What if I told you that your choice of country to retire in Europe is… a million-dollar decision?

That’s not an exaggeration.

Many people believe you need to be a millionaire to retire in Europe.

Yes, places like Ireland and Denmark demand millionaire budgets. But there are 18 other EU countries where you can retire comfortably on much less than that. Today, we will rank them from most expensive to the absolute cheapest. For those considering where to retire on $2,500 per month, options abound that offer a high quality of life without breaking the bank. Regions in Eastern Europe, for example, provide an attractive blend of culture and affordability.

Along the way, you’ll discover which nations have the highest taxes eating into your retirement income and which offer special tax exemptions.

And there is a good chance that you already have enough to retire in Europe – unless you want to live in the Netherlands.

After almost a decade of living and advising expats in Europe, I can attest: Europe can be surprisingly affordable. The charm of retiring in Europe lies not only in the picturesque landscapes but also in the rich history and culture that each country offers.

So get ready, because the country in our #1 spot isn’t the one you think.

The Criteria To Discover How Much To Retire in Europe

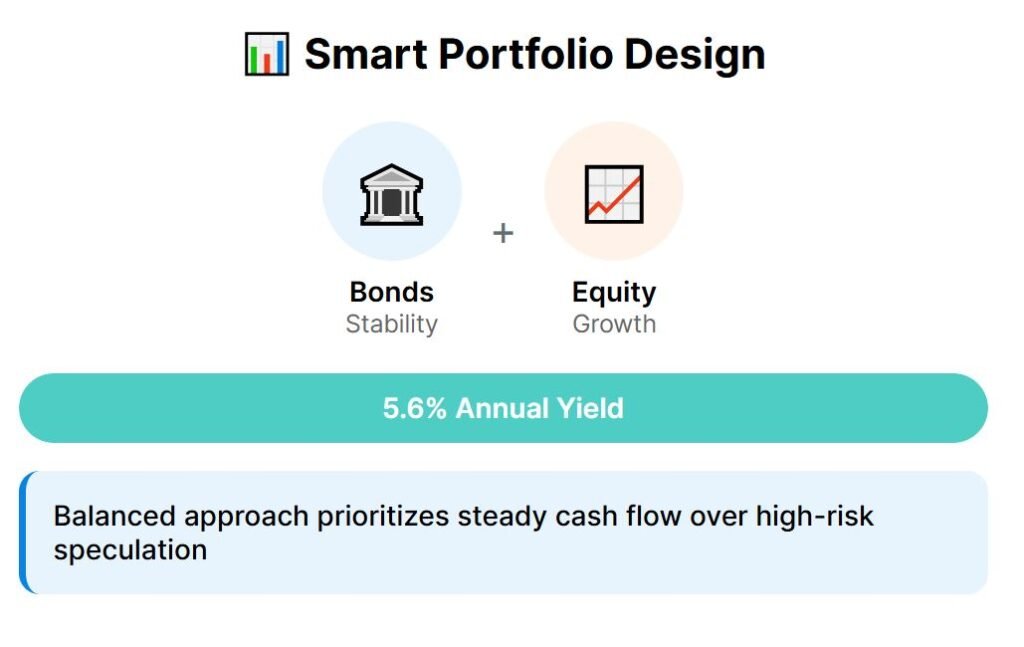

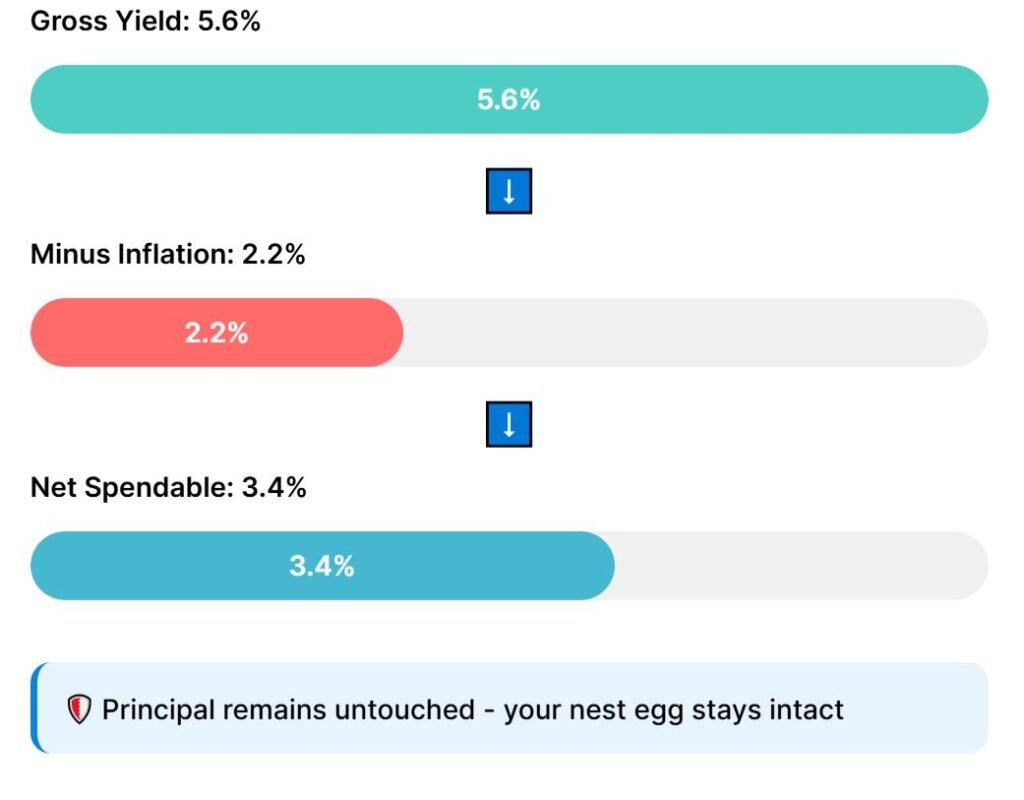

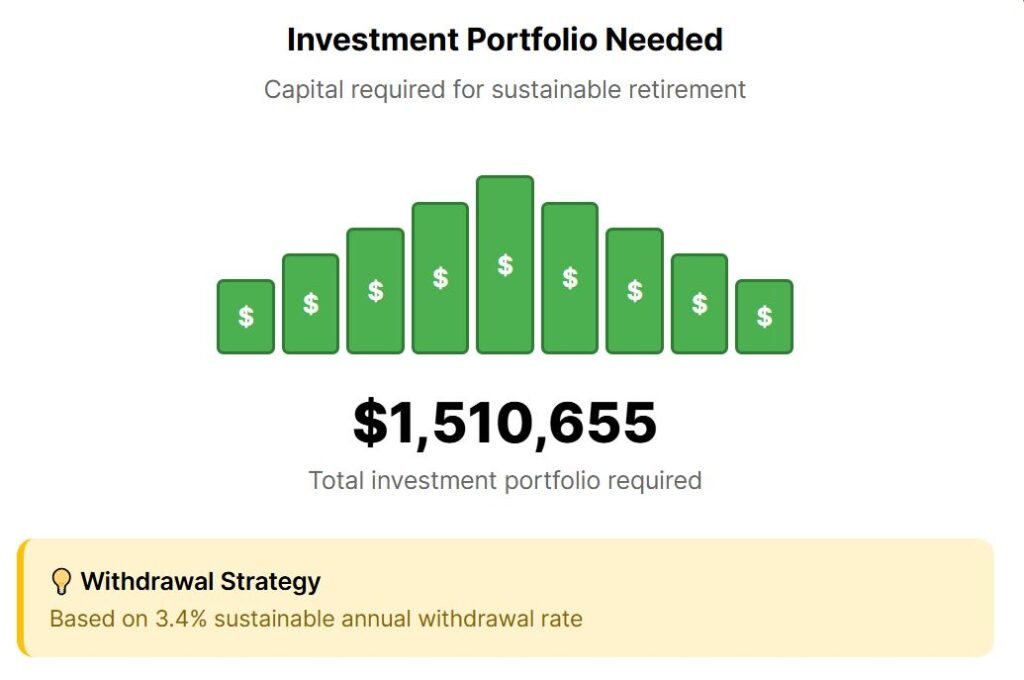

The model assumes you have an investment portfolio designed for income, yielding 5.6% per year. This isn’t a high-risk stock portfolio; it’s a balanced mix of bonds and equity for steady, reliable cash flow. But you can’t spend that full 5.6%.

We have to account for inflation, which we’ve set at a 2.2% average. Subtracting inflation leaves a net yield of 3.4%. By using such a measure, we guarantee your principal will not be consumed.

Then we calculate the cost of a comfortable but not extravagant life in a representative city for each country. It includes rent for a one-bedroom apartment, groceries, and other basic expenses. I took mostly mid-sized cities that are attractive to expats.

For a detailed, line-by-line breakdown of costs—from rent and utilities to the price of a beer—check my article on the cost of living in all 27 EU countries. The final, crucial step is taxes. We apply each country’s specific tax laws—whether progressive or flat—to determine the gross income required to cover all of those expenses.

Once we know how much you need each month to live in a specific country, we multiply that amount by 12 to get your annual expenses, then divide the result by 0.034. This calculation shows the total investment required to retire there and live entirely off the income from your investments. Now, let’s see the results, starting with the most expensive.

27 – The Netherlands

At number 27 is the Netherlands, the most expensive country in the entire European Union for a retiree. We used Utrecht as our reference city, a busy university and business hub with about 360,000 residents. Utrecht reflects the country’s high costs even outside the Dutch capital.

Monthly rent for a one-bedroom apartment reaches $1,500. Add another $1,205 for all the other expenses, and you already have $2,705 before taxes. But then come taxes, and you need to pay an additional $1,575 per month to the government.

That leads to a required gross income of over $4,280 a month, or $51,362 per year. Multiplying that by the 3.4% sustainable withdrawal rate, one would need $1,510,655 invested to sustain this lifestyle indefinitely. The Netherlands stands alone as the only EU country breaking the one-and-a-half-million-dollar threshold for retirement.

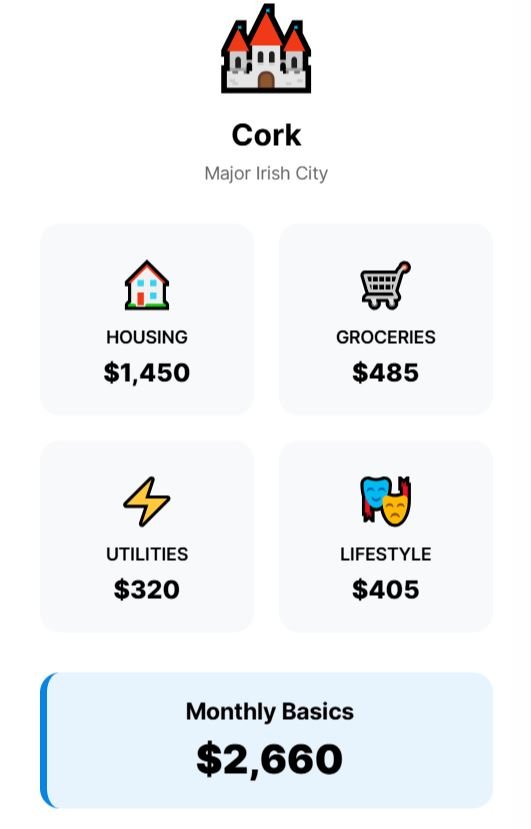

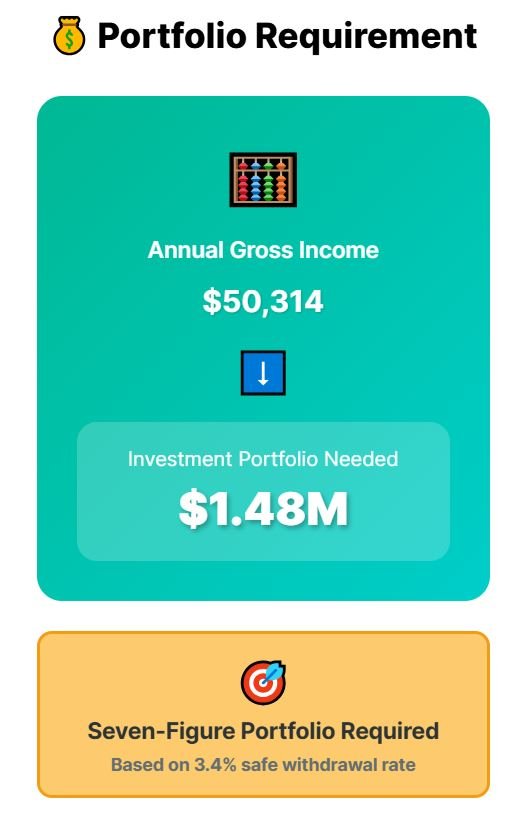

26 – Ireland

At number 26 is Ireland, and while it doesn’t top the scale, it still demands a seven-figure portfolio. The factor driving Ireland’s position isn’t just the general cost of day-to-day living, but the tax load you face once you add everything together. Our focus city is Cork, one of the largest cities in the country.

