Did you know that 95% of people who qualified for Portugal’s famous tax breaks won’t be eligible anymore?

But here’s what nobody’s talking about – the 5% who DO qualify will get even BETTER benefits than before!

The question is: which group are YOU in?

I talked to one of the biggest specialists on legal and tax matters for expats in Portugal – Lamares, Capela & Associados, to understand what is happening there.

And today, I will compare three expat cases: a retiree, a remote worker, and a tech specialist.

The differences are staggering, and one of them can still access that sweet low flat tax rate.

If you’re one of them, Portugal might actually be rolling out the red carpet for you while showing others the door.

Let’s find out if you’re one of the lucky ones.

Chapter 1. The Golden Era: Portugal’s Original NHR Program (2009-2023)

Remember when Portugal was practically giving away tax breaks to anyone who moved there?

Things changed a lot since then.

Back in 2009, as Portugal struggled through a devastating economic crisis, the government launched what would become one of Europe’s most generous tax incentive programs: the Non-Habitual Resident status.

This wasn’t just another bureaucratic scheme—it was Portugal’s financial lifeboat, designed to attract foreign investment and talent when the country needed it most.

The NHR program offered an almost unbelievable deal: move to Portugal, and you could enjoy a decade of tax exemptions on your foreign income.

Pensions, dividends, royalties—all potentially tax-free. And if you earned money in Portugal? You’d pay just a flat 20% tax rate instead of the progressive rates that went up to 48% for locals. It’s no wonder the program became wildly popular.

The qualification process was remarkably simple. You just needed to become a tax resident by spending at least 183 days in Portugal and prove you hadn’t been a tax resident there during the previous five years.

No complex investment requirements, no minimum income thresholds—just move to Portugal and register. That’s it.

To understand just how attractive this was, imagine two neighbors living side by side in Lisbon. One is Portuguese, earning a €50,000 salary and paying up to €24,000 in taxes.

Next door, an NHR expat with the exact same income pays just €10,000. Even more dramatic: a retiree from the UK with a €50,000 pension could pay zero tax under NHR, while their Portuguese neighbor with the same pension would hand over nearly half to the government.

The program worked—perhaps too well. Over 10,000 foreign residents flocked to Portugal, with the numbers growing each year.

Beautiful coastal cities and Lisbon neighborhoods transformed as wealthy retirees and remote workers moved in, bringing their tax-advantaged incomes with them.

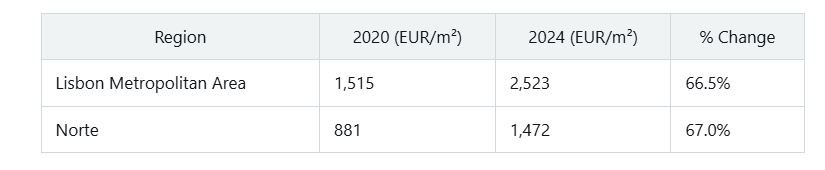

But this success story had unintended consequences. In cities like Lisbon and Porto, housing prices skyrocketed.

Long-term residents found themselves priced out of neighborhoods their families had lived in for generations. The housing market, once accessible to average Portuguese workers, became increasingly out of reach.

Meanwhile, the stark difference in tax treatment between locals and NHR beneficiaries created growing tensions.

Politicians and citizens began asking uncomfortable questions: Why should wealthy foreigners enjoy tax exemptions while Portuguese citizens shoulder higher tax burdens?

Was it fair that foreign pensioners paid nothing while Portuguese retirees with the same income paid substantial taxes? As housing costs continued climbing and local resentment grew, pressure mounted for reform.

The criticism reached a breaking point in October 2023, when Portugal’s Prime Minister made the announcement many had been expecting—but few in the expat community wanted to hear.

Citing “fiscal injustice” as a primary motivation, the government declared the end of the NHR program as it had existed since 2009. The golden era of Portugal’s tax giveaway was officially over.

But not for everyone – for some types of expats, things got EVEN BETTER.

FREE FOR A LIMITED TIME: Grab your Expat Wealth & Lifestyle Compass ($108 value) today! Includes our 74-page guide of Affordable European Cities, our Zero-Tax countries report, and our expat checklist. https://bit.ly/ExpatWealthLifestyleCompass Join us here before this offer ends

Chapter 2. The Big Reset: How NHR 2.0 Changes Everything

What if I told you that Portugal didn’t end its tax incentives – it just decided to be much pickier about who gets them?

