting about the housing prices in Luxembourg:

“The prices are extremely high both to purchase and to rent. Unless you have daddy’s money or a really high salary, it’s impossible for a couple to live here. That is why so many people live in France or Belgium and commute here to work every day.”

Housing is not the only high expense there—add basic household bills and food expenses, which together weigh in at more than $700.

Then comes the leisure budget, with an additional $460; a single beer in a local pub there easily costs more than $7. The result is a deficit of almost $1,000 each month, or minus 49%.

Retiring on our Social Security pension of $2,007 is completely unworkable there. There is a reason so many people live across the borders to work there instead of living in Luxembourg.

26 – Netherlands

For the Netherlands, our example is Utrecht, a city with around 360,000 residents, located in the central part of the country and only about 40 kilometers from Amsterdam. But life there is somewhat less costly than in the capital.

While Amsterdam’s rents often cross $2,000, Utrecht averages closer to $1,500 for a small apartment. Even cheaper than the capital, it is not a place one could call “cheap.”

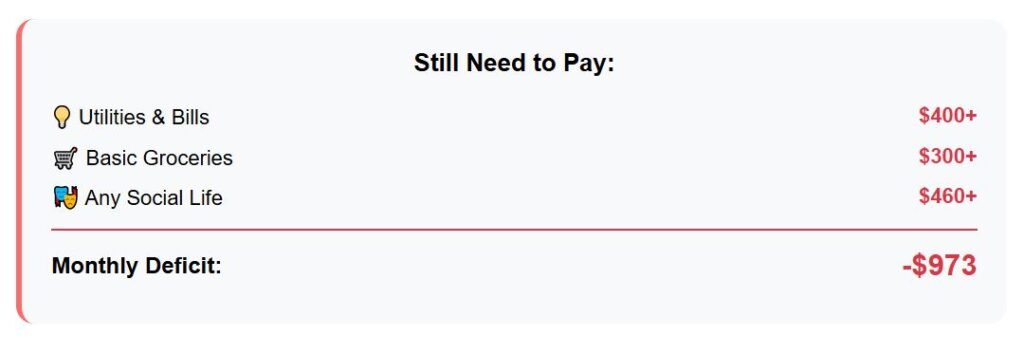

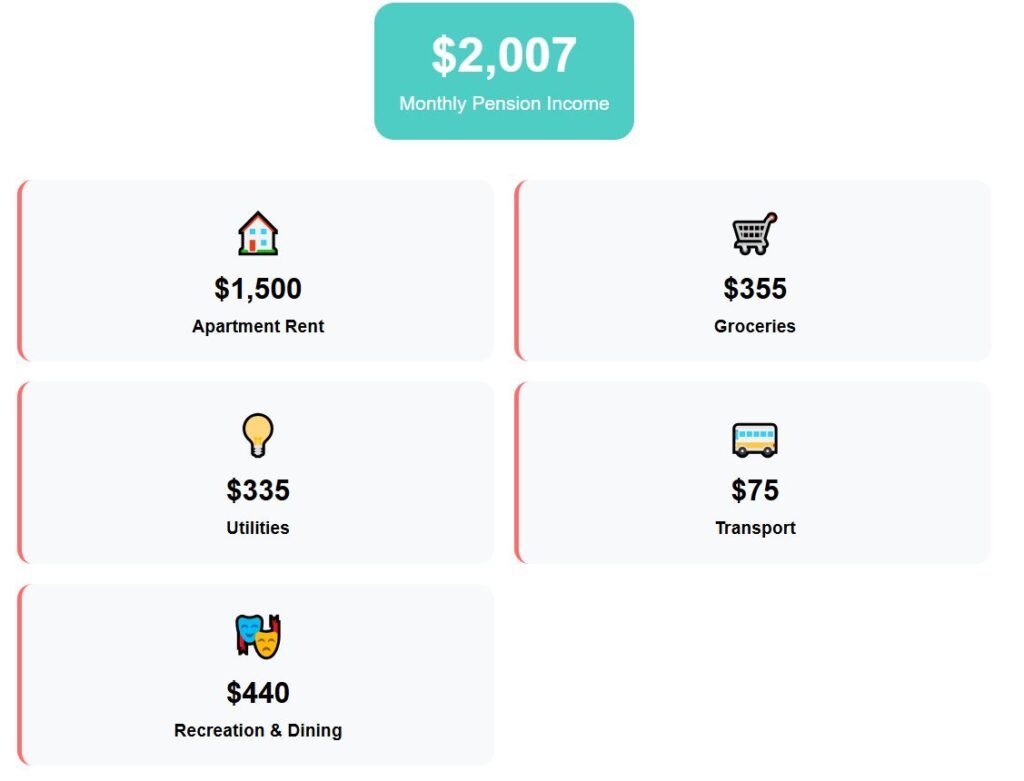

Groceries alone are about $355, utilities add roughly $335, and commuting is another $75. After adding recreation and eating out, all expenses together reach $2,705—a deficit of $698, or 35% of monthly income in the red.

Utrecht demonstrates that even outside the expensive Dutch capital, pensions cannot sustain retirement there.

25 – Ireland

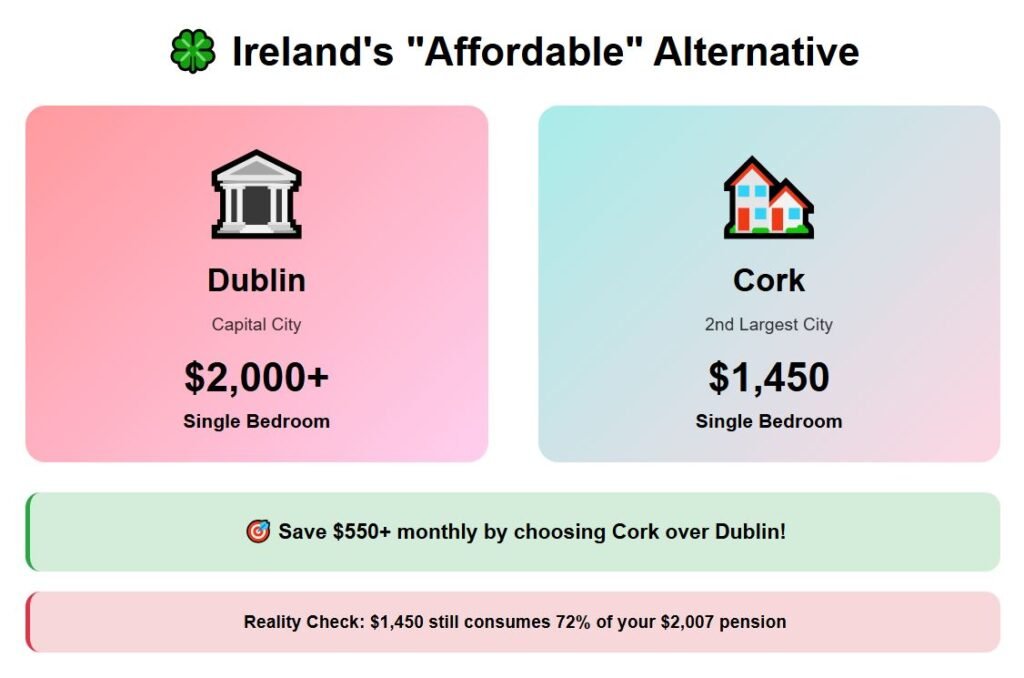

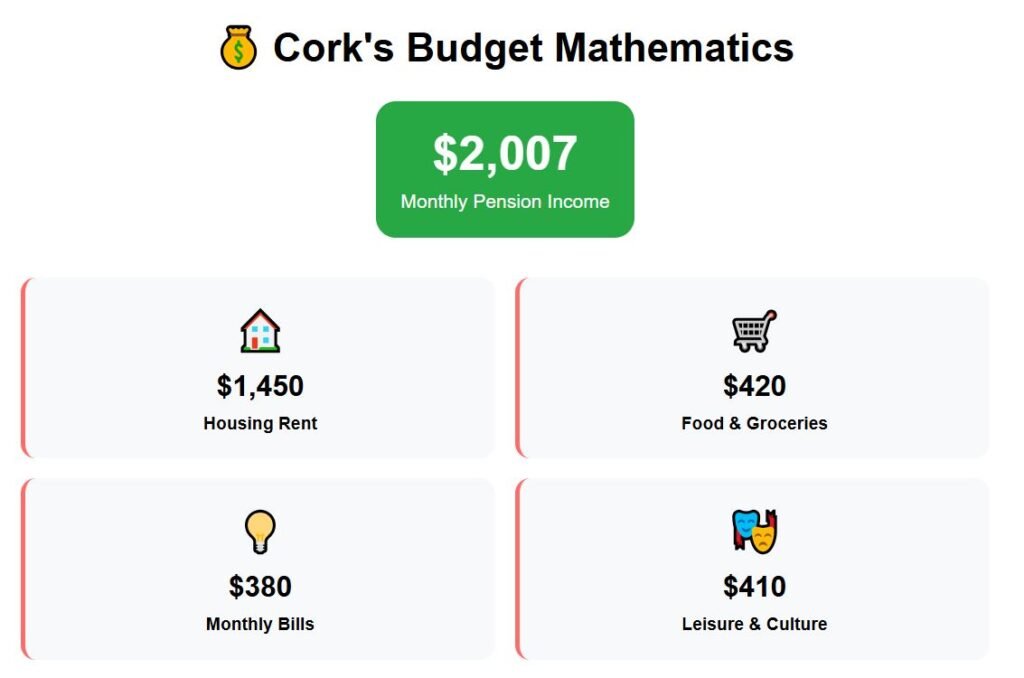

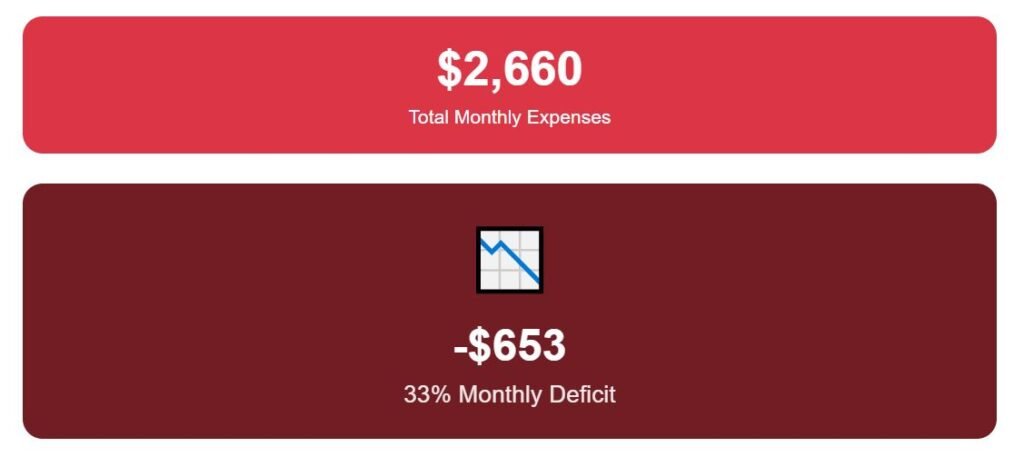

Here, the focus is on Cork. Located in the southwest of the country, with a population of 220,000, it is the second-largest city after Dublin.

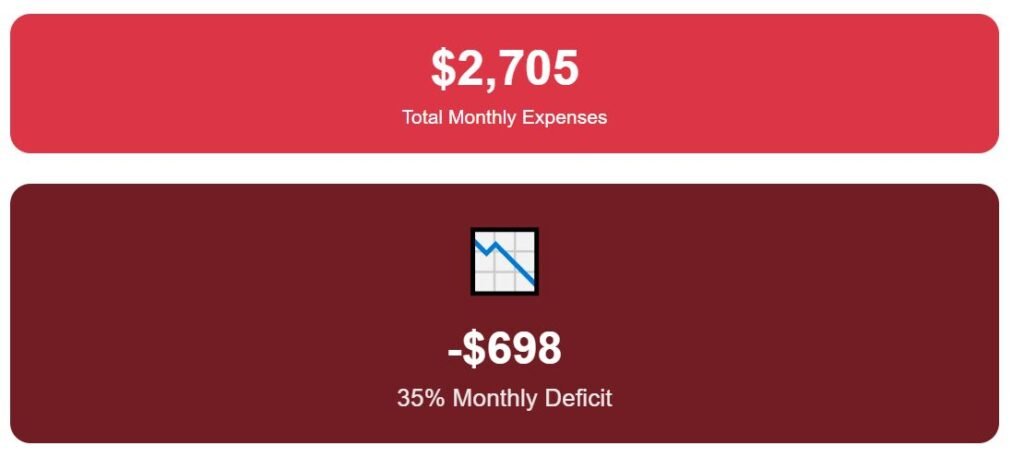

Compared to the capital, living costs are lower, particularly in housing, as Dublin’s rents close to $2,000 for a single-bedroom unit, while Cork provides the same space for about $1,450. Which is still very expensive for our budget—a $2,007 pension barely covers the main expenses in Cork.

While rent carves away most of it, food and monthly bills add further strain. Leisure, which includes dining out or cultural activities, quickly raises the total to $2,660 per month.

That means retirees fall short by $653 every month, equal to minus 33% of their income. Cork may be safe and lively, yet the figures show that a single $2,000 pension is not enough.

24 – Belgium

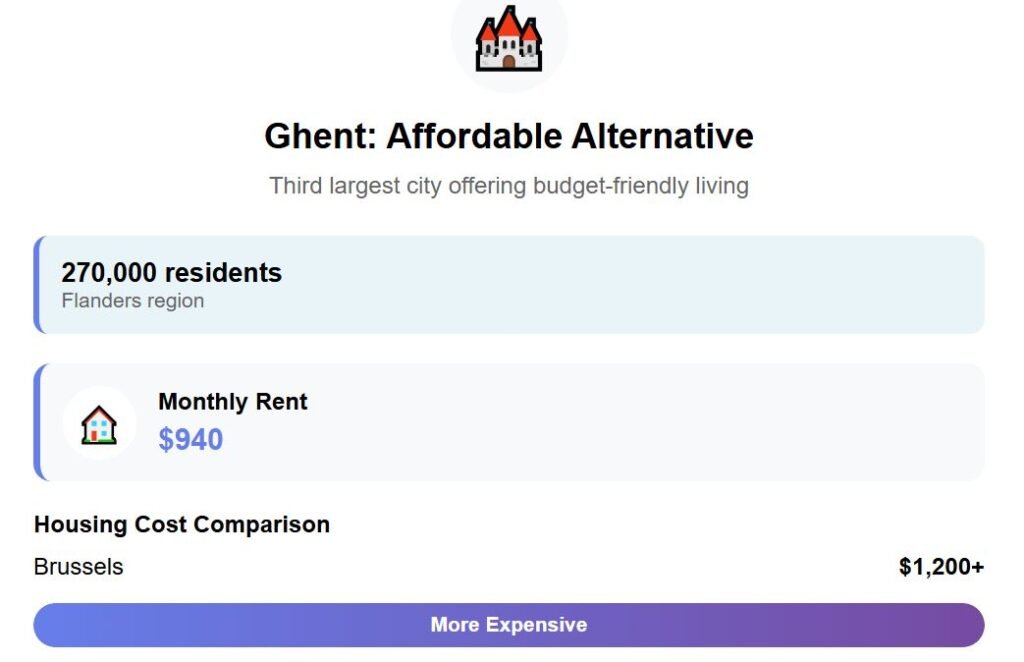

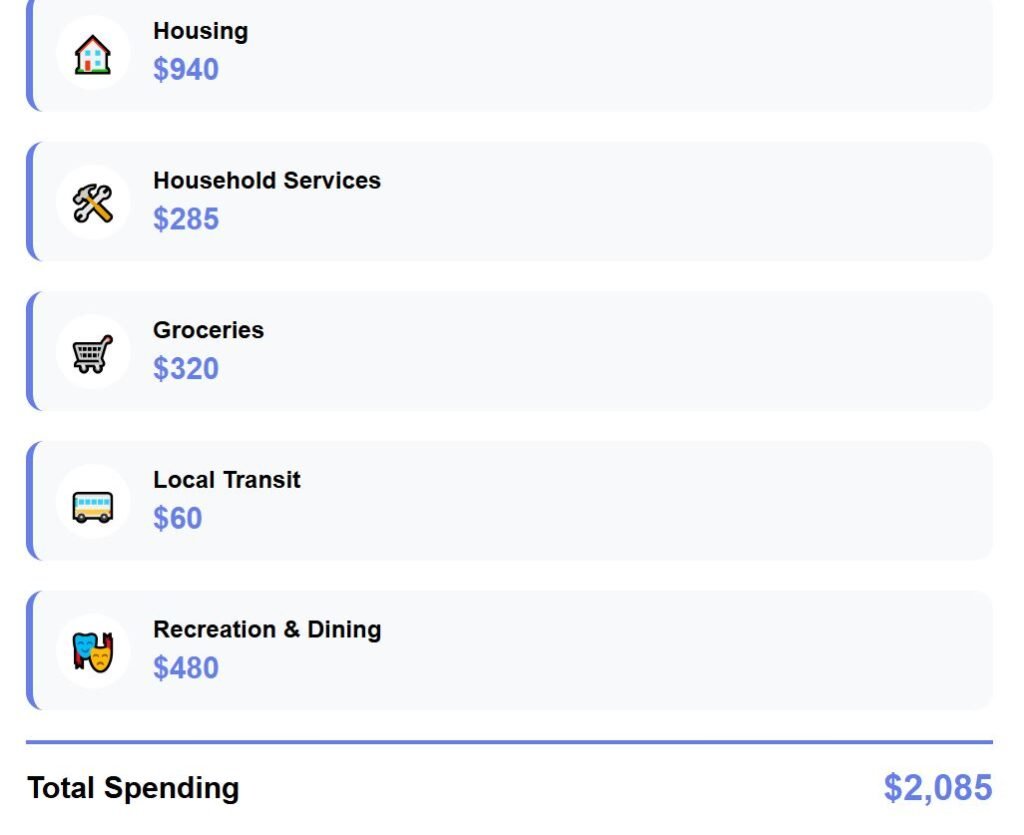

For Belgium, Ghent takes the spotlight. Positioned in the Flanders region, it has nearly 270,000 residents and stands as the country’s third-largest city.