Rent there runs about $1,450 per month, and adding groceries, utilities, healthcare, and leisure brings another $1,210. In Ireland, the tax bill for our example would the equivalent to $1,532 per month. That amounts to an effective rate of around 33%, among the highest seen.

To cover expenses in Cork, you need $50,314 per year. That translates into $1,479,838 invested so you can generate the income needed to live in Ireland.

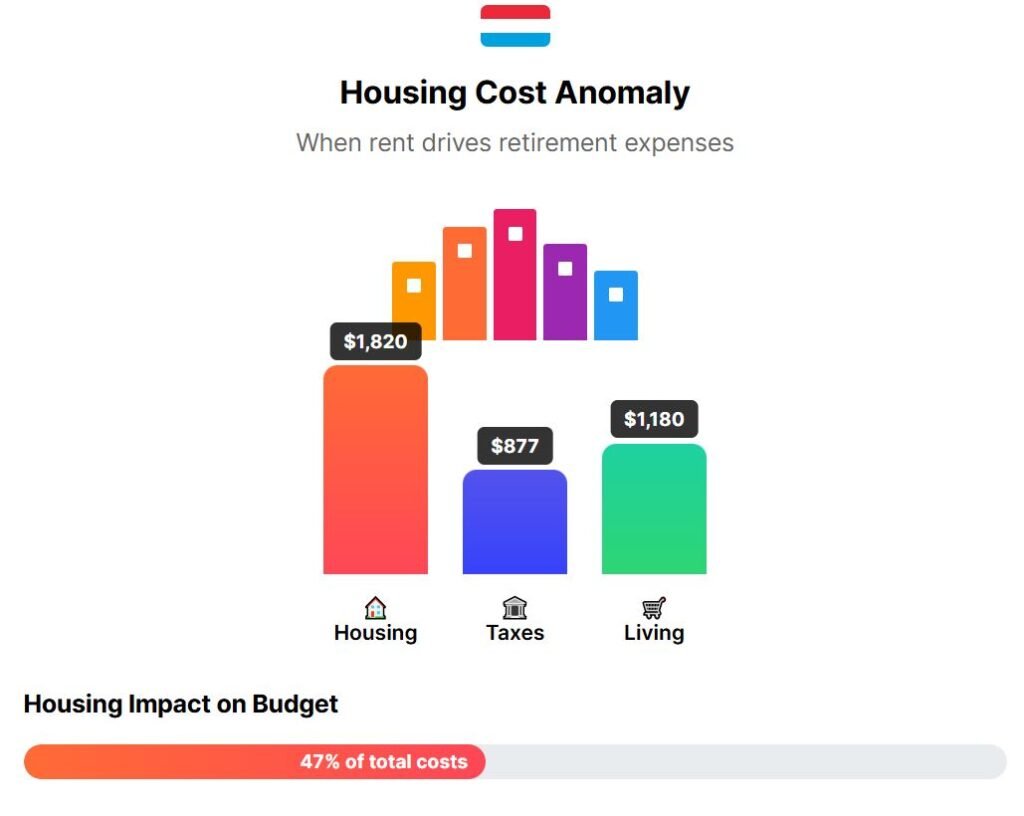

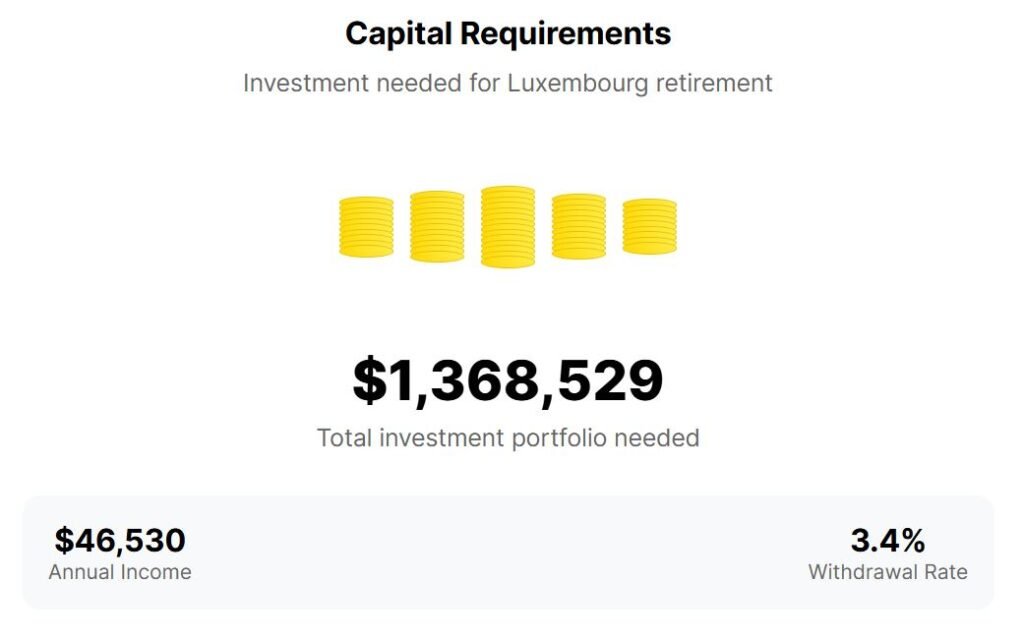

25 – Luxembourg

At number 25 is Luxembourg, a country often linked with high salaries and financial institutions. Its expensive status is mostly due to housing, not heavy taxation or daily costs. In Luxembourg City, rent for a one-bedroom apartment reaches $1,820 per month.

That single line item is the most expensive in the entire European Union, significantly impacting the retirement budget. The monthly tax bill stands at $877, far less than in other wealthy nations yet. Other living expenses, such as food, utilities, and healthcare, add predictable amounts, but the gap between rent and taxes is striking.

When everything is added, retirees need a gross annual income of $46,530. Dividing that by the 3.4% safe withdrawal rate results in $1,368,529 invested—proof that housing alone can define affordability.

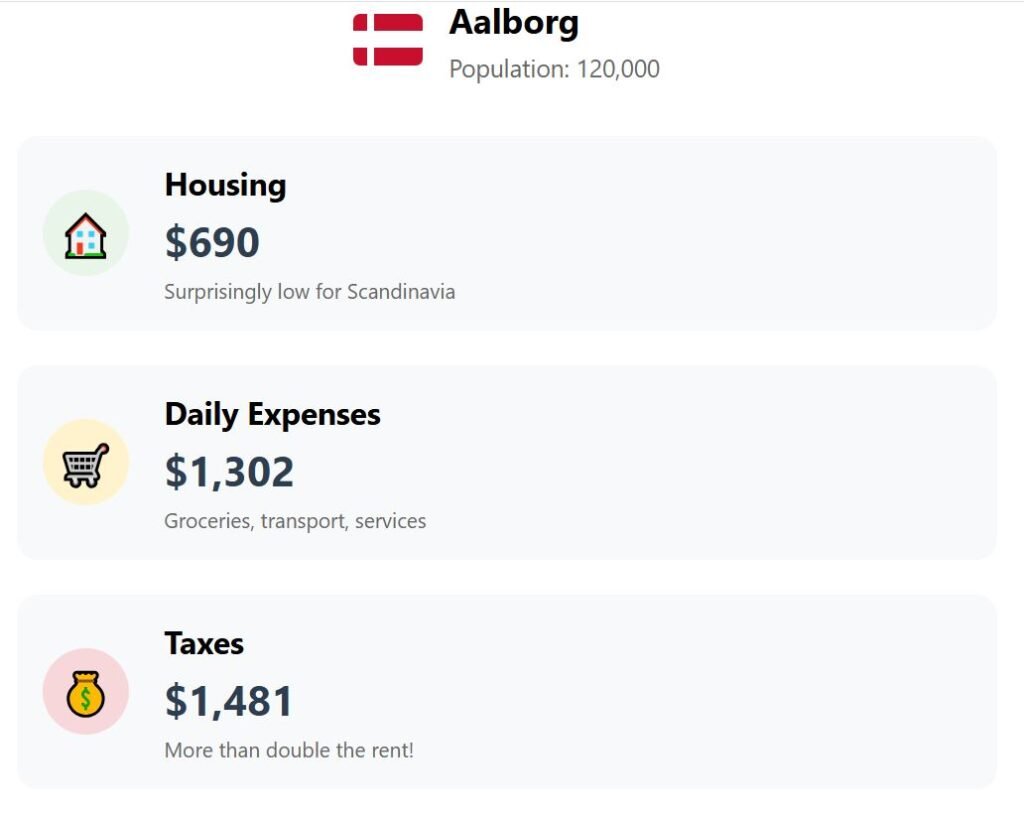

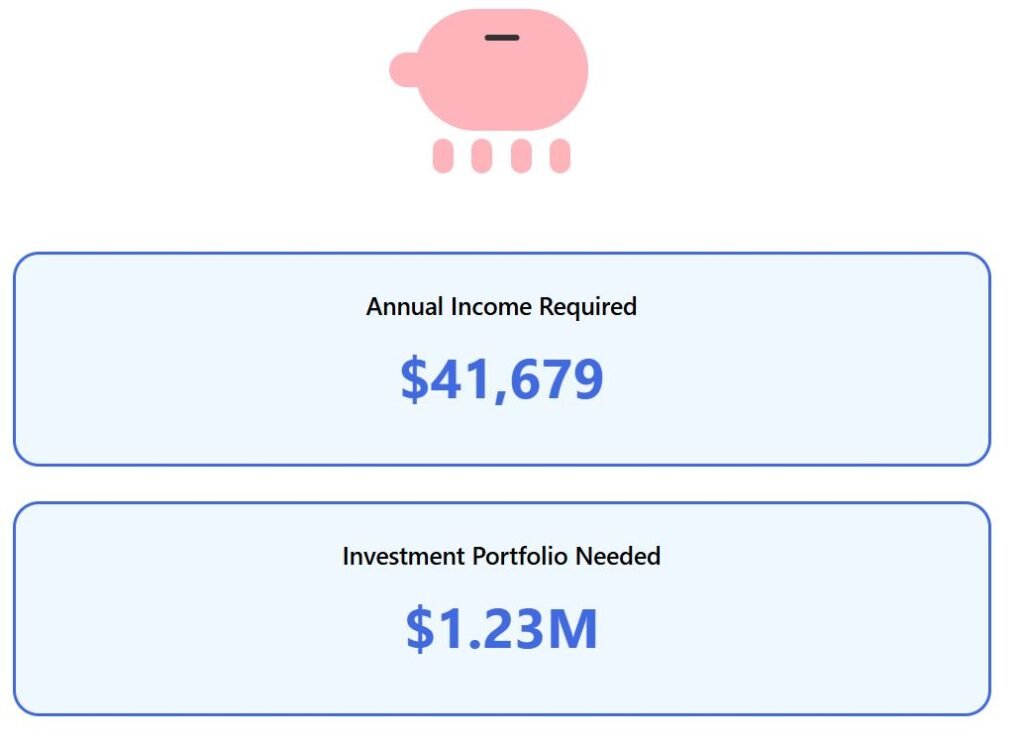

24 – Denmark

At number 24 is Denmark, where affordable rent doesn’t always mean affordable living. To represent it, we looked at Aalborg, a northern city with a population of about 120,000. Rent there is just $690 a month, unusually low for Scandinavia.

But the relief ends quickly. Daily costs reach $1,302 each month, covering groceries, public transport, and basic services that run far higher than the EU average. Then comes taxation.

Denmark’s monthly tax bill adds another $1,481, more than twice the amount spent on rent. This single factor transforms a modest budget into one of Europe’s costliest retirements. To sustain that standard of living, a retiree needs an annual income of $41,679 supported by an investment portfolio of $1,225,850.

In Denmark, high taxes and living costs outweigh any benefit from cheaper housing.

