Thinking of retiring in Spain? Have you ever asked about the cons of living in Spain?

Before you do, ask yourself:

Can you handle paying some of the highest electricity rates in Europe?

Higher than France, Higher than Germany, Higher than Sweden!

Are you prepared for a complex tax system that can be completely different between communities?

Are you aware that some Spanish cities are now more expensive than some large cities in Florida?

If these questions make you uncomfortable, keep reading, because I’m about to share 5 crucial reasons why some expats regret their decision to retire in Spain.

I personally investigated these things for you and the good part is that most of them, are quite easy to avoid – and you should avoid them, because your retirement dreams might depend on it.

We start with…

The Tax Trap: How Spain’s Complex System Can Drain Your Savings

Let’s think about a scenario: You’ve just retired to Spain, it is 29 degrees Celsius outside, perfect beach time – and the beach is just 300 meters from your apartment,

You are ready to enjoy your golden years!

But…. instead, you’re drowning in paperwork, trying to decipher a tax system that seems designed to confuse even the most financially savvy expats.

Let’s start with a shocker: Spain has a wealth tax. Yes, you heard that right. It’s not just your income they’re after, but your global assets too. Imagine working hard all your life, saving diligently, only to find out that the country you’ve chosen for retirement wants a slice of your entire financial pie.

And it gets even more complicated. The Spanish tax system is quite different from other major European countries like France or Germany, since Spain is composed of autonomous regions.