Compared to Brussels, where a one-bedroom rental might go above $1,200, Ghent has lower housing costs, attracting students and expats seeking affordability without losing access to services. Looking closely at the expenses, a retiree with this budget spends around $940 on rent, about $285 on household services, and $320 on groceries.

Local transit adds around $60, while recreation and eating out demand $480—including some beers, since you are in Belgium. Together, that brings spending to $2,085.

The outcome is negative: retirees face a monthly deficit of $78, equal to 4% below income. It’s not crushing debt, but the shortfall highlights how bills and leisure erase Ghent’s lower housing advantage.

Belgium is the last country on our list where a $2,007 pension is not enough to cover living expenses. From this point onward, the countries and cities listed fit inside our budget and the surpluses just increase.

But before, I have some really good news: FREE FOR A LIMITED TIME: Grab your Expat Wealth & Lifestyle Compass ($108 value) today! Includes our 74-page guide of Affordable European Cities, our Zero-Tax countries report, and our expat checklist. http://patreon.com/The_ExpatJoin us here before this offer ends.

23 – Denmark

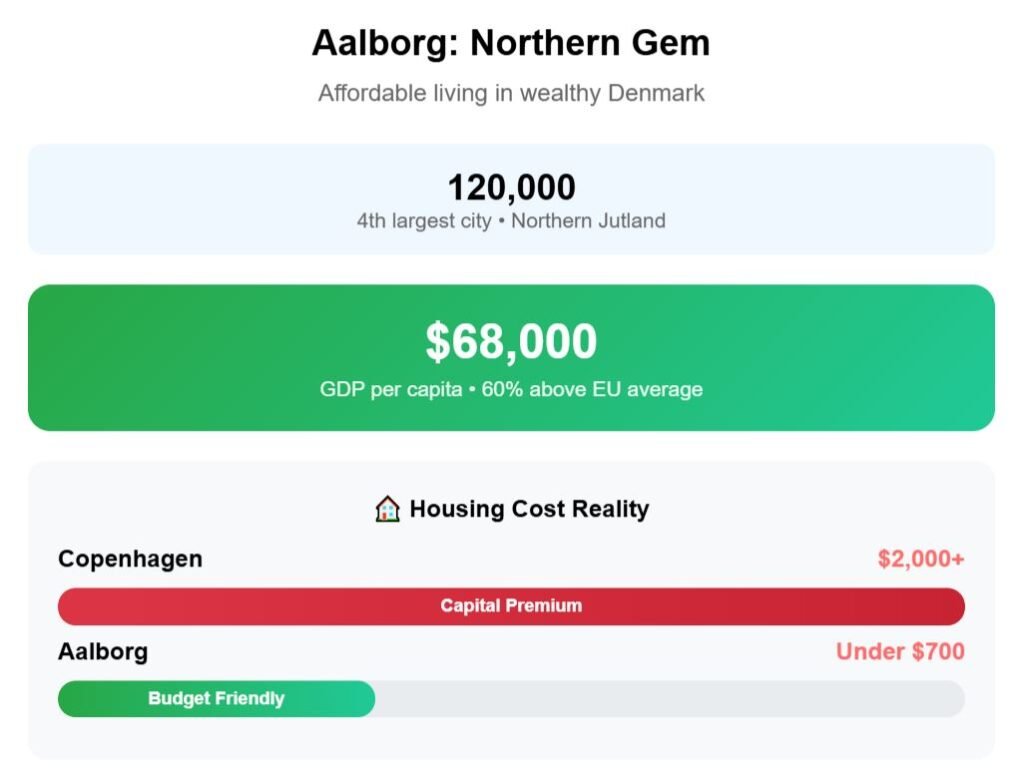

In Denmark, we chose Aalborg, in the northern part of Jutland, with about 220,000 residents, making it the fourth-largest city in the country. Denmark as a whole is among the wealthiest EU members, with GDP per capita above $68,000, nearly 60% higher than the EU average.

Aalborg is also cheaper than Copenhagen, where rent alone can exceed $2,000. So, despite Denmark being a very rich (and expensive) country, Aalborg is relatively accessible for our budget.

Rent is under $700, groceries push close to $370, and utilities come in at $350. Public transport adds about $72.

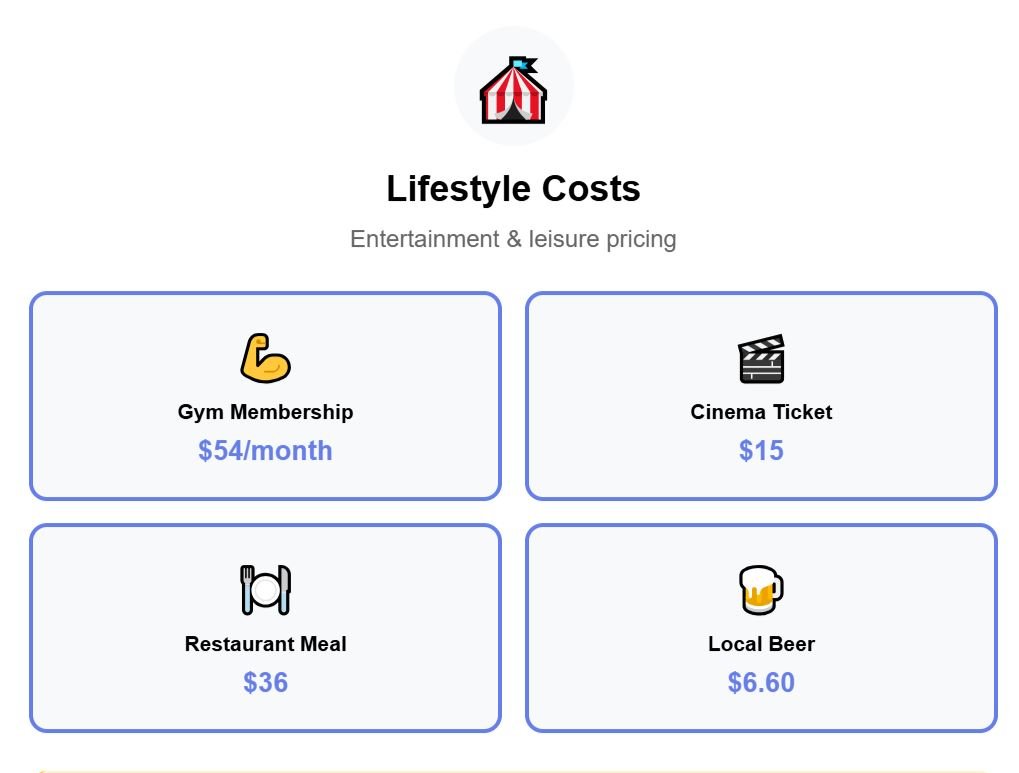

Entertainment is quite expensive, with our bundle adding $515. It is no surprise that so many Danes go to Germany when they want to have a beer, since it is so expensive there.

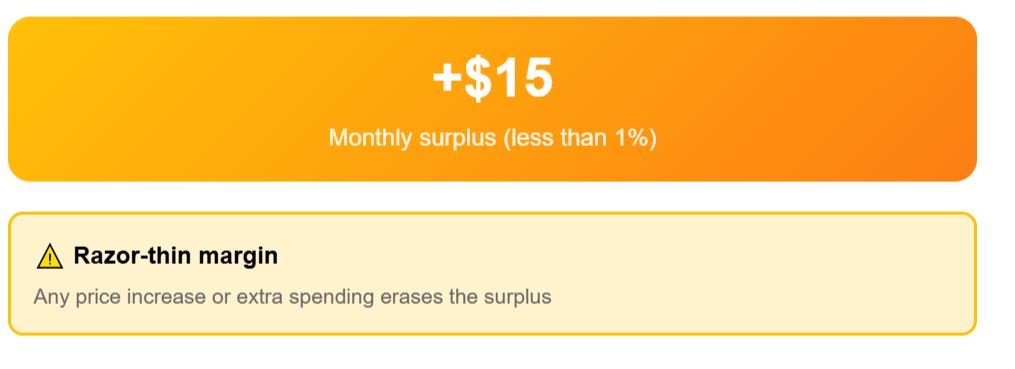

Combined, expenses total almost exactly our $2,007 pension amount and leave a surplus of just $15, equal to less than 1% of income. So it’s technically possible to live in Denmark on a Social Security pension, but any extra spending or price variation could erase it quickly.

22 – Malta

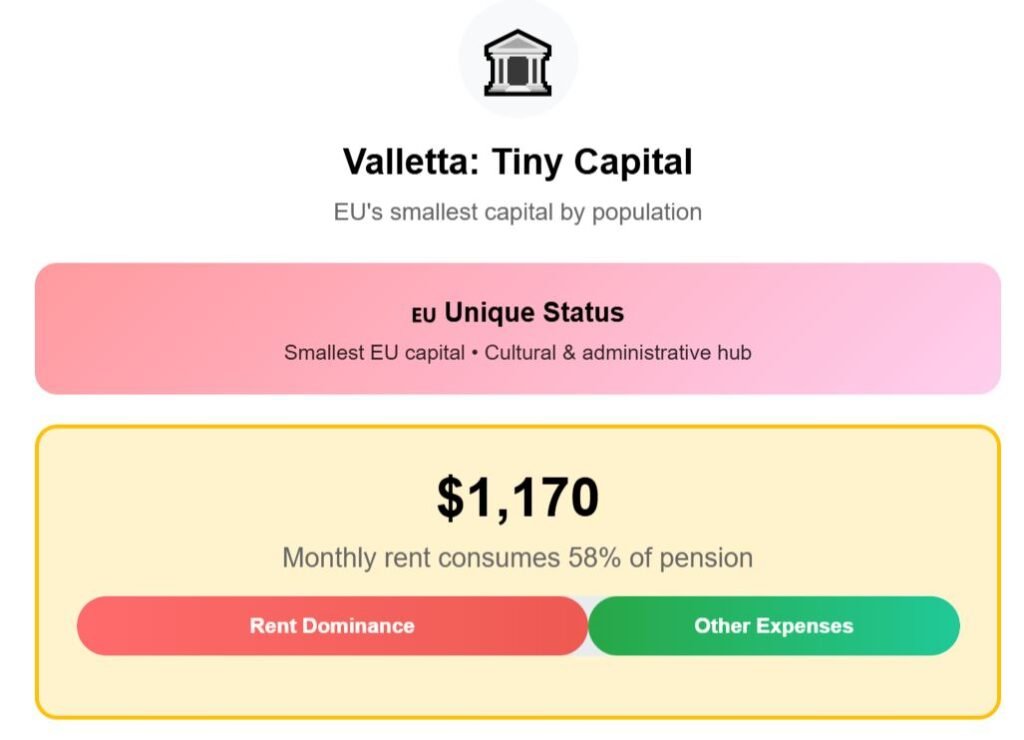

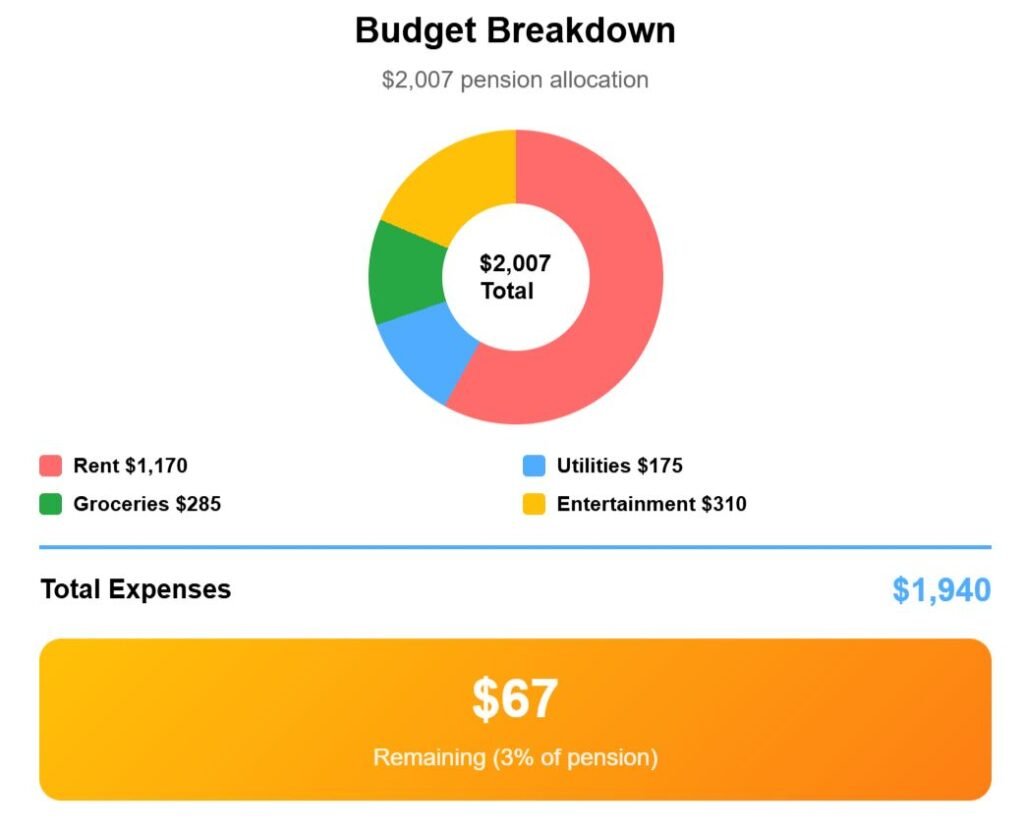

Valletta, Malta’s capital, is the smallest capital city of the European Union by population. Despite its size, it is Malta’s cultural and administrative hub, and its central position on the island makes it a natural choice for retirees.

Being the capital, it is more expensive than other Maltese towns, with rental costs leading the way. One-bedroom apartments average around $1,170, consuming over half a $2,007 pension.

Monthly utilities remain manageable at around $175, groceries add around $285, while entertainment pushes the total budget to $1,940. That leaves just $67 remaining from the pension, equal to a slim 3%.

The result is that while Valletta offers English as an official language and a healthy Mediterranean lifestyle, living there demands tight financial control with almost no margin.

