What if you could legally cut your business tax bill in half while gaining access to one of the most strategic markets in the world?

In the next paragraphs, I’m going to walk you through exactly how Singapore’s tax system can potentially save you tens of thousands in taxes annually.

I’ll cover:

- The business scheme that gives you 75% exemption on your first $100,000 in profits,

- The one-tier tax system that eliminates dividend taxes, and

- The territorial taxation that keeps foreign income tax-free.

By the end of this article, you’ll understand why expats over 45 are increasingly looking to Singapore not just as a travel destination, but as a strategic money-saving hub to incorporate a business.

These aren’t obscure loopholes — they’re fundamental features of Singapore’s tax system designed to attract legitimate entrepreneurs. And for expatriates looking to pay lower taxes, this combination of tax efficiency and business opportunity can be particularly powerful.

The Tax Challenge for International Business Owners

How much of your business earnings currently go to the government? For entrepreneurs operating in countries like the UK, US, or Australia, the answer can be painful. Business tax rates in many Western nations take a substantial portion of your earnings—typically 25-35% or more—before you even pay yourself.

Consider this scenario: a small UK business making £100,000 in profit loses £25,000 just to company tax. That’s capital you could reinvest in growth, use to hire talent, or save for retirement. This tax burden only increases as your business becomes more successful.

For business owners over 45, this situation is particularly frustrating. After years of building skills and growing a business, you’re finally generating healthy profits—but a significant percentage goes to taxes precisely when you should be maximizing your retirement savings.

The benefits of incorporating a company in Singapore extend far beyond simple tax reduction. Singapore’s approach to business taxation solves several problems that plague entrepreneurs in Western countries:

- Double taxation (paying tax on business profits, then again on dividends)

- Global income taxation that captures foreign earnings

- Complex compliance requirements with high accounting and legal costs

While domestic tax planning offers limited relief, smart business owners are exploring international options—legally establishing companies in jurisdictions with more favorable tax environments. This isn’t about shady arrangements or hiding money; it’s strategic international business planning.

Singapore’s Tax System: Designed for Business Success

Singapore stands out as a premier destination for international business. Unlike questionable “tax havens,” Singapore is a respected global business center offering substantial tax benefits with complete legitimacy. While its headline corporate tax rate of 17% already compares favorably to Western rates, the real advantages lie deeper in the system.

What makes Singapore truly exceptional are its tax exemption programs:

- Start-up Tax Exemption: New companies receive a 75% exemption on their first $100,000 of income and 50% on the next $100,000 for three years