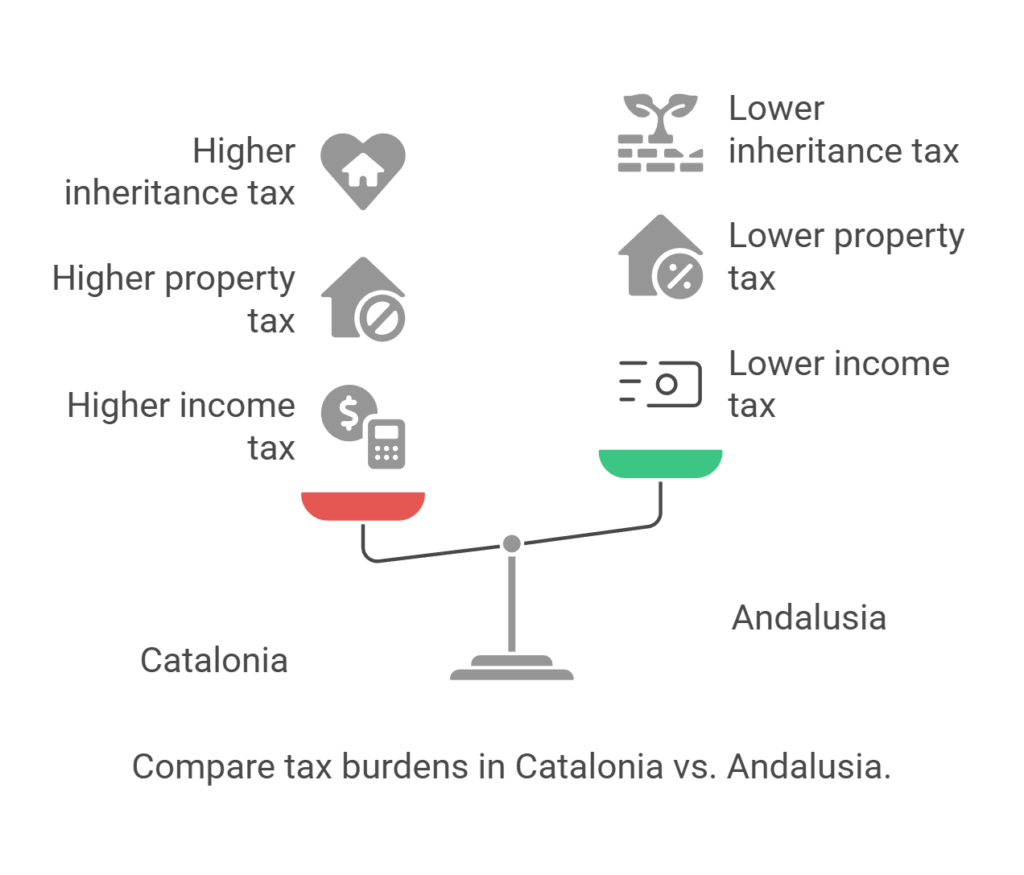

You might think you’ve found the perfect spot in sunny Catalonia, only to discover they charge up to 3.5% on assets over €500,000. Meanwhile, if you’d chosen Madrid, you’d be off the hook for the wealth tax entirely. It’s like playing a high-stakes game of financial roulette, where your choice of address can make or break your retirement budget.

Now, you might have heard about the ‘Beckham Law’ – sounds great, right? A special tax regime that was inspired by no one less than David Beckham and became an incentive for high earners to move to Spain. However… it’s generally not applicable to most retirees. So in this case, you can’t even take advantage of the tax breaks designed for the ultra-wealthy.

Here’s another bombshell: many expats are shocked to learn they might owe taxes to both Spain and their home country. Imagine the horror of realizing you’re on the hook for double taxation. Suddenly, that carefully planned retirement budget starts to look woefully inadequate.

You might be thinking, “Surely, there must be tax treaties to prevent this kind of thing?”

Well, you’re right, but here’s the catch: these treaties are often so complex and misunderstood that even tax professionals struggle to interpret them correctly. What was supposed to protect you from double taxation can end up being a source of confusion and unexpected liabilities.

Let’s put this into perspective. Many retirees ignore differences between Spanish autonomous communities and find themselves paying more in taxes in Spain than they ever did back home.

Let’s say that you are a foreigner retiring in Spain. Your annual income is the equivalent of 54000 euros. You want to buy a property close to the beach, worth around 170,000 euros, and live there.

If you chose the autonomous community of Catalonia, your income tax would be around 15,800 euros, and you would pay annual property taxes up to 2,210 euros.

If instead of Catalonia, you chose Andalusia, your income taxes would be 2% smaller, and the property taxes up to 69% lower!

Inheritance and gift taxes also show large differences: in Catalonia, you would pay higher rates (up to 21.25% inheritance taxes for distant relatives), while in Andalusia, you would benefit from discounts up to 99% for close relatives

So, what’s the lesson here? The autonomous community you choose to live in can have a massive impact on your savings due to significant tax code differences. Choose right, and you might save a lot of money.

The second reason some people regret retiring in Spain also hits our pockets, and many ignore this issue– but they shouldn’t.

But before revealing it, I’d like to ask a small favor: if you enjoy this episode, please hit the like and subscribe buttons.

The 2nd Reason Are the Unexpected Little Expenses That Get Big With Time.

Because just when you thought you chose the perfect autonomous community of Spain to pay lower taxes, there’s another financial surprise heading your way.

Did you know that staying cool in your Spanish home could cost you more than you ever imagined? It’s time to talk about the hidden costs that catch many retirees off guard.

Spain’s electricity rates are among the highest in Europe, often 20-30% more than in Germany or France. But wait, there’s more! Many Spanish homes lack proper insulation, which means you’re not just battling the summer heat – you’re in for a chilly surprise when winter rolls around.

Here is a tip however – you can save money in Spain by changing your electricity provider! This is what a local told us:

“I used to have an electricity cost of approx. 300 euro for every two month period, and I realized that this was a lot. I recently changed from Endesa Energy to Octopus Energy and my bills have halved!”

Electricity bills are not the only thing that might surprise you. If you’re thinking of bringing your car to Spain or buying one there, brace yourself. Owning a vehicle in Spain isn’t just about fuel costs and insurance. You’re looking at hefty annual taxes and mandatory inspections that can add a significant chunk to your yearly expenses. It’s not uncommon for retirees to find themselves questioning whether that convenient set of wheels is worth the financial burden.