21 – Austria

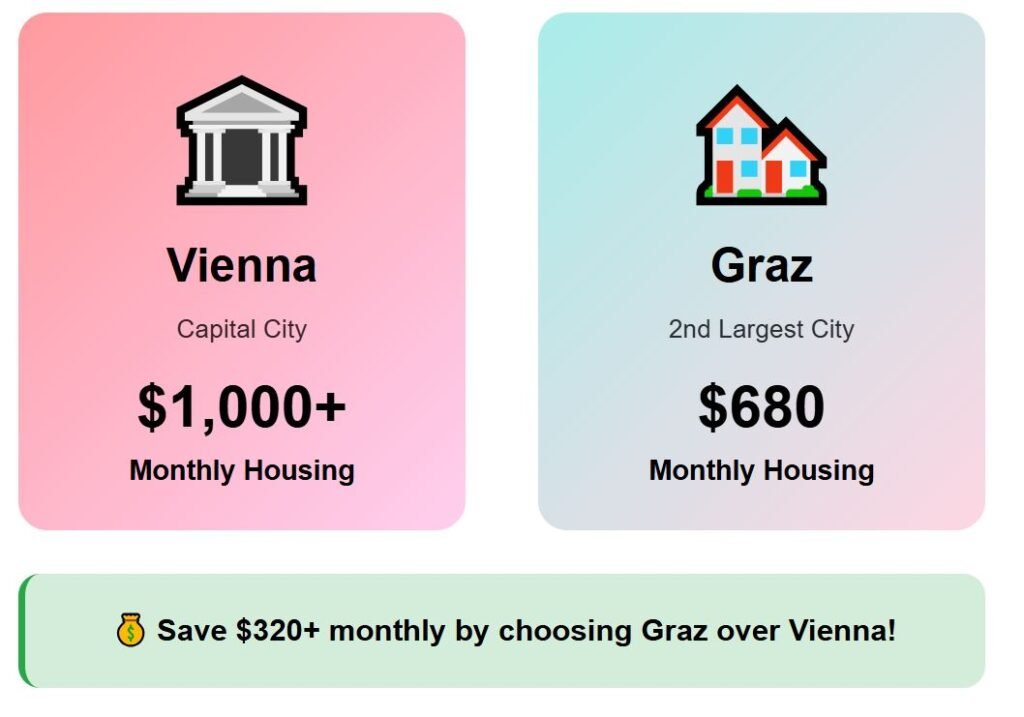

In Austria, the focus city is Graz. Positioned in the southeast near the Slovenian border, it is the country’s second-largest city with about 300,000 residents.

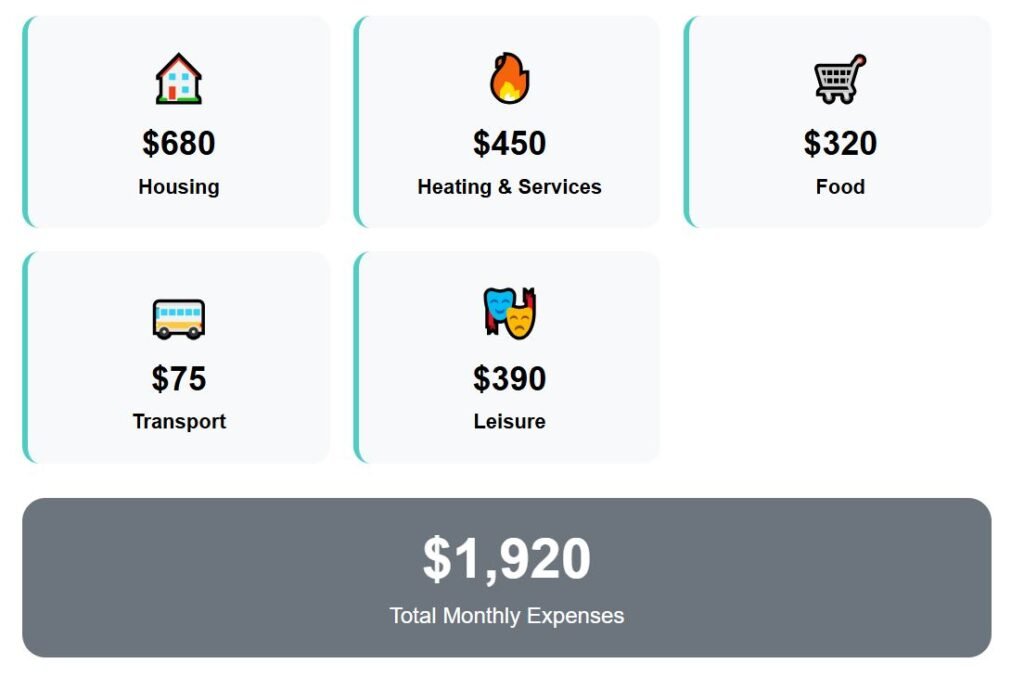

Graz is cheaper to live in than the capital Vienna, especially in rent, where housing costs under $680 compared to Vienna’s rates that often exceed $1,000. Rent is still the largest expense, but utilities also take a heavy share at $450, driven higher by cold winters.

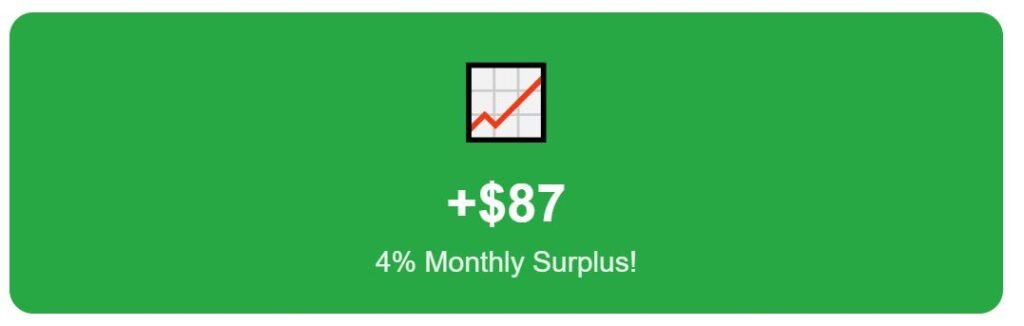

Food adds about $320, transportation $75, and leisure activities consume another $390. In total, a retiree on this budget spends nearly $1,920 in Graz.

That leaves a positive balance of $87 per month, which equals about 4% of income. It is not a wide margin, but it shows that living modestly in Austria can remain within budget.

20 – France

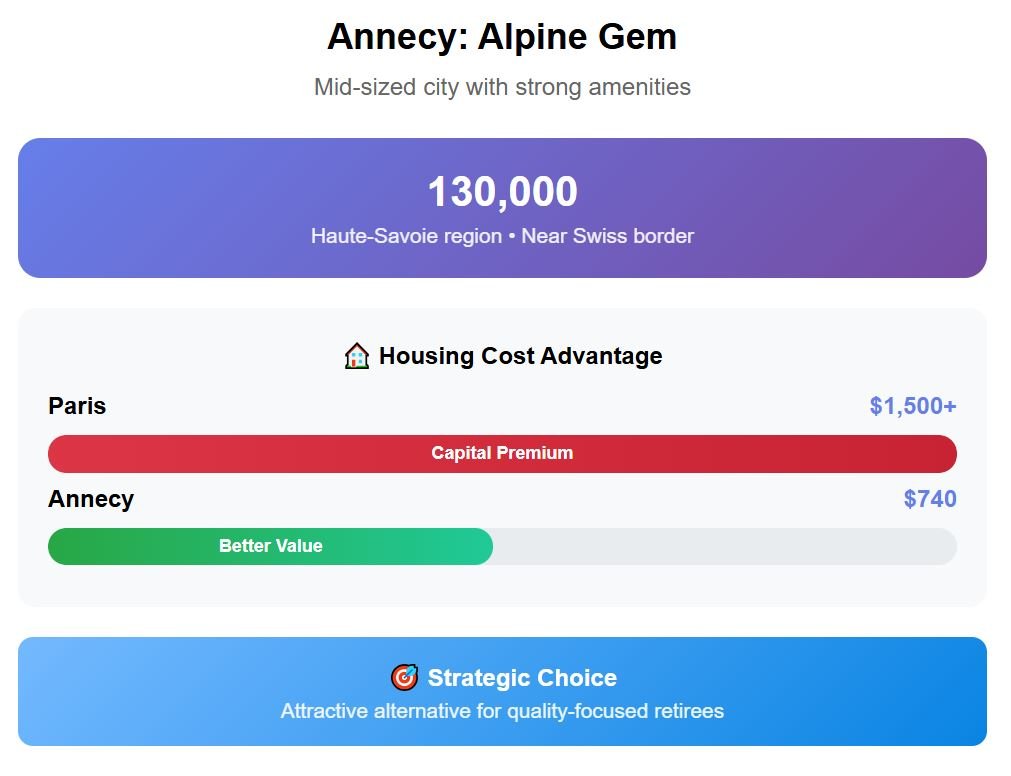

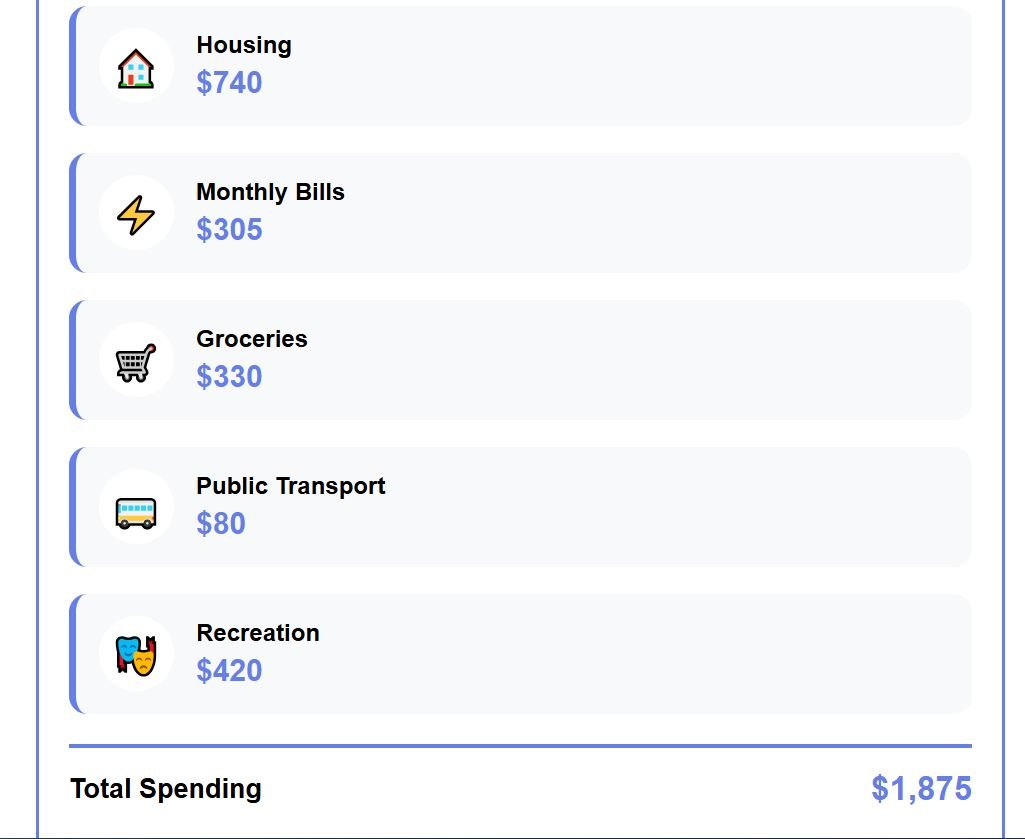

For France, the spotlight is on Annecy. Located in the Haute-Savoie region near the Swiss border, it has a population of about 130,000.

In France, living costs vary a lot depending on location. In Paris, rent for a flat can exceed $1,500, but Annecy offers much lower prices.

Housing in Annecy averages around $740, monthly bills add about $305, while groceries are near $330. Public transport costs are low at around $80, and recreation adds another $420.

Altogether, total expenses are $1,875 per month, leaving retirees with $132—so 7% of our budget is untouched. Not large, but it still provides some breathing space for someone prioritizing the quality of surroundings and steady comfort.

19 – Slovenia

Here, we chose the capital, since it is the only mid-sized city. Ljubljana has around 300,000 residents, offering a blend of culture, accessibility, and safety that appeals to expats.

The city’s manageable size means you have reliable healthcare and transport within reach, while still experiencing the architectural charm of Central Europe. For retirees, the numbers matter most, and Ljubljana presents a clear balance between Western and Central Europe.

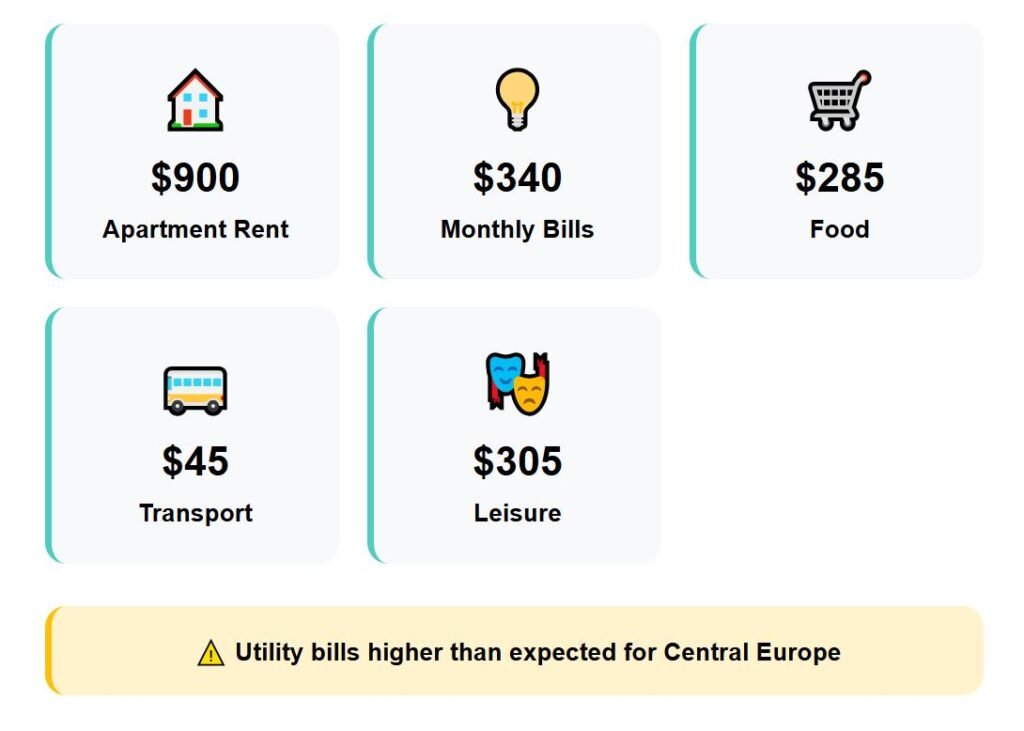

Rent averages $900 for a flat. Monthly utilities often reach $340, which is higher than expected for this part of Europe.

Add $285 for food, $45 for commuting, and $305 for leisure, and the total costs sum $1,825. That leaves $182 to spare each month, equal to about 9% of the pension—a small surplus, but positive.

18 – Finland

In Finland, the example city is Turku. Positioned in the southwest along the coast, it has about 195,000 residents and is one of the country’s oldest cities.

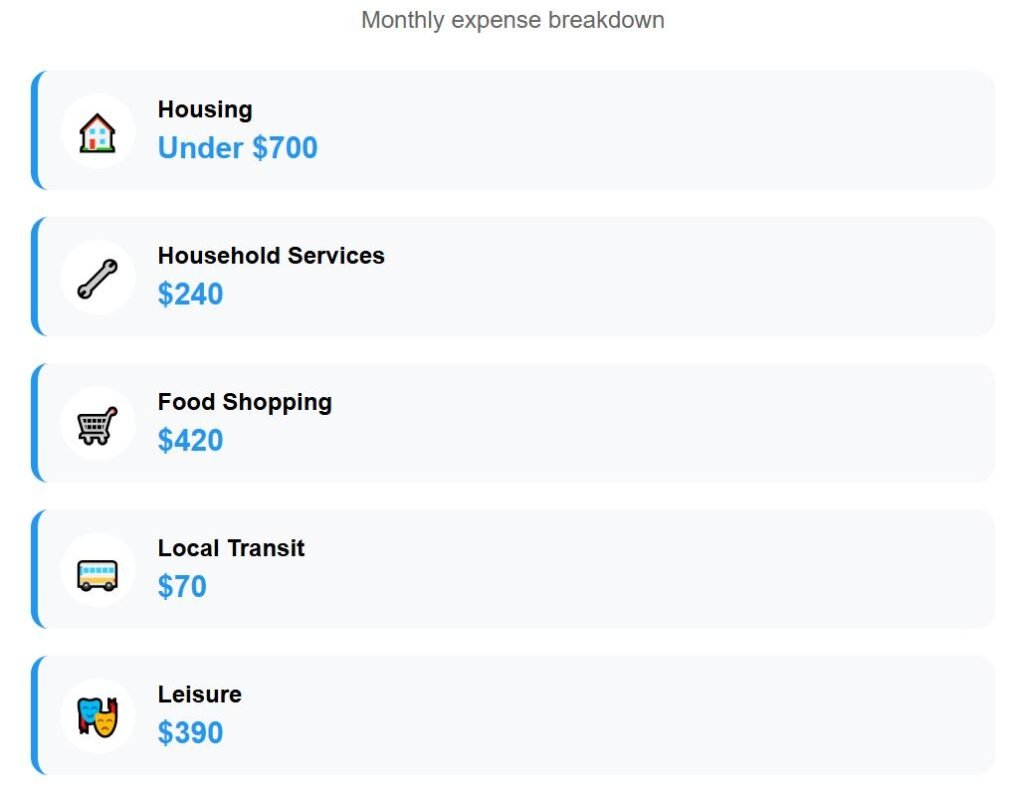

Compared to Helsinki, where a flat averages around $1,050, Turku is far more affordable at under $700. This difference makes it one of the more realistic options for anyone living on a pension.

