Suppose you’ve ever wondered which country is the ultimate Mediterranean spot for those looking to live a peaceful, sunny, and healthy life in Europe while paying lower taxes.

In that case, I’ve got a groundbreaking comparison that will completely change the way you see both Italy and Greece.

I have been to both places numerous times and talked to numerous expats living there.

Today, I will show you how these two countries compare in five essential factors that almost nobody considers but are crucial to your quality of life.

By the end of this guide, we will compare three cities in Greece to three cities in Italy.

Considering all these factors, plus the cost of living, we will crown the king of Mediterranean destinations for retirees looking to move abroad. Among the stunning options available, one destination stands out for its striking balance of culture, climate, and cost-effectiveness. This region offers not only breathtaking views and rich history but also affordable homes for retirees abroad, making it an attractive choice for a serene lifestyle. With numerous amenities catered to the expat community and a welcoming atmosphere, it’s no wonder that this charming locale is quickly becoming the go-to paradise for those looking to retire in the Mediterranean.

We will not include factors like weather, which is splendid in both Italy and Greece. Food, which is also mouthwatering in both countries, will also be left out, although I must note that Greek cuisine is my personal favorite.

Retirement in Italy vs Greece Comparison

1. Taxes

We start our comparison with a factor that directly impacts everyone’s pockets. Which Mediterranean country has lower taxes on income and pensions from abroad—Italy or Greece?

Italy’s Tax Regime

Italy offers an attractive tax regime, where you can pay much lower taxes than in countries like France or Portugal, but it comes with specific conditions.

In this special tax regime, individuals pay a flat tax rate of 7% on income and pensions from abroad during the first 10 years. So if you earn the equivalent of 50,000 euros per year, this is less than half of the percentage you would pay in France, for example. Since, differently than Italy, France does not offer a flat tax rate for expat retirees, but just a progressive system that would take more than 16% of their income.

However, this attractive tax regime offered by Italy has some conditions. First, it is valid only in the southern regions of the country. These regions include Sicily, Calabria, Sardinia, and parts of Campania, Basilicata, and Puglia.

Another rule is that this special tax treatment is only valid for towns with populations below 20,000 people. So, if you’re thinking of moving to a larger city like Bari or Palermo, you won’t benefit from these lower rates.

It’s an attractive deal, but it’s highly specific to these less-populated areas, making it perfect for someone looking for a quieter lifestyle in smaller towns.

Greece’s Tax Regime

Greece, on the other hand, has a very similar special tax regime, also with just a flat tax rate of 7%, but with a BIG difference. It applies across the entire country, without restricting the benefit to certain regions or small towns. In Greece, foreign retirees can benefit from a flat 7% tax rate on their worldwide income, regardless of whether they choose to live in Athens, Thessaloniki, or one of the many beautiful islands like Crete or Rhodes.

And while in Italy you have the benefit of these much lower taxes for the first 10 years after you move there, in Greece, this tax regime is available for up to 15 years.

Winner: Greece, for its flexibility in location and a longer tax benefit period.

2. Car Ownership

The next question is a bit less complex to learn, and maybe that is why so many people ignore it—but they regret it later. Is it easier to buy, drive, and maintain a car in Italy or Greece?

Italy’s Car Market

Italy offers a wide range of choices of cars if you are buying locally, from compact city cars ideal for navigating narrow streets to luxury brands like Ferrari and Maserati, born right in the country.

As someone who drove in Southern Italy, I strongly recommend you not take a too-large car—it will be a nightmare to maneuver on the narrow urban roads of some older towns.

In terms of costs, while the car prices are not expensive—they are not cheap either. Things get tricky with other related expenses—road taxes and fuel prices in Italy are among the highest in Europe.

The government imposes an Imposta Provinciale di Trascrizione (IPT), which is essentially a car registration tax. This cost varies depending on the region, but it’s a non-negligible amount, especially for higher-end cars. Add to that the cost of gasoline, which consistently ranks as one of the most expensive in Europe.

On the plus side, Italy has an extensive highway system, with the famous Autostrade network allowing for fast and efficient travel. However, many of these highways are toll roads, so you’ll need to budget for that.

Greece’s Car Market

Buying a car in Greece tends to be a bit more affordable than in Italy, particularly if you’re purchasing a used vehicle. However, the choices might be more limited, especially on the islands where dealerships and options can be fewer. Greece has also imposed high taxes on imported cars, particularly vehicles with higher emissions.