But the surprises don’t stop there. If you’ve chosen a lovely coastal area for your retirement (and Spain has MANY lovely coastal areas for you to choose – I made an entire article about them), still, you might be in for a seasonal shock.

Many coastal regions in Spain charge extra for water during tourist seasons. Suddenly, that refreshing shower after a day at the beach comes with a price tag that might make you think twice about your water usage.

Another tidbit that often catches expats off guard are the healthcare costs. While Spain has a decent universal healthcare system, the waiting lists for an appointment might be long sometimes.

Another issue with public healthcare in Spain is that your medical history is not on a national database, but on the public system of each autonomous community, so if you move from Valencia to Murcia, just 2 hours away, the public hospital in your new city will have little to no information about you.

For those reasons, many expats opt for additional private insurance – this decision can add an extra €100-200 per month to your expenses.

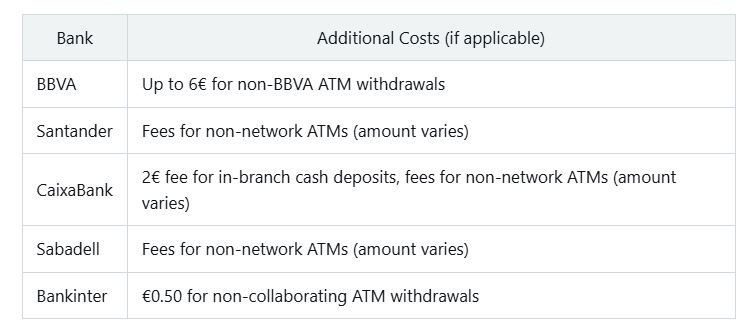

And let’s not forget about banking. If you open a regular current account in Spain, chances are you’ll have to pay for it. Big banks like Santander, and Unicaja charge around €240 per year in maintenance fees alone. On top of that, you may pay around €20 for a credit or debit card.

It’s these kinds of unexpected fees that can slowly but consistently eat away at your retirement savings.

The next reason does not affect your savings, but your patience…

The Bureaucratic Nightmare: How Spanish Red Tape Can Turn Your Dream into a Headache

Spain’s bureaucracy is like a labyrinth designed by a mischievous architect. Processes that should take days can drag on for months or even years. Imagine spending half a year trying to get your residency card, only to discover you need to start all over again because a rule changed while you were waiting.

It’s not just frustrating; it’s a time-consuming nightmare that can leave you questioning your decision to retire in Spain.

Many government offices in Spain still operate like it’s 1985, with paper-based systems that require multiple in-person visits.

You’ll find yourself shuttling between offices, collecting stamps and signatures like they’re rare Pokemon cards.

But wait, it gets better (or worse, depending on how you look at it). If your Spanish isn’t up to par, you’re in for a real treat. Many official procedures require fluency in Spanish, and while some larger cities might offer English-language services, don’t count on it in smaller towns or rural areas. Language barriers can turn a simple task into a Herculean challenge – but more about that in a few minutes.

Let’s talk about appointments. In many countries, you can book an appointment online and show up at the designated time. In Spain? Not always. Getting an appointment for official paperwork can be a frustrating game of chance and patience. You might find yourself refreshing a government website at midnight, hoping to snag one of the few available slots.

And just when you think you’ve got it all figured out, the rules change. Without warning, requirements can shift, leaving expats scrambling to comply. It’s like playing a board game where someone keeps changing the rules mid-play. Some retirees report spending thousands of euros on lawyers and translators just to navigate this ever-changing maze of bureaucracy.

Even tasks that should be simple, like registering a car, can turn into week-long ordeals. You might start the process on Monday, thinking you’ll be done by Tuesday afternoon, only to find yourself still running around on Friday, collecting yet another obscure document from yet another office.