Household services in Turku are about $240, which for Nordic standards is considered manageable. Food shopping raises costs considerably at $420, and local transit averages $70.

Leisure is also on the heavy side, adding $390 monthly. Altogether, these expenses reach $1,820.

The surplus in Turku is $187 each month, equal to about 9% of income. Even though the numbers show a surplus, the challenge is the seasons—long winters push heating costs higher, and that often eats into the small margin.

17 – Sweden

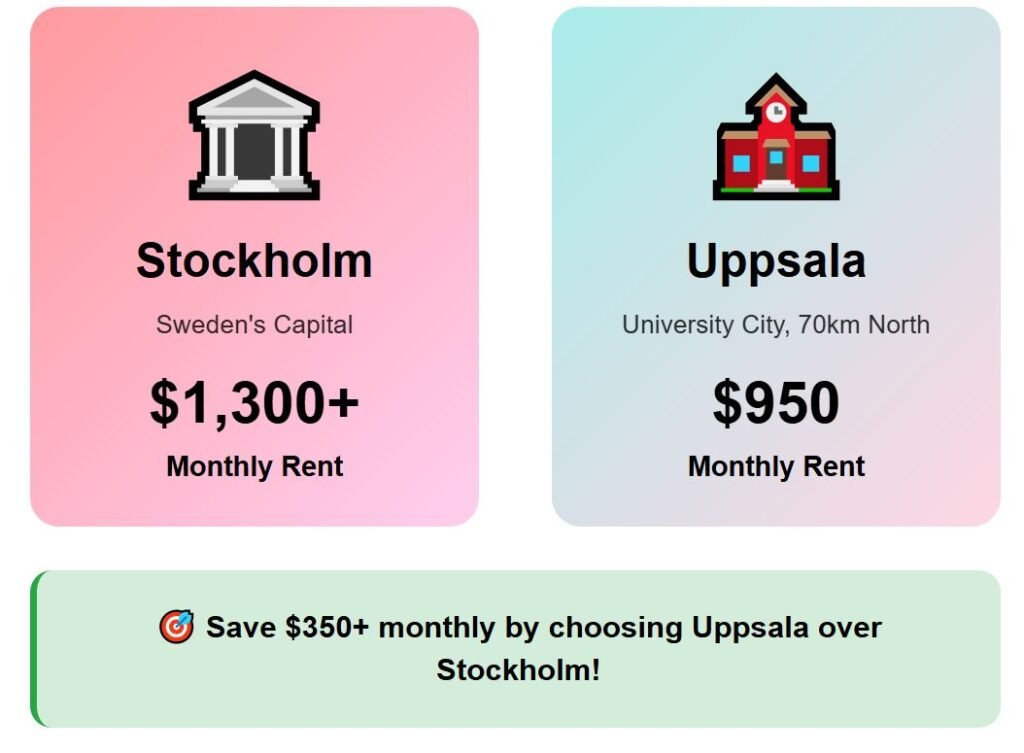

Here, our focus is on Uppsala. Located 70 kilometers north of Stockholm, it is Sweden’s fourth-largest city with a population of around 177,000.

Uppsala is noticeably less expensive than the Swedish capital. A one-bedroom apartment costs around $950 here, compared to Stockholm where prices can exceed $1,300.

The financial picture shows how numbers play out for someone living on $2,007. Rent is the largest share, while utilities consume another $160, and groceries $360.

Transportation demands $110, and entertainment expenses are about $435 a month. Now you get why Swedes often prefer to travel to other countries to have fun.

Total monthly costs reach around $1,815, so from our budget, $192 remains at the end of the month. From now on, the next countries leave more than 10% of your pension untouched, and contrary to what you might think, among those countries are some of the most developed nations in Europe.

16 – Spain

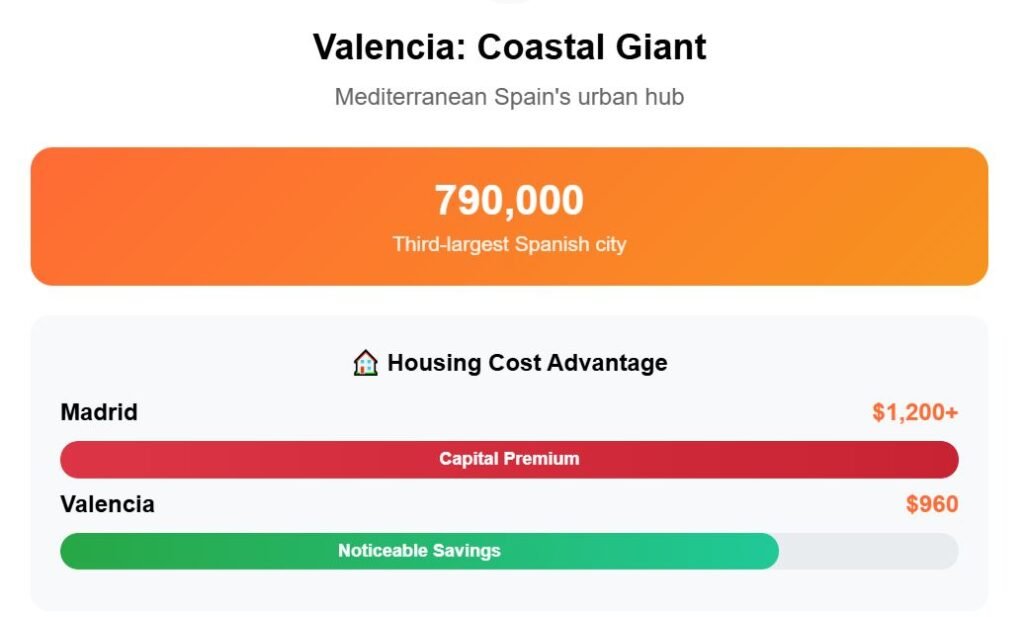

For Spain, the focus city is Valencia. Located on the Mediterranean coast, it has a population of about 790,000 and serves as the country’s third-largest city.

Compared to Madrid, where one-bedroom rents often exceed $1,200, Valencia averages around $960—a noticeable cost advantage while still delivering good urban infrastructure. Breaking down expenses gives a clear picture.

Utilities are about $180 per month, groceries average $310, and public transport $35. Entertainment adds just $270—Spain, in general, is a country where to have a good time, you don’t need to break the bank, and that is why I go there multiple times per year.

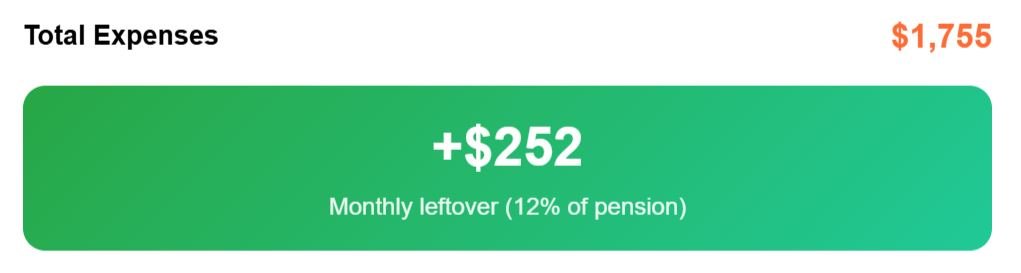

Altogether, that puts total expenses at $1,755 per month, and from our budget, 12% ($252) remains each month. It shows how a city like Valencia provides not just lifestyle appeal, but also a realistic financial cushion.

For many, this is Southern Europe at its most retiree-friendly.

15 – Germany

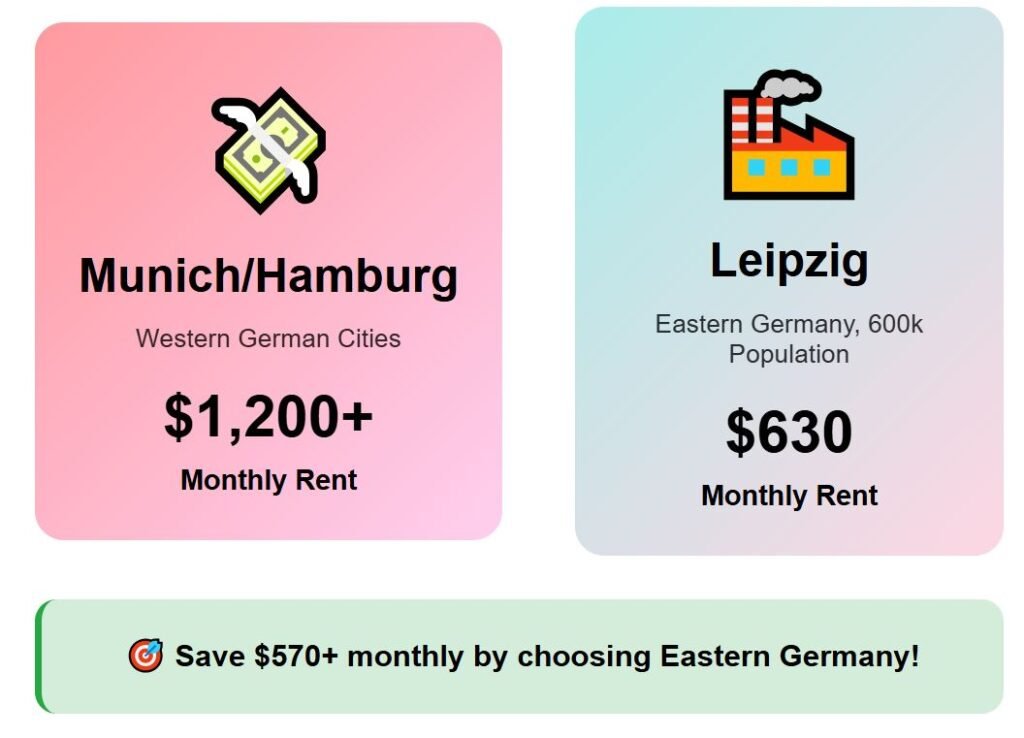

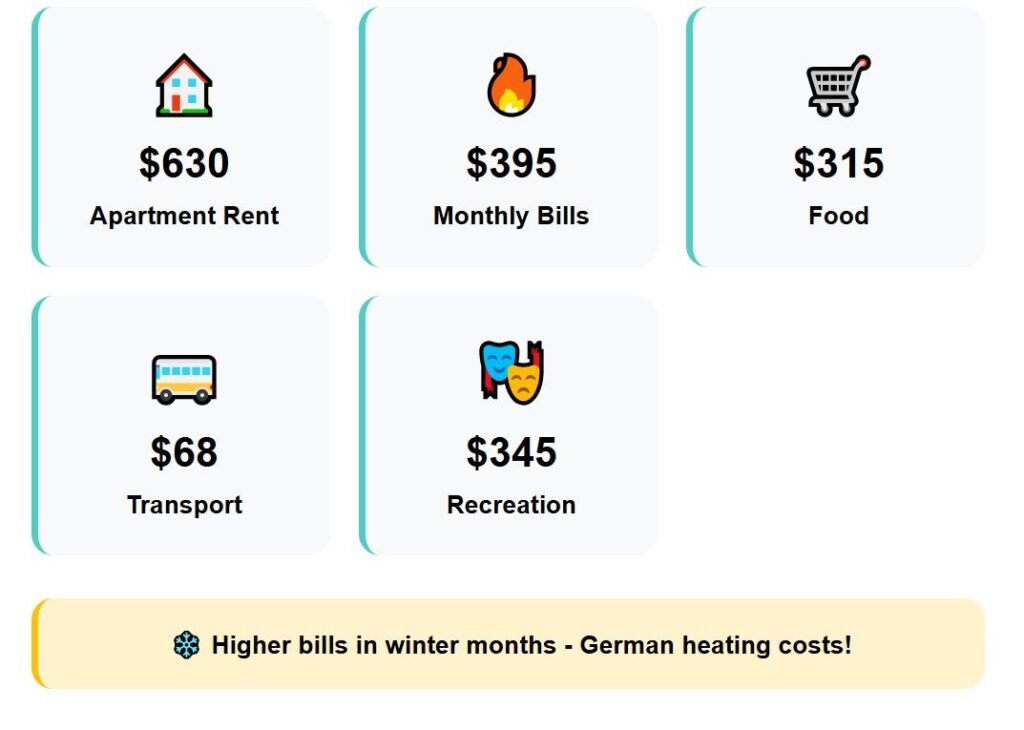

In Germany, the focus is Leipzig, positioned in the eastern part of the country with a population of about 600,000. While Munich or Hamburg are known for high living costs, Leipzig offers a more affordable balance—rent alone shows this difference, at about $630 in Leipzig.

Monthly utility bills, however, are significant at $395 and become even heavier in the colder months. Food costs come in at $315, transportation runs about $68, and recreation averages $345.

Adding all categories brings total monthly expenses to around $1,753. The remainder from our budget is $254 each month, or 13% of the income.

This creates a comfortable margin and shows how Leipzig can make retirement on a US Social Security pension plausible even in a rich country like Germany.

14 – Croatia

For Croatia, the spotlight is on Split. Located on the Adriatic coast, Split is the country’s second-largest city with a population of about 160,000.

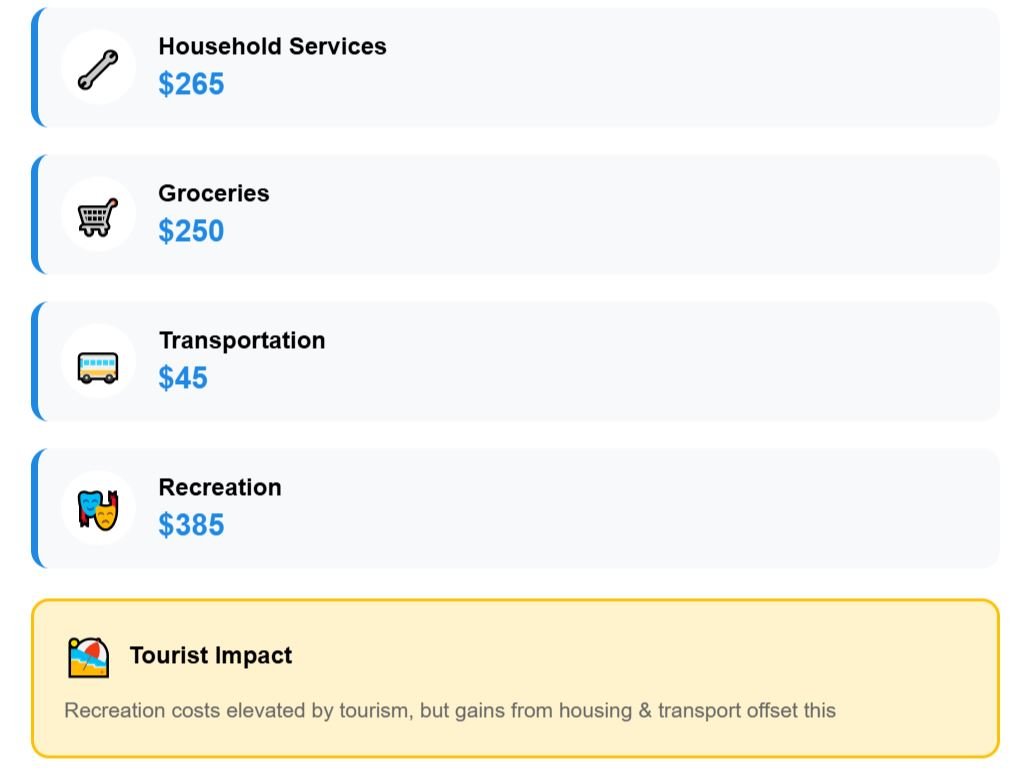

Compared to the capital Zagreb, where rent for a one-bedroom averages close to $900, housing in Split is more affordable at around $755. Looking at the pension budget, expenses in Split include utilities at $265, groceries at $250, transportation at $45, and recreation at $385.