When the Prime Minister announced the termination of the original NHR program, he simultaneously unveiled its replacement: NHR 2.0, officially called the Tax Incentive for Scientific Research and Innovation (IFICI), which launched on January 1, 2024.

The specialists from Lamares, Capela & Associados gave us a very good definition of what the NHR 2.0 means:

“NHR 2.0 reaffirms itself as a strategic opportunity to attract talent and investment to Portugal, promoting key sectors and reducing regional inequalities. Despite the changes, the status remains a powerful tool for qualified residents seeking competitive taxation and support for their professional development.”

This isn’t just a minor tweak to the original program – it’s a fundamental reimagining of who Portugal wants to attract.

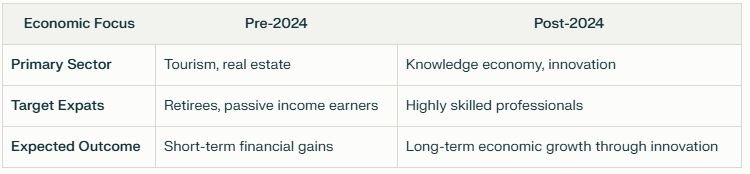

Where the original NHR cast a wide net welcoming almost anyone with sufficient means, the new system employs a precision approach, targeting only those who can directly contribute to Portugal’s knowledge economy.

The shift is dramatic.

According to experts familiar with both programs, approximately 95% of expats who qualified under the original NHR would find themselves ineligible under the new criteria.

Portugal has effectively closed the door on passive income earners while leaving a small window open for highly qualified professionals.

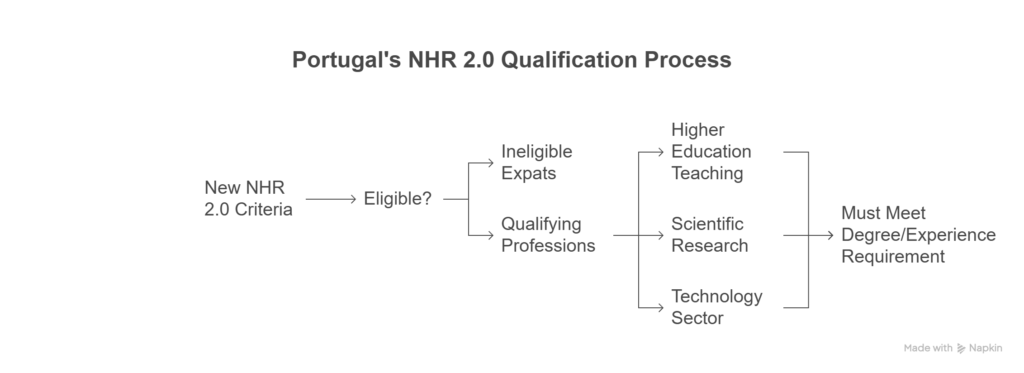

To qualify for NHR 2.0, you must work in specific sectors deemed valuable to Portugal’s future. These include higher education teaching, scientific research, technology, and other government-recognized strategic areas.

The qualifying professions list is selective: company directors, specialists in physical sciences, mathematics, engineering, doctors, and university professors make the cut – provided they have at least a bachelor’s degree or equivalent experience.

Remember how straightforward the original application process was? Those days are gone.

Applying for NHR 2.0 requires navigating a complex web of government agencies. You’ll need to register with the Foundation for Science and Technology, the Portuguese Trade and Investment Agency, the Tax and Customs Authority, and the Agency for Competitiveness and Innovation.

Each step requires documentation proving your qualifications and contributions to Portugal’s strategic sectors.

The timeline for application has also become more structured. Applications must be submitted by January 15th of the year following when you become a Portuguese resident.

For those becoming residents in 2024, there’s a transitional deadline of March 15, 2025 – a date many expats have already marked on their calendars.

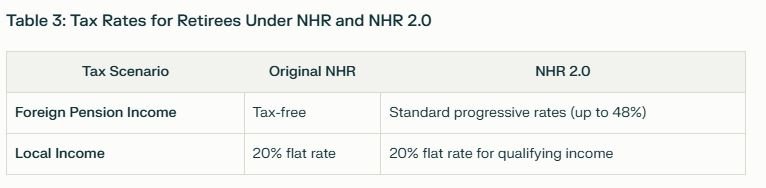

The most seismic change affects retirees. Under the original program, foreign pension income enjoyed complete tax exemption.