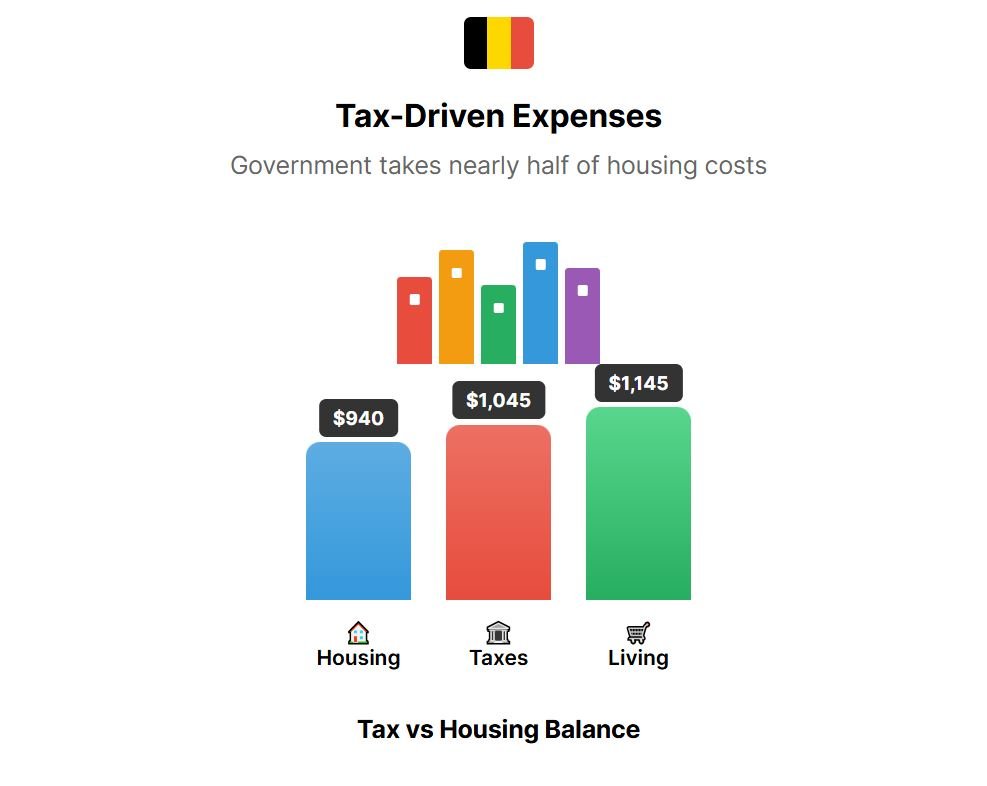

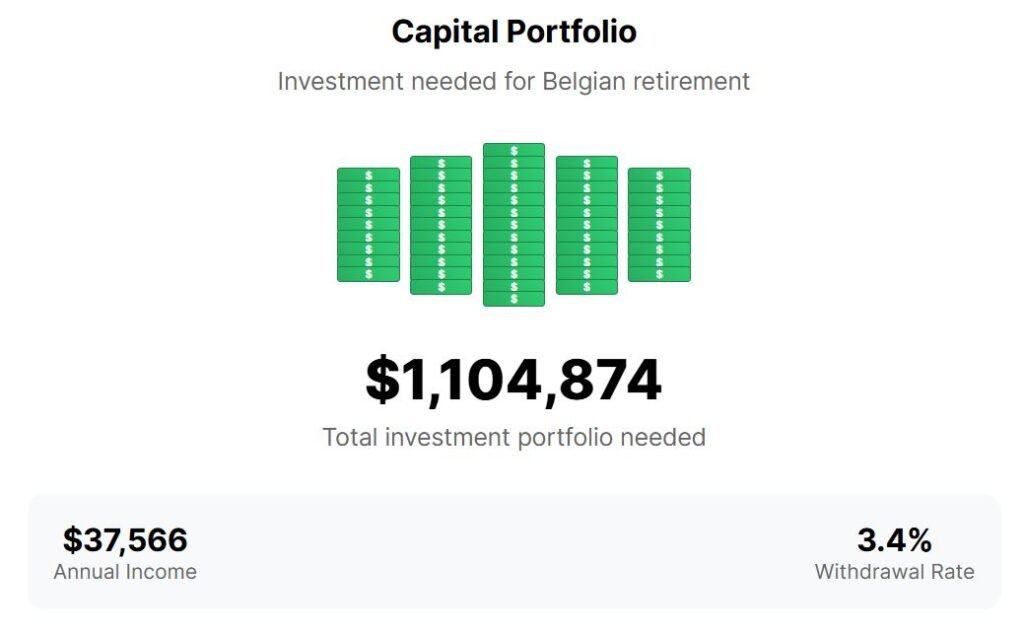

23 – Belgium

At number 23, Belgium is the last country requiring more than a million dollars to retire comfortably. Using Ghent as our representative city, the numbers show how living in Western Europe’s heartland pushes savings to the limit. Rent for a one-bedroom apartment averages $940 per month, while groceries, utilities, and daily expenses add another $1,145.

While those figures might not appear extreme, taxation significantly impacts the total. One pays the equivalent of $1,045 per month in income tax, almost a one-to-one match with rent. This represents a large share of total spending directed to the government.

To meet these combined costs, you’d need a gross annual income of $37,566. With a sustainable annual yield of 3.4%, that translates into an investment of $1,104,874. Taxes, not housing, are what make Belgium one of Europe’s priciest retirement destinations.

The next country is the first to require less than 1 million in investments, and it gets increasingly cheaper!

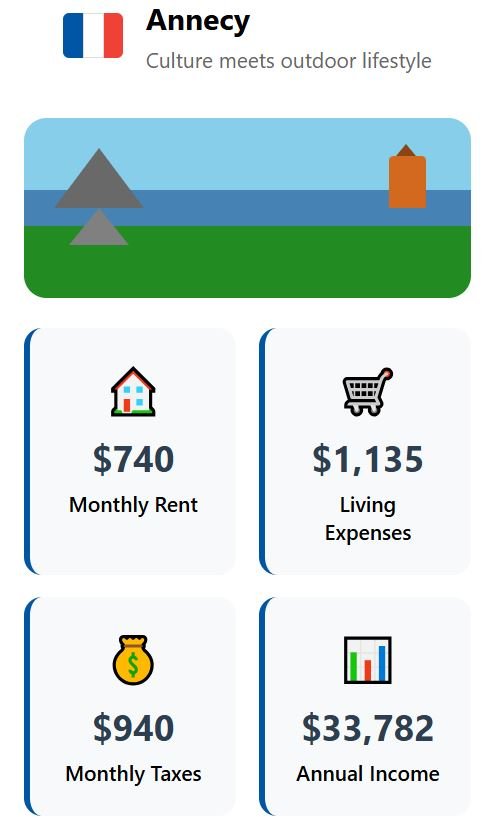

22 – France

At number 22 is France, where the required retirement investment finally drops below one million dollars. Annecy is our example, a lakeside city known for its balance of culture and outdoor life. Monthly rent there averages $740, a manageable figure.

However, that impression fades once other expenses are included, which total around $1,135 each month, reflecting high prices for food, utilities, and everyday services. The biggest influence on cost, however, is taxation. A retiree in France can expect to pay about $940 per month in taxes, keeping France among the higher-cost countries.

After combining all these factors, the needed gross annual income amounts to $33,782. To sustain that income indefinitely at a 3.4% withdrawal rate, you would need $993,592 invested. Even outside Paris, achieving a comfortable life in France still requires a significant financial commitment.

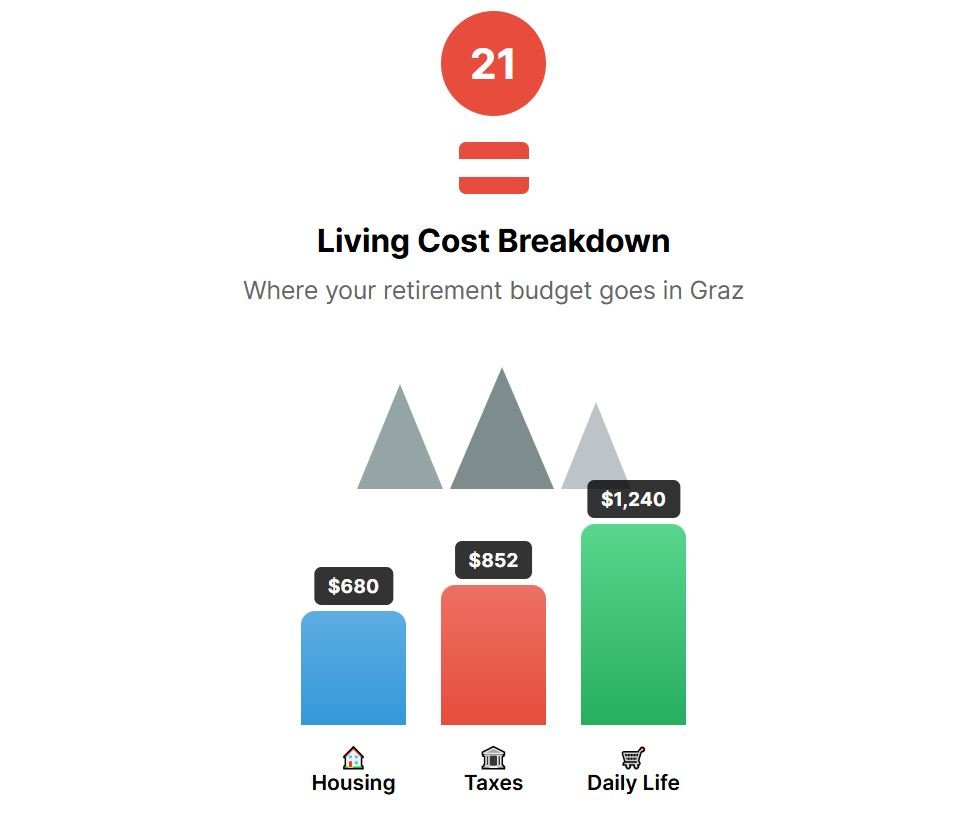

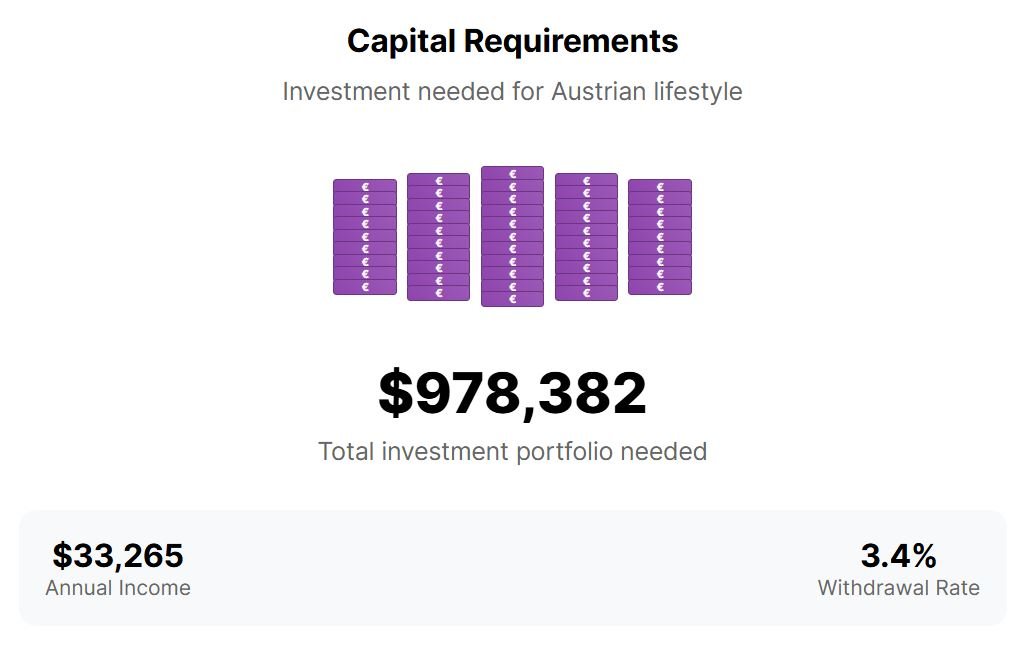

21 – Austria

At number 21 is Austria. Using Graz as the example city, its reputation for quality living comes with a cost. Rent for a one-bedroom apartment averages $680 per month, which looks affordable compared to most Western European standards.

That advantage diminishes once daily expenses are added, reaching $1,240 a month for groceries, transport, utilities, and other basics. Taxes further increase the cost. An expat in Austria can expect to pay around $852 each month in income tax.

Maintaining a comfortable lifestyle in Graz demands a gross annual income of $33,265, which requires an investment of $978,382.

PS: I have some really good news: FREE FOR A LIMITED TIME: Grab your Expat Wealth & Lifestyle Compass ($108 value) today! Includes our 74-page guide of Affordable European Cities, our Zero-Tax countries report, and our expat checklist. http://patreon.com/The_ExpatJoin us here before this offer ends.