Total monthly expenses are on average $1,700 for a single person. With a pension of $2,007, that leaves retirees with a surplus of $307—about 15% of their income.

Recreation costs are relatively high compared to everyday expenses—tourists push the price of restaurants higher—yet they do not erase the gains from lower housing, transportation, and bills.

13 – Cyprus

In Cyprus, Larnaca takes the focus. Found on the southeastern coast of the island, it has close to 145,000 residents.

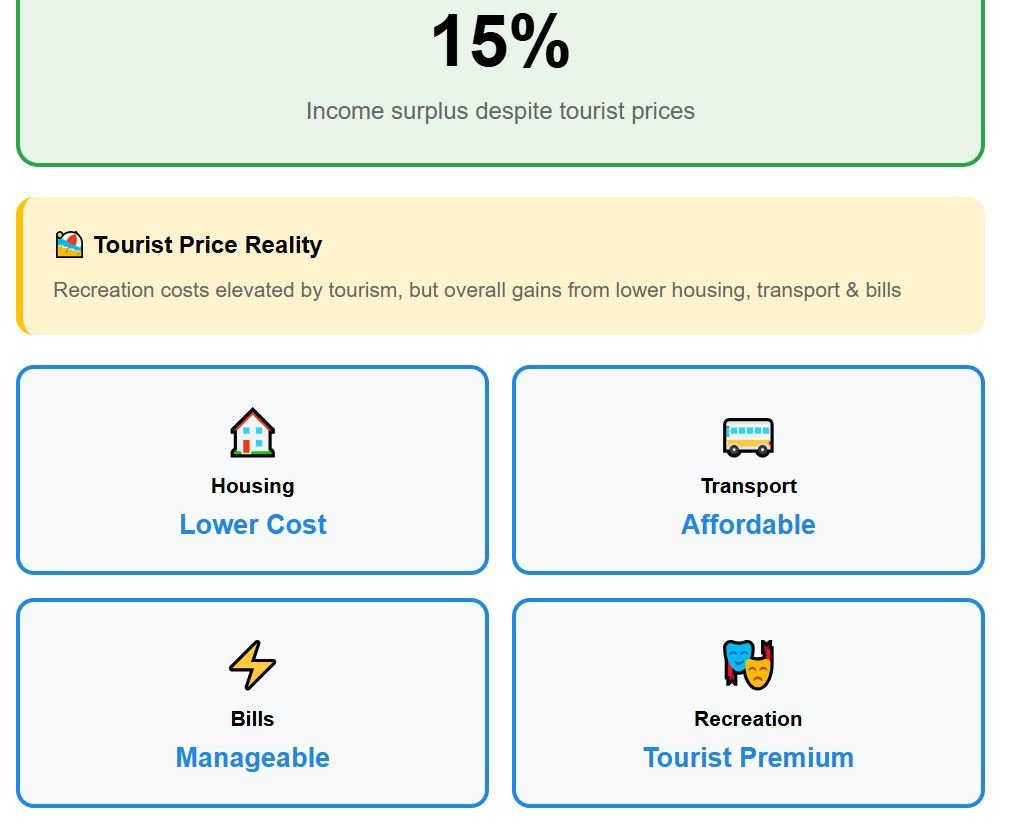

A one-bedroom apartment in Larnaca costs about $795 per month—a relatively low price when compared to other Mediterranean counterparts like Malta. Utilities reach $230, groceries average $285, local transit costs stay modest at $60, while entertainment is around $310.

Adding these expenses together with rent brings the total to around $1,680. That keeps $327 from a $2,007 pension—16% of savings.

Cyprus also has many other added benefits, like strong tax incentives, which I covered in another video.

12 – Czech Republic

For the Czech Republic, Brno is our highlight. Located in the southeast of the country, it has a population of 380,000 residents, making it the second-largest city after Prague.

The advantage here is clear: Brno is much cheaper than the capital. Rent for a flat in Prague usually exceeds $1,000, while in Brno the average is about $780 per month.

Monthly utility bills, however, are quite high, at $345. Groceries are more manageable at $245.

The most impressive here is the very low cost of commuting, adding just $30 per month. Recreation is also affordable—living up to the Czech fame for good and cheap beer—at just $255.

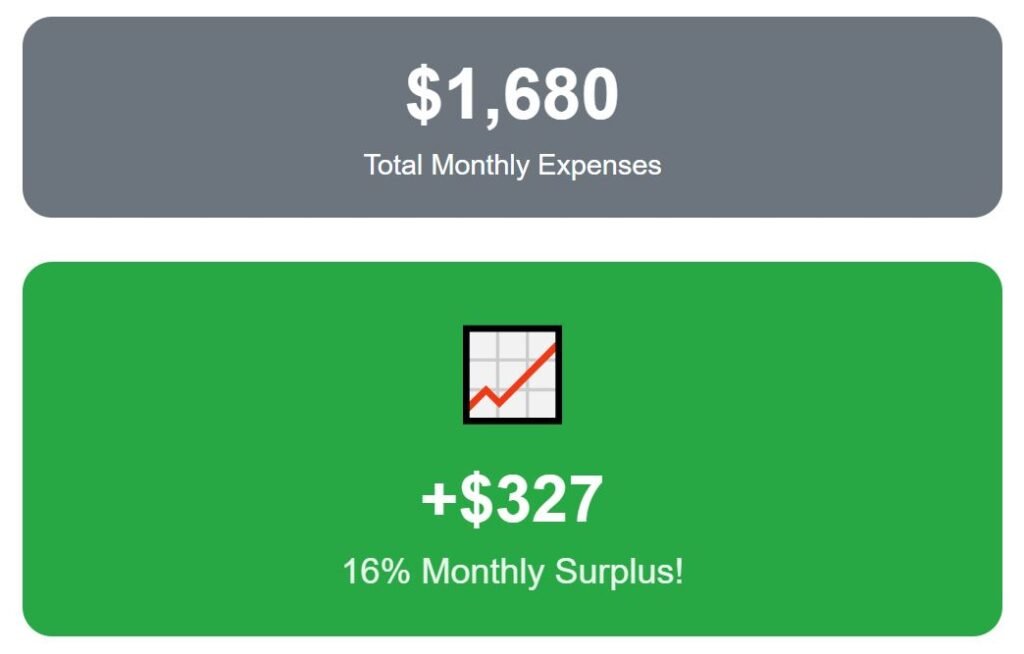

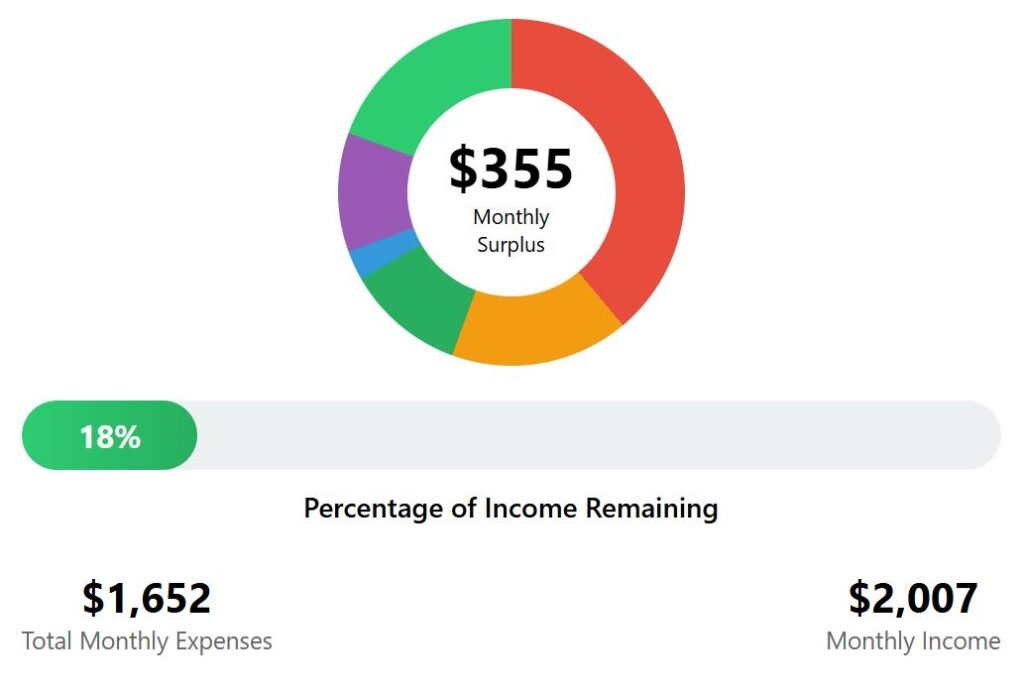

When all costs are combined, total spending is close to $1,652. From our budget, $355 remains, which equals 18% of the total pension.

11 – Poland

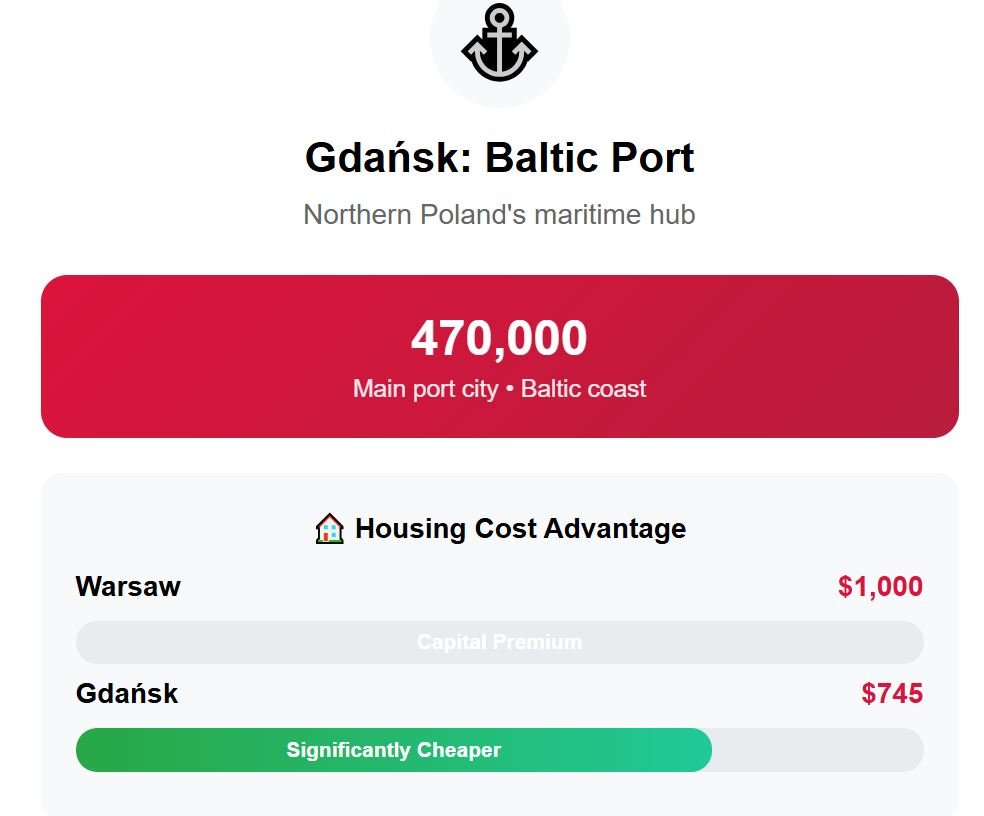

In Poland, the example city is Gdańsk. Found on the Baltic coast in the north of the country, it has a population of about 470,000 and serves as one of Poland’s main port cities.

Compared to Warsaw, where a one-bedroom apartment averages close to $1,000, Gdańsk is significantly cheaper at about $745. That difference in rent, combined with reasonable food prices, creates a noticeable gap in living costs between this historical city and the overpriced Polish capital.

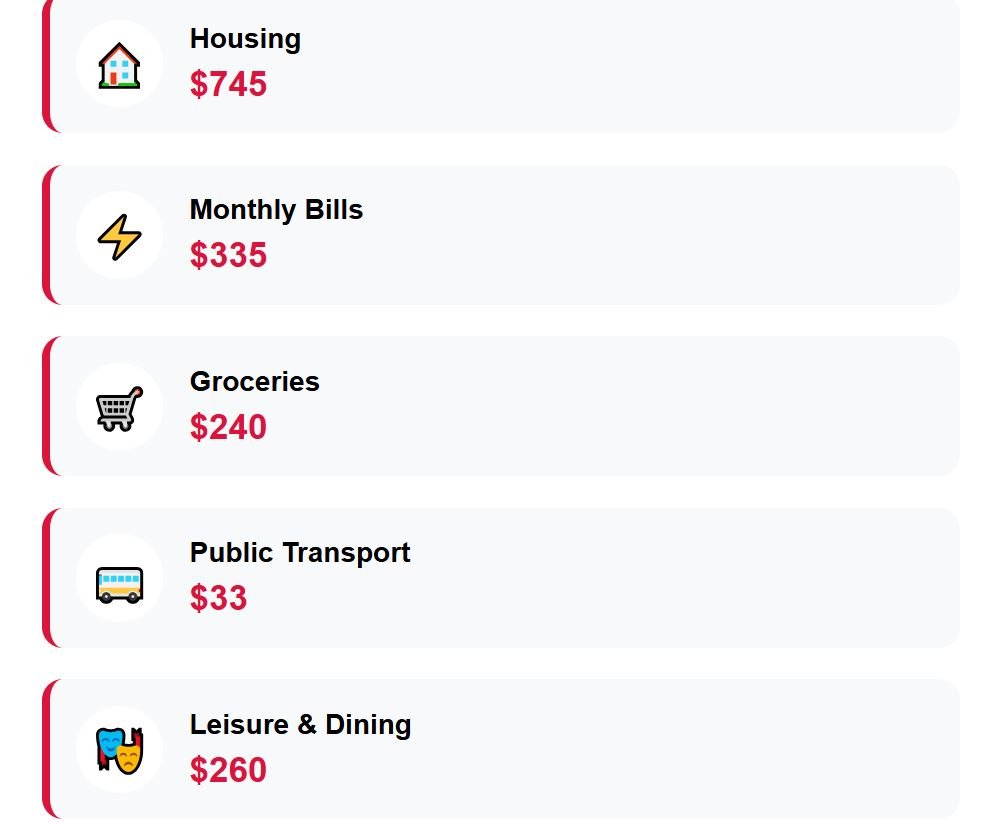

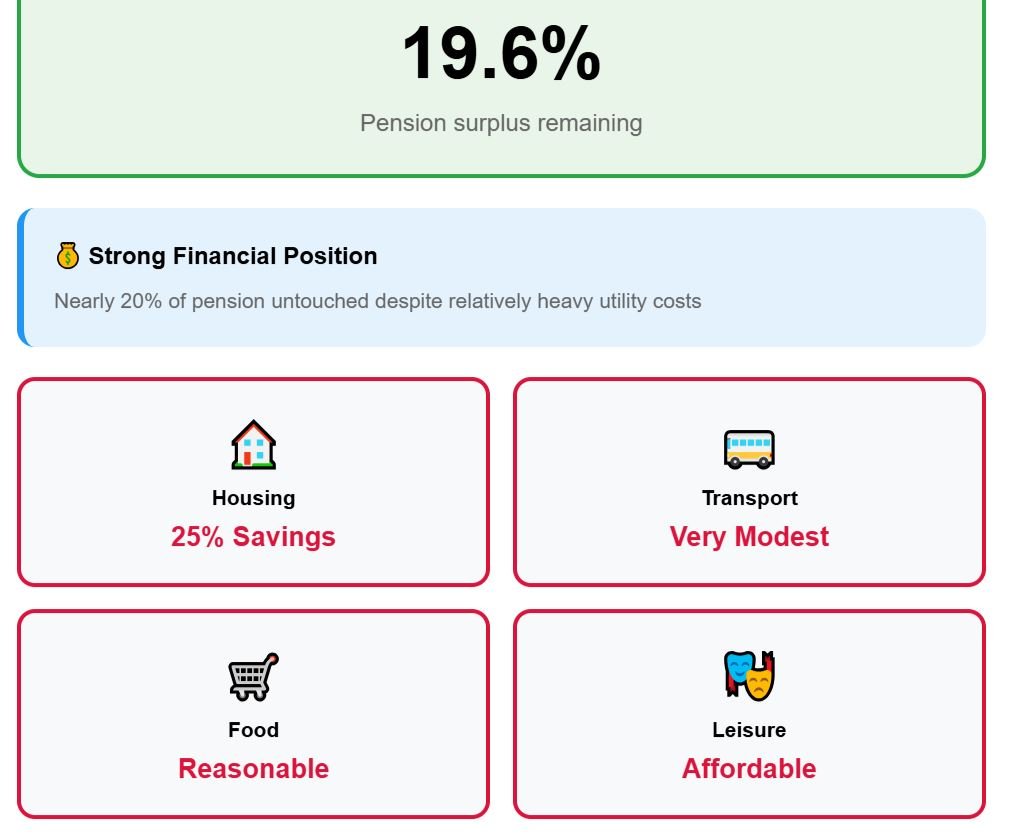

Looking at detailed expenses, monthly utility bills take up $335 each month, which is relatively heavy. Groceries are about $240, while public transport remains modest at only $33.