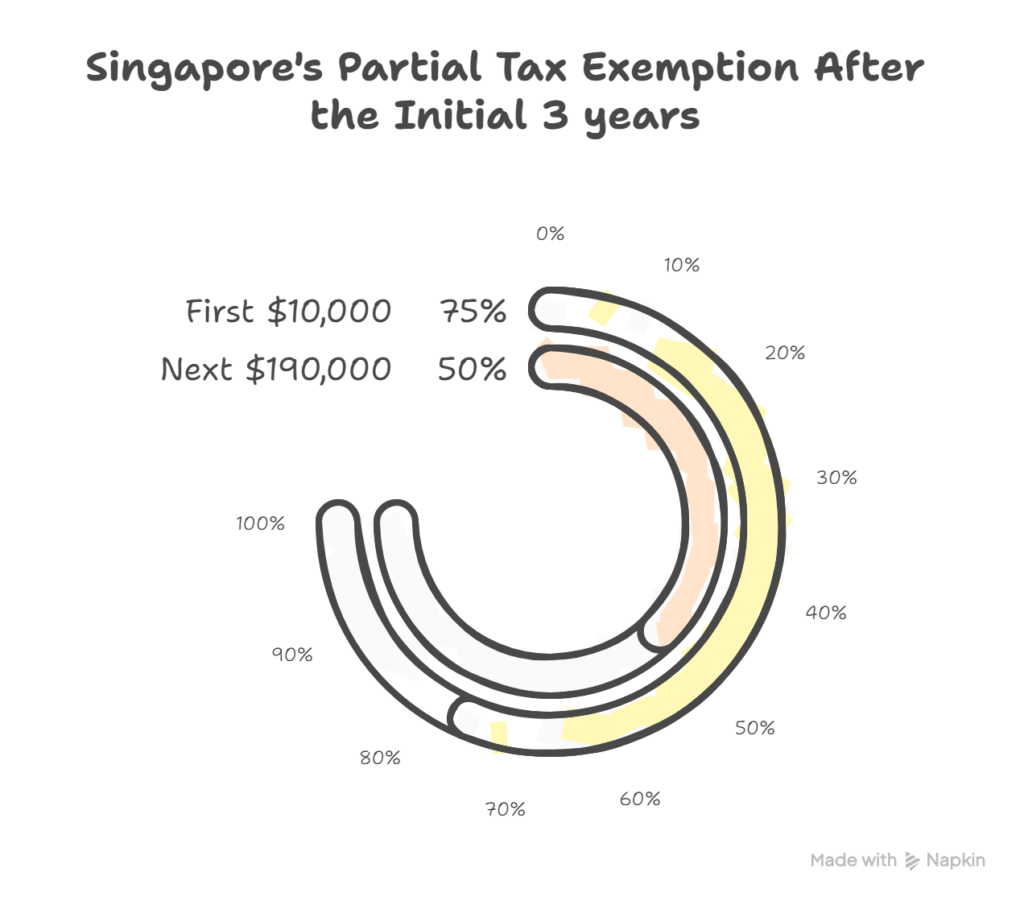

- Partial Tax Exemption: After the initial period, businesses still enjoy 75% exemption on the first $10,000 and 50% on the next $190,000 of taxable income

To illustrate: if your business generates $200,000 annually during its first three years, you might only pay tax on $65,000. This creates substantial savings during your critical growth phase and continues providing benefits as your business matures.

Even after three years, Singapore’s Partial Tax Exemption still helps. It offers 75% exemption on the first $10,000 and 50% on the next $190,000 of taxable income. This ongoing help means businesses keep saving tax as they grow.

For businesses operating internationally, another major benefit of incorporating a company in Singapore is its territorial taxation system. If you meet certain conditions, income earned outside Singapore can be exempt from Singapore taxation—allowing you to operate globally with remarkable tax efficiency.

The One-Tier Tax System: Pay Once and Done

Beyond favorable rates, Singapore’s business framework embodies a refreshingly simple principle: pay tax once, and you’re finished. This represents a dramatic departure from Western approaches.

Singapore’s one-tier tax system works like this: once a Singapore company pays its 17% tax on profits, that’s it. The money can flow directly to shareholders as dividends with no additional taxation. This applies regardless of whether shareholders are individuals or companies, residents or non-residents.

Compare this to your current situation: company tax followed by personal tax on dividends—a double taxation that significantly erodes your earnings. For business owners who’ve operated for years in high-tax jurisdictions, this straightforward system seems almost too good to be true. Yet it’s entirely real.

Singapore deliberately designed this system to position itself as a global business hub. While most Western tax authorities view profits as something to tax repeatedly, Singapore recognized that allowing business owners to retain more capital leads to greater investment and growth.

Setting Up Your Singapore Business: Practical Considerations

The Private Limited Company (Pte Ltd) structure typically offers the best option for foreign investors. It provides liability protection—keeping your personal assets safe from business obligations—while carrying global credibility, often more so than entities from less established jurisdictions.

There are some important requirements to understand:

- Every Singapore company needs at least one resident director (a citizen, permanent resident, or pass holder)

- A company secretary (who must be a Singapore resident) is required within six months

- If you are the sole director, you cannot also serve as the secretary—these must be different individuals

A key benefit of incorporating a company in Singapore for many expatriates over 45 is that you don’t necessarily need to relocate there to enjoy the advantages. While physical presence does unlock additional tax benefits, many key advantages remain accessible even with remote management. Success depends on having proper management systems and understanding which functions should be performed in Singapore versus elsewhere.

For those interested in being closer to their Singapore operation, several work pass options exist:

- Employment Pass: For foreign professionals meeting salary and qualification requirements

- EntrePass: Designed for entrepreneurs with innovative, funded, or tech-driven businesses

- Tech.Pass: Created for established foreign technology experts

Many foreign-owned Singapore companies thrive without the owner physically relocating. Modern digital tools, video conferencing, and local support services make remote management entirely viable. You could effectively oversee your Singapore operation through regular online meetings while living wherever you choose.

Making it Happen: Steps to Incorporate in Singapore

What if you could set up your Singapore company in weeks and start saving money fast?

Incorporating your business in Singapore is a breeze with Osome.

As a top global destination for entrepreneurs, Singapore offers great tax benefits—and Osome makes it even better by handling the entire process remotely and paper-free.

With Osome’s expert accountants and intuitive software, you can leave your financial admin, taxes, bookkeeping, and accounting to them. Everything happens in one platform: track invoices, monitor cash flow, and get real-time insights into your business—all while enjoying Singapore’s business-friendly tax environment.

Join over 15,000 entrepreneurs who are running their businesses better with Osome.

