Have you ever imagined keeping every single dollar you earn? These countries make it possible—legally! But first of all, you might be asking why I decided to talk about the 5 best countries with zero-income tax, instead of talking about ALL 15 countries that have no income taxes? Many people overlook the implications of income tax rates in South America, where some nations offer significantly lower rates compared to others.

The answer is simple: Because I respect your time.

Why would I waste your time telling you that countries like Somalia or North Korea have no income tax?

Would you move there just to not pay taxes?

And risk becoming a hostage of pirates, or worse, a hostage of this dictator who really likes lubricant.

Yes, I don’t think so.

Instead, I selected 5 countries that offer decent standards of life, and no income tax at all – ZERO.

The first country is actually a place where I lived for years, and is one of the richest in the world.

Qatar

When I first moved there, I realized that zero income tax is just one of the many intriguing characteristics of this country.

And yes, I will talk about the matter of Islamic law and the apparent lack of freedom in a few minutes, because those are important considerations, but first, allow me to explain the other side of this small country – a side that I discovered living there.

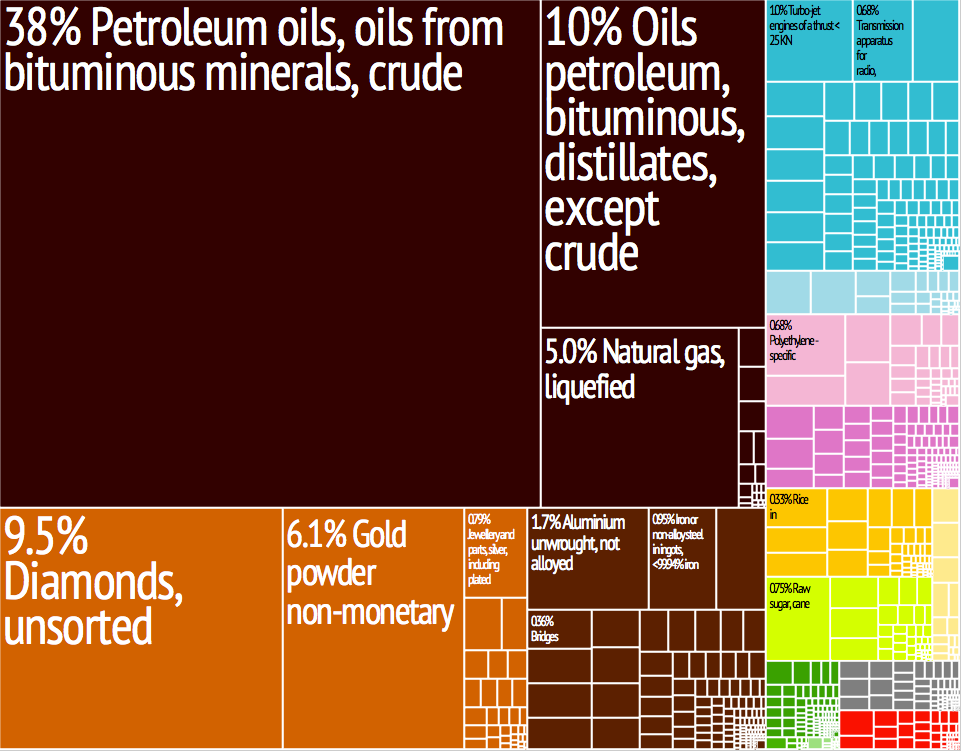

Located in the Arabian Peninsula, Qatar is known for its abundant oil and natural gas reserves, and it is one of the wealthiest nations on Earth by GDP per capita. Qatar’s economy relies on hydrocarbons (oil and gas), and revenues from these resources let the government fund modern infrastructure.

Despite having ZERO income tax, the roads are well-maintained, and most public services are very decent. They built an impressive subway network in record time, so now people can travel around Doha in comfortable, fast, and air-conditioned underground wagons.

Public healthcare is well-taken care of – they have one of the biggest and best public hospitals in the entire Middle East, The Hamad Medical Corporation.

Another impressive thing about Qatar is that you don’t need to speak Arabic to live there – I don’t, and I lived there for years just fine. More than 85% of the country’s population are foreigners, and English is common everywhere.

Qatar’s government welcomes expats for skilled jobs, and most expats work on a contract or sponsorship basis, not paying any income tax.

Now, the thing that probably you are expecting me to talk about: Qatar is an Islamic country, and one of the most conservative in the GCC – there is some cultural shock when you live there.

I was warned once because I was drinking water in public during Ramadan – and during Ramadan, you are not supposed to drink water in Public.

But…

What if I told you that there is a neighbor from Qatar, that offers similar advantages, but with a much smaller cultural shock?

A country where you can live in a much more relaxed manner?