And remember when I mentioned language issues when dealing with Public offices? Well, it is not really just at public offices that this might be a problem,

And indeed the next reason for regret about moving to Spain is more common among Brits who expect that everyone would speak English in Spain…

The Language Barrier: When ‘Hola’ Isn’t Enough

You might think that this is a non-issue because if you had been to Barcelona or Madrid, most people you met could speak English on a decent level, right?

But Barcelona and Madrid are DEFINITELY not representative of Spain on this matter.

Spain has one of the lowest percentages of the population able to hold a conversation in English in the entire Europe!

English proficiency in Spain is well below Poland, or Romania.

Imagine trying to set up utilities, deal with bureaucracy, or make new friends when you can barely string together a sentence in Spanish. It’s not just inconvenient; it can be downright isolating.

And I am not blaming them here by the way – they are in Spain, so, unless they work in the tourism sector, we cannot blame them for not speaking English. As I often say in my other articles, if you are planning to move to a country, you are the one who should adapt – and that includes learning the local language.

Unfortunately, it is common for people to ignore that this rule is also valid for Spain and they just try to move there with barely any knowledge of Spanish.

Many expats report feeling cut off from the local community, unable to form meaningful connections with their Spanish neighbors. This isolation can take a toll on mental health and social integration, turning what should be an exciting new chapter into a lonely experience.

Healthcare is a major concern, with language barriers risking miscommunication with doctors. Expats may struggle to explain symptoms or understand treatments, especially in public healthcare, where English-speaking staff are scarce.

Even simple daily tasks become daunting when you’re struggling to express yourself.

Often retirees from the US and UK rely on English-speaking expat communities, limiting cultural immersion.

For example, 60% of the British expats who live in Málaga do not speak Spanish well in, and one-third rarely meet locals

But here’s the good news: learning Spanish can dramatically improve your retirement experience in Spain. Many resources are available for older learners, including community classes, online platforms, and local language exchange meetups.

Additionally, there is a funnier and nicer way to learn a language. The method I use to learn new languages is this one (by using this link you get a 40% discount after trying for free, and if you subscribe, you’ll get a 40% discount!)

But enough talking about things that take our time – let’s go back to things that take our money.

The next reason some expats regret moving to Spain is…

The Housing Squeeze: The Most Recent Of The Cons of Living in Spain

By the way, if you’re reading this article, you’re probably planning to travel abroad for a longer time, and you want to save money and pay fewer taxes. I’ve written three top-rated Amazon books on living abroad, based on my experiences and insights from hundreds who’ve done the same – You can purchase them through this link.

Remember those quaint, affordable Spanish villas you’ve been dreaming about? Well, they’re mostly gone – they are not there anymore, at least in most cities.

Spain’s housing market has undergone a seismic shift that in many cases even caused some popular turmoil. People protested the increasing housing prices and in many cases, they blamed tourists or even retired expats.

Something that, in my opinion, is utterly bollocks.

Prices do not raise only because you have more demand, but also because government-stimulated inflation makes money worth less – and I am pretty sure this opinion might make some of my viewers furious in the comment section – so if you disagree, tell me in the comment section why.

But I repeat: I don’t believe expats are to blame for the increasing housing prices in Spain, so back to the subject…

The demand for housing in popular cities like Barcelona, Madrid, and Malaga has skyrocketed while, leaving many retirees shell-shocked.