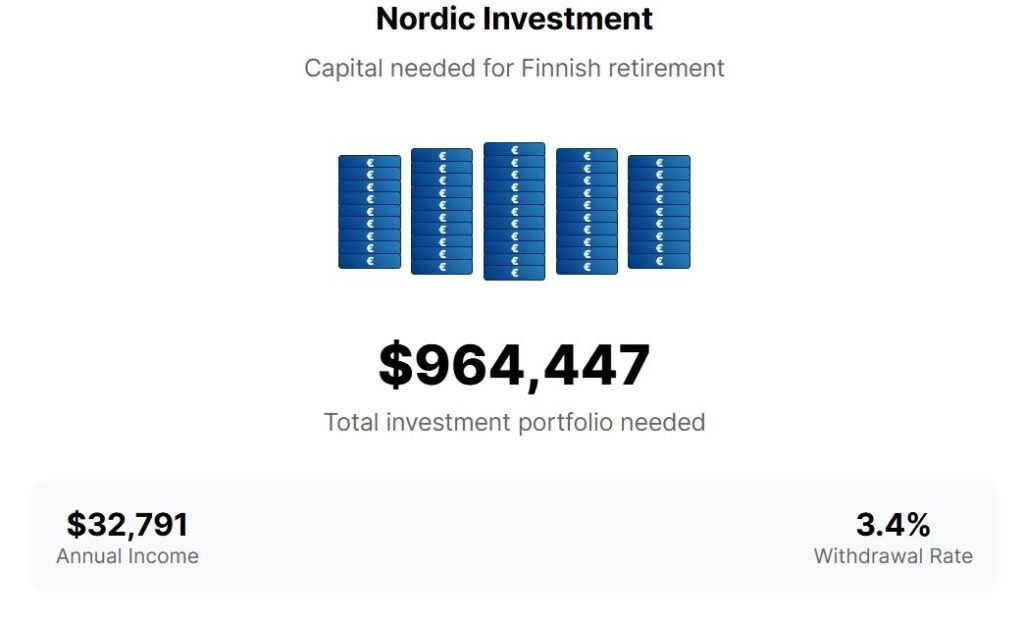

20 – Finland

At number 20 is Finland, the first Nordic country where less than a million dollars invested is enough. The representative city is Turku, one of Finland’s oldest urban centers and a good indicator of national living expenses. While the exact rent figure isn’t specified, the overall cost structure indicates considerable expenses for housing, food, and transport, contributing to a higher baseline.

The Nordic system emphasizes strong public services—comprehensive healthcare, public transport, and education—but demands very high taxation. Expatt must budget for it through a higher income requirement. To maintain a comfortable, predictable lifestyle, a retiree in Finland needs an annual gross income of $32,791.

Applying the steady 3.4% withdrawal rate places the total investment needed at $964,447.

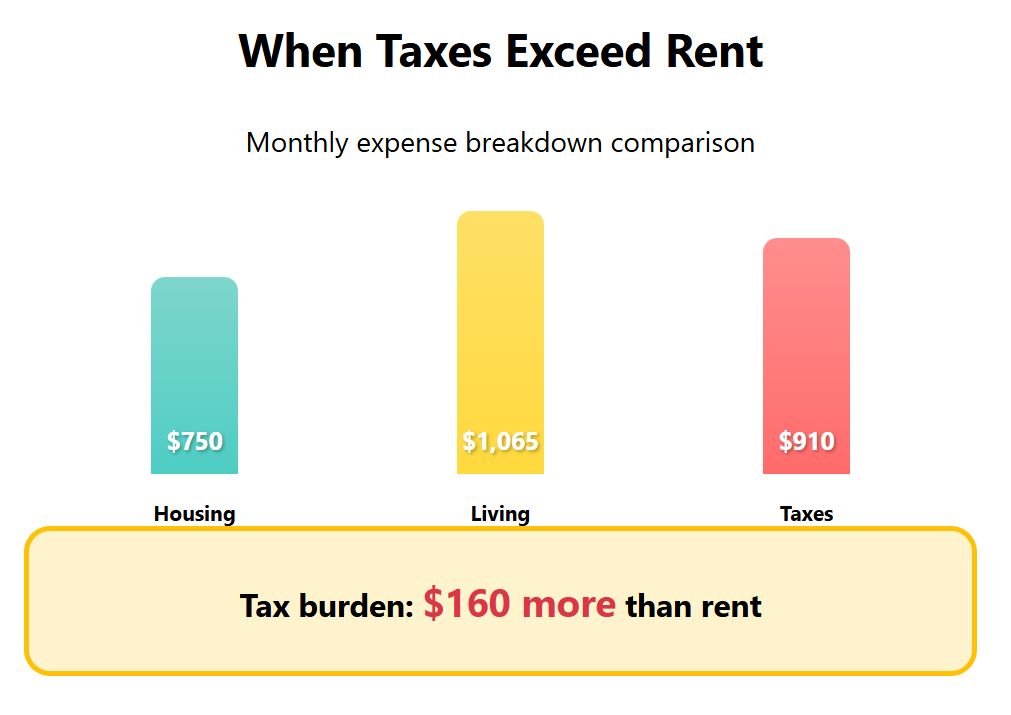

19 – Sweden

At number 19 is Sweden. The focus is on Uppsala, a major university city that combines academic life with close proximity to Stockholm. Monthly rent for a one-bedroom apartment averages $750, and living expenses such as groceries, electricity, and local transportation add about $1,065.

Taxes are a significant factor in Sweden’s costs – the equivalent of $910 each month in income taxes – exceeding the cost of rent. To live comfortably, a gross annual income of $32,701 is required. That means a total investment of $961,797.

Sweden is cheaper than Denmark, yet it still requires almost a million-dollar portfolio.

18 – Slovenia

At number 18 is Slovenia, a small Central European country that appears affordable at first glance but still demands a considerable investment to retire comfortably. In Ljubljana, rent for a one-bedroom apartment is $850 per month, with another $975 going toward essentials like food and utilities. Taxes also play a significant role, adding the equivalent of $711.

Combined, these costs require a gross annual income of $30,441. Slovenia’s position in the Eurozone and proximity to wealthier neighbors like Austria and Italy help explain the higher prices.

To sustain that income under a 3.4% withdrawal rate, a retiree would need an investment of $895,323, placing Slovenia firmly in the upper-middle range for EU retirement costs.

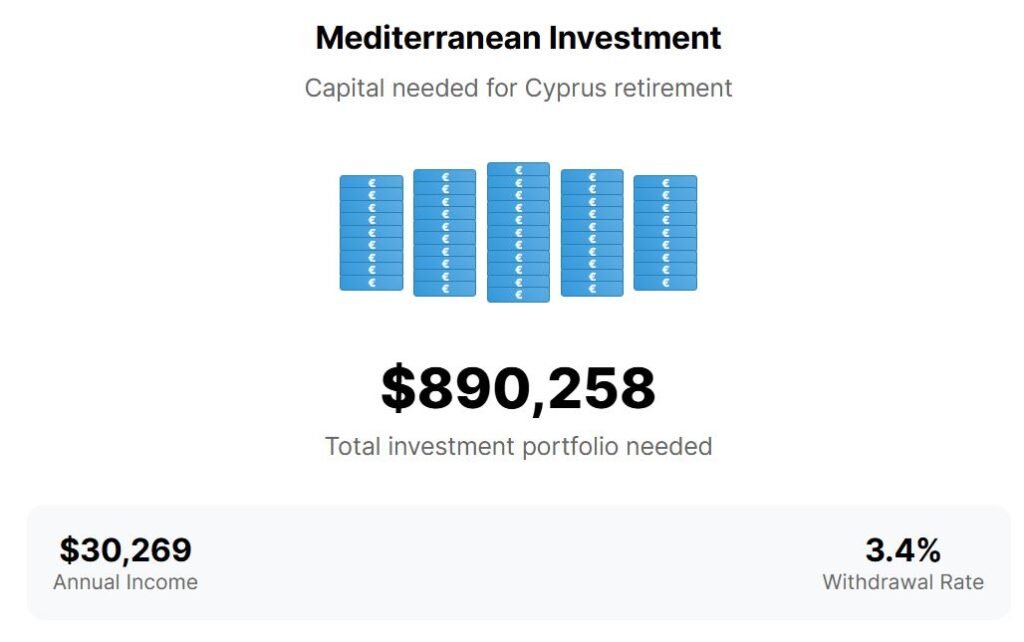

17 – Cyprus

Number 17 is Cyprus, a Mediterranean island that blends a relaxed pace with beautiful beaches. In Larnaca, a coastal city popular with retirees and expats, rent averages $795 per month. Add $885 in other living expenses, and the total cost of daily life stays moderate compared to Western Europe.

The monthly tax bill reaches $842. The curious thing about Cyprus (and many southern European countries) is that there are some legal ways to pay much lower taxes than that. If you would like to know better, contact me via my Patreon.

Altogether, a retiree in Larnaca needs a gross annual income of $30,269. At a 3.4% withdrawal rate, the required investment comes to $890,258. Cyprus lands just below the $900,000 mark, making it the more expensive of the two EU Greek-speaking countries.

16 – Germany

At number 16 is Germany, Europe’s largest economy, which lands in the middle of the ranking largely thanks to its housing market outside major cities.

The reference city here is Leipzig, a growing cultural and tech hub that offers an affordable alternative to Munich or Hamburg. Rent for a one-bedroom apartment costs about $630 per month, one of the lowest among Western European nations with similar infrastructure and quality of life.

Daily expenses, however, are different. Food, healthcare, and utilities total $1,123 per month, reflecting the strong consumer market and high labor costs that underpin Germany’s economic strength. US$734 goes for taxes.

To live comfortably under these conditions, a gross annual income of $29,853 is necessary. With a 3.4% sustainable withdrawal rate, that translates into an investment of $878,026—significant, but manageable for Europe’s industrial powerhouse.

15 – Spain

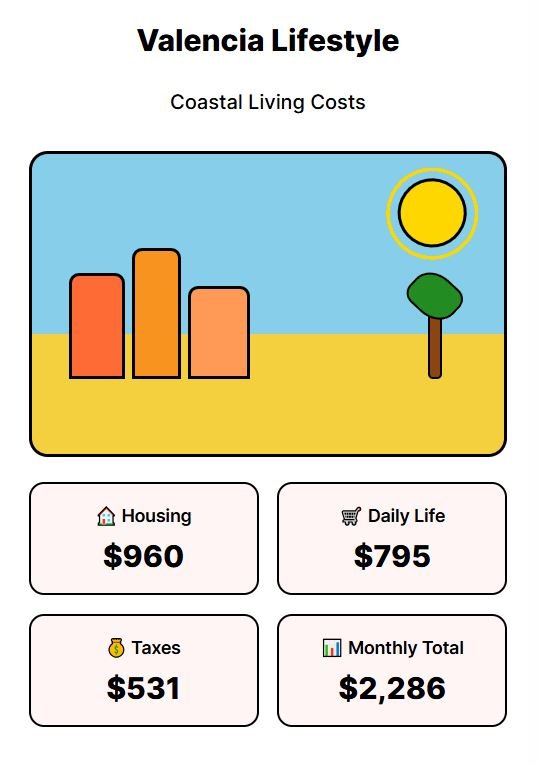

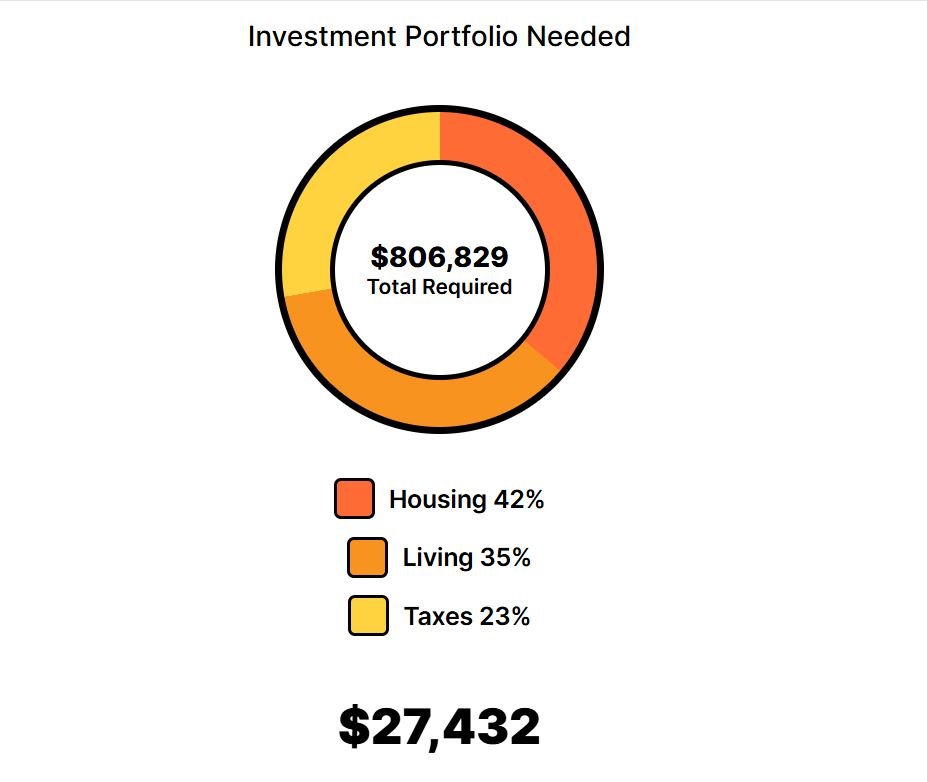

At number 15 is Spain, long recognized as one of Europe’s favorite retirement choices. Valencia serves as the example city here, offering coastal living with relatively balanced expenses. Rent averages $960 per month, reflecting its popularity among locals and expats.