Leisure, including eating out, is just $260 per month. In a bar, you can get a pint of beer for just 11.5 zlotys—about $3!

The monthly total expenses are $1,613, leaving us with a $394 surplus. And now we will enter into the top 10 cheapest countries (and mid-sized cities) to live in Europe on a $2,007 pension.

Surprisingly, the next name is a developed country, with incredibly good weather, amazing food, and where people live longer and healthier!

10 – Italy

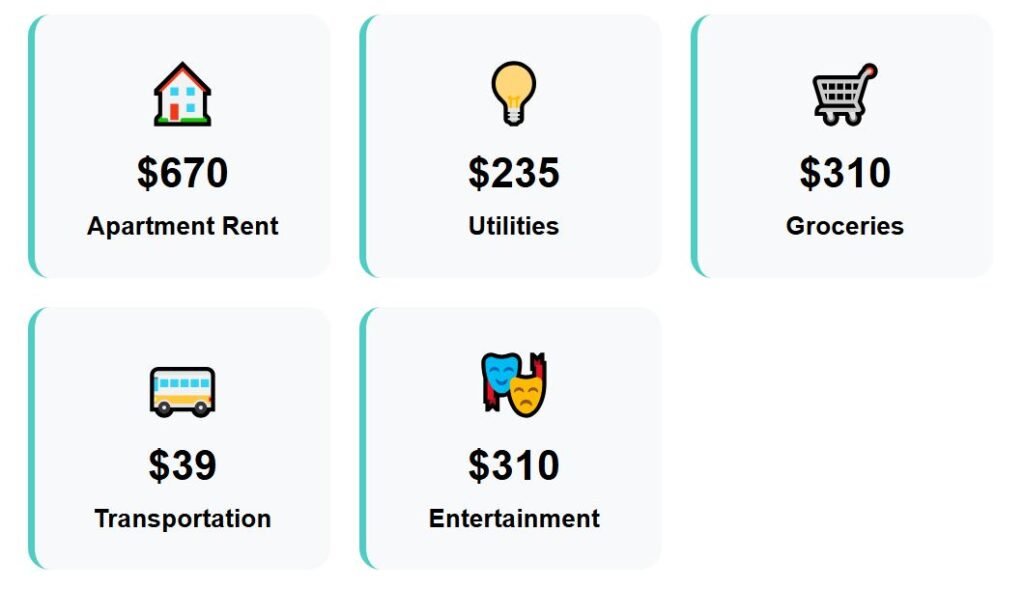

For Italy, the focus is on Bari, a city in the southern region of Apulia along the Adriatic coast, with 315,000 residents. Compared to Rome or Milan, where a one-bedroom apartment regularly exceeds $1,000, Bari is far more affordable—rent there averages just $670.

Traditionally, Southern Italy has much lower prices than the rest of the country. Besides rent, utilities add about $235 per month, groceries come in higher at $310, transportation costs on average just $39, and entertainment around $310.

Adding these totals together, average expenses reach $1,564 each month, leaving $443 untouched from our $2,007 budget. Not only does Bari provide a surplus, but it also offers one of the best climates in Europe—a Mediterranean weather similar to California, but at a fraction of the cost.

It might get hot there, so a milder Italian alternative is Tuscany, which I covered in another video.

09 – Slovakia

In Slovakia, our focus is Košice. Located in the eastern part of the country, this is Slovakia’s second-largest city, with 240,000 residents.

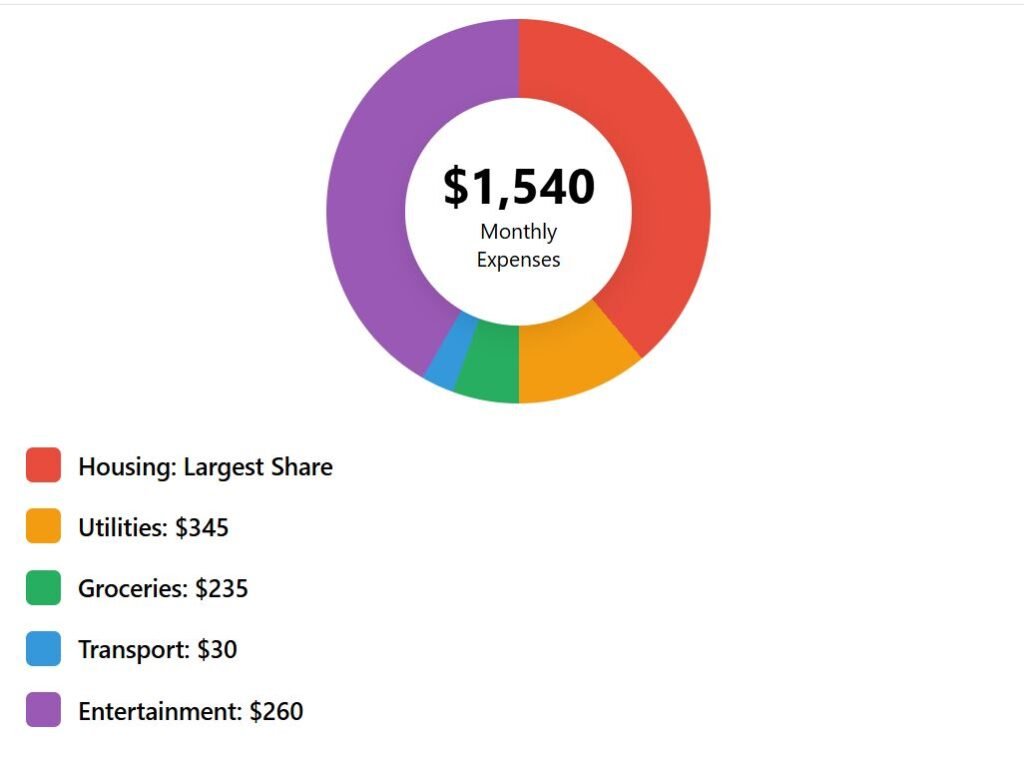

In Košice, rent still accounts for the largest expense—$670—but both groceries and leisure are affordable at $235 and $260 per month respectively. Transport costs $30, one of the lowest so far.

Monthly utility bills are more demanding, with an average cost of $345, reflecting both the colder Central European climate and energy prices. Total expenses are $1,540 per month, so $467 remains from the $2,007 pension—23% of the total.

Month after month, Košice provides breathing room and a sense of security.

08 – Portugal

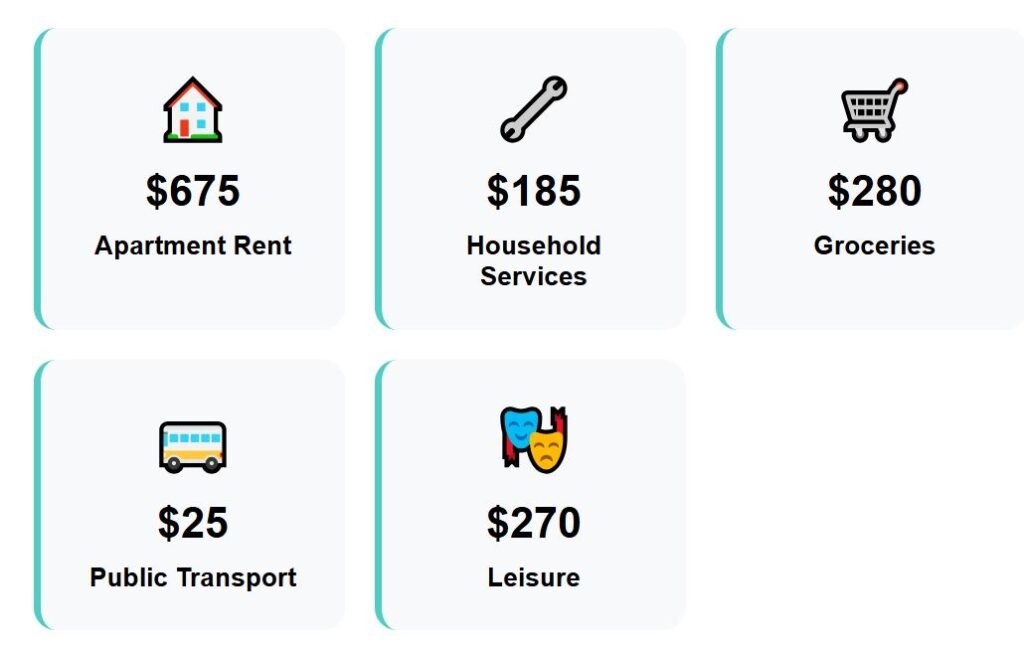

Here, the spotlight is on Braga, a city in the northern part of the country, with a population of about 190,000, and a cheaper alternative to Lisbon. While rent in Lisbon for one bedroom averages over $1,200, in Braga a comparable apartment is about $675.

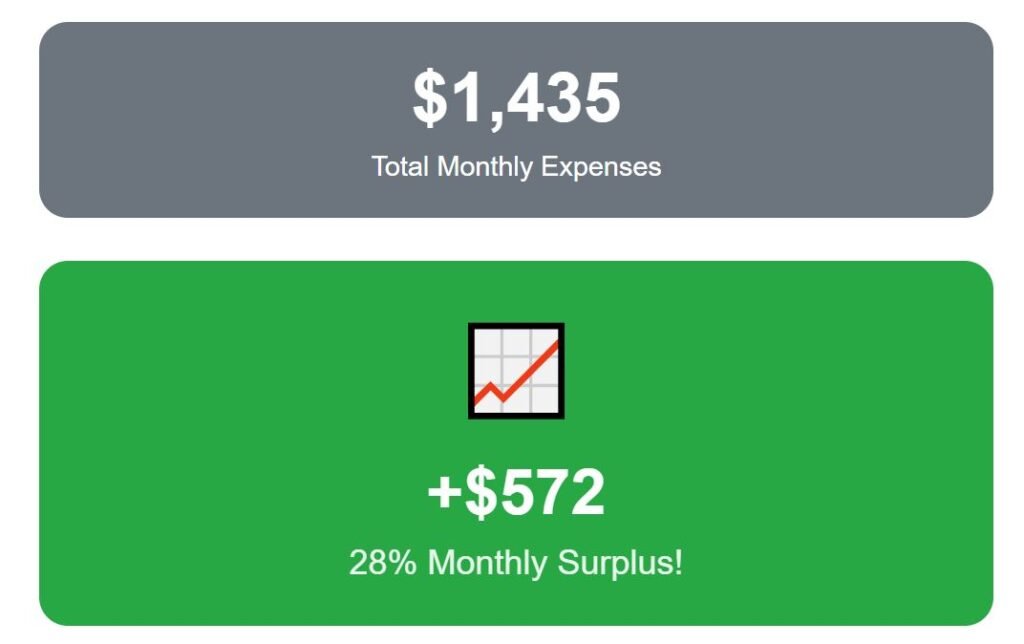

Looking at costs, household utilities average $185 per month, while groceries are about $280. Public transport is inexpensive at $25, and leisure adds $270 every month.

Overall expenses stay manageable at $1,435. For someone receiving $2,007, the remainder is $572.

The balance is not only positive but sizable, providing space for unexpected costs or extra travel.

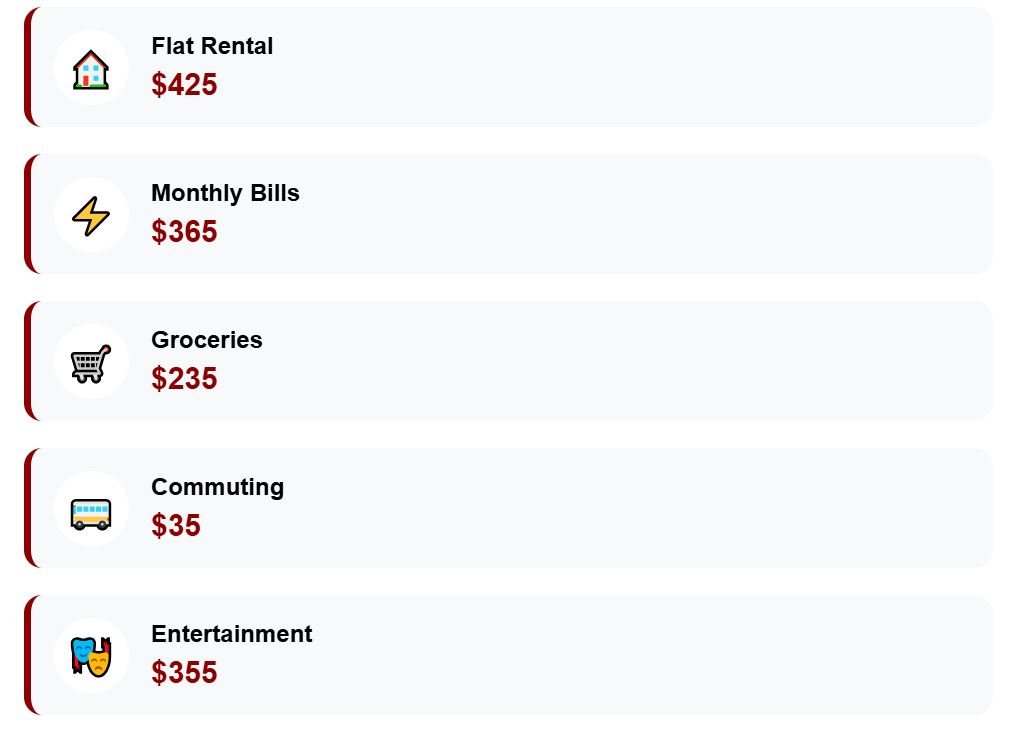

07 – Latvia

Here we exceptionally choose the capital Riga, since there are no other major cities. Riga has nearly 600,000 residents, so more than a quarter of Latvia’s total population.

Rent in Riga averages $425 for a flat, among the three lowest values in this ranking. Monthly utility bills, however, run high at $365, groceries about $235, commuting $35, and entertainment about $355.

Altogether, typical spending reaches $1,415. That leaves our budget with $592, equal to 30% of income remaining after covering recurring costs.