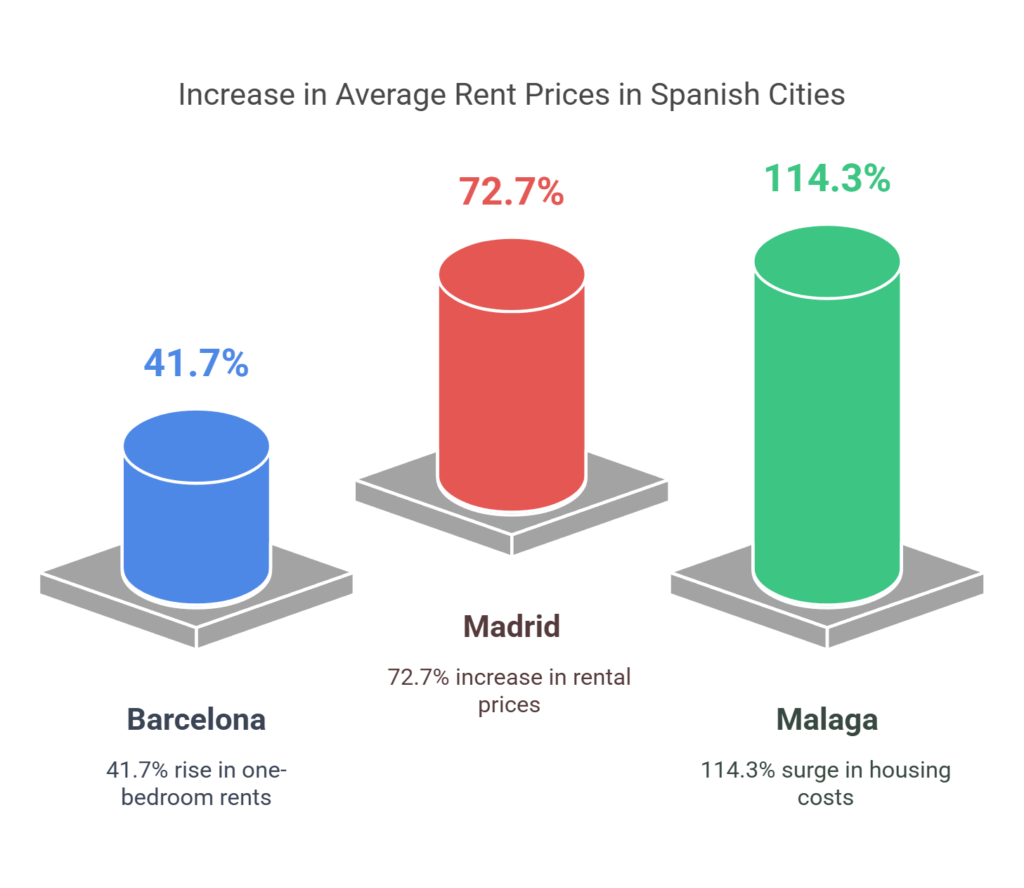

Barcelona saw a 41.7% increase in average rent for a one-bedroom apartment, from €776 in 2015 to €1,100 in 2023. Madrid experienced a 72.7% rise, with rents jumping from €550 in 2014 to €950 in 2024. Malaga had the highest increase at 114.3%, with rents for a one-bedroom going from €350 in 2014 to €750 in 2024.

That cozy apartment with a view of the Mediterranean? It might now be completely out of reach.

One of the reasons for this is the Airbnb effect. The boom in short-term vacation rentals has thrown a wrench into the housing market. In Barcelona, Airbnb listings grew from 2,000 in 2014 to 12,000 in 2024, a sixfold increase. Madrid saw listings rise from 1,000 to 19,000, a nineteenfold increase, while Malaga’s listings grew from 500 to 4,905, nearly tenfold.

Many landlords now prefer the lucrative short-term rental market over long-term tenants, driving prices even higher. It’s not just tourists feeling the pinch – locals are struggling too. Spanish citizens have taken to the streets in protest, highlighting just how severe this housing crisis has become.

And if you’re hoping to find a nice studio or one-bedroom apartment, brace yourself for another surprise. Many rental properties in major cities are designed for shared living, making it even tougher for retirees looking for their own space. The hunt for housing has become so competitive that securing an apartment, especially during the summer months, can feel like trying to win the lottery.

HOWEVER… This is something that mostly happens in big cities like Barcelona, Madrid, or Valencia.

Honestly, why would you prefer to retire in the middle of a big, expensive city? People go to those big cities to make money, not to enjoy their lives – so I made an article about the best small cities to retire in Europe – and many of them are actually located in Spain, so take a look at this article.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small commission if you make a purchase.