While housing has a premium price, daily costs such as groceries, and transportation are far more manageable, coming to about $795 per month. Taxation, in this case, is surprisingly a positive point (at least when compared to other European countries so far). The monthly tax bill equals $531—noticeably lower than in many Western European countries.

Altogether, an expat needs a gross annual income of $27,432 to maintain comfort in Valencia. That figure converts into a required investment of $806,829. Spain offers a balance where pleasant living and moderate prices align for long-term retirees.

14 – Italy

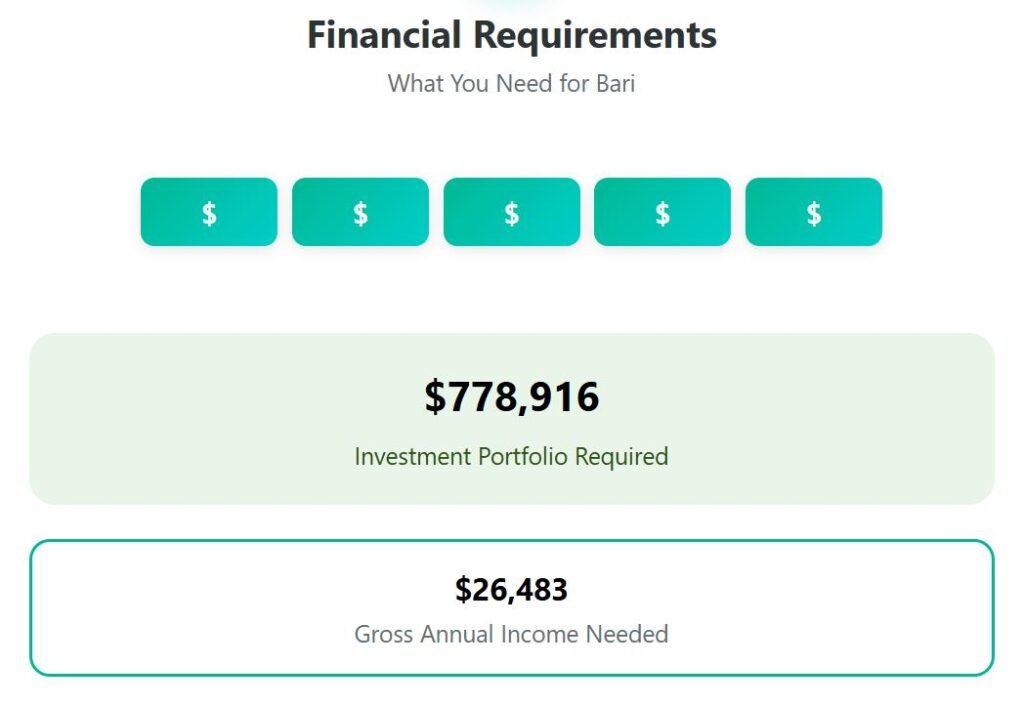

At number 14 is Italy, revealing a side most people overlook. While Italy is usually linked with high costs, the analysis focuses on Bari in the south, showing that location is everything when it comes to retirement. Compared to the industrialized north, Bari’s affordability is striking.

Rent there is a modest $670 per month, a fraction of what you would pay in Rome or Milan, while still offering all the essential services, and a Mediterranean pace of life that many retirees seek. Other living expenses add $894 per month. Taxes add another $642 to the budget each month, significant but smaller than in many Western European countries.

Altogether, you need a gross annual income of $26,483, supported by an investment portfolio of $778,916. Bari demonstrates how the north-south divide within Italy can translate into nearly 20% more purchasing power for retirees.

13 – Portugal

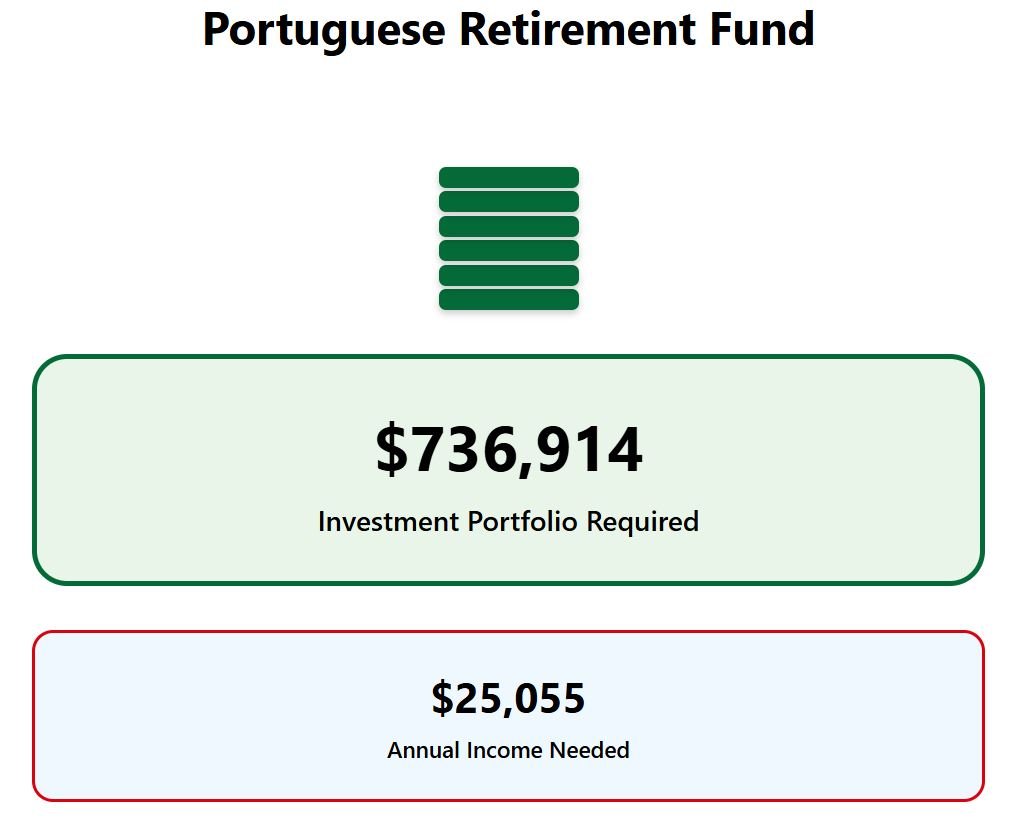

Number 13 is Portugal, represented by the northern city of Braga, a long-time favorite among retirees looking for comfort without the premium price tag found in Lisbon or Porto.

Rent there remains affordable, and the overall cost of living reflects the relaxed pace of a smaller regional center rather than a capital. Day-to-day expenses, including food, transport, and healthcare, align with an efficient, comfortable lifestyle appealing to those seeking stability over luxury.

A retiree in Braga would need a gross annual income of $25,055 to cover essential needs. At a 3.4% real return, this translates into a required investment of $736,914.

12 – Poland

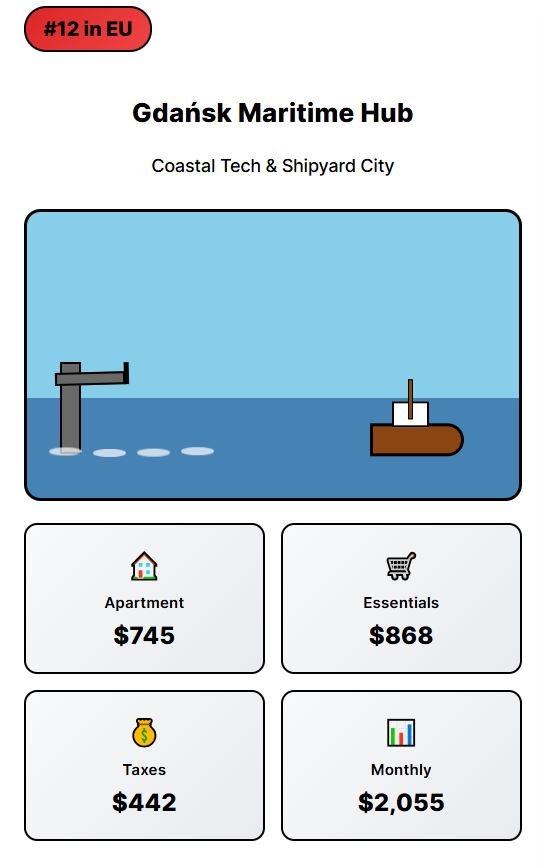

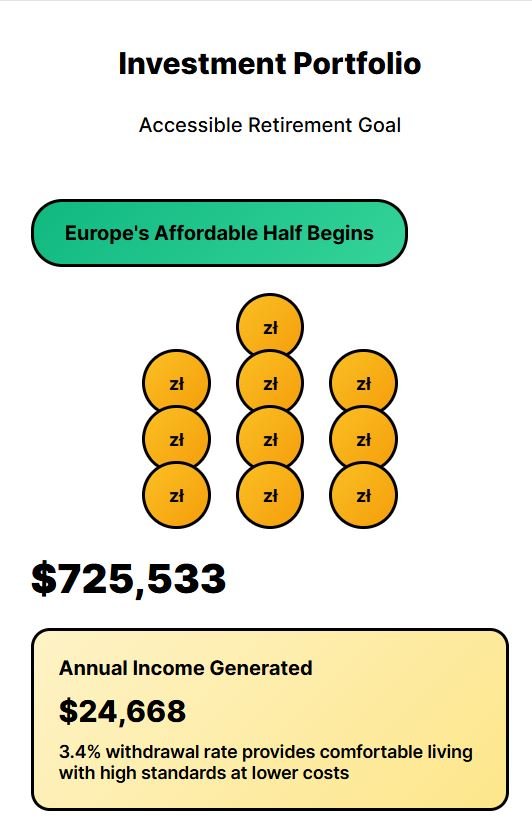

At number 12 is Poland, where the financial picture for expat retirees and remote workers change noticeably. The focus city is Gdańsk, a coastal hub known for its shipyards and growing tech presence. A one-bedroom apartment rents for $745 per month, and other core expenses—covering food, utilities, and healthcare—add $868.

Despite Gdańsk being both a tourist and economic center, those outlays remain remarkably lean. The significant difference comes from taxes. About $442 per month, a level far below what’s common in Western Europe.

Combining these elements results in a necessary gross annual income of $24,668, positioning Poland among Europe’s most accessible destinations.

An invested portfolio of $725,533 fully covers these expenses. Poland marks the start of Europe’s affordable half, where living standards remain high despite far lower costs.

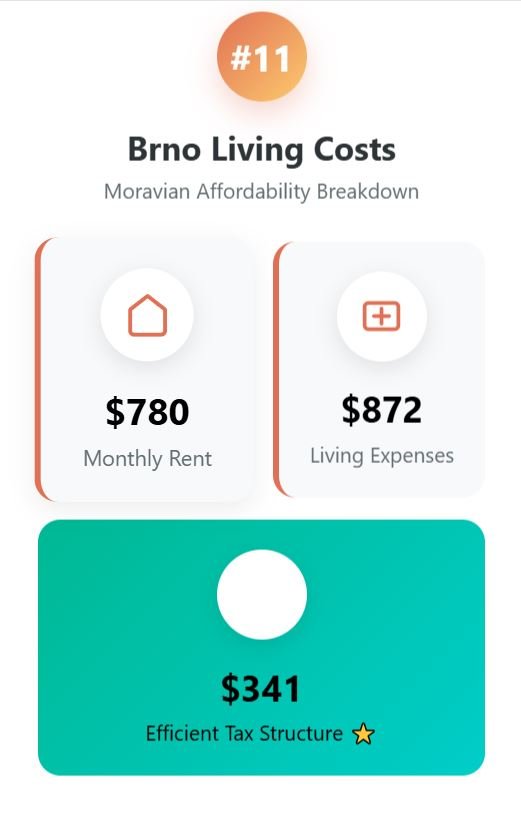

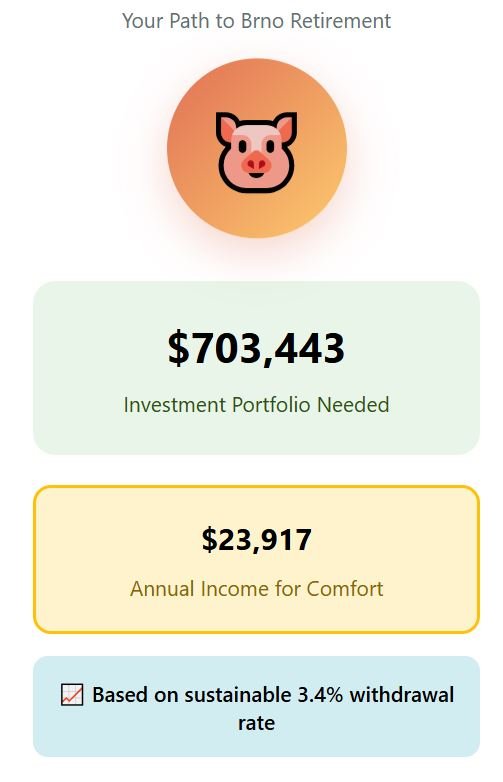

11 – Czechia

Number 11 is Czechia, represented by Brno, a city known for its universities and growing tech sector. It is a place with good infrastructure and quality of life, but without the financial weight one could expect of Central Europe. Rent for a one-bedroom apartment averages $780 per month, and other living costs reach about $872.