Fuel prices in Greece, while still high compared to non-European countries, are typically lower than in Italy. This can make a difference, especially if you plan to drive frequently or live in a more remote area where public transportation might not be as reliable. Road taxes in Greece are more straightforward, but they can still add up, especially for larger vehicles with higher engine capacities.

Greece’s road network is decent between large cities, but quality varies when we consider less inhabited areas, especially in mountainous or island regions. Tolls are less frequent in Greece than in Italy.

Winner: It is a tie. Greece has cheaper costs, but the Italian infrastructure and mix of options is better.

3 . Driving Style

But what about the driving style of Southern Italians versus Greeks?

Well… In Southern Italy, driving can be a bit of an adventure, especially if you are from a country with more orderly traffic behavior, like in Scandinavia.

Rules exist, of course, but they are sometimes treated as “guidelines” rather than strict laws. Tailgating, overtaking on narrow roads, and ignoring traffic signals are not uncommon, and motorbikes weaving between cars add an extra layer of unpredictability.

This isn’t to say that everyone drives recklessly, but you’ll need to be a confident and defensive driver in Southern Italy.

It’s part of the culture, and while it can be stressful for newcomers, locals seem to navigate these roads with an impressive amount of skill and awareness. Accidents do happen more frequently here than in the northern parts of Italy, and insurance rates tend to reflect this higher risk.

Now, Greece is a similar story, but with its own unique twist.

In larger cities, drivers also have a reputation for being less than cautious. Roundabouts, which are increasingly common, can be particularly challenging as the rules are not always followed—I know that from experience.

Outside the cities, especially on the islands, you’ll notice a more relaxed driving style. However, roads can become narrow, winding, and poorly maintained, which adds to the risk. Greece has higher rates of road fatalities compared to many other European countries.

Parking in Greece, like in Southern Italy, can be a bit of a challenge. That is why, again, people tend to wisely prefer smaller cars.

Result: Tie, as driving styles are equally challenging in both countries.

Driver’s License

Which country makes it simpler to get a driver’s license as an expat?

Italy

In Italy, if you’re an EU citizen, you can use your home country’s driver’s license without any need to convert it. However, for non-EU citizens, things get a bit more complicated. Non-EU expats can use their foreign licenses for up to 12 months, but after that, they must either convert their existing license or take the Italian driving exam.

Italy has agreements with certain countries, allowing a relatively simple license exchange. If your country has this agreement with Italy, you’re in luck—it’s mostly paperwork. But for those from countries without an agreement, you’ll need to take both the theoretical and practical exams, which are all in Italian – if this changed lately, please correct me in the comment section.

Moreover, the bureaucracy in Italy is well-known for being slow. While the licensing system works, you should expect some delays and additional paperwork. The whole process can take a few months to complete, so it’s wise to start early if you’re nearing the end of your 12-month period.

Greece

Greece has the exactly same rules and process as Italy for both EU and Non-EU expats. But one notable difference is that Greece’s driving tests can be taken in English, making the process a little more accessible for expats.

Winner: Greece, for offering English-language tests.

4. Language Difficulty

The next factor in our comparison is among the most interesting of all: How much of a challenge is learning the language in each country?