Under NHR 2.0, that same pension income gets taxed at Portugal’s standard rates – which can climb to a painful 48%. This single change effectively eliminates the primary financial incentive that attracted thousands of retirees over the past decade.

For the select few who do qualify, the 20% flat tax rate on qualifying income remains in place – a substantial benefit when compared to Portugal’s progressive tax rates.

But the message is unmistakable: Portugal no longer wants to be Europe’s retirement haven. Instead, it’s positioning itself as a destination for working professionals who can contribute directly to its economic transformation.

According to Lamares, Capela & Associados:

“The NHR 2.0, continues to offer attractive tax benefits, such as a reduced 20% income tax rate for qualified professionals in strategic areas for the national economy.”

The government’s strategy is clear. Rather than simply collecting property taxes and VAT from wealthy retirees, Portugal now wants to attract the architects of its future economy – researchers, engineers, and innovators who can help transform Portugal from a tourism-dependent economy to a knowledge-based one.

This shift represents a calculated gamble. Portugal is sacrificing the immediate cash flow from thousands of wealthy retirees in exchange for a smaller number of skilled professionals who might create lasting economic value.

Whether this strategy succeeds depends on how many qualified professionals choose Portugal over competing destinations like Estonia, Ireland, or the Netherlands, which offer their own incentives for tech talent.

Chapter 3. Winners and Losers: Three Real-World Scenarios Under NHR 2.0

While Portugal recalibrates its expat strategy, real people face dramatically different financial futures.

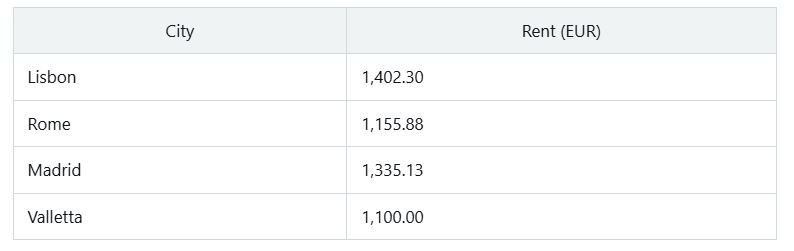

What happens when three different expats – a British retiree, a tech entrepreneur, and a digital marketer – all try to make Portugal their home in 2025? The numbers tell a story that might change your entire relocation plan.

Let’s meet Mary, a British pensioner who planned to enjoy her retirement years in Portugal beginning in 2025. Mary receives a €50,000 annual pension from the UK, which under the original NHR would have been completely tax-exempt (or taxed at just 10% if she registered after April 2020).

But NHR 2.0 has completely upended her financial outlook.

Under the new system, pension income no longer qualifies for any special treatment.

Mary’s €50,000 will now be subject to Portugal’s standard progressive tax rates, which can climb all the way to 50%.

Running the numbers, Mary could find herself paying more than €15,000 in annual taxes – compared to paying nothing (or at most €5,000) under the previous system. That’s not just a minor adjustment – it’s a financial shock that could force her to reconsider her entire retirement strategy.