The benefits of incorporating a company in Singapore become even more accessible with the right partner to guide you through the process. Let’s look at how simple it is:

- Choose the right business structure – For most expatriates, a Private Limited Company offers the ideal balance of flexibility and protection

- Meet registration requirements – You’ll need at least one shareholder (which can be yourself) and up to 50 total, along with documentation detailing share distribution

- Appoint required officers – If you won’t be relocating to Singapore, you’ll need to engage a nominee director to satisfy the resident director requirement

- Submit registration – The process is handled online via BizFile+, with many applications approved within hours

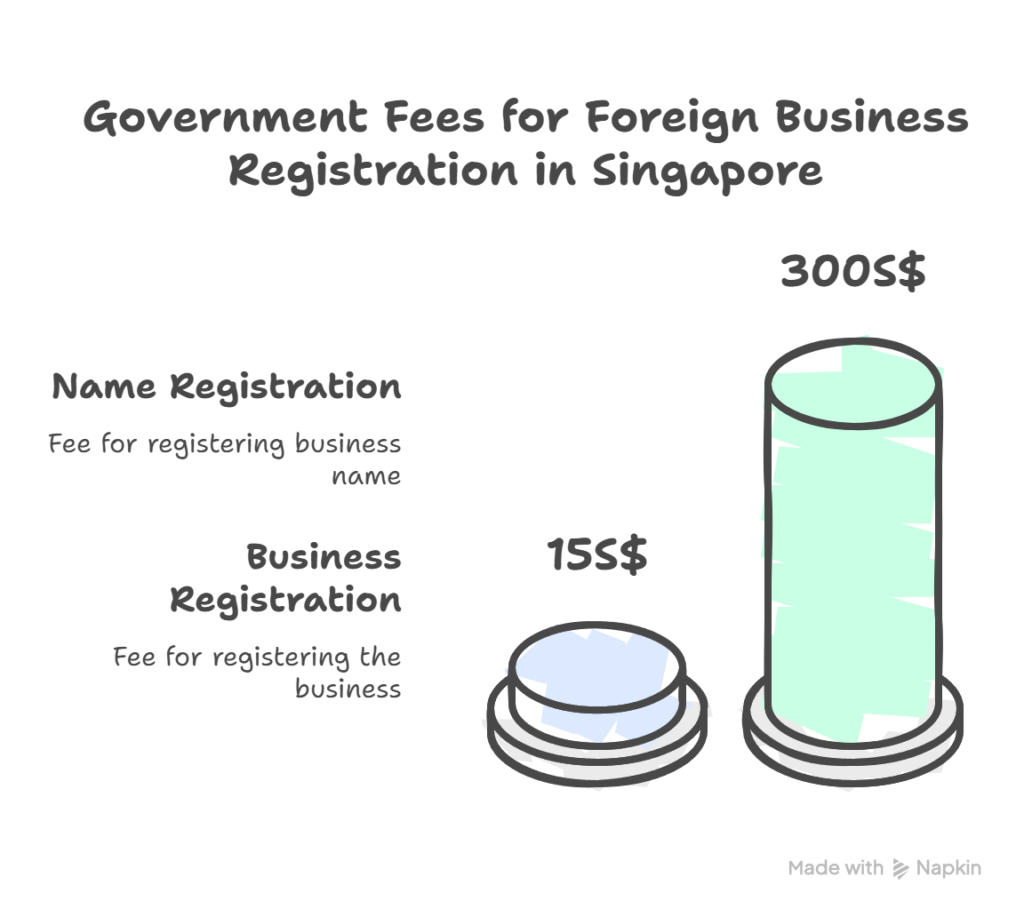

The direct government fees are remarkably low—just S$315 (S$15 for name reservation and S$300 for registration). You’ll have additional costs for service providers if you use them, which most foreign owners do.

To maintain compliance, you must:

- Hold an Annual General Meeting

- File Annual Returns on time

- Submit estimated taxable income within three months after your financial year ends

- File your final tax return by November 30th annually

Missing deadlines can result in penalties, so establishing solid accounting practices from the beginning is essential.

It’s worth noting that Singapore will implement new global tax rules (BEPS 2.0) in 2025. However, these primarily impact large multinational corporations with global revenue exceeding €750 million and likely won’t affect typical expatriate businesses.

If you’re serious about taking advantage of Singapore’s tax benefits, talking to a Singapore corporate service provider like Osome is the best first step. They can handle the incorporation process, provide nominee director services, and manage your ongoing compliance requirements, making it easy to run your Singapore company from anywhere in the world.

Conclusion: A Strategic Decision for Business Owners

PS: Singapore is also one of the best countries for education in the world.

For entrepreneurs seeking greater tax efficiency and access to Asian markets, the benefits of incorporating a company in Singapore are compelling. The combination of low tax rates, exemption programs, territorial taxation, and the one-tier system creates an environment specifically designed to help businesses retain more capital for growth and distribution to owners.

Unlike complicated tax avoidance schemes, Singapore offers a legitimate, respected business environment with transparent advantages built directly into its tax code. For expatriate business owners, particularly those over 45 who are focused on maximizing returns in their prime earning years, Singapore represents not just a travel destination but a strategic hub for financial optimization.

Osome makes incorporation in Singapore hassle-free and completely paperless, so you can manage everything online from anywhere in the world. Incorporate your Singapore company today, and let Osome do the heavy lifting. Click the link below for 16% off any Osome services and get started today!

And if instead of opening a company abroad you just want to retire in a nice place, with sunshine, low taxes, and low cost of living, check my MOST IMPORTANT video ever, where I selected the best cities to move to in Europe – it is by far our greatest video, and you can watch it below.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.