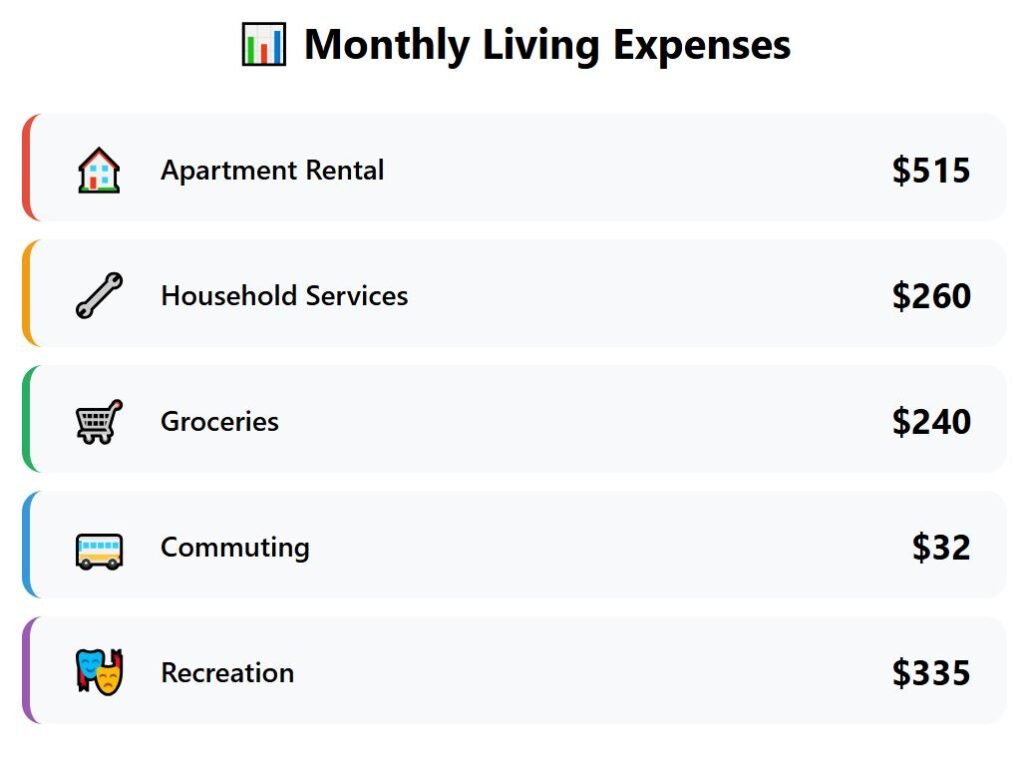

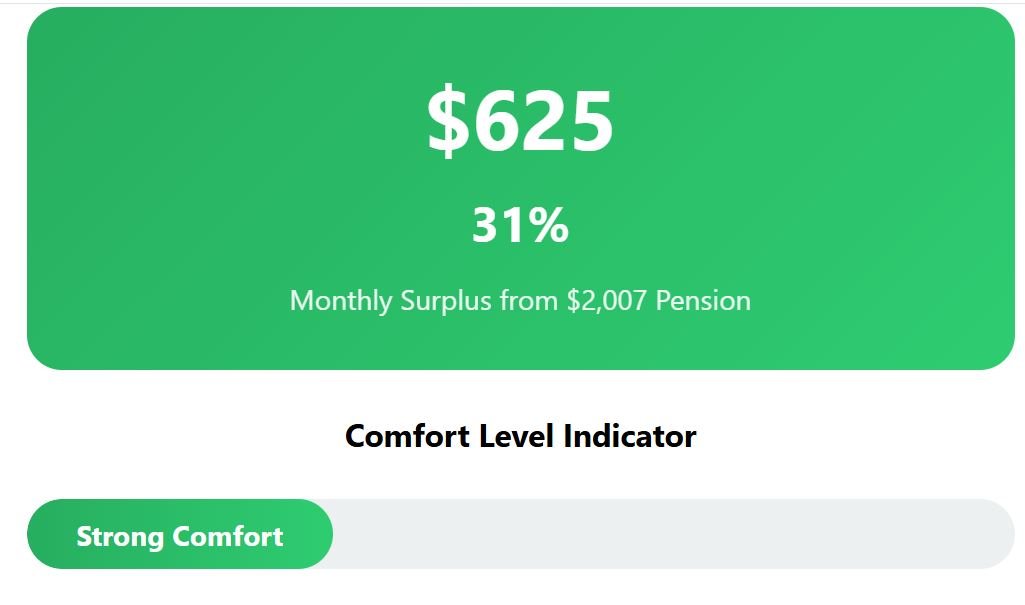

06 – Lithuania

Here, Kaunas takes the focus. Found in the central part of the country, it is the second-largest city, with a population of around 300,000.

Kaunas is cheaper than the capital Vilnius, especially for housing—a one-bedroom apartment there costs, on average, $515 per month. Household utility bills come in at $260 per month.

Groceries average about $240, commuting adds $32, and the entertainment package totals $335. While the leisure bill is higher than someone could expect for Eastern Europe, the overall balance remains favorable.

Total monthly spending in Kaunas is $1,382, and the surplus is $625—equal to 31% of the budget and providing good financial comfort.

Now time for the top five—the five countries in the EU where the biggest share of your pension would remain in your pocket. In these countries, favorable tax policies and lower living costs contribute significantly to the overall retention of your pension. However, when considering investments or relocations, it’s essential to avoid the least advisable European property markets, which can diminish your financial security. Careful research into local economies and property trends will ensure that your pension works optimally for you abroad.

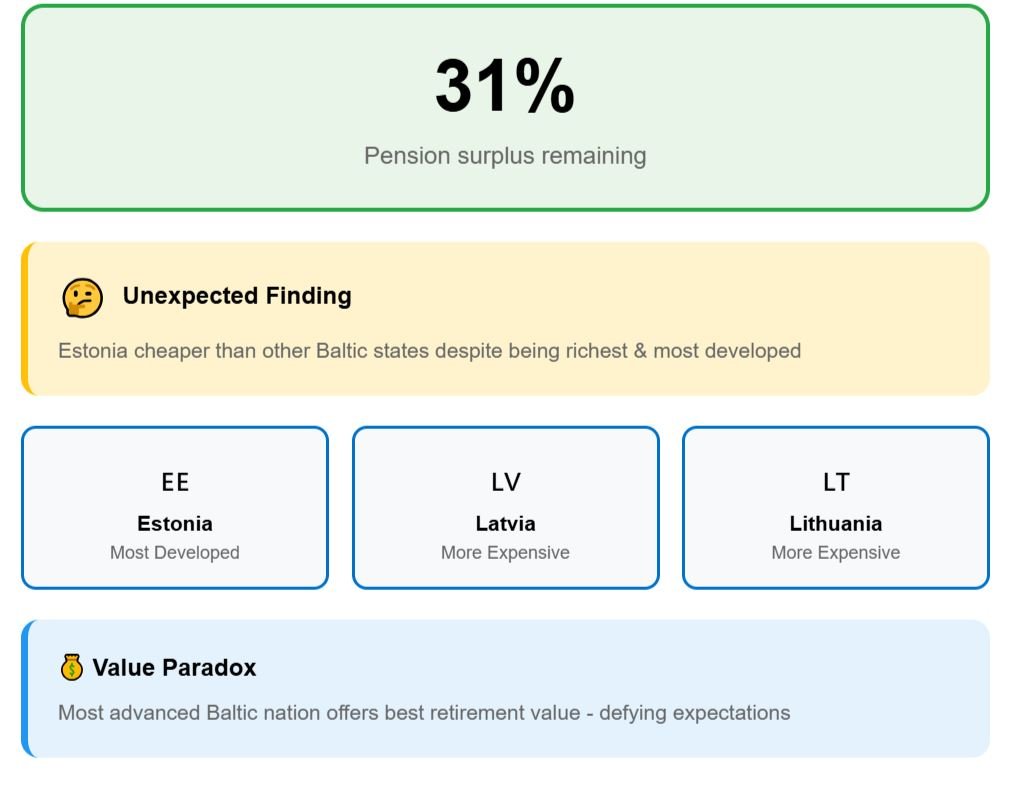

05 – Estonia

There, we chose Tartu. Located in the southeastern part of the country, it has about 95,000 residents and functions as Estonia’s main university hub.

Compared to the capital, Tartu is cheaper in almost every category, and lower housing stands out the most. In Tallinn, rent for a one-bedroom can exceed $800, but in Tartu the average is just $445.

Looking at expenses, utilities are the heavier side of the budget at $315 per month. Groceries come in at $245, transportation is low at $30, and leisure activities average $345.

Adding rent, the monthly total rises to $1,380, so $627 remains in our hand from our budget after paying for everything. It is quite surprising for me to realize that Estonia is cheaper than the other two Baltic states—Lithuania and Latvia—since it is the richest and most developed of the three.

The next country is one of my favorites in Europe, and also among the favorites of the readers, which often asks me to cover it more often.

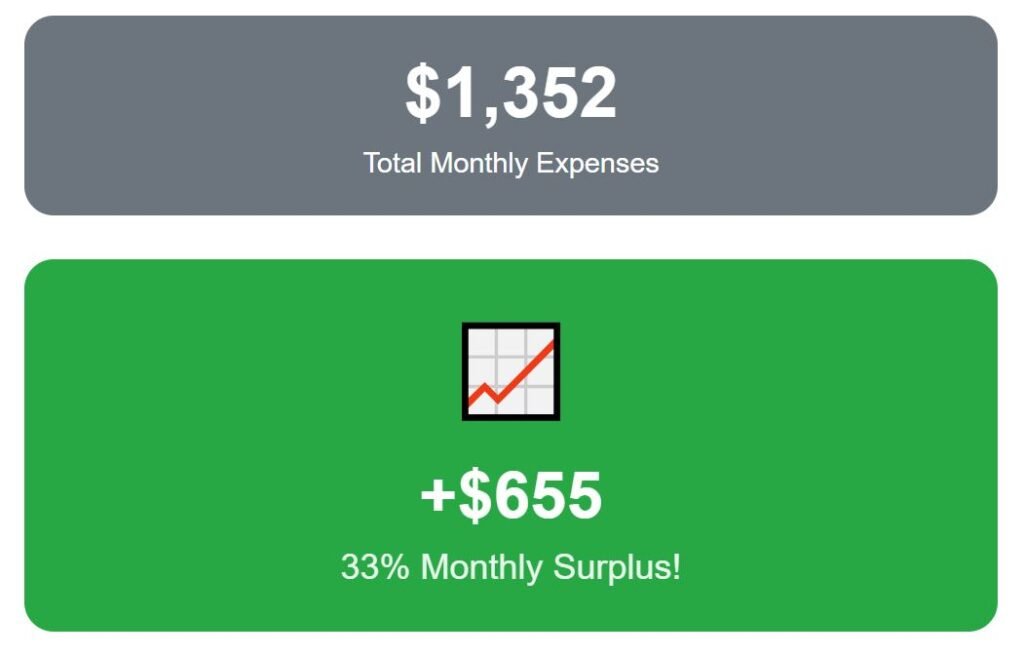

04 – Greece

Thessaloniki is our pick in Greece. Found in the north of the country along the Thermaic Gulf, it is Greece’s second-largest city with about 320,000 residents in the urban center and more than one million in the metropolitan area.

Compared to Athens, costs in Thessaloniki are lower, especially in terms of housing. A flat in Thessaloniki averages $470 per month, while in the capital the same rental easily reaches double that amount.

Monthly bills count for $255, which stays manageable even during winter. Food costs amount to $275 per month, transportation costs $32, and leisure activities cost $320.

Adding all categories, the total is close to $1,352. That leaves a pensioner drawing $2,007 each month with $655 left over—a savings rate of about 33%.

The appeal goes beyond numbers. Thessaloniki provides a Mediterranean climate with mild winters, abundant sunshine, and a food culture tied to longevity.

Greeks in this region are known to live longer, healthier lives—a lifestyle well balanced between affordability and well-being.

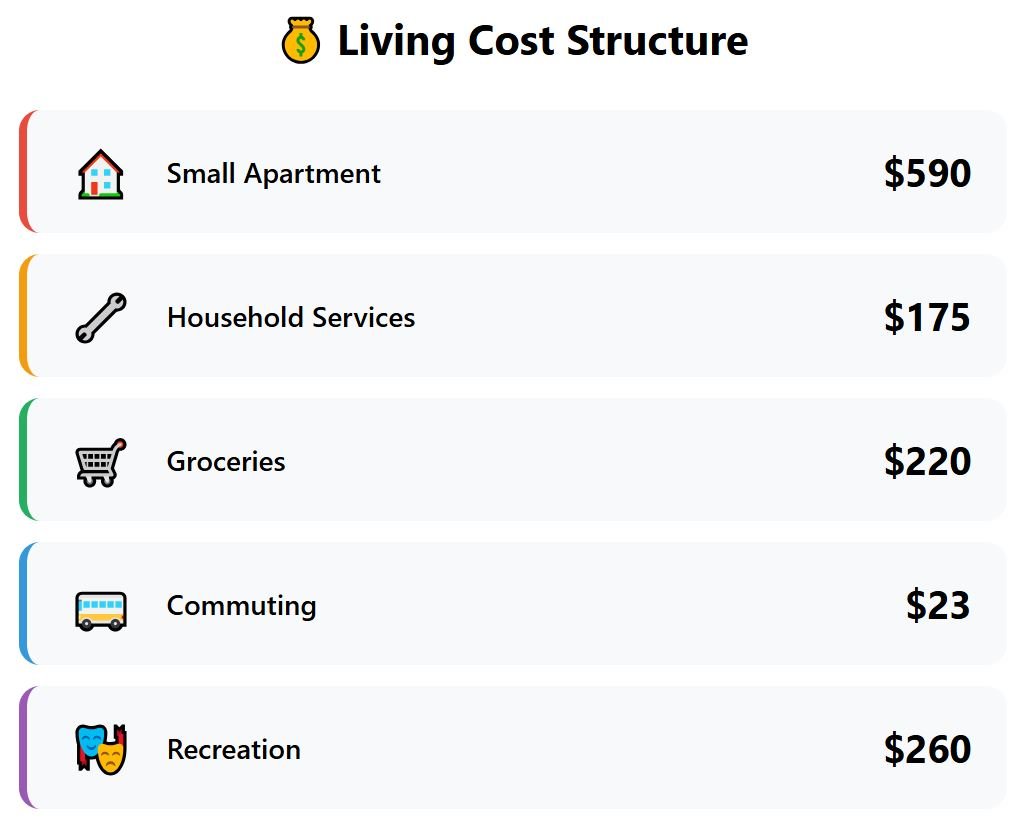

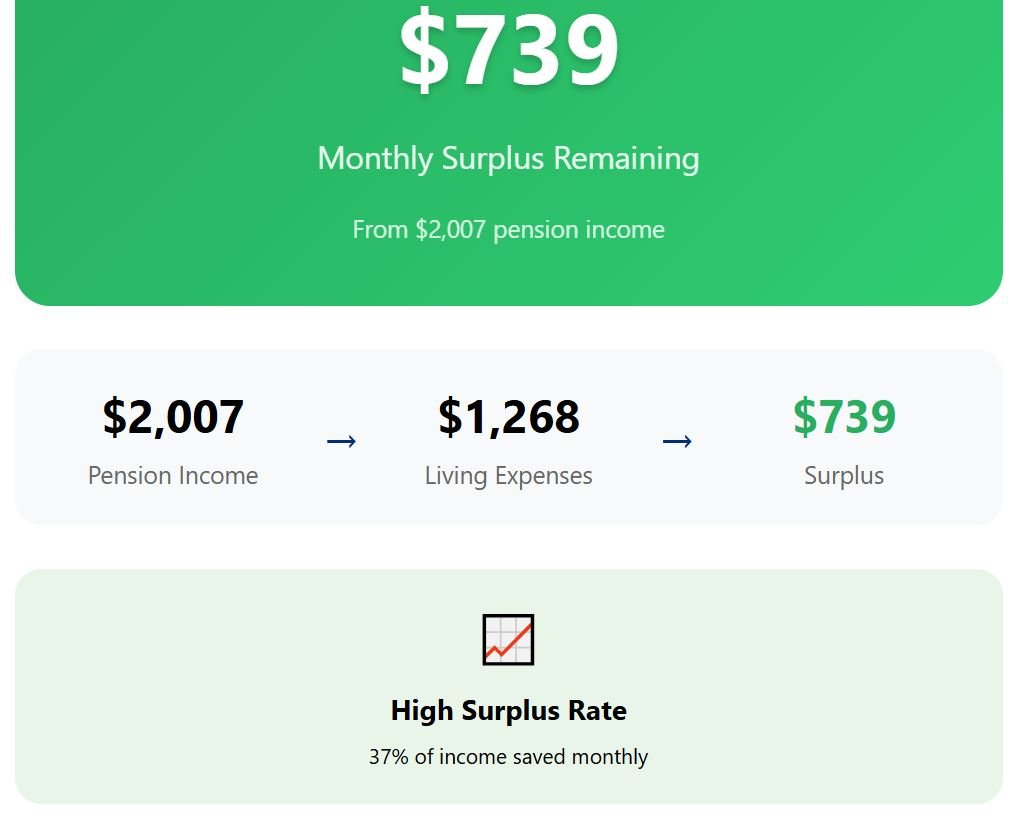

03 – Romania

Our choice here is Cluj-Napoca. Located in the northwest of the country, it has 320,000 residents and ranks as Romania’s second-largest city after the capital, Bucharest.