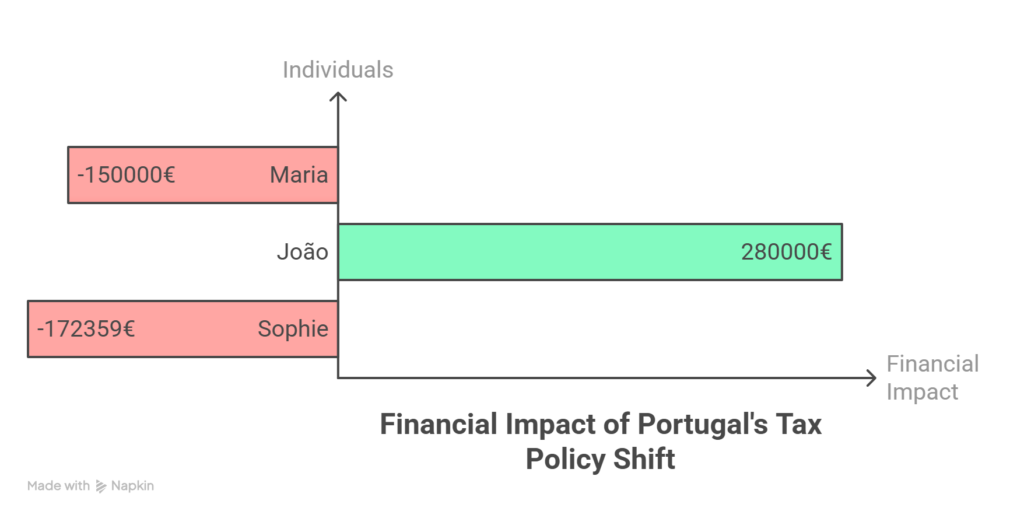

Now, contrast Maria’s situation with João, a Portuguese-American tech entrepreneur who moved to Portugal in 2024 and registered for NHR 2.0 in early 2025.

João makes€100,000 a year from his tech startup, placing him squarely in the category of professionals Portugal is actively courting. His profession qualifies him for that coveted 20% flat tax rate on his Portuguese income.

Without NHR 2.0, João would be staring at tax rates of up to 48%. But thanks to his qualifying profession, he’ll save approximately €28,000 annually.

That’s money he can reinvest in his business, improving his quality of life, or simply saving for the future.

Over the 10-year period of the program, João stands to save about $280,000 – a significant competitive advantage that Portugal has intentionally engineered for entrepreneurs like him.

What about someone in between these two extremes? Meet Sophie, a French digital marketer who relocated to Portugal in 2025, earning €60,000 annually from clients back in France.

Despite being a working professional, her particular field doesn’t make the cut for NHR 2.0’s approved list of professions.

This means Sophie’s foreign income is now taxable in Portugal if it’s not already being taxed in France. If that income falls under Portuguese taxation, she could face up to €17,235 in taxes – whereas, under the old NHR system, she would have paid nothing on that foreign-sourced income.

That’s a potential €288,000 difference over a decade.

You might also find yourself in a situation like Carlos (not mentioned in our three main examples), who registered for the original NHR before 2024. These early birds will continue to enjoy their benefits until their 10-year term expires, creating an interesting disparity where neighbors with identical professions and incomes might have drastically different tax situations based solely on when they arrived.

Adding up the decade-long impact shows just how strategic Portugal’s policy shift has been. Mary loses over €150,000 compared to the old system. João gains €280,000 he wouldn’t have had under standard taxation. Sophie potentially loses out on €172,359 in tax savings she would have enjoyed just a year earlier.

Conclusion on Moving to Portugal in 2025

What’s fascinating about Portugal’s new approach is that while the door has narrowed, it hasn’t closed completely. The country is simply being more selective about who it rolls out the red carpet for.

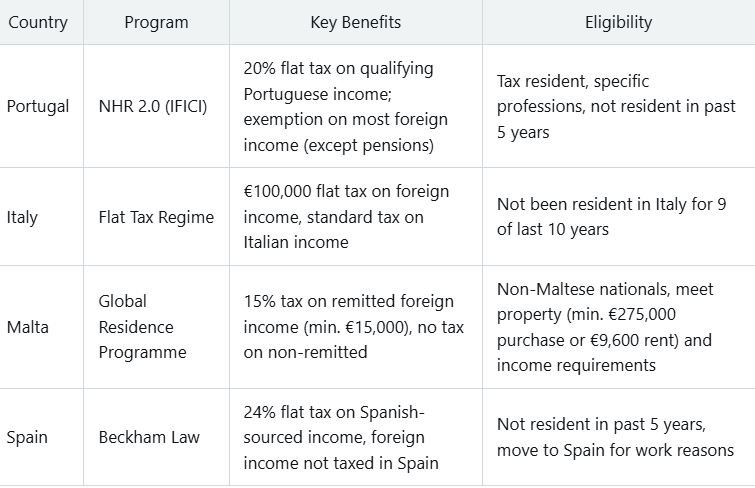

If your career doesn’t fit into Portugal’s strategic vision, don’t worry – alternatives await.

And remember: Portugal is much more than just Lisbon and Porto. It has some incredible smaller cities, with high quality of life and very affordable cost of living. 3 of them are among the 15 best small cities to retire in entire Europe! These charming cities offer a rich cultural experience, stunning landscapes, and delicious local cuisine that rivals the larger metropolitan areas. Additionally, their affordability makes them some of the cheapest European flight destinations, allowing you to explore not only Portugal but also the surrounding countries with ease. Embracing life in these smaller cities can provide a fulfilling and enriching retirement experience.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.