Czechia truly stands out in its taxation. The monthly tax bill in our example is only $341. Altogether, a retiree needs a gross annual income of $23,917 to live comfortably.

Applying the sustainable 3.4% withdrawal rate results in a required investment of $703,443. Czechia delivers remarkable affordability without compromising stability or modern amenities.

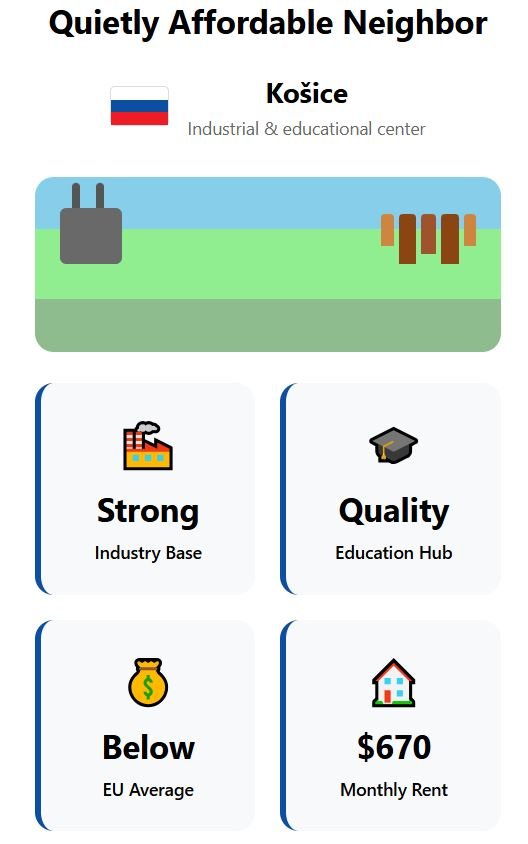

10 – Slovakia

At number 10 is Slovakia, represented by Košice, a city known for industry, education, and lower living costs compared to Western Europe.

Rent for a one-bedroom apartment comes to $670 per month, offering a good balance between affordability and comfort. Everyday expenses add another $870, far below the EU average.

Taxation is also modest – $422, slightly higher than its regional peers but still low by European standards.

To cover all expenses, a retiree in Košice needs a gross annual income of $23,552, which requires an investment of $692,697. Slovakia officially crosses into the top 10 most affordable EU destinations for retirement.

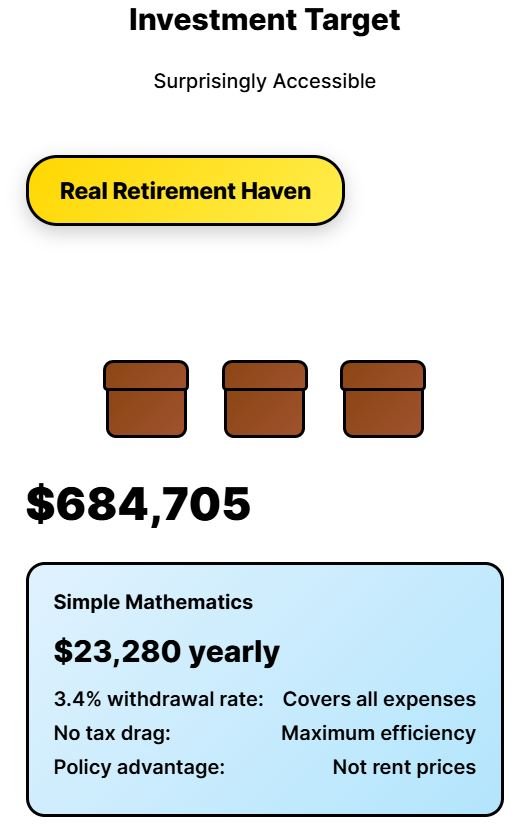

09 – Malta

At number 9 is Malta, the small island nation that completely breaks the pattern. On paper, Malta should be expensive. In Valletta, rent for a one-bedroom apartment averages $1,070 per month, and when you add $870 for groceries, utilities, and healthcare, the monthly cost of living looks similar to Western Europe.

Normally, such high rents would mean no affordability, but… Malta stands apart due to its taxes. The government offers special retirement schemes that can reduce the monthly tax bill to zero.

This single policy transforms Malta from a high-cost to one of the least expensive countries in the European Union for retirement. The math is simple. With no tax drag, you only need a gross annual income of $23,280 to cover all expenses – that requires an investment of just $684,705.

Government low-tax policy, not rent prices, makes Malta a real retirement hotspot.

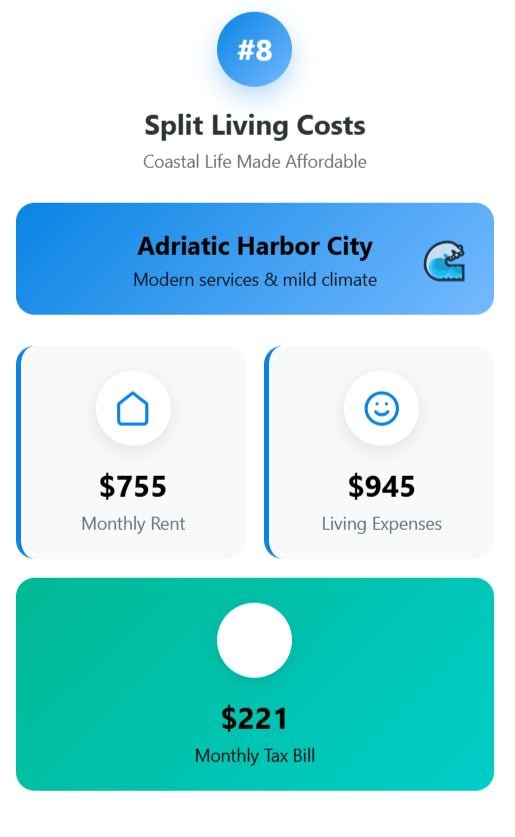

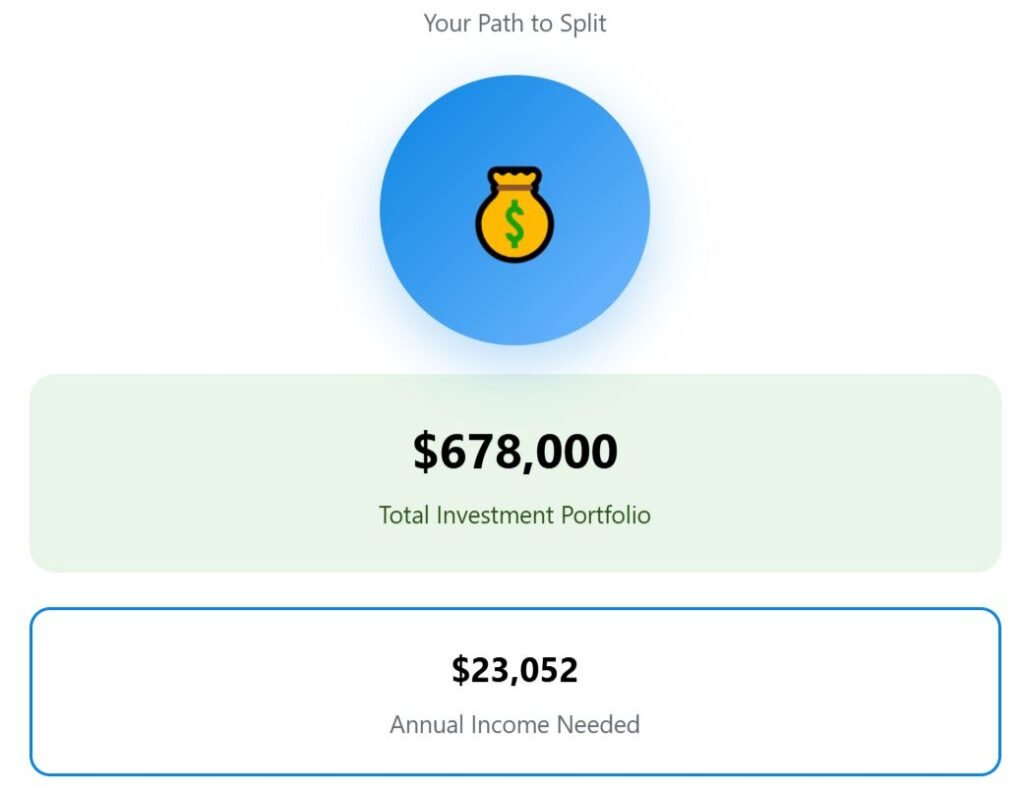

08 – Croatia

At number 8 is Croatia, with one of the strongest balances between lifestyle and cost in the European Union.

The analysis centers on Split, a major city on the Adriatic known for its active harbor and mild climate. Rent for a one-bedroom apartment averages $755 per month, and other monthly expenses reach $945.

Despite tourism influencing prices, these costs remain moderate for a coastal hub with modern services and easy access to healthcare. Croatia becomes financially efficient in its taxation. In our example, the monthly tax bill is just $221, one of the lowest levels across all EU countries.

Altogether, you need a gross annual income of only $23,052 to live comfortably in Split, bringing the total required investment to $678,000.

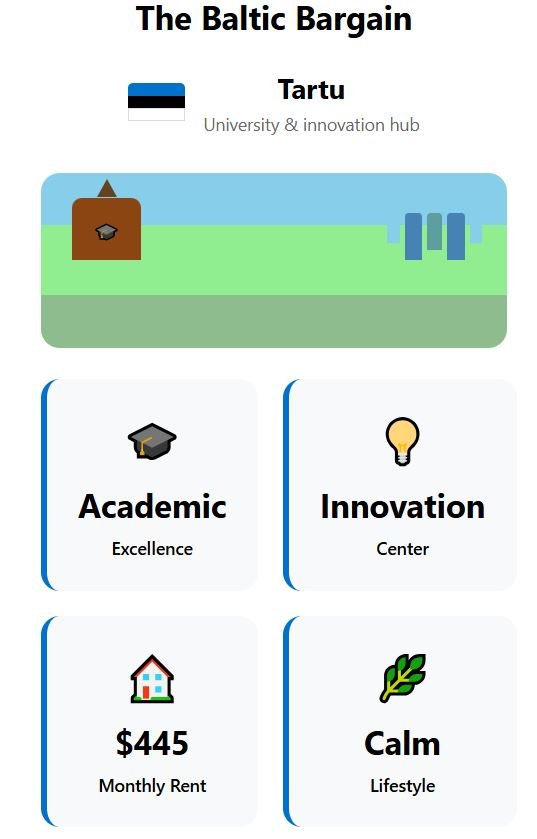

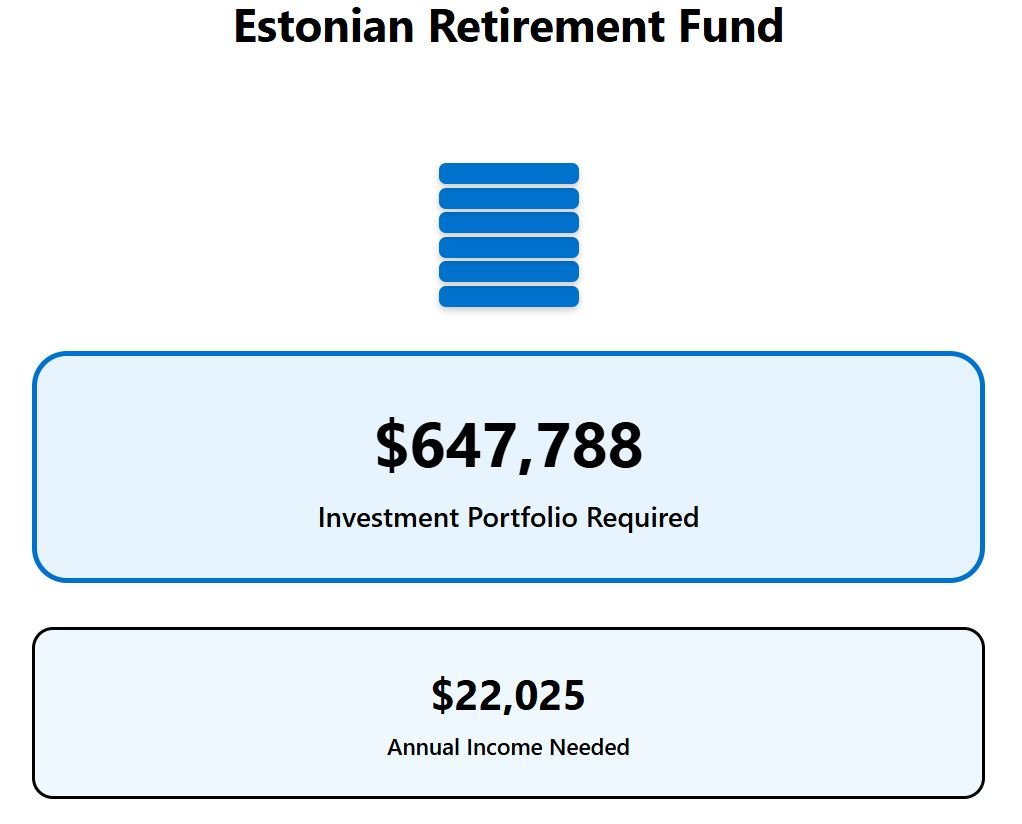

07 – Estonia

At number 7 is Estonia, represented by the university city of Tartu, known for innovation, education, and a calm rhythm of life.