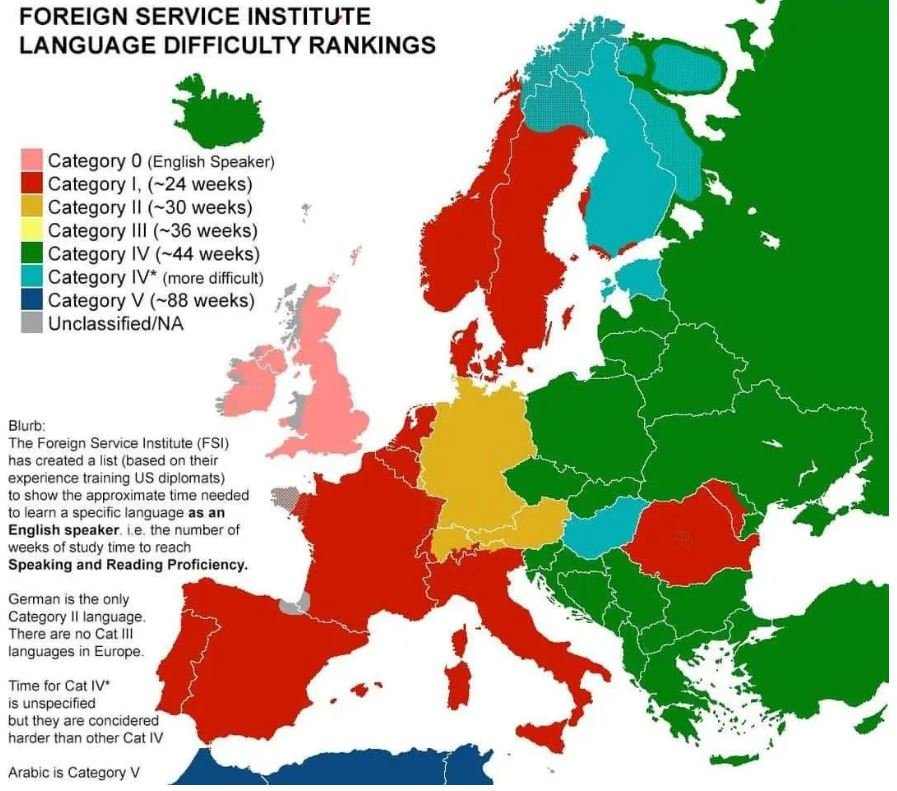

This one is very easy to answer. The Foreign Service Institute of the US already helped us with that, by ranking all European languages in 5 categories of difficulty for English speakers to learn.

The easiest ones are in category I – here you find languages like Spanish, Dutch, Romanian, and also Italian. Meanwhile, Greek is in category IV, together with languages like Polish or Turkish.

So yes, Greek is considerably more difficult to learn than Italian.

This is what Mr. Estrada, a viewer of my channel “The Expat”, told us about his experiences with Italian and Greek language:

“We had a wonderful time in Puglia. It was very easy to communicate with the people in Italian and they really appreciated us speaking to them in their language. Both Greece and Italy have a lot in the way of historical sites and great food, but the one big advantage for Italy is the language, especially written. It would only take a short time for us to master Italian, but a long time to master Greek, especially written.”

Winner: Italy, as the Italian language is easier for English speakers to learn

Some viewers might say that the difficulty of learning Greek, however, can be partially compensated by the fact that many more people in Greece are able to speak English than in Italy—and that is true.

But here is an important point: if you plan to move to ANYWHERE in Greece or Italy, but especially to small towns, get ready to learn some of the local language. It is NOT that difficult, and once you start to speak it, your life will be so much better. The difference in your daily interactions with the locals is mindblowing. The method I use to learn new languages is this one (by using this link you get a 40% discount after trying for free).

5. Healthcare

The next question to answer in our comparison is: Which country offers retirees better access to affordable healthcare—Italy or Greece?

Private Healthcare Costs

In terms of private healthcare, private insurance costs in Italy tend to be higher than in Greece. A comprehensive private insurance plan in Italy could range from €1,000-€3,000 annually, depending on age and health. In Greece, private insurance is more affordable, typically ranging from €600-€2,000 annually. Private doctors in Greece also tend to be more proficient in English.

Public Healthcare

In terms of public healthcare, Italy has a system, known as the Servizio Sanitario Nazionale (SSN). Expat retirees who are legal residents can access this system after all the bureaucratic procedures and by paying a fee.

Greece has a public healthcare system, ESY (Ethniko Systima Ygeias), which is available to all residents, including expat retirees. However, public healthcare in Greece has suffered from underfunding in recent years, and waiting times can be long.

Winner: Greece, due to lower private insurance costs and better English proficiency among healthcare providers.

6. Community Integration

Now, the next factor is often ignored, but it makes an enormous difference in day-to-day life. How easy is it to integrate into local communities as a foreigner in Italy compared to Greece?

Italy

Southern Italians are known for their warm, welcoming nature. Foreigners often report that people are friendly, especially in smaller towns. However, integrating can be more challenging if you don’t speak Italian. English proficiency in the South is lower compared to the North, which can create a language barrier—but remember: Italian is not difficult to learn.

Greece

Greece is also known for its hospitality. The Greek concept of “philoxenia,” or love for strangers, makes foreigners feel welcome. English is widely spoken, particularly in larger cities, making it easier for non-Greek speakers to integrate initially.

A big similarity between Southern Italy and Greece is the importance of traditions and family ties. Locals tend to have close-knit social circles, which can make it harder for newcomers to fully integrate. However, joining local activities like cultural and religious festivals and public events helps build connections. And you would be surprised to know how many festivities small towns in Southern Italy and Greece have per year!

Result: Tie, as both countries offer warm hospitality, but language skills are crucial for integration.