Romania’s average income is $18,400, one of the lowest within the EU, but that also explains why daily living costs are well below Western European standards. Rents there average $590 for a small apartment.

Looking at other expenses, household services in Cluj-Napoca are about $175 per month, groceries average $220, while commuting remains very affordable at $23. Recreation and entertainment add another $260.

Putting all of these together, the monthly total spending reaches approximately $1,268. With a pension of $2,007, that leaves our budget with $739 remaining.

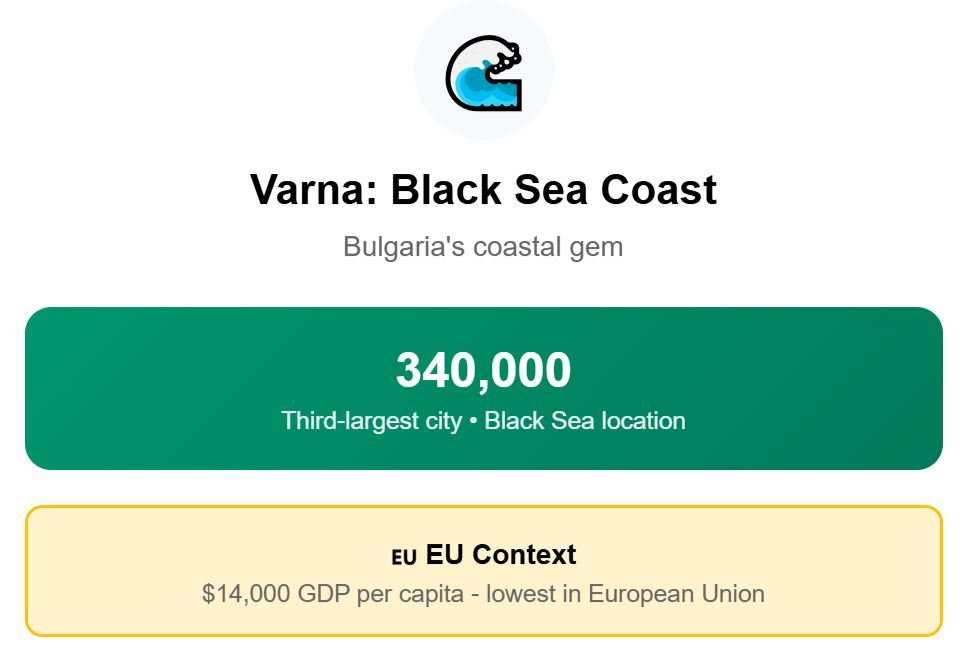

02 – Bulgaria

For Bulgaria, the chosen city is Varna. Positioned on the Black Sea coast, it has around 340,000 residents, making it the country’s third-largest city after Sofia and Plovdiv.

Bulgaria’s GDP per capita is just above $16,000, which is the lowest in the European Union. Compared to the capital Sofia, Varna is noticeably more affordable—housing prices alone are far lower while still offering solid infrastructure and a coastal environment.

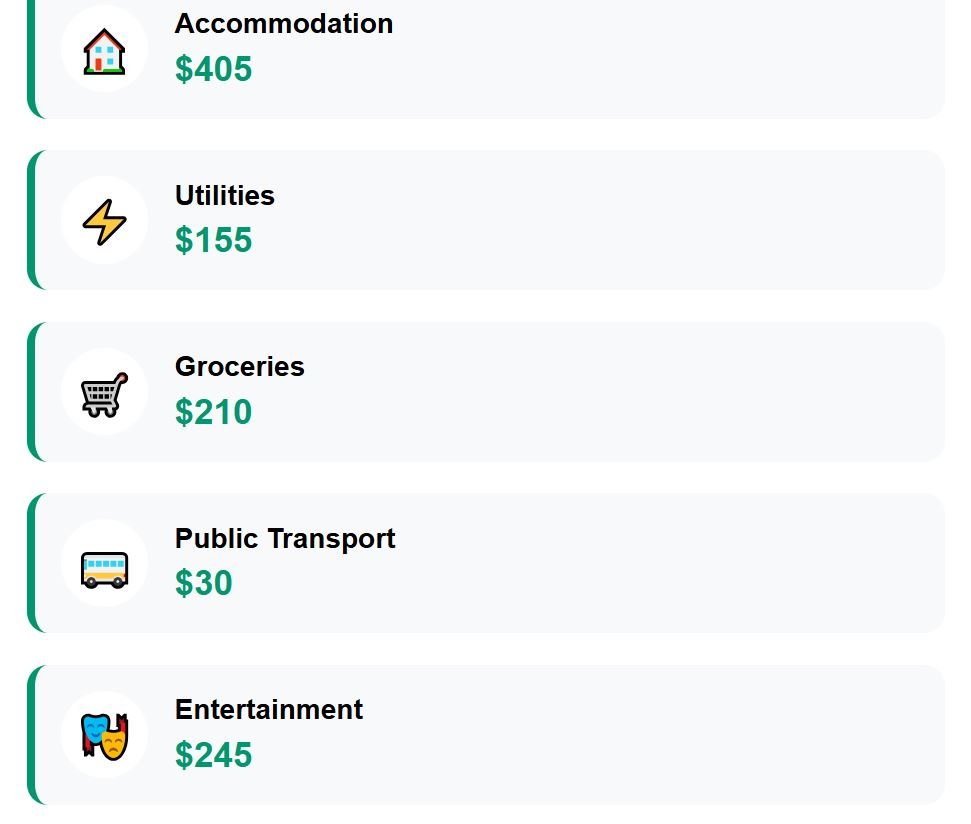

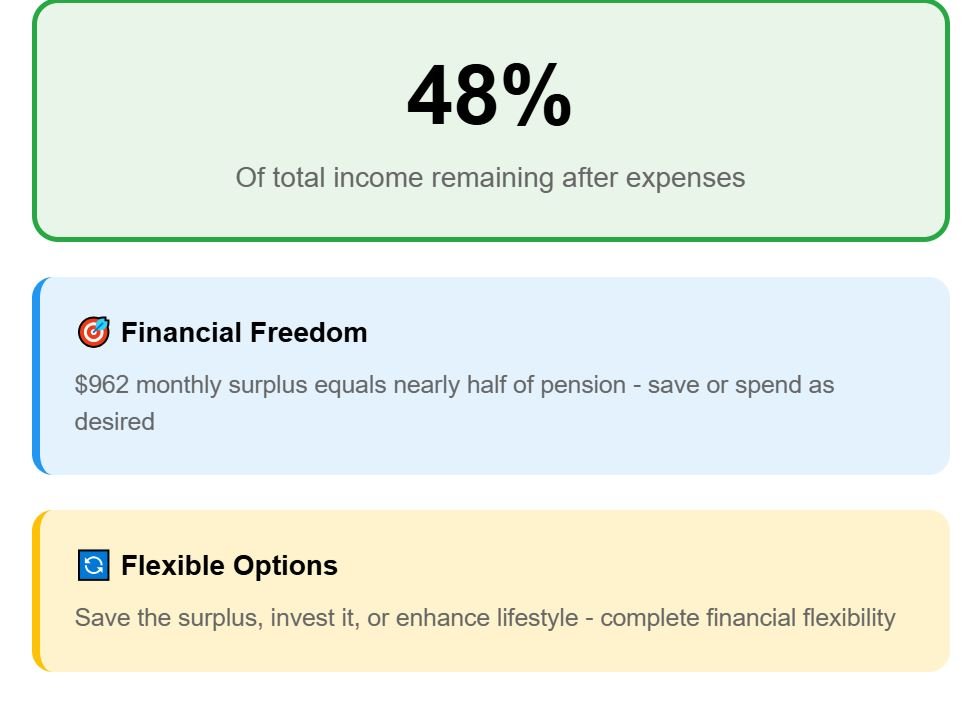

Expats living on a $2,007 pension find immediate relief in accommodation costs. Rent for a one-bedroom apartment averages $405 per month, one of the lowest values across the European Union.

The rest of the expenses are also among the lowest we saw so far. All costs together bring monthly spending to $1,045—so pensioners have $962 left each month after all basic expenses.

A 48% surplus of their total income to save, or do whatever they want with it. With a combination of low rent and restrained monthly costs, Varna confirms that affordable coastal retirement in the European Union is not only possible but practical.

01 – Hungary: The Cheapest Country to Live in the European Union

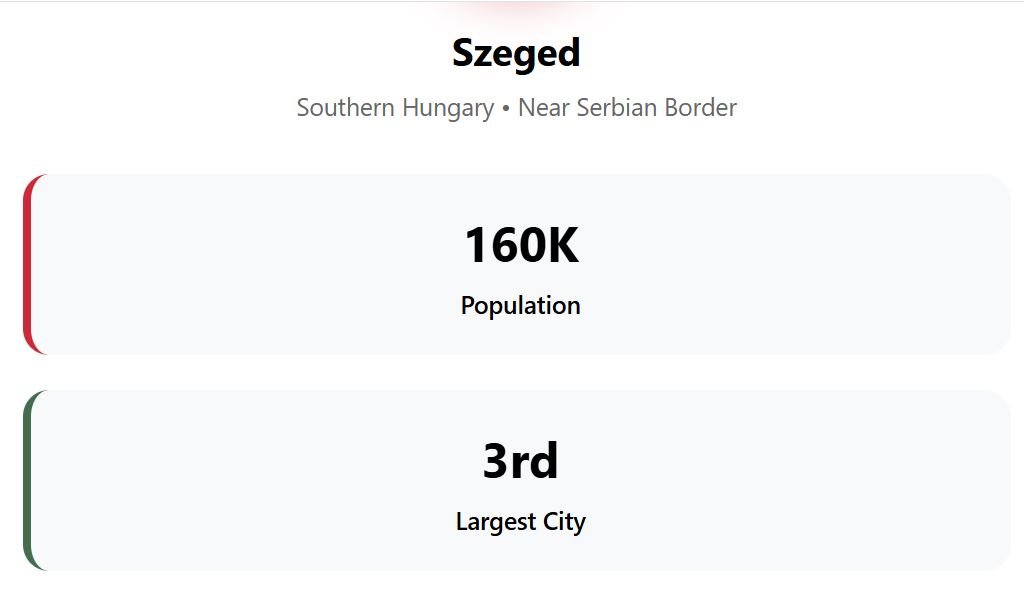

The number one place in the European Union where a US Social Security pension leaves the biggest surplus is Szeged, Hungary. Located in the southern part of the country near the Serbian border, Szeged has about 160,000 residents, making it the third-largest city in Hungary after Budapest and Debrecen.

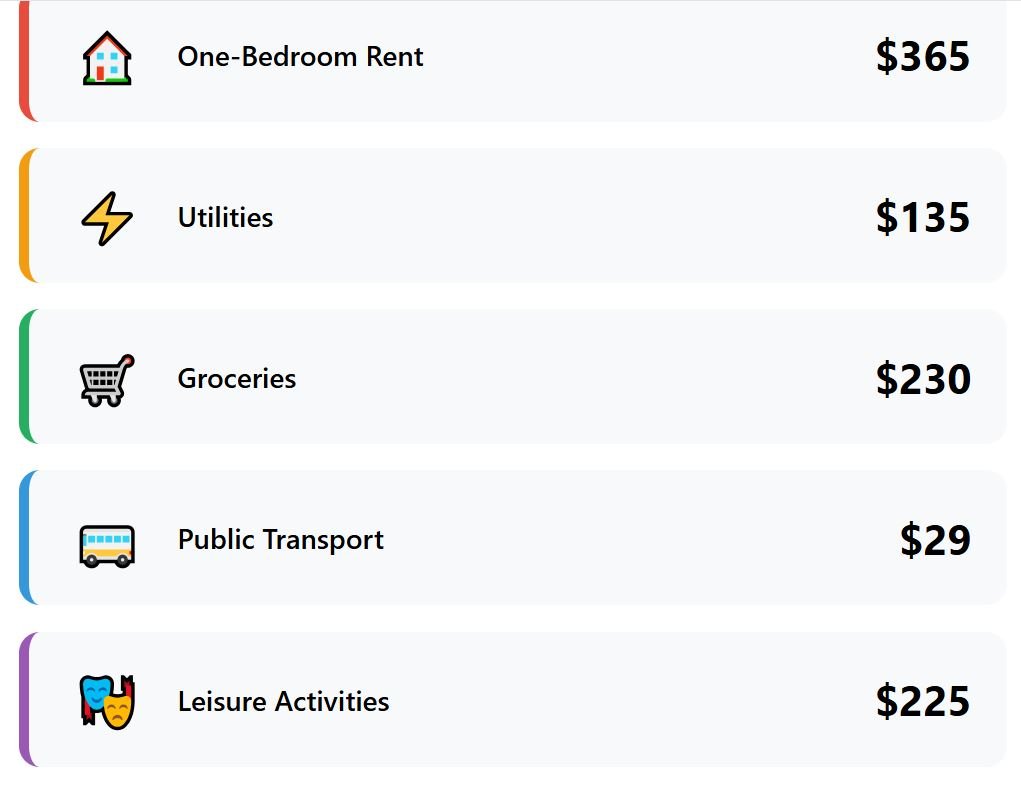

Compared to Budapest, where one-bedroom apartments average around $750, in Szeged it averages just $365 per month. Utilities add another $135, which is among the lowest in the entire region.

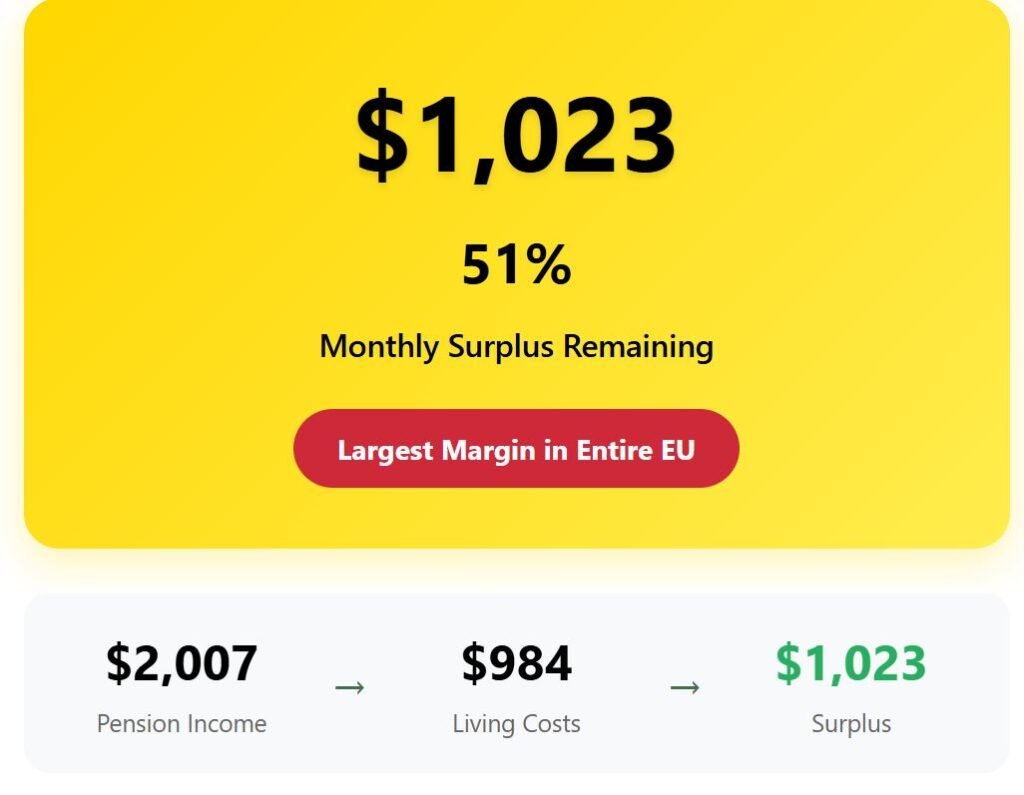

Then come groceries at $230, public transport for only $29, and leisure expenses at around $225. The combined monthly cost is $984.

So from our $2,007, we are left with $1,023 at the end of the month—more than half of the income remains unspent. That margin is the largest in the entire European Union.

Szeged proves that in the right places in Europe, retirement on a US Social Security pension also leaves room for comfort and choice.

But what if, instead of a city with over 300,000 residents like those we mentioned today, you would prefer a smaller city or town where life is slower, prices are even lower, and everything looks simpler? For you, I ranked the best cities and towns to live in Europe.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.