The data for retirees here reveals a balanced cost profile with an exceptional advantage—low housing prices. Renting a one-bedroom apartment costs $445 per month, a figure that sharply reduces the overall monthly requirement.

Other living expenses total $935, including food, healthcare, and utilities, consistent with a modern Northern European lifestyle. The country’s flat tax system adds a predictable $455 each month.

Thanks to lower rent and flat taxes, you need an annual income of just $22,025 to maintain good living standards, meaning an investment of $647,788.

Estonia delivers stability at an accessible price.

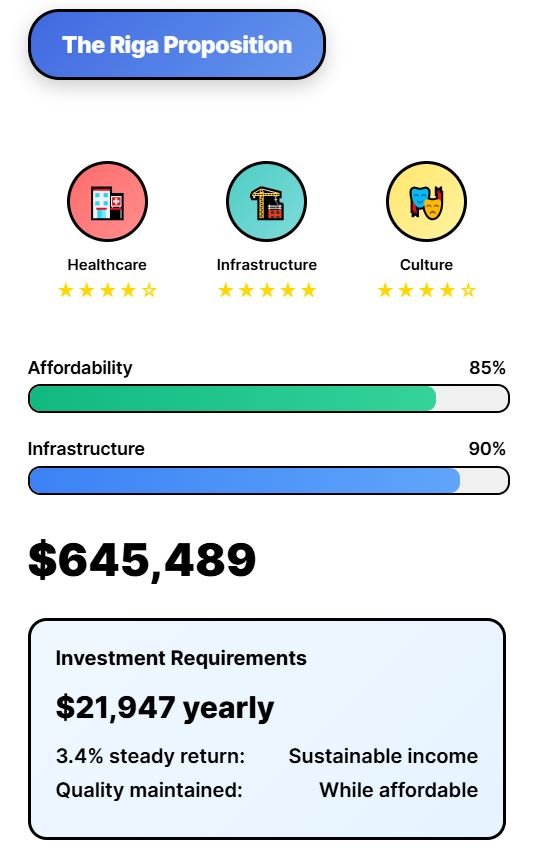

06 – Latvia

Number 6 is Latvia, where the capital city of Riga offers affordability paired with solid infrastructure. Housing is where most retirees notice the difference. Local markets indicate that rent and utilities stay moderate compared to most EU capitals, while food and transport maintain reasonable pricing.

Latvia’s tax system significantly contributes to this balance. Designed to attract investment and skilled residents, it keeps retirement income needs lower than in many European countries with comparable services. The model calculates a required gross annual income of $21,947 to sustain an average lifestyle in Riga.

Applying a steady 3.4 percent return, the investment needed totals $645,489. Riga remains affordable while offering quality healthcare, strong infrastructure, and access to culture.

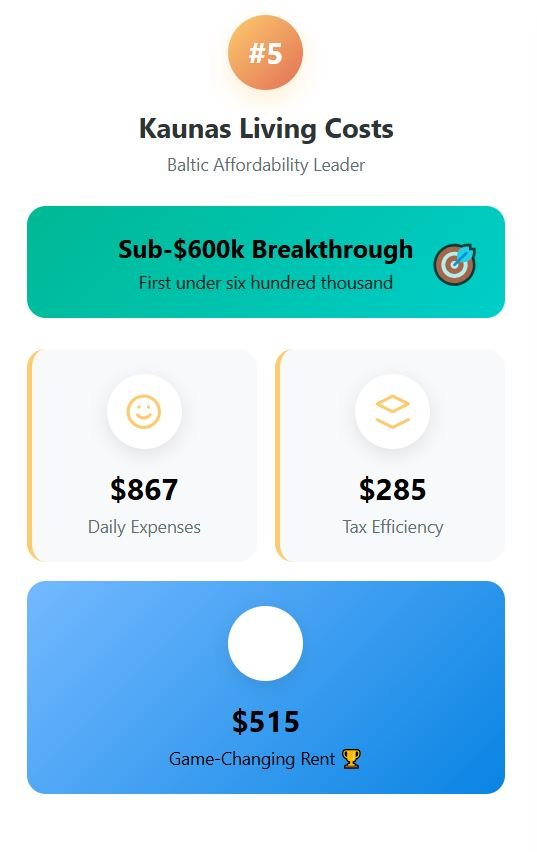

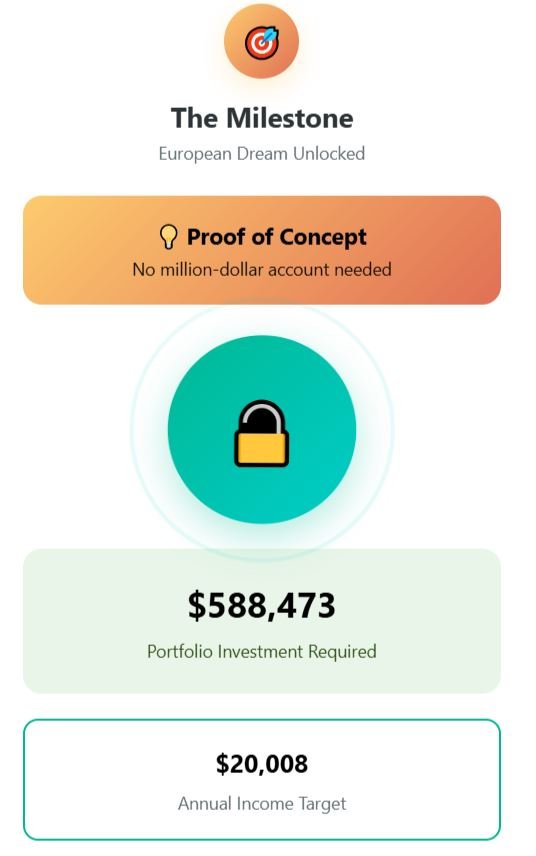

05 – Lithuania

At number 5 is Lithuania, the last Baltic nation in our ranking. The focus is Kaunas, a modern, mid-sized city with a growing expat population and balanced living standards.

Rent for a one-bedroom apartment averages $515 per month, a figure that immediately drops the overall budget to one of the lowest on this list.

Other living costs, such as food, utilities, and public services, total about $867. This results in a sustainable monthly budget well below the EU average. The tax system offers another advantage. The monthly tax bill reaches only $285, preserving much of your investment income and simplifying planning.

Because of this efficiency, a retiree needs a gross annual income of just $20,008, supported by a portfolio of $588,473. Lithuania marks a milestone—proof that retirement in Europe doesn’t require a million-dollar account.

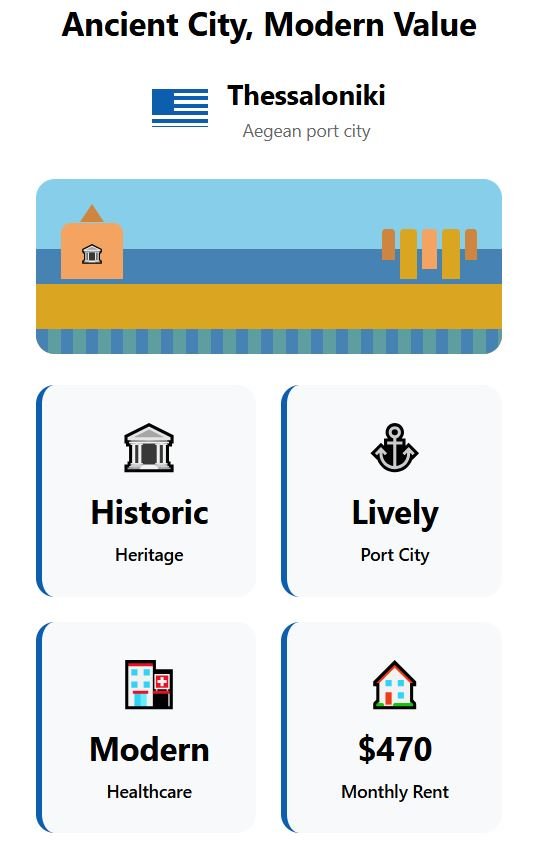

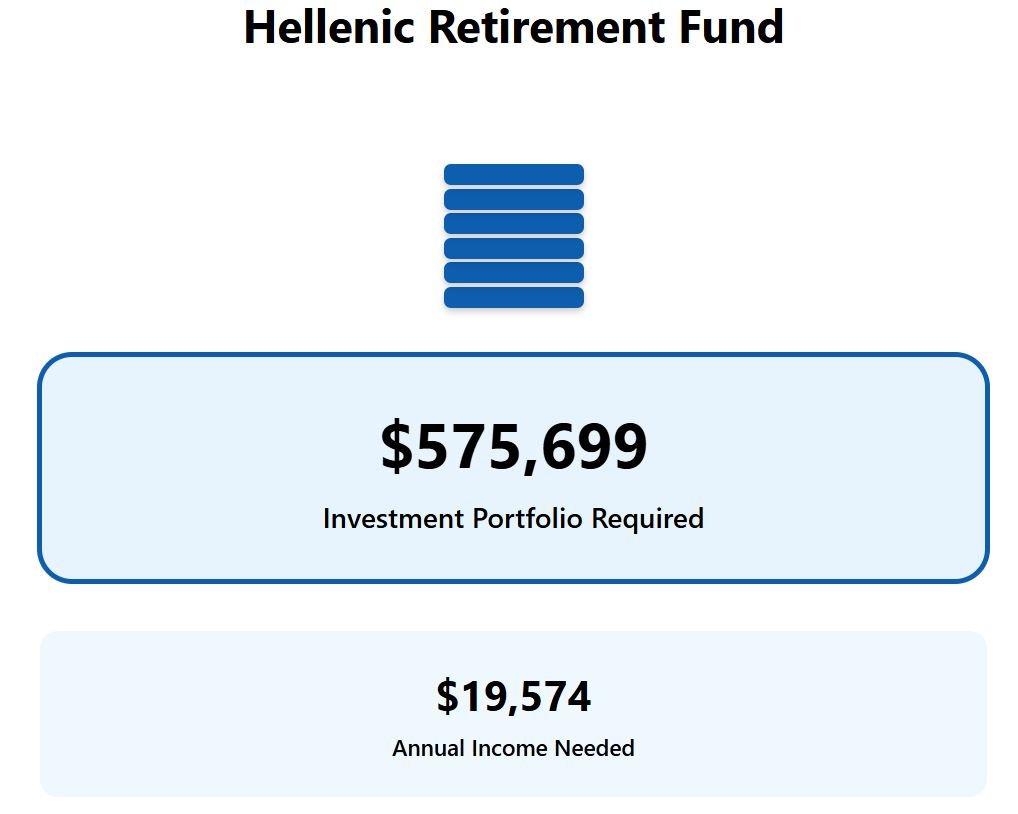

04 – Greece

At number 4 is Greece, where Thessaloniki is our focus city. It’s a lively port on the Aegean, with modern healthcare and infrastructure, yet far more affordable than the capital. Rent for a one-bedroom apartment there averages $470 per month, among the lowest in the region.

Living costs are reasonable, at about $882 each month ordinary expenses. Monthly taxes are just $279, a fraction of what’s required in most Western nations. Together, these figures result in one of the lowest monthly budgets anywhere in Southern Europe.

This is part of the reason Greece’s overall affordability is rising in international comparisons. The needed annual income there is just $19,574, marking the first time the total has dropped below the $20,000 threshold. To have that income indefinitely, you’d need an investment portfolio of $575,699.

Greece also enjoys one of the world’s highest life expectancies, outpacing countries like Germany and the United States, offering longevity, health, and cost advantage.