7. Cost of Living Comparison for Retirement in Greece vs Italy

So far, the score is very close, so it is time for the most important part of our comparison: How do Italy and Greece compare when it comes to the cost of living for retirees? Both Italy and Greece offer relatively affordable options for retirees, though the specifics can vary depending on location and lifestyle preferences. Italy might have slightly higher costs in cities and tourist hotspots, while Greece is often praised for its lower housing and daily expenses. For those considering alternatives, exploring retiring in Cyprus pros and cons could also be a worthwhile endeavor, as Cyprus boasts favorable tax incentives and a warm Mediterranean lifestyle, though it may have fewer cultural attractions compared to Italy and Greece. Additionally, when weighing the retirement pros and cons in Greece, it’s important to consider the slower pace of life and the friendly local communities that many expats cherish. The stunning landscapes and rich history can greatly enhance the retirement experience, making it a compelling option for many. Ultimately, each individual’s priorities will play a significant role in deciding which country offers the best retirement experience for their needs.

Both Italy and Greece are countries with a high variety of regions and cities. From small villages to large cities, the cost of living varies tremendously. Therefore, to compare apples with apples, we will match 3 Italian cities with their Greek equivalents, in 3 different sizes.

Small Towns: Sant’Agata di Militello (Italy) vs. Parga (Greece)

The first category is cities, or rather towns, with less than 20,000 residents.

The Italian competitor is Sant’Agata di Militello, and the Greek counterpart is Parga.

Sant’Agata di Militello

Let’s start by looking at Sant’Agata di Militello in Italy, located on the northern coast of Sicily, facing the Tyrrhenian Sea. This town has a population of around 12,000 residents, making it a peaceful and quiet spot for retirees seeking a slower pace of life.

One major advantage of Sant’Agata is that it qualifies for Italy’s special tax regime since it has less than 20,000 residents. This special tax regime allows retirees to pay only a 7% flat income tax on foreign pensions for up to 10 years.

Life in Sant’Agata comes with beautiful coastal views, with the Aeolian Islands just a short ferry ride away. The cost of living is also lower compared to larger Italian cities. However, retirees might find the language barrier challenging, as English proficiency in this part of Sicily is low, so learning Italian would be essential for smoother integration into the local community.

While the town offers a rich cultural experience with local festivals and Sicilian hospitality, it has limited healthcare facilities and amenities, meaning some trips to Messina, 90 kilometers away, might be necessary. Public transportation is also less reliable, so owning a car might be essential.

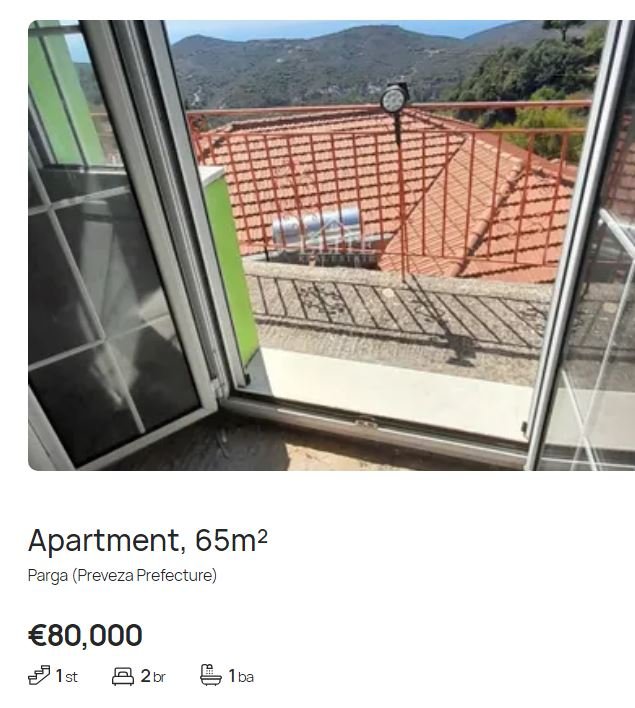

Parga

Now, let’s compare Sant’Agata with Parga, a picturesque coastal town located in northwestern Greece on the Ionian coast.

One of Parga’s advantages is that due to its tourism-driven economy, many locals speak English, which makes it easier for expats to settle in without needing to immediately learn Greek. The town’s natural beauty is undeniable, with its crystal-clear waters and scenic surroundings.