The United Arab Emirates (UAE)

This is the place where we, expats in Qatar, usually went to have fun – and that says a lot about the differences between Qatar and the UAE. It is also another country with zero income tax, so let’s see what makes it so appealing.

Because much like Qatar, the UAE built its economy on hydrocarbons. However, it has diversified ,and now, finance, tourism, and real estate help drive growth.

Dubai is a top financial hub in the Middle East. The emirate leverages free trade zones that draw foreign companies and investors and this policy fosters healthy business competition and a thriving economy.

Yes, it is not a cheap place to live, and the cost of living can be high in cities like Dubai and Abu Dhabi – housing, especially in prime areas, carries a premium. However, the Emirates is much more than Dubai or Abu Dhabi, and not long ago I wrote an article about Ras Al-Khaimah.

Ras Al Khaimah is a city that offers the same tax advantages as Dubai or Abu Dhabi, but with a much lower cost of living – and then, there is the upside of zero income tax.

Many expats decided to move to the UAE because they weigh the costs and see that they can still save money compared to high-tax countries, and honestly, if you live in a large city in Canada, the US, or England, there is a big chance that Dubai is actually cheaper than your city.

Dubai is cheaper than Vancouver in Canada.

And it is cheaper than Portland in Oregon.

With the added benefit of not having entire districts taken over by Fentanyl junkies.

Entertainment is something that you will be well-served in the UAE. Theme parks, global restaurants, and year-round sunshine will not let you be bored – and if you are, just hop on a flight and you can travel anywhere in the world using their 5-star airlines.

Just like Qatar, the UAE has very, very, very low crime rates – the government enforces strict laws, and the police presence is visible. This gives many expats a strong sense of security, and it is also a key reason families choose to settle there.

The UAE offers investor visas, employment visas, and other permits that allow people to live in the country long-term TAX-FREE – and by the way, if you want me to make another video with more details about the UAE or Qatar or any of the countries I will mention today, let me know in the comment section.

The next country is also in close – and it is the last Middle Eastern country we will talk about today.

Syria!

No, I am just kidding.

It is Bahrain

This is another Gulf country where individuals do not pay income tax. It shares many cultural similarities with Qatar and the UAE. Yet, it has its own personality and advantages.

The main issue people have with Bahrain is that it is very small, so at some point it is easy to get bored. And that is why expats who want a smaller, more laid-back alternative to Dubai sometimes pick Bahrain.

Bahrain positions itself as a financial hub. It is home to numerous banks and financial institutions, and offshore banking plays a big role in its economy. Oil and gas are still part of the equation, but Bahrain has made strides to diversify. Its business-friendly environment includes policies aimed at foreign investors.

Housing costs in Bahrain are generally lower than in the UAE and Qatar. The capital, Manama, has modern apartment buildings, malls, and a waterfront promenade. Like others in the Gulf, it has a hot climate, but the indoor facilities are well-air-conditioned.

And here allow me to a quick digression:

Many people fear the excruciating temperatures in this part of the world, but during my years living there, I rarely noticed them, because nearly everywhere, from shops, to public offices, to stadiums, is air-conditioned.

Despite its small size, Bahrain is known for some big events, like the Formula One race, and a lively dining scene. This is what a local resident told us about living in Bahrain:

“The country has very friendly people and a big expat community as well. I used to live in England, and I hated how everything closed around 4 PM where I lived, but in Bahrain, shops and malls are open till 10 PM if not more. The food is good and there are plenty of options. Weather is a double-edged sword, very hot in the summer, but very pleasant in the ‘winter’. The country is incredibly safe as well, and the most dangerous things here are the stupid drivers.”

Investors can apply for a self-sponsored investor visa, and one impressive thing about this island is that Bahrain has a liberalized economy with 100% foreign ownership allowed in most sectors – something impossible in Qatar, for example. Once you have legal residency, you can benefit from zero personal income tax.

Now from the Middle East, we go to Europe, the continent where the next country in our list is located.

Monaco

Monaco isn’t just another European destination—it’s an entirely different world, and here are some things you probably never heard about.

Their history is deeply tied to the Grimaldi family, who have ruled since the 13th century. Over the centuries, they created a stable, secure haven that gradually became a magnet for the world’s wealthy. And while the Monte Carlo Casino is one of Monaco’s most famous landmarks, there’s an intriguing twist—the citizens of Monaco aren’t allowed to gamble there, only visitors!

Monaco is located in the stunning French Riviera, and the entire principality covers just over two square kilometers. To put that into perspective, it’s about half the size of Central Park in New York.

So yes, Monaco is small, but still, 9 of the 12 best tennis players in the world live there, as well as 9 of the 20 Formula 1 Pilots live in Monaco.

And do you know why?