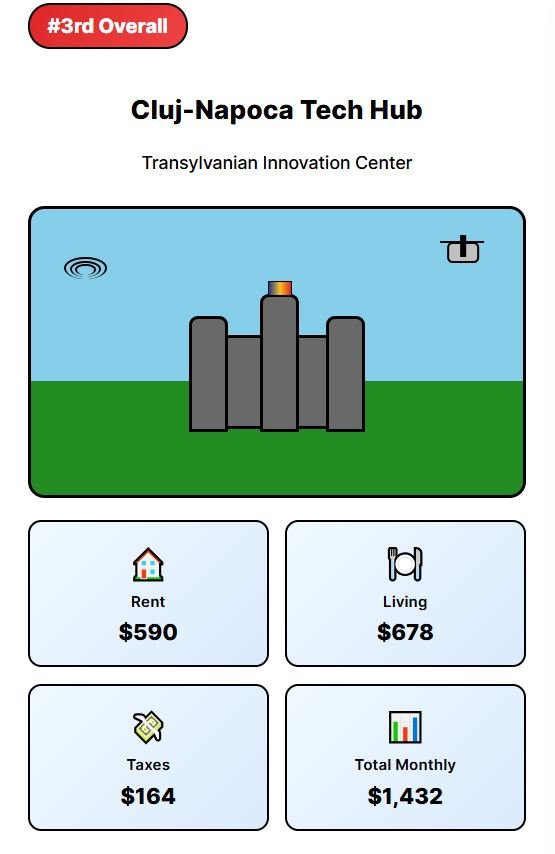

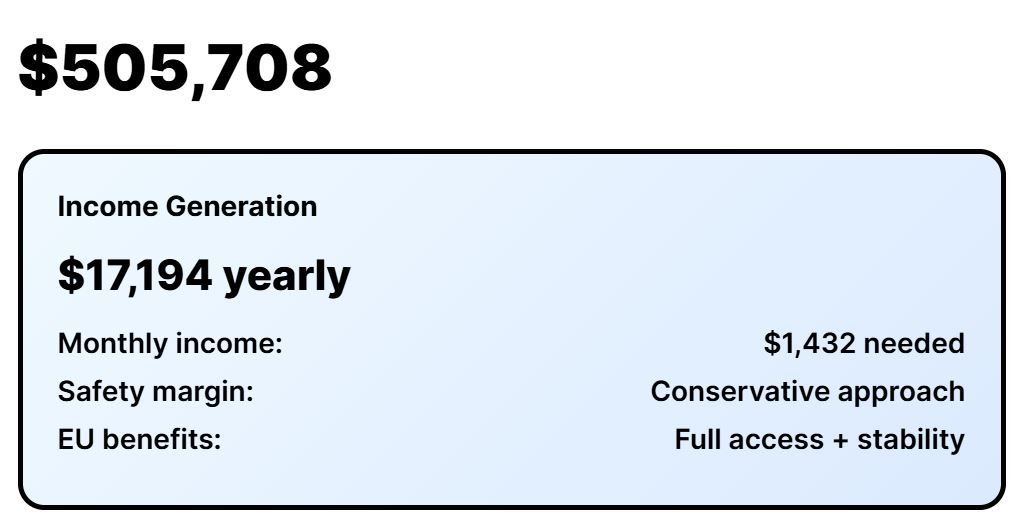

03 – Romania

At number 3 is Romania, represented by the city of Cluj-Napoca. A tech center that has grown steadily over the past decade, while keeping everyday living costs surprisingly low. It’s recognized among the top three cities in Romania for overall quality of life, alongside Brașov and Sibiu.

The local economy blends strong university influence with steady foreign investment, creating a well-serviced city that maintains affordability across all key expenses. Rent for a one-bedroom apartment is around $590. Other living costs sum just $678.

Tax pressure is minimal as well—only $164 per month, thanks to the flat-tax rate. Combining all these costs, the total required annual income is $17,194, so even modest savings can comfortably sustain a long-term stay. To generate this, you’d need about $505,708 invested.

Romania offers an affordable entry point into the EU with a stable urban infrastructure.

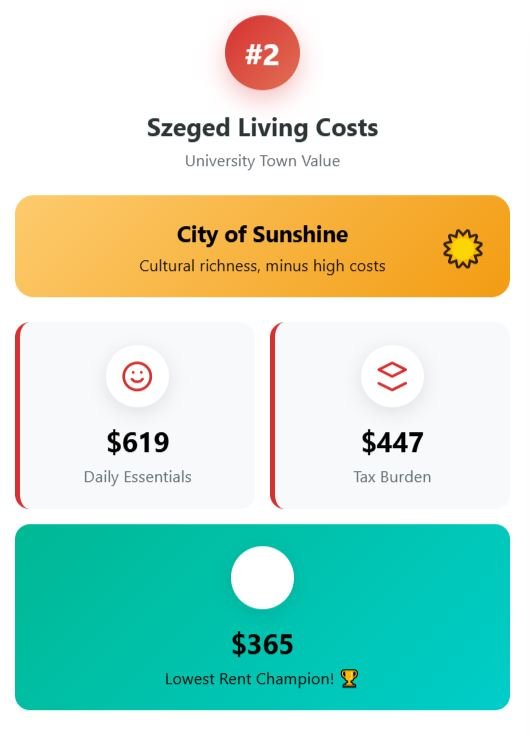

02 – Hungary

It’s a bit of sweet irony to see Romania and Hungary side by side in this ranking, given their deep connections and long history. They are neck and neck, proving that Central Europe might hold the best value for money. At number 2, Hungary is represented by the city of Szeged—often called the City of Sunshine.

It’s an affordable university city with cultural richness, minus the high costs of Western Europe or EU capitals. The first surprising number is housing. Rent for a one-bedroom apartment in Szeged is just $365 per month—the lowest rental cost of any city in this analysis.

Daily essentials are also affordable, at $619. But taxes are relatively high. The monthly bill for income tax averages $447, slightly higher than its neighbors, and that small difference prevents it from taking the top spot.

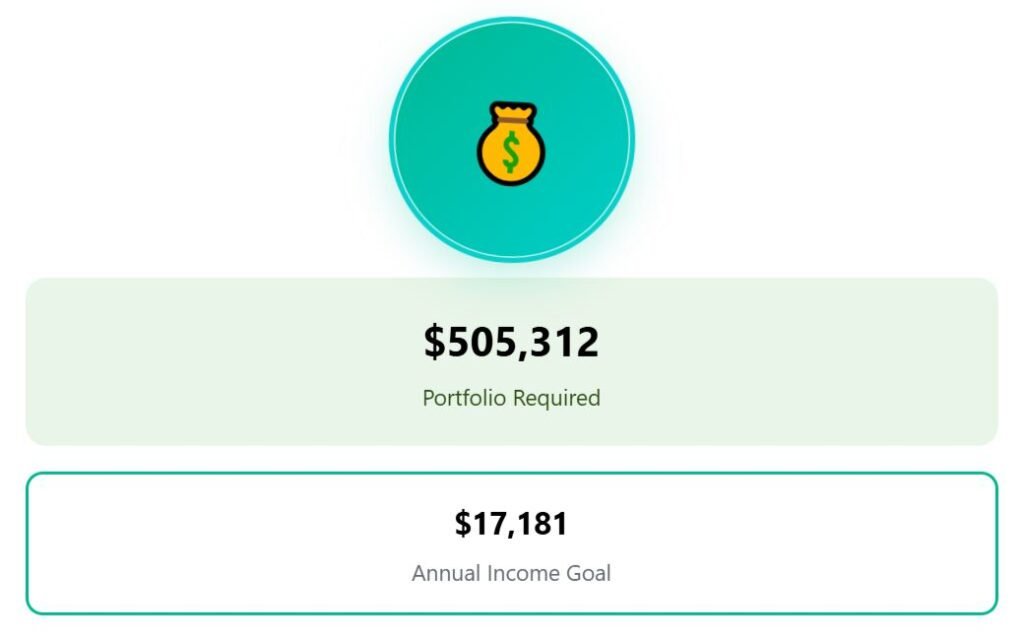

Even with that, you only need a gross annual income of $17,181. To support that life, $505,312 invested is enough for a long, balanced, and comfortable retirement.

01 – Bulgaria

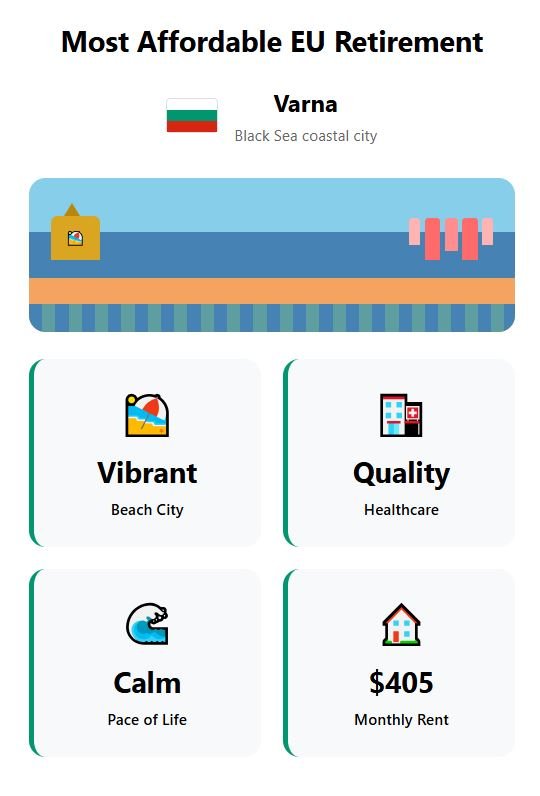

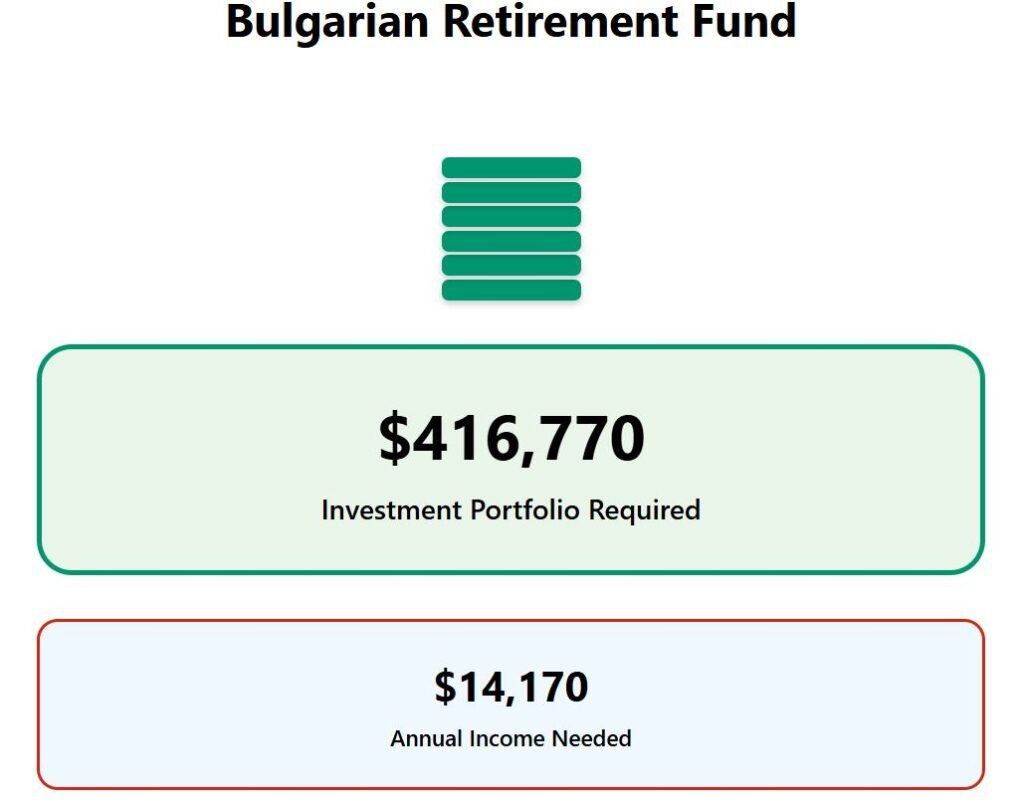

The number one most affordable country to retire in the European Union is Bulgaria. And here we use the example of Varna, a major city on the Black Sea coast. It’s a vibrant place with beaches, access to healthcare, and a calm pace that rivals bigger Mediterranean destinations without the high costs.

Varna is often compared to Burgas for the title of the country’s main seaside city. In numerical terms, the affordability is unmatched. Rent is around $405 per month.

Add another $640 for daily needs, and your entire monthly cost remains just over $1,000. Taxes are low – only $135 per month in our example, the lowest on our list. Combine all these figures, and the required gross annual income is a mere $14,170.

To fund that indefinitely, you would need $416,770 invested. Bulgaria demonstrates that retiring comfortably in Europe isn’t about being a millionaire—it’s about knowing where to settle.

But what if you prefer a smaller city or town where life is slower, prices are even lower, and everything looks simpler? For you, I ranked the best cities and towns to live in Europe.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.