Similar to Sant’Agata, healthcare facilities in Parga are limited, and for more serious medical issues, travel to larger cities like Preveza or Ioannina is necessary. While during summer Parga has more than 10 thousand inhabitants, it has only 2,500 residents during the off-season. During summer, this influx of tourists gives the town a lively, energetic atmosphere, but it can feel quieter during the off-season, with fewer activities and events. Another downside is that during summer, some things tend to be more expensive.

Housing Comparison

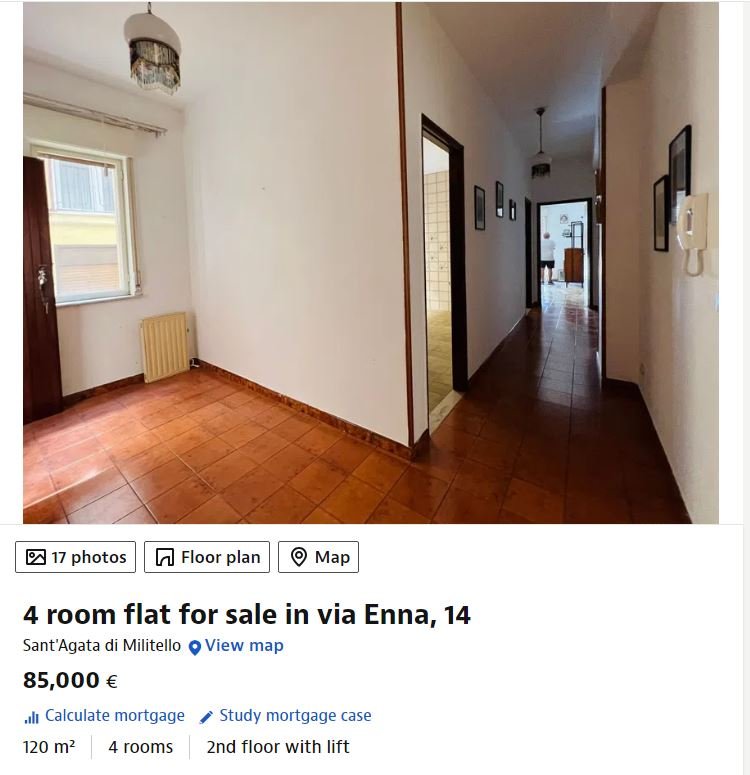

Let’s see what you can buy for 90,000 euros—less than 100,000 dollars—in each city.

In Sant’Agata di Militello, with that budget, you can buy a 120sqm apartment with 4 rooms…

…and just 123 meters from the seaside.

Now, in Parga, for a similar price, you can buy a 2-room apartment, with 65 square meters, located a bit farther in the countryside instead of closer to the seaside.

As said before, Parga has a more touristic appeal, so prices there are higher than in Sant’Agata, including housing prices.

Despite the two cities being similar in many aspects, here Sant’Agata di Militello, the Italian town, had the upper hand due to the lower costs.

Winner: Italy, for the lower cost of living and tax benefits in Sant’Agata di Militello. The picturesque surroundings and vibrant community further enhance its appeal. Additionally, it’s important to consider the costs of property ownership in Italy, which can be significantly lower compared to other European countries. This makes Sant’Agata di Militello not just an attractive destination for living but also a savvy investment choice.

Medium Cities: Ragusa (Italy) vs. Kalamata (Greece)

The next comparison is between two medium-sized cities, Ragusa in Italy and Kalamata in Greece.

Ragusa

Ragusa is located in the southeastern part of Sicily and has a population of around 73,000. It is a UNESCO World Heritage site, famous for its baroque architecture and historic charm.

Ragusa offers a relatively low cost of living compared to larger Italian cities, making it attractive to retirees. While it does not fall under Italy’s 7% flat tax regime for foreign retirees (as the population exceeds 20,000), it still provides a peaceful lifestyle with access to excellent local food, cultural heritage, and Mediterranean weather.

Healthcare in Ragusa is quite good for a city of its size, with the Ospedale Civile Maria Paternò Arezzo providing comprehensive medical care. However, for highly specialized treatments, residents might need to travel to Catania, which is about 100 kilometers away and has larger hospitals such as Policlinico Vittorio Emanuele and Ospedale Garibaldi.

Kalamata

The Greek counterpart to Ragusa is Kalamata, in the Peloponnese region. It is almost the same size, with around 70,000 residents, but with this size, you will have most of the benefits of a city, without the chaos and high prices.

This is what a local told us:

“I feel it is hard to beat Kalamata as a value proposition for remote work. And it is only 2,5 hours from Athens by car.”

By the way, if you are a fan of olives, like me, know that this city has some of the best in the world.