Let’s get straight to the point— because Monaco does not impose personal income tax. Whether you’re an entrepreneur, investor, or a high-earning professional, this means you get to keep 100% of what you make. While most European countries impose hefty income taxes (often upwards of 40-50%), Monaco has remained a tax-free haven since 1869. This is the number one reason why the wealthy relocate there.

But it’s not just about income tax. Monaco also has no capital gains tax or wealth tax, making it incredibly attractive for those with significant assets. Whether your income comes from investments, business profits, or high salaries, it stays entirely yours. For residents, this translates to an unmatched level of financial freedom.

While anyone can visit Monaco, not just anyone can become a resident. To take advantage of its tax benefits, you need to establish official residency. That typically requires:

- Proof of financial stability – Generally, you need to deposit a significant sum (often €500,000+) into a Monégasque bank.

- Property ownership or rental – You must either buy or rent property in Monaco, and rental prices can be extremely high.

- A minimum stay requirement – While not as strict as some other countries, you do need to spend a fair amount of time in Monaco to maintain residency.

Once you’re officially a resident, you’re free to enjoy all of Monaco’s perks—including its tax-free status.

Of course, nothing this good comes without a trade-off. Monaco is one of the most expensive places to live in the world. Real estate prices are astronomical, with properties often costing upwards of €50,000 per square meter. Rental costs are equally high, and daily expenses match the overall level of luxury. However, depending on how much you will save on taxes, these extra costs might be more than justified.

Let’s take for example the top tennis player Jannik Sinner, who is Italian but lives in Monaco.

In 2024 he made only on tournament prizes – not counting sponsorship deals – 19.7 million dollars.

If he lived in his native Italy, he would have paid 8.5 million euros, or 8.8 million dollars, in taxes – but in Monaco, he paid ZERO.

But while Monaco attracts tennis players and Formula 1 pilots looking to pay less taxes, there is another country that attracts singers and musicians.

By the way, if you’re reading this article, you’re probably planning to travel abroad for a longer time, and you want to save money and pay fewer taxes. I’ve written three top-rated Amazon books on living abroad, based on my experiences and insights from hundreds who’ve done the same – You can purchase them through this link.

Now answer me one question: How is it possible that Shakira pays no income taxes?

Here is the answer:

Because she lives in the Bahamas!

Or at least that is what she told the Spanish tax authorities for a very long time.

Now, in this article, I didn’t enter into much detail on how to become a fiscal resident of these countries, but if you want to know more about it, let me know in the comment section.

Back to the subject, the Bahamas isn’t just a postcard location for celebrities—it’s also one of the few places in the world where personal income tax simply doesn’t exist.

No deductions, no surprise withholdings, just your full paycheck, untouched by the government.

But the most curious part is that The Bahamas is not an oil-rich state like Qatar or Bahrain

So you might be wondering: If there’s no income tax, how does the government keep things running?

The answer lies in two major economic pillars—tourism and financial services.

Tourism is the Bahamas’ bread and butter. Millions of visitors touch down every year, drawn by its powdery white beaches, crystal-clear waters, and luxurious resorts. With high-end hotels, cruise ship stops, and a buzzing travel industry, tourism dollars pour into the local economy, helping to fund public services.

Then there’s the financial sector and here is where things get really interesting.

Banks, offshore investment firms, and international businesses are drawn to the Bahamas because of its favorable tax laws and a prime location near the U.S. The government has created policies that make it attractive for foreign investors to bring their money there. And while some might think these laws only benefit the ultra-wealthy, the reality is that they help keep the entire economy humming.

The quality of life there is among the highest in Latin America and the Caribbean.

It’s not just personal income tax that’s nonexistent in the Bahamas. There’s also no corporate tax, no capital gains tax, and no inheritance tax. Whether you’re an entrepreneur, a remote worker, or a retiree, your money stays yours. No wonder so many celebrities move there, using the Bahamas as either a full-time home or a tax-friendly base.

Of course, the government still needs revenue, so they make up for it in other ways. There’s a tax on imported products, and property taxes on some real estate. Fees related to tourism also bring in steady income. This system has held up—largely thanks to the Bahamas’ year-round tourist appeal, which keeps the cash flow consistent.

At the end of the day, the Bahamas offers more than just stunning scenery. It’s a place where your money stays yours, your stress levels drop, and your biggest decision might just be whether to spend the afternoon at the beach or on a boat. And honestly, that sounds like a pretty good way to live.

Now, if any of the countries I mentioned today are for your taste, don’t worry.

There are some places in Europe where you pay lower taxes – maybe not zero, but single-digit taxes.

Two of them are very attractive because not only do they offer you a special tax scheme where you pay just 7% income tax, but also…

PEOPLE THERE LIVE LONGER.

If you are curious to know more about these two countries, check this article.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.