One key benefit for expat retirees in Kalamata is that they can still take advantage of Greece’s 7% flat tax regime on worldwide income for up to 15 years, regardless of the city size. English is widely spoken in Kalamata, which can ease integration for foreign residents.

In terms of healthcare, Kalamata has the Kalamata General Hospital, which provides a good range of medical services for everyday healthcare needs.

In the comparison between both cities, Ragusa offers historical charm, good local healthcare, and a comfortable lifestyle, but without the special tax incentives—there, you pay normal Italian income taxes.

Kalamata, on the other hand, gives you access to the 7% tax regime, making it financially advantageous for retirees.

Winner: Greece, for its tax benefits and easier integration in Kalamata.

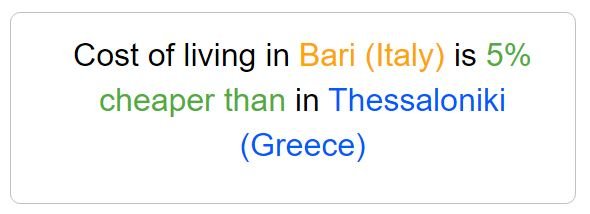

Large Cities: Bari (Italy) vs Thessaloniki (Greece)

The last comparison is between two larger cities, both regional capitals: Bari in Italy vs Thessaloniki in Greece.

Bari

This city is located on the Adriatic coast in the southern region of Puglia and has a population of about 320,000. Bari is known for its beautiful old town, Bari Vecchia, and its proximity to stunning coastal areas.

While Bari does not qualify for Italy’s 7% flat tax regime (since it exceeds the population limit and is outside the designated southern areas), it still offers a much more affordable cost of living compared to northern Italian cities like Milan or Rome.

Healthcare in Bari is excellent, with the city being home to several well-regarded hospitals, like the Policlinico di Bari, providing comprehensive medical services. The city’s connectivity to the rest of Europe is also highly developed, with an international airport and frequent train connections to the rest of Italy, making it convenient for both travel and healthcare access.

Thessaloniki

Thessaloniki, in Central Macedonia, is the second-largest city in Greece, with around 1 million people in its metro area.

As with every big city, it has its pros and cons. Lots of cars and noise in certain parts, but also good hospitals, plenty of things to do, and an international airport. One good characteristic of Thessaloniki is that it is considerably cheaper and safer than Athens.

Locals also said that one huge advantage is how close the city is to the Chalkidiki peninsula, which has wonderful beaches and national parks and is just a one-hour drive away.

The best neighborhoods of Thessaloniki for an expat, according to locals, are Kalamaria, Sofouli, and Toumba. However, one local alerted us that Toumba might be chaotic before and after football games.

This is what a local told me about the city: “Thessaloniki would be the way to go. Beautiful, popular, easy to walk around, inexpensive, great people.”

Housing Comparison in Large Cities

When we compare the cost of living in Bari vs Thessaloniki, the Italian city is slightly cheaper.

Even more than Bari, Thessaloniki can be crowded and has a faster pace of life, and traffic and urban congestion are common.

But how do they compare in terms of the cost of housing?

If you prefer to rent, and your budget is 700 euros per month:

- In Bari, for exactly 700 euros, you can rent a 4-room flat with 115 square meters in a very central part of the town, close to the Piazza Giardino Garibaldi.

- Meanwhile, in Thessaloniki, for the same price, you can rent an apartment with 2 bedrooms and 93 square meters, just a bit smaller than the one in Bari.

The comparison between Bari and Thessaloniki is really, really tight. If you have a high income from overseas, maybe Thessaloniki is a better option due to the lower income tax of only 7%. However, for a middle-class expat retiree, Bari takes the upper hand due to the lower cost of living.

Retirement in Greece vs Italy – Final Score

It is a tie! Italy 5, Greece 5. It pretty much depends on the lifestyle you choose:

- If you prefer a smaller town, in Southern Italy you would have multiple advantages, including the special tax regime that grants you much lower taxes, allied to a very low cost of living.

- For medium cities, Greece has the upper hand, since their special tax regime has no limitation for city size like Italy.

Now, since we are talking about lower taxes, there is a tiny Island in Europe with excellent weather and also lower income taxes for expats—I am talking about Malta.

Levi Borba is the founder of expatriateconsultancy.com, creator of the channel The Expat, and best-selling author. You can find him on X here. Some of the links above might be affiliated links, meaning the author earns a small comission if you do a purchase.